June 2021

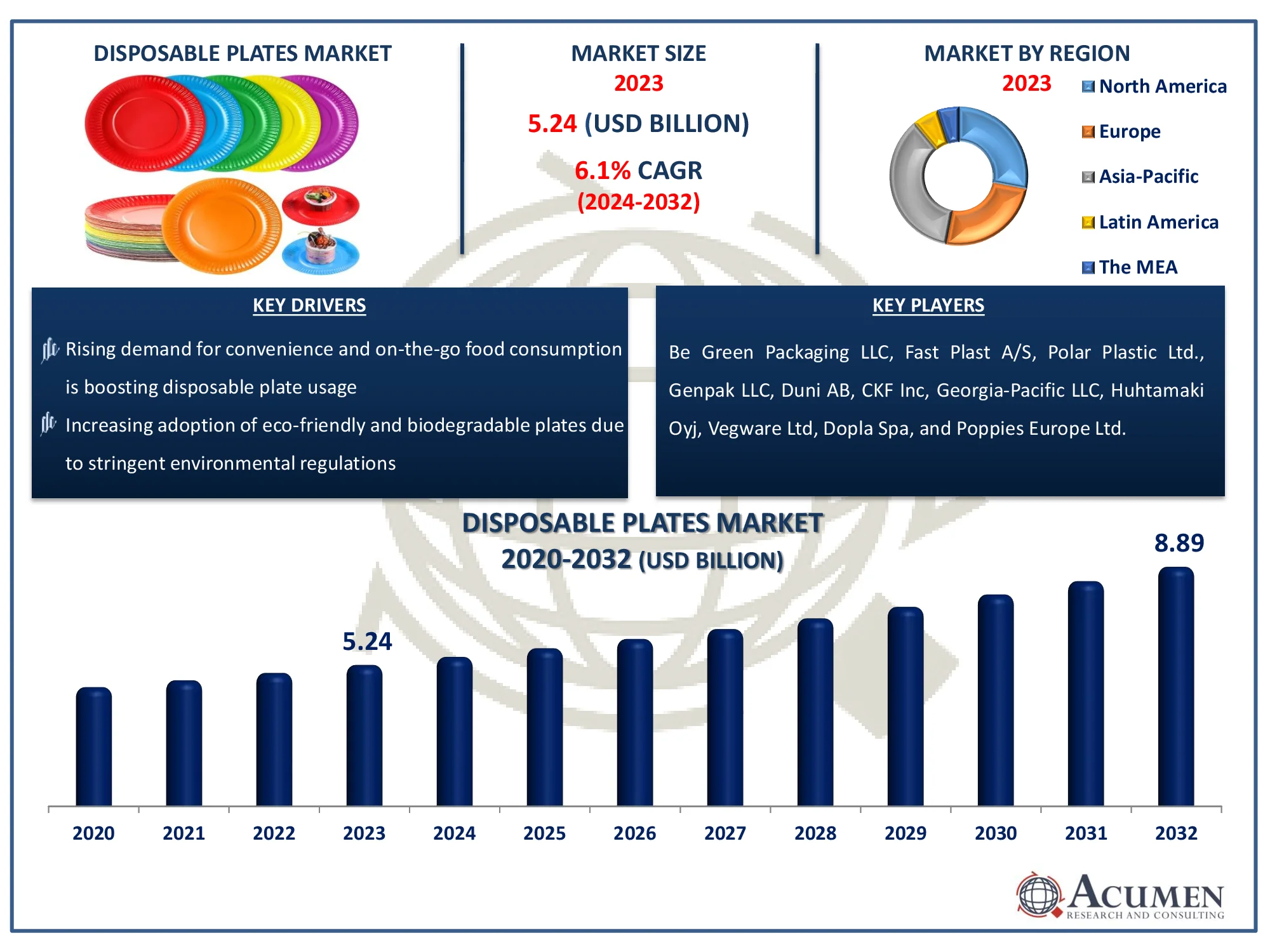

The Global Disposable Plates Market Size accounted for USD 5.24 Billion in 2023 and is estimated to achieve a market size of USD 8.89 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

The Global Disposable Plates Market Size accounted for USD 5.24 Billion in 2023 and is estimated to achieve a market size of USD 8.89 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

