March 2024

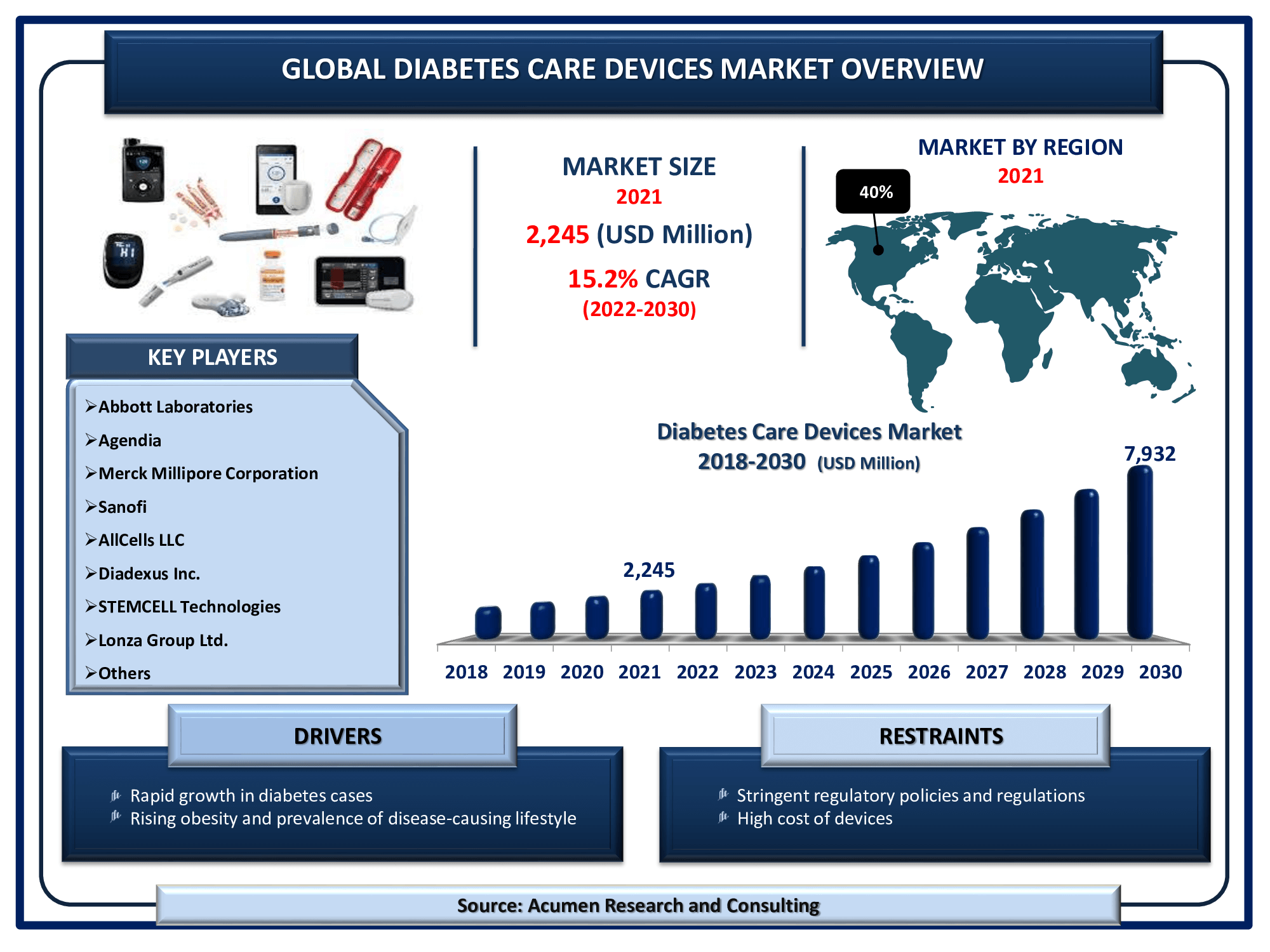

Diabetes Care Devices Market Size accounted for USD 2,245 Million in 2021 and is estimated to garner a market size of USD 7,932 Million by 2030 rising at a CAGR of 15.2% from 2022 to 2030.

