May 2023

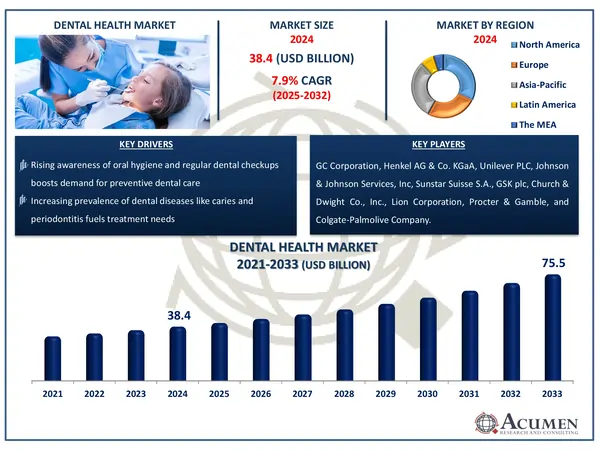

The Global Dental Health Market Size accounted for USD 38.4 Billion in 2024 and is estimated to achieve a market size of USD 75.5 Billion by 2033 growing at a CAGR of 7.9% from 2025 to 2033.

The Global Dental Health Market Size accounted for USD 38.4 Billion in 2024 and is estimated to achieve a market size of USD 75.5 Billion by 2033 growing at a CAGR of 7.9% from 2025 to 2033.

Dental or oral health refers to the teeth, mouth, and gums. The act of maintaining dental health in order to balance overall health involves preventing issues such as tooth decay (cavities) and gum disease. Maintaining good oral health from birth to maturity can help a person's teeth and gums stay healthy. Brushing and flossing every day, quitting smoking, eating a healthy diet, and getting regular dental examinations will help you avoid cavities, gum disease, and other oral problems.

|

Market |

Dental Health Market |

|

Dental Health Market Size 2024 |

USD 38.4 Billion |

|

Dental Health Market Forecast 2033 |

USD 75.5 Billion |

|

Dental Health Market CAGR During 2025 - 2033 |

7.9% |

|

Dental Health Market Analysis Period |

2021 - 2033 |

|

Dental Health Market Base Year |

2024 |

|

Dental Health Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product, By Distribution Channel, By Care Provider, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

GC Corporation, Henkel AG & Co. KGaA, Unilever PLC, Johnson & Johnson Services, Inc, Sunstar Suisse S.A., GSK plc, Church & Dwight Co., Inc., Lion Corporation, Procter & Gamble, and Colgate-Palmolive Company. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increased knowledge of oral hygiene, together with the rising incidence of dental problems, is considerably contributing to the regional oral hygiene market value. According to the Colgate-Kantar India Mouth Audit Report, more than 71% of Indians wash their teeth only once a day, with 15% brushing less than once. This gap in fundamental oral hygiene behaviors is a significant potential for awareness efforts and preventive dental care services. Furthermore, the World Health Organization (WHO) estimated that India had approximately 135,929 new instances of lip and oral cavity cancer in 2020, emphasizing the crucial need of treating oral health issues as part of overall healthcare planning.

Furthermore, the increasing demand for cosmetic dentistry and aesthetic dental procedures is propelling oral hygiene market growth, particularly in urban and semi-urban areas. The aesthetic appeal of orthodontics, teeth whitening, and smile makeovers is attracting a younger demographic. This growth is reinforced by the rising prevalence of dental ailments such as tooth decay, gingivitis, and periodontal disease, especially among middle-aged and elderly populations. As per the Indian Ministry of Health and Family Welfare, approximately 85–90% of adults in India have dental cavities, and 60–80% of school children are affected by dental caries, which highlights the wide reach of untreated oral issues.

