March 2024

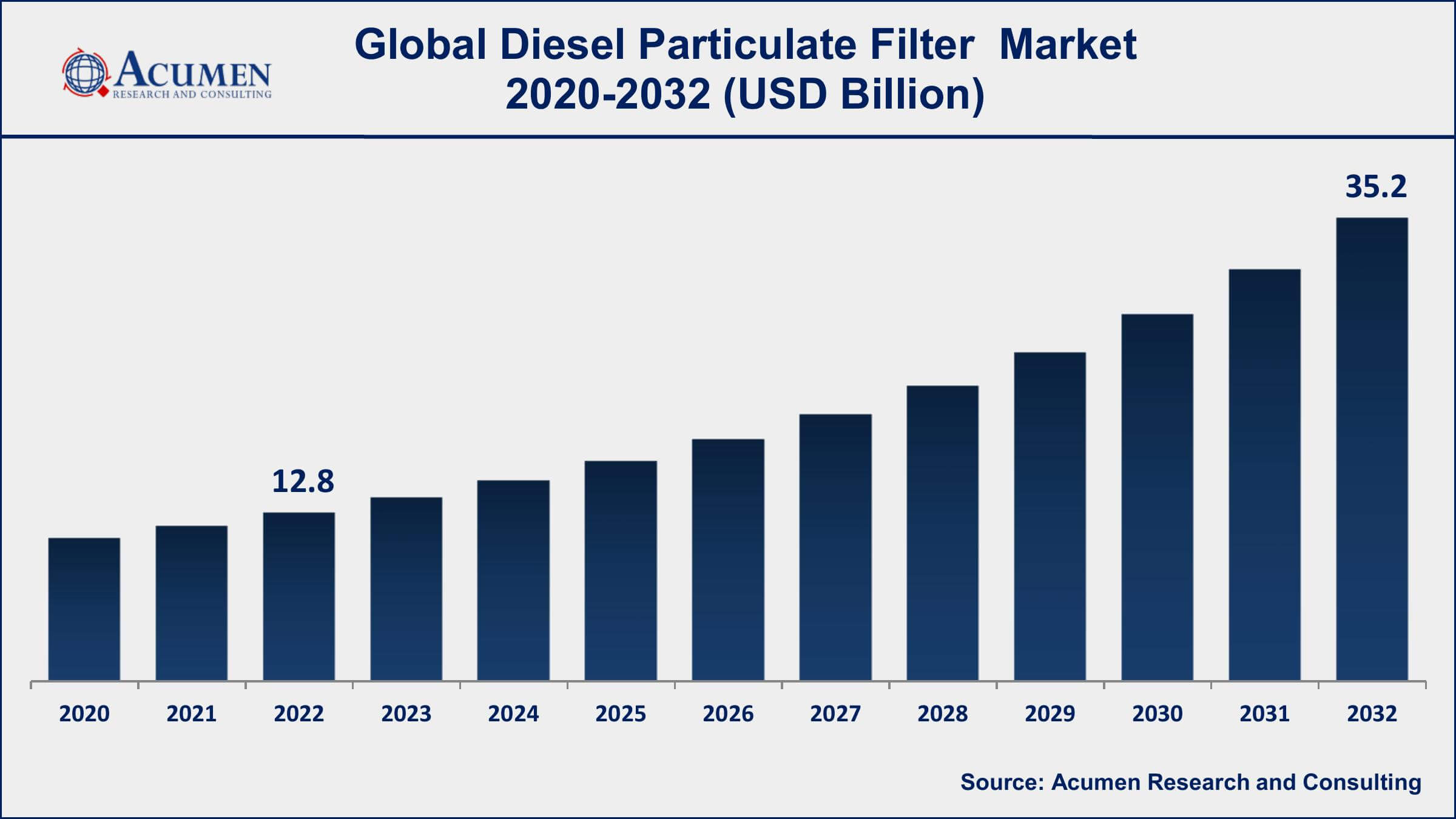

Diesel Particulate Filter Market Size accounted for USD 12.8 Billion in 2022 and is projected to achieve a market size of USD 35.2 Billion by 2032 growing at a CAGR of 10.8% from 2023 to 2032.

The Global Diesel Particulate Filter Market Size accounted for USD 12.8 Billion in 2022 and is projected to achieve a market size of USD 35.2 Billion by 2032 growing at a CAGR of 10.8% from 2023 to 2032.

Diesel Particulate Filter Market Highlights

A Diesel Particulate Filter (DPF) is a device integrated into the exhaust system of diesel-powered vehicles to capture and reduce the emission of particulate matter (PM) or soot generated during the combustion process. DPFs work by trapping these particles within their porous structure, allowing clean exhaust gases to pass through while periodically regenerating to burn off the accumulated particulate matter.

