December 2024

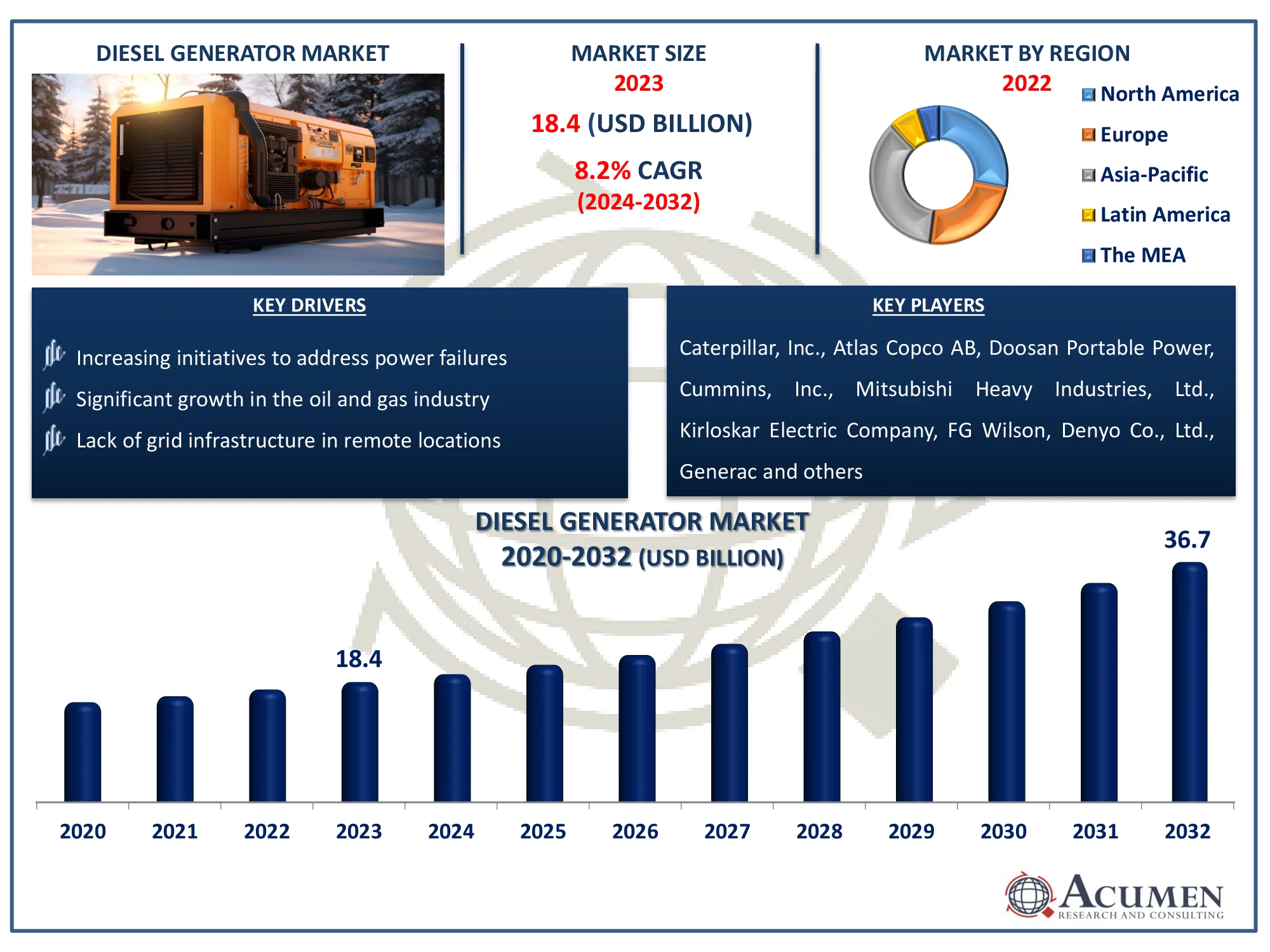

The Diesel Generator Market is poised to expand from USD 18.4 billion in 2023 to USD 36.7 billion by 2032, growing at a CAGR of 8.2%. Learn more about the industry's outlook and growth opportunities.

The Global Diesel Generator Market Size accounted for USD 18.4 Billion in 2023 and is estimated to achieve a market size of USD 36.7 Billion by 2032 growing at a CAGR of 8.2% from 2024 to 2032.

Diesel Generator Market (By Power Rating: <75 kVA, 75-375 kVA, 376-750 kVA, and >750 kVA; By Mobility: Stationary, and Portable; By End-Use: Residential, Commercial, and Industrial; By Application; Standby, Peak Shaving, and Prime/Continuous; and By Region: North America, Europe, Asia-Pacific, Latin America, and the MEA)

Diesel Generator Market Highlights

A diesel generator is a piece of equipment that converts the chemical energy contained in diesel into electrical energy. It can power electrical appliances and equipment. It may also power a wide range of applications, including institutions, healthcare facilities, businesses, and homes. It could serve as a primary source of electricity or during an emergency. Generators are split into four categories according to their intended function. For backup applications, emergency standby and limited-time power, as well as continuous and prime rated power when used as a primary power source. A diesel generator's efficiency ranges from 30 to 50 percent, which is a combination of diesel engine and alternator efficiencies. The main advantages of diesel generators are their long life, high efficiency, low cost in contrast to other generators, and short setup time. Furthermore, the use of diesel generators pollutes the environment and incurs substantial maintenance and operating costs.