The rapidly expanding geriatric population is another factor fueling demand. India had about 100 million elderly people (aged 60+) in 2013, a number expected to rise to 325 million by 2050, according to the National Oral Health Programme (NOHP). This demographic is prone to several oral health problems such as tooth decay, gum diseases, receding gums, and dry mouth, all of which increase the need for both preventive and restorative dental care services. Technological advances in the profession, such as the advent of painless tooth extraction, digital radiography, and computer-aided dental design systems, are attracting more patients and streamlining dental care delivery. Simultaneously, the growing breadth of private health insurance, particularly dental coverage (estimated to grow from USD 3.4 billion in 2023 to USD 8.4 billion by 2030 in India), is easing the financial burden on patients and encouraging more people to seek dental care.

The worldwide market for dental health is split based on product, distribution channel, and geography.

According to dental health industry analysis, the toothbrush category is expected to dominate the market due to its extensive use, regular replacement cycles, and ongoing design and technological improvement. Customers are increasingly turning to electric and smart toothbrushes, which provide enhanced plaque removal and real-time feedback for better dental hygiene. Furthermore, rising awareness of oral care, backed up by educational activities and endorsements from dental professionals, is driving constant demand. The availability of a varied range of goods tailored to different age groups, dental issues, and preferences helps to drive dental hygiene market growth. Furthermore, eco-friendly and sustainable toothbrush variations, such as bamboo brushes, are becoming popular, appealing to environmentally conscious consumers and expanding the segment's dental hygiene market share.

Supermarkets/hypermarkets generate the highest revenue in the oral health market due to their wide product offerings, high foot traffic, and convenient one-stop shopping experience. These retail designs provide prominent shelf space for dental care products, which increases consumer exposure and impulsive purchases. Competitive pricing, frequent promotional offers, and the ability to personally inspect items before purchasing increase customer trust and sales. Furthermore, having both premium and economic brands in the same location appeals to a broad audience, resulting in high volume sales. The strategic placement of oral health items near personal care aisles or checkout counters boosts revenue, making supermarkets and hypermarkets the most profitable distribution channels in oral health market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

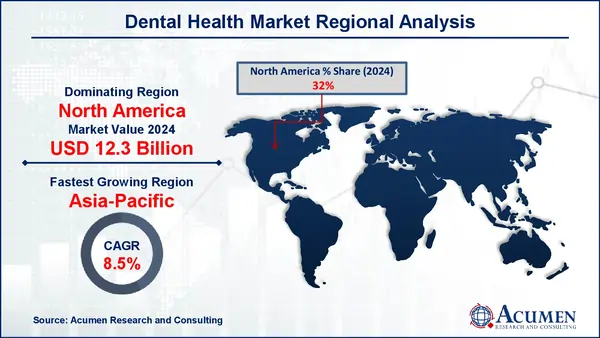

North America dominates the worldwide dental health market, accounting for around 32% of total market value as of 2024. This domination is partly due to a high level of oral hygiene awareness, a strong healthcare system, and widespread access to innovative dental procedures and technology. The presence of significant dental product manufacturers, as well as a well-regulated reimbursement environment, helps the region to maintain its leadership. The North American market is expected to be worth around USD 12.3 billion by 2024. The region also benefits from a high prevalence of dental disorders including caries and periodontal disease, particularly among the elderly, which increases demand for professional dental treatment and consumer oral health products.

On the other hand, the Asia-Pacific region is emerging as the world's fastest growing throughout the oral health market forecast period. Valued at more than USD 11.5 billion in 2024, the market is expected to grow at a CAGR of 8.5%. Rising disposable incomes, increased urban populations, and improved oral hygiene education all contribute to this rapid expansion. Governments in India, China, and Indonesia are investing in public dental care programs, while commercial dentistry franchises are expanding. Furthermore, the region's large population and increasing need for cosmetic dentistry services contribute to its promising future prospects.

Some of the top dental health market companies offered in our report include GC Corporation, Henkel AG & Co. KGaA, Unilever PLC, Johnson & Johnson Services, Inc, Sunstar Suisse S.A., GSK plc, Church & Dwight Co., Inc., Lion Corporation, Procter & Gamble, and Colgate-Palmolive Company.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2023

April 2025

December 2020

November 2022