The market for diesel particulate filter has experienced significant growth in recent years. One of the key drivers of this growth is the tightening environmental regulations and increasing awareness about the adverse impacts of air pollution. As governments and regulatory bodies prioritize air quality and pollution reduction, manufacturers of diesel engines and vehicles have been compelled to adopt technologies like DPFs to meet these requirements. This has created a robust demand for DPFs across various industries, including automotive, construction, transportation, and more. Additionally, advancements in DPF technology, such as improved filter materials and regeneration strategies, have enhanced the efficiency and durability of these filters, further driving market expansion. As a result, the DPF market is expected to continue its growth trajectory as environmental concerns persist and emissions regulations become even more stringent, spurring greater adoption of emission control technologies like DPFs.

Global Diesel Particulate Filter Market Trends

Market Drivers

Market Restraints

Market Opportunities

Diesel Particulate Filter Market Report Coverage

| Market | Diesel Particulate Filter Market |

| Diesel Particulate Filter Market Size 2022 | USD 12.8 Billion |

| Diesel Particulate Filter Market Forecast 2032 | USD 35.2 Billion |

| Diesel Particulate Filter Market CAGR During 2023 - 2032 | 10.8% |

| Diesel Particulate Filter Market Analysis Period | 2020 - 2032 |

| Diesel Particulate Filter Market Base Year | 2022 |

| Diesel Particulate Filter Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Substrate Type, By Regeneration Process, By Regeneration Catalyst, By Equipment Process, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bosal International, Tenneco Inc., Faurecia, Johnson Matthey, Corning Incorporated, NGK Insulators, Eberspächer Group, DENSO Corporation, Cataler Corporation, Donaldson Company, Inc., MANN+HUMMEL, and Hug Engineering AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A diesel particulate filter (DPF) is a specialized emissions control device designed to reduce the emission of particulate matter from diesel engines. Particulate matter, commonly referred to as diesel soot, is composed of fine particles and aerosols that are produced during the combustion of diesel fuel. DPFs play a critical role in mitigating this issue by capturing and storing these particles within their porous structure, preventing them from being released into the atmosphere.

The application of diesel particulate filters spans various industries, primarily within sectors that rely heavily on diesel-powered engines. In the automotive sector, DPFs are integrated into modern diesel vehicles, including cars, trucks, and buses, to meet stringent emissions regulations imposed by governments around the world. Construction, mining, and agriculture industries also benefit from DPFs as they are commonly used in heavy machinery and equipment powered by diesel engines. Additionally, marine vessels, locomotives, and power generation units adopt DPF technology to minimize their impact on air quality and adhere to environmental standards. The versatility of DPFs across these sectors highlights their pivotal role in curbing particulate emissions and contributing to a cleaner and more sustainable future.

The diesel particulate filter market has witnessed significant growth in recent years and is expected to continue expanding in the coming years. Several factors contribute to this market growth including, increasing global awareness of air pollution's adverse effects on health and the environment, governments have imposed stringent emissions standards on vehicles and industrial equipment. This has led manufacturers to adopt emission control technologies like DPFs to comply with these regulations. Furthermore, ongoing research and development efforts have resulted in more efficient and durable DPF designs, improving their performance and lifespan. As the world continues to prioritize cleaner air and stricter emissions controls, the DPF market is poised to experience sustained growth, especially in industries like automotive, construction, and industrial machinery.

Diesel Particulate Filter Market Segmentation

The global diesel particulate filter market segmentation is based on substrate type, regeneration process, regeneration catalyst, equipment process, vehicle type, and geography.

Diesel Particulate Filter Market By Substrate Type

According to the diesel particulate filter industry analysis, the Silicon Carbide segment accounted for the largest market share in 2022. Silicon Carbide DPFs offer superior thermal resistance compared to traditional ceramic filters, allowing them to withstand high exhaust temperatures that occur during engine operation. This characteristic is crucial for efficient regeneration, a process where accumulated soot particles are burned off to maintain filter performance. Additionally, SiC-based filters have a longer lifespan and require less frequent maintenance due to their enhanced durability, reducing downtime and maintenance costs for operators.The growth of the Silicon Carbide segment can be attributed to its ability to address the challenges posed by modern diesel engines, which operate at higher temperatures and produce finer particulate matter. As industries like automotive, construction, and industrial equipment adopt Silicon Carbide DPFs to meet emissions standards and enhance performance, this market segment is projected to experience sustained expansion, driven by the combination of regulatory compliance, technological innovation, and the demand for more efficient emission control solutions.