Global Diesel Generator Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Diesel Generator Market Report Coverage

| Market | Diesel Generator Market |

| Diesel Generator Market Size 2022 |

USD 18.4 Billion |

| Diesel Generator Market Forecast 2032 | USD 36.7 Billion |

| Diesel Generator Market CAGR During 2023 - 2032 | 8.2% |

| Diesel Generator Market Analysis Period | 2020 - 2032 |

| Diesel Generator Market Base Year |

2022 |

| Diesel Generator Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Power Rating, By Mobility, By End-Use, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Caterpillar, Inc., Atlas Copco AB, Doosan Portable Power, Cummins, Inc., Mitsubishi Heavy Industries, Ltd., Kirloskar Electric Company, FG Wilson, Denyo Co., Ltd., Generac Power Systems, Inc., Kohler Co., Wartsila Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Diesel Generator Market Insights

The diesel generator market is being pushed by a growing demand for continuous and regular power delivery, as well as an increase in the number of power outages. Furthermore, industrialization and urbanization in developing countries, continuous energy outages, an increasing number of data centers, rapid population growth, the need for constant power supply to healthcare systems, and other factors are propelling the diesel generator market.

Its low cost of maintenance, durability, safe storage, quick access to fuel, and the finding of hydrocarbon deposits, among other things, provide it a competitive advantage in the market. Diesel generators' cheap operating costs are encouraging their use in industrial and commercial applications, which is fueling the industry's growth.

Furthermore, the increasing use of electronic gadgets in the engineering industry is increasing the demand for generators for optimum power sources, which is driving market expansion. For instance, according to The State Council, China intends to enhance the supply of high-end electronic equipment in order to stimulate consumption and the economy, as part of a plan released jointly by the Ministries of Industry and Information Technology and Finance. China's consumer electronics industry has shown consistent expansion in recent years.

Moreover, as data centers and critical systems become more essential, they need reliable backup power to stay operational during outages. Diesel generators are perfect for this because they provide strong and dependable power. With the increasing need for constant power, the demand for diesel generators is rising. Key manufacturers are increasingly innovating to provide sustainable and reliable backup electricity. For instance, Caterpillar Inc. launched a demonstration project in December 2022 that uses HFC technology and large-format hydrogen fuel cells to create sustainable and reliable backup electricity for Microsoft data centers. Caterpillar, Microsoft, and Ballard Power Systems are collaborating on a three-year initiative. Advances in technology are making these generators more efficient and cleaner, boosting their appeal.

Diesel Generator Market Segmentation

The worldwide market for diesel generator is split based on power rating, mobility, application, end use, and geography.

Diesel Generators Market By Power Rating

According to the diesel generator industry analysis, diesel generators under 75 kVA are popular because they’re small, affordable, and perfect for homes and small businesses. They’re easy to maintain and use less fuel, making them great for backup power where electricity is unreliable. Many people require generators with less than 75 kVA capacity for places with no grid power. New technology has made them even better and cheaper which lead the market.

Diesel Generators Market By Mobility

According to the diesel generator industry analysis, the stationary diesel generator segment will dominate the global market, owing to increased demand from industrial sectors such as mining, manufacturing, agriculture, and construction. Furthermore, the portable category is predicted to rise significantly in the market throughout the forecast period. Portable diesel generators are portable, designed for staff use, inexpensive, provide emergency backup and injury protection, and last a long time. Portable generators are in high demand as a result of their advantages.

Diesel Generators Market By End-Use

The commercial segment dominated the diesel generator market due to rising demand from commercial venues such as supermarkets, malls, complexes, theaters, and other uses. The quick development rate can be ascribed to a wide range of applications, including government centers, data centers, educational institutions, hospitality, healthcare, agriculture, and telecommunications, among others.

Diesel Generators Market By Application

According to the diesel generator market forecast, the standby power sector is predicted to dominate the global market. Standby power diesel generators are used to provide emergency power for a brief period of time due to the absence of overloading capabilities built into the generator units. Companies realize the standby power diesel generator market's consistent growth rate and, as a result, focus on new product launches to generate business revenue through increasing product sales revenue.