The Global Diabetes Care Devices Market Size accounted for USD 2,245 Million in 2021 and is estimated to garner a market size of USD 7,932 Million by 2030 rising at a CAGR of 15.2% from 2022 to 2030. Growing prevalence of diabetes and obesity is the leading aspect fueling the diabetes care devices market growth. In addition, the growing emphasis on diabetes care is supporting market expansion. Furthermore, a popular diabetes care devices market trend that is reinforcing industry growth is product advancement and technological advancements in the sector.

Diabetes Care Devices Market Report Key Highlights

Diabetes care devices are specialized devices intended for the management of diabetes in patients. Diabetes is a lifestyle disorder affecting millions every year. Among the US population in 2018, 34.2 million people of all age groups, or 10.5% were diagnosed with diabetes. In addition, 34.1 million adults aged 18 years or older which is 13.0% suffered from diabetes.7.3 million adults aged 18 years or older that met the laboratory criteria did not report having diabetes. This number represents 2.8% of US adults and 21.4% of all US adults suffering from diabetes. The percentage of adults suffering from diabetes gradually rises with age reaching 26.8% among the 65 years or older age group.

The vision of diabetes care devices is to assist people suffering from the disorder to think less about their daily diabetes routine checks so as to get relief day and night. The wide range of products available in the market proves impactful through convenient, efficient, and effective diabetes management solutions. These involve blood glucose meters, insulin delivering systems, lancing devices, and digital solutions for data management.

Global Diabetes Care Devices Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Diabetes Care Devices Market Report Coverage

| Market | Diabetes Care Devices Market |

| Diabetes Care Devices Market Size 2021 | USD 2,245 Million |

| Diabetes Care Devices Market Forecast 2030 | USD 7,932 Million |

| Diabetes Care Devices Market CAGR During 2022 - 2030 | 15.2% |

| Diabetes Care Devices Market Analysis Period |

2018 - 2030 |

| Diabetes Care Devices Market Base Year | 2021 |

| Diabetes Care Devices Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Dexcom Inc., Merck & Co., Abbott Laboratories, Bayer AG, Lifescan, Inc., B Braun Melsungen AG, GlaxoSmithKline Plc, Dickinson and Company, Acon Laboratories, and Medtronic. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Diabetes Care Devices Market Insights

The Quintessential Factors of “Regulatory Landscape” in Europe for Sale of Diabetes Care Devices

The European Association for the Study of Diabetes (EASD) has announced “big calls” for the current CE MARKING PROCEDURE for the evaluation and approval of medical devices in Europe. At present, non-CE marking on medical device products could result in situations that can have a serious impact on the life of people with diabetes due to product inadequacies.

Currently, there is a low level of regulation and control of medical devices in the European Union. For the sale of medical devices in Europe it is necessary to have CE Marking. The CE Marking for medical devices guarantees the safety of the devices being sold. However, it does not represent an independent confirmation associated with quality features. Moreover, EASD had big calls for an improvement of the current European system for device registration which too has failed to represent in front of the European markets. With improvement in quality management of diabetology, the European countries work in collaboration with a Scandinavian evaluation of laboratory equipment for point of care testing (SKUP). EASD works closely with SKUP to promote the results of their evaluation of medical devices for diabetes.

COVID-19 Impact on Diabetes Care Devices Market Share

Hoffmann-La Roche Ltd is one of the dominant players in the diabetes care devices market by the sale of 8-9 million glucometer devices in India worth around Rs. 1200 crore. As per the company records, in March when the lockdown was announced worldwide sales fell by almost 50% compared to February as the supply chain was disrupted. From May onwards, the demand for glucometer devices rise as patients were unable to get tested in labs and started utilizing self-monitoring blood glucose levels devices sitting at home. It has given rise to online sales that have grabbed only 5-8% of the overall sales in the past that increased to 15% in the COVID-19 outbreak.