Diesel Particulate Filter Market By Regeneration Process

In terms of the regeneration process, the passive segment is dominating the market in 2022. Passive DPF systems have gained prominence due to their simplicity, reliability, and effectiveness in reducing particulate matter emissions from diesel engines. Unlike active systems that require additional energy to regenerate, passive DPFs rely on engine exhaust temperature and natural conditions to facilitate the regeneration process. Furthermore, the growth of the passive DPF segment can be attributed to the global push toward cleaner air and stricter emission standards. Regulatory bodies across various regions are enacting regulations that mandate the reduction of particulate matter emissions from diesel engines. Passive DPF systems play a crucial role in helping manufacturers achieve compliance without introducing complex and energy-intensive technologies. Their simplicity and reliability align well with the ongoing trend towards sustainability and environmental responsibility, ensuring that vehicles contribute less to air pollution while minimizing the impact on operational efficiency. As the demand for cleaner transportation solutions continues to rise, the passive DPF segment is poised to maintain its dominance in the diesel particulate filter market.

Diesel Particulate Filter Market By Regeneration Catalyst

According to the diesel particulate filter market forecast, the palladium-rhodium segment is expected to witness significant growth in the coming years. Palladium and rhodium are precious metals used as catalysts in DPF systems to facilitate the oxidation of harmful pollutants such as hydrocarbons and carbon monoxide, promoting cleaner exhaust emissions. One of the primary drivers to the growth of The increasing stringency of emissions regulations globally has spurred the demand for highly efficient emission control technologies, propelling the adoption of palladium-rhodium catalysts in DPFs. As emissions standards become more stringent, manufacturers are seeking innovative solutions to ensure compliance while maintaining engine performance. The palladium-rhodium catalysts have demonstrated superior catalytic activity and durability, making them a preferred choice for achieving higher emission reduction efficiency. Additionally, the growing demand for cleaner transportation and the need to reduce the environmental impact of diesel engines have fueled the growth of the palladium-rhodium segment. The durability and efficiency of these catalysts allow manufacturers to design engines that meet the latest emissions standards while maintaining power and fuel efficiency.

Diesel Particulate Filter Market By Equipment Process

Based on the equipment process, the construction equipment segment is expected to witness significant growth in the coming years. Diesel-powered construction equipment, such as excavators, loaders, and bulldozers, often operate in urban and densely populated areas, where emissions control is crucial to mitigate air pollution and comply with local emissions standards. As a result, the adoption of DPFs in this segment has become increasingly essential to reduce particulate matter and NOx emissions. One of the key drivers for the growth of diesel particulate filters in the construction equipment segment is the increasing environmental regulations and the imperative to reduce emissions from heavy machinery used in construction and mining operations. As governments around the world enact stricter emissions standards to improve air quality, construction equipment manufacturers are turning to advanced emission control technologies like DPFs to meet these requirements. DPFs equipped with efficient filtration and catalyst systems, including precious metals like Palladium and Rhodium, are becoming integral to construction equipment, enabling them to effectively capture and reduce particulate matter emissions and harmful pollutants.

Diesel Particulate Filter Market By Vehicle Type

Based on the vehicle type, the passenger segment in the diesel particulate filter market has had significant growth in the recent year due to serveral factors. One of the factors is that increased consumer demand for fuel efficiency and reduced emissions.The growth in the passenger segment's adoption of DPFs is further fueled by the rising demand for sustainable and eco-friendly transportation solutions. As consumers become more environmentally conscious and governments provide incentives for cleaner vehicles, diesel vehicles equipped with efficient DPFs are becoming a preferred choice. Moreover, technological advancements in DPF design and materials have led to the development of compact, efficient, and durable filters that integrate seamlessly into passenger vehicle exhaust systems. This trend aligns with the global shift toward cleaner mobility and complements the industry's overall efforts to reduce the environmental impact of transportation.