Diesel Generator Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

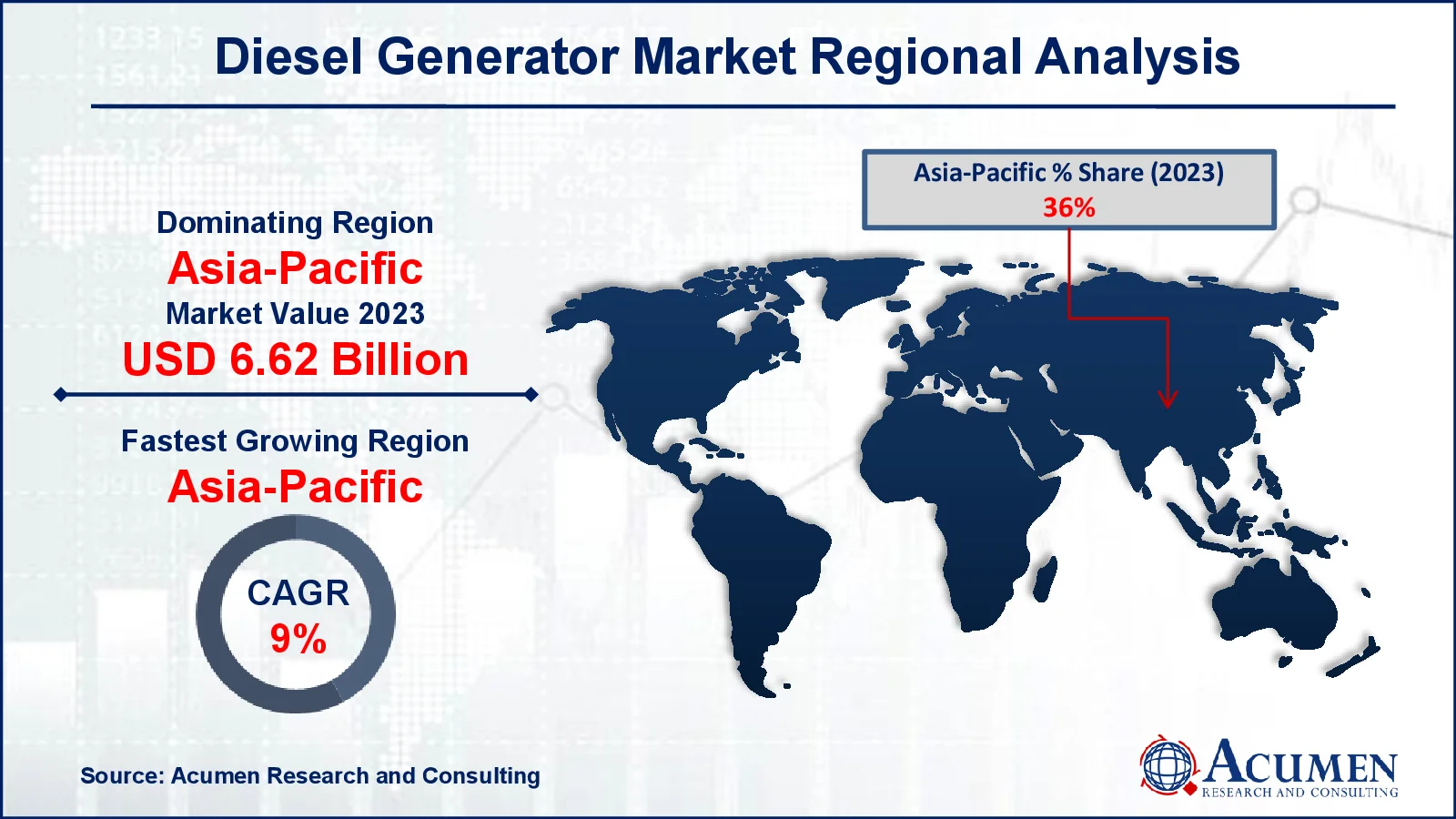

Diesel Generator Market Regional Analysis

For several reasons, Asia-Pacific dominated the global diesel generator market in 2023, and this trend is expected to continue throughout the forecast period. The growing number of manufacturing facilities and infrastructural enhancements in China, as well as the widening electrical demand-supply mismatch and rapid expansion of commercial office space, are all expected to improve the region's industrial structure. Additionally, advancements by key manufacturers further contribute to market growth in Asian region. For instance, September 2023 - Mitsubishi Heavy Industries Engine System Asia (MHIES-A) proudly launched a new model in the Mitsubishi Generator Series (MGS-R) family designed for 50Hz markets. The newly introduced MGS3100R is the most powerful 16-cylinder industrial diesel generator available. It is equipped with the original Mitsubishi common rail system, which decreases emissions and fuel consumption.

Moreover, China is the Asia-Pacific region's top diesel generator market, owing to expanding infrastructure projects, an increasing power demand-supply gap, the growth of industrial facilities around the country, and rising commercial office space. The low cost and high efficiency of diesel generators benefit the country, since rising living standards increase demand for power backup equipment.

Diesel Generator Market Players

Some of the top diesel generator companies offered in our report includes Caterpillar, Inc., Atlas Copco AB, Doosan Portable Power, Cummins, Inc., Mitsubishi Heavy Industries, Ltd., Kirloskar Electric Company, FG Wilson, Denyo Co., Ltd., Generac Power Systems, Inc., Kohler Co., Wartsila Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2024

March 2023

February 2023

April 2025