December 2020

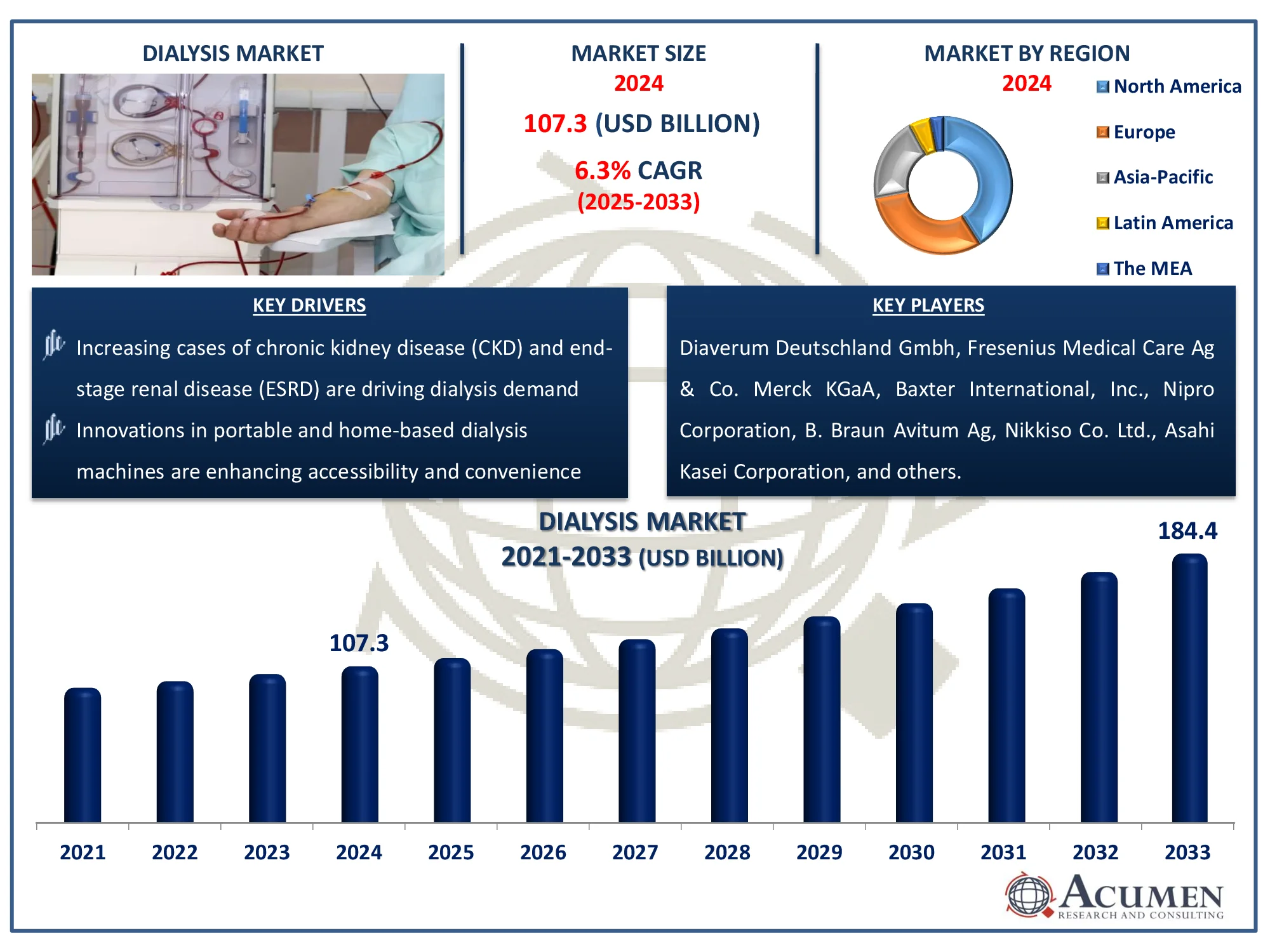

The Global Dialysis Market Size accounted for USD 107.3 Billion in 2024 and is estimated to achieve a market size of USD 184.4 Billion by 2033 growing at a CAGR of 6.3% from 2025 to 2033.

The Global Dialysis Market Size accounted for USD 107.3 Billion in 2024 and is estimated to achieve a market size of USD 184.4 Billion by 2033 growing at a CAGR of 6.3% from 2025 to 2033.

Dialysis is a treatment that takes over some functions of a healthy kidney when the kidneys fail, helping to maintain the body's balance. It works by removing waste, excess salt, and water while ensuring safe levels of essential chemicals such as potassium, sodium, and bicarbonate in the blood. Additionally, dialysis aids in regulating blood pressure. This procedure can be performed in hospitals, dialysis centers, or at home, based on the patient’s medical condition and comfort, as determined by the doctor.