Diesel Particulate Filter Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

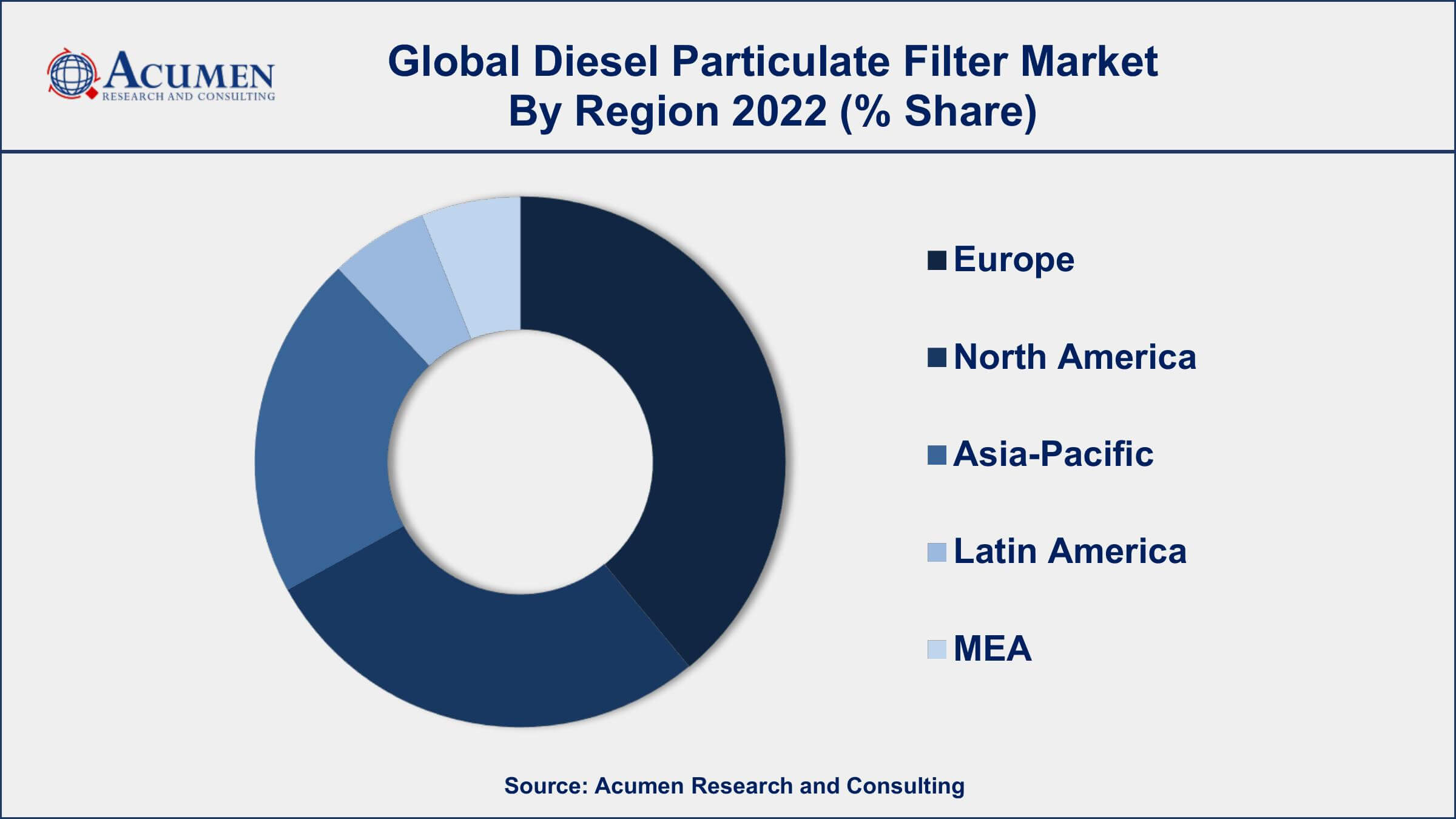

Diesel Particulate Filter Market Regional Analysis

Geographically, Europe is dominant region in the Diesel Particulate Filter (DPF) market in 2022. The European Union (EU) has been at the forefront of implementing stringent emissions standards aimed at curbing pollution and improving air quality. These regulations, such as Euro 6 standards, mandate the reduction of particulate matter emissions from diesel engines. As a result, manufacturers and vehicle owners in Europe are compelled to adopt advanced emission control technologies like DPFs to meet these stringent requirements. Additionally, Europe's strong emphasis on environmental sustainability and clean air initiatives has spurred demand for technologies that mitigate the adverse effects of particulate matter emissions. The region's dense urban areas and stringent air quality targets create a pressing need for effective solutions to combat pollution. The automotive industry's focus on innovation and compliance has also driven the adoption of DPFs in passenger cars and commercial vehicles. Moreover, the continent's well-established infrastructure and regulatory frameworks have facilitated the integration of emission control systems like DPFs into vehicles and industrial equipment. Europe's proactive approach to environmental protection, coupled with its well-defined regulatory landscape and commitment to technological advancement, positions it as a dominant region in the Diesel Particulate Filter market.

Diesel Particulate Filter Market Player

Some of the top Diesel Particulate Filter Market companies offered in the professional report include Bosal International, Tenneco Inc., Faurecia, Johnson Matthey, Corning Incorporated, NGK Insulators, Eberspächer Group, DENSO Corporation, Cataler Corporation, Donaldson Company, Inc., MANN+HUMMEL, and Hug Engineering AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2024

March 2023

October 2023

November 2024