Also, the company took a strong initiative by offering free access to the mySugar Pro app that helped millions of Americans living with diabetes maintain their personalized daily diabetes routine during a pandemic. People suffering from diabetes had gained a lot of access to the app for monitoring blood glucose levels at home to avoid the severity of infection in the pandemic.

Diabetes Care Devices Market Segmentation

The worldwide diabetes care devices market is split based on type, end-user, and geography.

Diabetes Care Devices Market By Type

According to our diabetes care devices industry analysis, insulin delivery devices will hold a significant market share in 2021. Furthermore, diabetes management mobile applications will record the highest CAGR in the forthcoming years. The diabetes management mobile application segment will gain a significant pace owing to its simplicity, convenience, and utility in offering real-time insights regarding the diabetic condition to patients and healthcare for integrated diabetes management.

These apps have grabbed enormous potential over the years by extending the product pipeline by the competitors. As 2.7 billion individuals globally used smartphones and 0.5 billion people have access to mobile apps for chronic disease management small scale studies of digital programs targeting glucose control, weight loss, and medication have shown promising results. Currently, several apps prove to be standalone examples and there is a rising trend towards integration and automation. With the gain of such rapidly changing trends, the landscape of such digital health apps will be transformed to greater integration.

Diabetes Care Devices Market By End-User

As per our diabetes care devices market forecast, the hospitals & specialty clinics sub-segment occupied the utmost market revenue in 2021 and is expected to do so in the coming years. The rising frequency of diabetic hospitalizations is driving up demand for the segment. Diabetes patients are three times more likely to be hospitalized than individuals who do not have diabetes. On the other hand self & home care, sub-segment is anticipated to witness the fastest growth rate in the coming years. This increase can be linked to increased awareness of diabetes preventative care.

Diabetes Care Devices Market Regional Outlook

North America

Europe

Latin America

Asia-Pacific

The Middle East & Africa (MEA)

72.48% of the Market Share is grabbed by North America in Health Monitoring Devices

Based on regions, North America will grab the largest market share for the diabetes care devices market globally followed by Europe. A major share of these regions is attributed to advanced healthcare facilities located in this region, the growing diabetic population, and the presence of big manufacturers focusing on advancements in medical devices for diabetes. On the other hand, Asia Pacific is anticipated to grow at a faster pace in the forecast period owing to the predominant sedentary lifestyle and ever-growing aging population. In the Asia Pacific, India and China will witness tremendous growth in diabetes care devices.

The rising demand for insulin has provoked tremendous R&D activities in manufacturing different types of painless insulin deliverable devices that involve Continues Glucose Monitoring (CGM), extremely accurate blood glucose monitoring devices (flash glucose monitoring devices), integrated insulin pumps, and improved lancets for glucometers. With advancements in the needle-based delivery system, the invention of the insulin jet injector came into the limelight. The insulin jet injector witnessed high sales in developed countries like Canada and the US. This insulin jet injector is considered to be future of the insulin delivery systems.

In addition, Germany accounted for USD 2.19 billion in 2018. This is attributed to high cases of diabetes in this country as a rise in the adoption of a sedentary lifestyle, growing obesity cases, and unhealthy eating habits. The German healthcare system offers reimbursement and insurance coverage for diabetes care devices boosting the adoption of medical devices in this country. High adoption of insulin health deliverables and growing per capita spending on diabetes will further fuel the German industry revenue.

Diabetes Care Devices Market Players

Some of the top diabetes care devices companies offered in the professional report includes Dexcom Inc., Merck & Co., Abbott Laboratories, GlaxoSmithKline Plc, Dickinson and Company, Bayer AG, Lifescan, Inc., B Braun Melsungen AG, Acon Laboratories, and Medtronic.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2024

February 2025

August 2024

December 2020