There are two main types of dialysis: hemodialysis and peritoneal dialysis. Hemodialysis, the more common type, uses an artificial kidney to filter waste and excess fluids from the blood. During the process, a tube connected to a needle in the arm carries the blood to the artificial kidney for filtration before returning it through another tube.

Peritoneal dialysis, on the other hand, filters blood inside the body using the peritoneum the inner lining of the abdomen instead of an external machine. A catheter, a plastic tube, is permanently inserted into the abdomen to facilitate this process. The procedure typically takes 30 to 40 minutes and is repeated about four times a day. It can also be done overnight using a machine while the patient sleeps.

|

Market |

Dialysis Market |

|

Dialysis Market Size 2024 |

USD 107.3 Billion |

|

Dialysis Market Forecast 2033 |

USD 184.4 Billion |

|

Dialysis Market CAGR During 2025 - 2033 |

6.3% |

|

Dialysis Market Analysis Period |

2021 - 2033 |

|

Dialysis Market Base Year |

2024 |

|

Dialysis Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Product And Services, By End-User, And By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Diaverum Deutschland Gmbh, Fresenius Medical Care Ag & Co., Merck KGaA, Baxter International, Inc., Nipro Corporation, B. Braun Avitum Ag, Nikkiso Co. Ltd., Asahi Kasei Corporation, Nxstage Medical, Inc., Davita Inc, and Cantel Medical Corporation (Medicators, Inc). |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The growing number of end-stage renal disease (ESRD) patients globally is a major driver of market expansion. According to the National Institute of Health, the increased prevalence of end-stage kidney disease (ESKD) is due to improved patient survival rates, an aging global population, and an increase in diabetes, hypertension, and obesity caused by urbanization and lifestyle changes. Furthermore, increased access to kidney replacement therapy (KRT) in developing nations is fueling this development. In China, attempts are underway to develop a national kidney registry, whereas India, the world's second-most populous country, continues to lack a centralized register for ESKD cases.

Furthermore, the growing number of chronic kidney disease (CKD) patients is driving market growth; with diabetic kidney disease cases increasing as diabetes prevalence rises. Over 35.5 million persons in the United States suffer from CKD, and those with diabetes or hypertension are at a much higher risk. Kidney disease affects one-third of diabetics and one-fifth of hypertensive people. The scarcity of kidney donors, combined with increasing research and development spending in both developed and developing countries, is enhancing market growth.

Demand is likely to rise in the coming years as the older population grows, government efforts expand, and technological improvements accelerate. For example, India's Pradhan Mantri National Dialysis Programme (PMNDP) attempts to provide affordable dialysis services, particularly to those living below the poverty line. As of December 31, 2022, the program has been implemented in all 36 states and union territories, serving 641 districts with 1,350 dialysis centers and 8,871 hemodialysis machines. The Indian government has also asked states and union territories to enhance PMNDP coverage nationwide. However, potential problems connected with dialysis treatment may serve as a barrier to market expansion in the near future.

The worldwide market for dialysis is split based on type, product and services, end-user, and geography.

According to dialysis industry analysis, hemodialysis industry has a considerable market share and is predicted to increase steadily throughout the forecast period. One of the primary elements driving this industry is its superior clearance efficiency and shorter treatment time when compared to peritoneal dialysis. Furthermore, significant market companies are expanding their services, such as Nipro Medical Corporation, which debuted the SURDIAL DX Hemodialysis System in the United States in March 2022, aiming to improve the dialysis experience for both patients and physicians. Furthermore, hemodialysis is commonly performed three times each week for four hours each, which efficiently supports normal kidney function.

According to dialysis industry analysis, the dialysis sector is primarily driven by services, as ongoing care is critical for patients with renal disease. For example, in August 2024, Innovative Renal Care opened a cutting-edge dialysis center, NCG Piedmont, in Covington to expand its service options in the area. Regular dialysis treatments, whether in hospitals, specialized clinics, or at home, require constant physician supervision, equipment upkeep, and patient care. The continuous requirement for dialysis treatments ensures a steady demand for services, making them a significant income source in the sector.

According to dialysis market forecast, in-center dialysis is the leading option as most patients prefer treatment in specialized facilities under expert supervision. Dialysis clinics offer innovative equipment, competent medical personnel, and emergency care, resulting in improved patient safety and efficiency. Many people, particularly the elderly and seriously ill, find in-center dialysis more trustworthy than home-based options. Furthermore, the broad availability of dialysis clinics, as well as reimbursement support, contribute to in-center dialysis' market domination.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

