August 2018

Diabetes Devices Market Size accounted for USD 33.4 Billion in 2022 and is estimated to achieve a market size of USD 69.5 Billion by 2032 growing at a CAGR of 7.7% from 2023 to 2032.

The Diabetes Devices Market Size accounted for USD 33.4 Billion in 2022 and is estimated to achieve a market size of USD 69.5 Billion by 2032 growing at a CAGR of 7.7% from 2023 to 2032.

Diabetes Devices Market Highlights

.jpg)

The market for diabetes devices includes a variety of instruments and apparatus made to control and keep track of blood glucose levels in diabetics. Devices including continuous glucose monitoring (CGM) systems, insulin administration systems (such as insulin pumps and pens), glucose monitoring systems, and other relevant accessories are included. The market has grown quickly since diabetes is becoming more and more common worldwide. The creation of more precise, user-friendly, and integrated devices has been made possible by technological improvements, which has improved patient convenience and treatment efficacy. The need for wearable and less invasive medical devices has increased, helping diabetes patients live better lives and control their diseases. The market for cutting-edge and effective diabetes gadgets is anticipated to grow as long as diabetes remains a serious health concern.

Global Diabetes Devices Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Diabetes Devices Market Report Coverage

| Market | Diabetes Devices Market |

| Diabetes Devices Market Size 2022 | USD 33.4 Billion |

| Diabetes Devices Market Forecast 2032 | USD 69.5 Billion |

| Diabetes Devices Market CAGR During 2023 - 2032 | 7.7% |

| Diabetes Devices Market Analysis Period | 2020 - 2032 |

| Diabetes Devices Market Base Year |

2022 |

| Diabetes Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Distribution Channels, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, Arkray, Inc., B Braun Melsungen AG, Bayer AG, Lifescan, Inc., Companion Medical, Dexcom Inc., F.Hoffmann-La-Ltd., Insulet Corporation, Lifescan, Inc., Medtronic plc, Novo Nordisk, Sanofi, Valeritas Holding Inc., and Ypsomed Holdings. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Diabetes Devices Market Insights

The market for diabeties devices is significantly influenced by the rising incidence of diabetes globally. Effective management and monitoring are more important as diabetes becomes more common due to a number of variables, such as ageing populations, urbanization, and changes in lifestyle. The increased prevalence of diabetes is driving up demand for diabetic devices, like insulin delivery tools and glucose monitoring systems, which help improve patient outcomes and disease control. Moreover, diabetes treatment is being revolutionised by ongoing technological breakthroughs. Modern innovations in diabetes care, such as wearable technology, smart insulin pumps, and continuous glucose monitoring systems, provide increased precision, practicality, and effectiveness. Diabetes devices are seeing rapid expansion in the market because of these technological advancements that not only improve patient comfort and adherence but also give medical professionals greater data to make educated decisions.

Furthermore, diabetes devices are still quite expensive, which is a major problem for those with diabetes who live in developing countries or don't have enough insurance. The market's potential for growth and reach may be impacted by the high cost of purchasing these devices and continuing maintenance, which may restrict accessibility and prevent widespread adoption.

The potential is in the easy integration of telemedicine systems with diabetic devices. Through this interface, patients and healthcare practitioners can share real-time data more easily and remotely. It improves overall results and accessibility to care by fostering proactive illness management, extending medical care outside of traditional healthcare facilities, and enhancing patient engagement. This device-telehealth synergy offers a possible path forward for improving and expanding diabetes control.

Diabetes Devices Market Segmentation

The worldwide market for diabetes devices is split based on type, distribution channels, end-user, and geography.

Diabetes Devices Types

Insulin delivery devices are a broad category of tools used to provide insulin to diabetics. The diabetic devices sector is dominated by this market segment since insulin is necessary for the management of diabetes. These gadgets, which provide a range of choices for accurate dosage and delivery, include insulin pens, pumps, and injectors. The substantial demand for these devices is driven by the prevalence of diabetes that is insulin-dependent, especially Type 1 diabetes. This market is growing because of the constant advancements in insulin delivery technologies, such as patch pumps and smart pumps, which are designed to improve patient outcomes and disease management by making insulin administration more accurate, convenient, and adherence-promoting.

Diabetes Devices Distribution Channels

According to diabetes devices industry analysis, for a number of important reasons, hospitals pharmacies are the primary distribution channel for diabetes devices. For patients getting initial diabetes diagnosis, treatment, and ongoing care, these pharmacies serve as essential hubs. They provide an extensive selection of diabetic devices, such as insulin administration instruments, glucose monitoring systems, and associated accessories. Device sales through this channel are mostly driven by the credibility and trust that hospitals have, as well as the presence of medical specialists who may offer advice and prescriptions. Hospital pharmacists dominate this market category in large part because hospitals are also frequently centres for critical care, which promotes the purchase of specialised and cutting-edge diabetes management devices.

Diabetes Devices End-Users

Hospitals make up the largest end-user category in the market and its expected to hold position throughout the diabetes devices industry forecast period due to their considerable engagement in patient care. They provide diagnosis, treatment, and specialised care, serving as the main hubs for all-encompassing diabetes management. Hospitals deal with a lot of acute cases that need to be treated right away, which makes diabetes devices used for treatment and monitoring very common. These facilities also house a variety of experts, such as diabetes educators and endocrinologists, who offer advice and skills on the use of various devices. Hospitals are the key end-user sector in the market due to their availability of cutting-edge technologies and a wide variety of devices, solidifying their position as the primary destination for diabetes-related care.