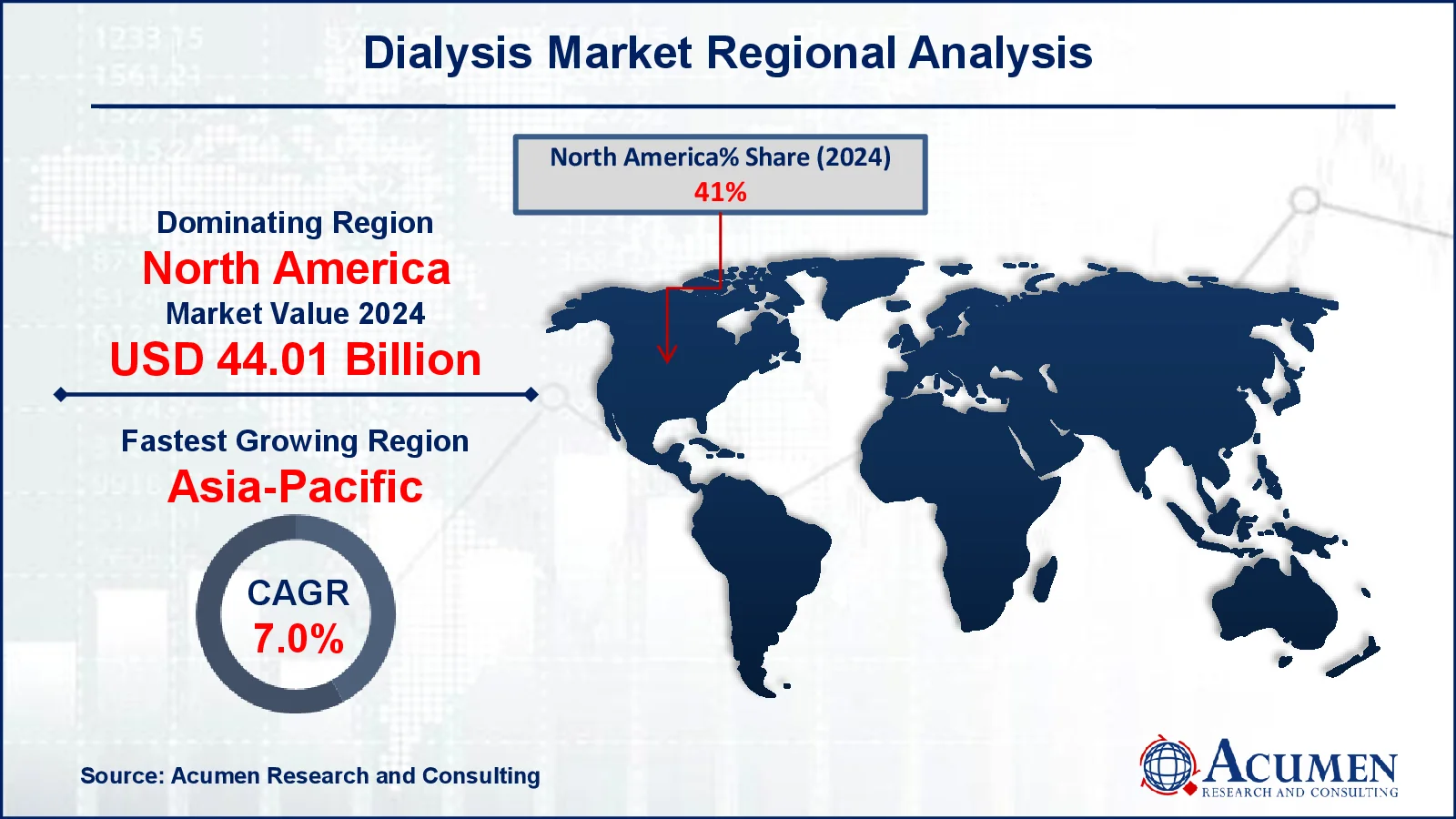

In terms of regional segments, the presence of a well-established healthcare infrastructure, together with easy access to innovative treatment procedures, is a fundamental driver of regional market growth. In North America, good reimbursement policies for dialysis therapy boost market value. The increasing prevalence of chronic kidney disease (CKD) in the United States is also driving regional growth. The National Kidney Foundation estimates that around 37 million people in the United States have CKD, accounting for 15% of the adult population, with over 90% ignorant of their illness.

Meanwhile, the Asia-Pacific region is the fastest-growing dialysis industry, owing to an aging population and an increase in kidney-related diseases. In June 2023, NephroPlus, an Indian dialysis service provider, collaborated with Shri Vamshi Hospital to create a revolutionary container dialysis machine. This project, which aims to provide real-time monitoring, consultations, and other critical services, is expected to make a major contribution to regional market growth throughout the forecast period.

Some of the top dialysis companies offered in our report include Diaverum Deutschland Gmbh, Fresenius Medical Care Ag & Co., Merck KGaA, Baxter International, Inc., Nipro Corporation, B. Braun Avitum Ag, Nikkiso Co. Ltd., Asahi Kasei Corporation, Nxstage Medical, Inc., Davita Inc, and Cantel Medical Corporation (Medicators, Inc).

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2020

February 2021

February 2025

March 2024