Diabetes Devices Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Diabetes Devices Market Regional Analysis

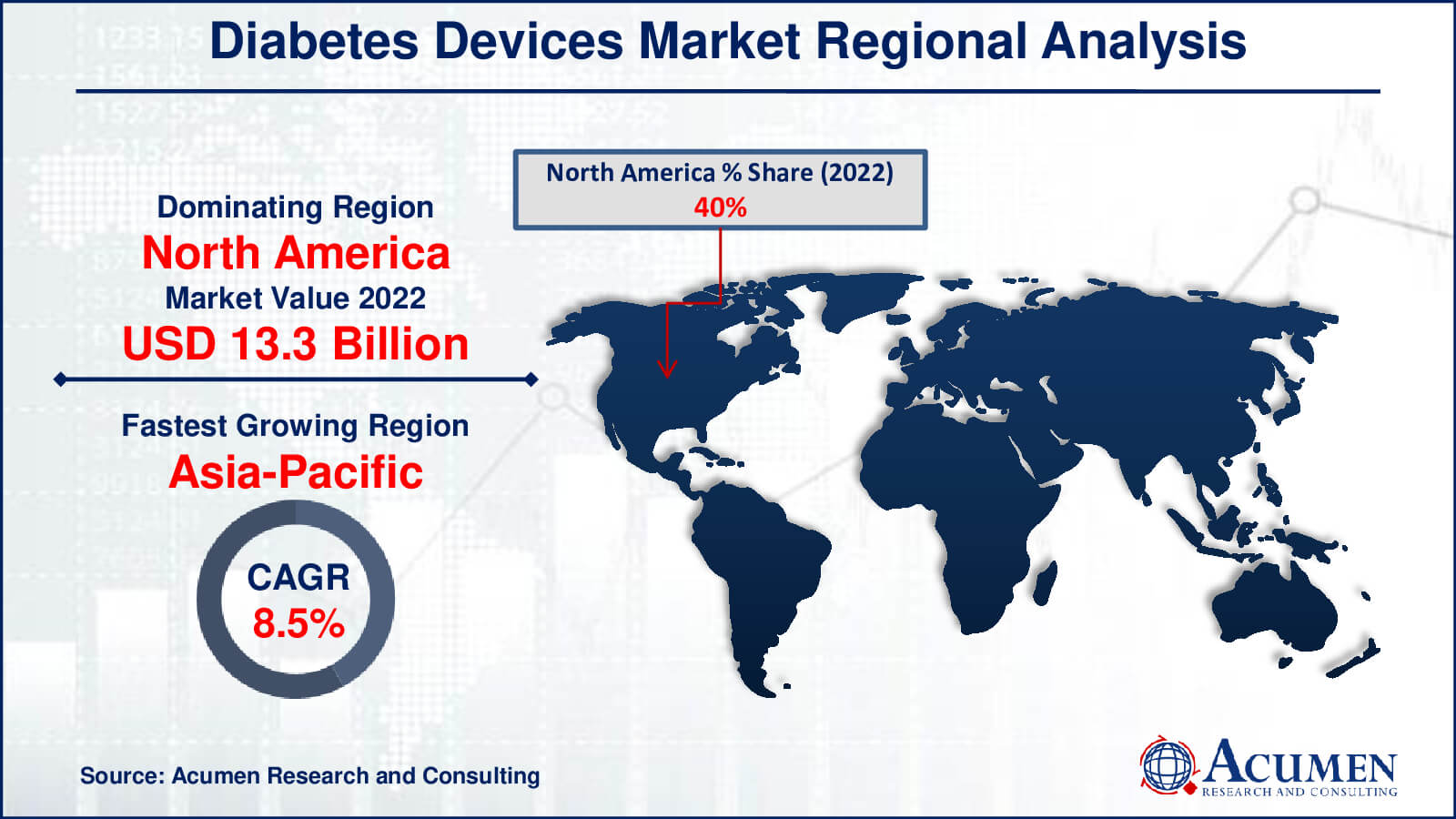

In terms of diabetes devices market analysis, a number of factors lead to North America becoming the largest area. The United States and Canada have the highest rates of diabetes, which has led to a strong market demand for diabetes treatment devices. Additionally, the area is leading the way in healthcare infrastructure development and technology breakthroughs, which encourages the broad use of cutting-edge gadgets. Tight legal policies also guarantee the supply of cutting-edge, authorized devices, which supports market leadership.

However, the market for diabetes devices is expanding at the quickest rate in Asia-Pacific. Diabetes cases are on the rise in nations like China, India, and Japan as a result of rapid urbanization, altered lifestyles, and altered eating patterns. In this region, the demand for diabetic devices is driven by rising disposable income and better access to healthcare. Asia-Pacific is a major hub for industry participants due to the growing awareness of diabetes management and the implementation of innovative technologies that drive market expansion.

Europe is currently the second-largest region in terms of the diabetes devices market. There is a significant diabetic population in the region, particularly in nations like the United Kingdom, Germany, and France. Diabetes devices are more widely used when there are well-established healthcare systems and a proactive approach to managing chronic diseases. The region's focus on R&D encourages technological innovation and makes cutting-edge devices more accessible and widely used.

Diabetes Devices Market Players

Some of the top diabetes devices companies offered in our report includes Abbott Laboratories, Arkray, Inc., B Braun Melsungen AG, Bayer AG, Lifescan, Inc., Companion Medical, Dexcom Inc., F.Hoffmann-La-Ltd., Insulet Corporation, Lifescan, Inc., Medtronic plc, Novo Nordisk, Sanofi, Valeritas Holding Inc., and Ypsomed Holdings.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2018

August 2024

May 2023

October 2024