Disposable plates are particularly designed for a single use after which they are recycled or disposed of as solid waste. These are made up of plastic, aluminum, and paper, among others, and have usage across picnics, buffets, appetizer plates, receptions, retirement parties, holiday meals, business events, and organic restaurants, among others. They are frequently used because they are convenient, cost-effective, and provide sanitary benefits. The increased preference for environmentally friendly and biodegradable plates is boosting market demand, particularly in the food service industry. Furthermore, their versatility in terms of size, shape, and material makes them appropriate for a wide range of uses, from casual parties to formal events.

|

Market |

Disposable Plates Market |

|

Disposable Plates Market Size 2023 |

USD 5.24 Billion |

|

Disposable Plates Market Forecast 2032 |

USD 8.89 Billion |

|

Disposable Plates Market CAGR During 2024 - 2032 |

6.1% |

|

Disposable Plates Market Analysis Period |

2020 - 2032 |

|

Disposable Plates Market Base Year |

2023 |

|

Disposable Plates Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product Type, By Design, By Sales Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Be Green Packaging LLC, Fast Plast A/S, Polar Plastic Ltd., Genpak LLC, Duni AB, CKF Inc, Georgia-Pacific LLC, Huhtamaki Oyj, Vegware Ltd, Dopla Spa, and Poppies Europe Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing demand for ready-to-go food coupled with rising disposable income is primarily supporting the market value. The rising number of home delivery and online food service platforms are further supporting the market value. The increasing awareness regarding hygiene and sanitation, changing consumer preferences, growing organized retail sector, and emerging economies are propelling the global market value. Moreover, the increasing production of biodegradable plates is likely to provide potential opportunities during the forecast period from 2024 to 2032.

On the other hand, strict regulations associated with the rising environmental concern, such as emissions of harmful gases from disposable plates due to breakdown in landfills or incineration, are projected to hamper the growth over the estimated period.

A prominent trend in the disposable plate market is a growing desire for environmentally friendly and biodegradable solutions. Due to growing environmental concerns and tight plastic waste rules, producers are increasingly developing plates made from eco-friendly materials such as bagasse, bamboo, cornstarch, and palm leaves. Consumers are becoming more conscious of the importance of sustainability, which is driving up demand for biodegradable and compostable plates. Additionally, restaurants and catering enterprises are implementing green packaging solutions to lessen their environmental impact. Material technological advancements have improved biodegradable plates, making them more durable, heat-resistant, and moisture-proof. These enhancements make eco-friendly plates a viable alternative to plastic plates, benefiting both commercial and residential customers.

Disposable Plates Market Segmentation

Disposable Plates Market SegmentationThe worldwide market for disposable plates is split based on product type, design, sales channel, and geography.

According to disposable plates industry analysis, the market is separated into four product categories plastics, paper, metals, and others. Plastic plates are currently the market leader due to their low cost, durability, and versatility. Plastic plates are lightweight, break-resistant, and may be molded and sized to suit a wide range of applications. Plastic plates are also frequently used in commercial and residential settings due to their low production costs and widespread availability. However, growing environmental concerns about plastic waste are driving up demand for eco-friendly alternatives such as paper and biodegradable plates, which is expected to climb in the coming years.

Plain plates segment are expected to take the largest share of the disposable plates market due to their extensive use and inexpensive cost. These plates are basic and lack partitions, making them ideal for presenting a variety of foods in homes, restaurants, parties, events, and takeouts. Their low cost and ease of manufacturing contribute to their great demand, particularly in the food service and retail industries. Plain plates are also available in a variety of materials, including plastic, paper, aluminum, and biodegradable solutions such as bagasse and bamboo, to meet the diverse needs of consumers. With the increased demand for eco-friendly disposable items, producers are focused on manufacturing compostable and recyclable plain plates, which will increase their global popularity.

The disposable plate market is classified into two parts based on sales channel: B2B and B2C. The B2B market is undergoing rapid expansion. This is primarily due to the high volume purchasing that occurs in commercial settings such as restaurants, catering firms, and institutional food services. These businesses require a steady and readily available supply of disposable plates to keep their operations running smoothly. Bulk purchases save money, which boosts the B2B segment's growth. Furthermore, B2B vendors' appeal among enterprises is due to the simplicity and speed of their procurement processes. The disposable plate market's B2B segment is expected to grow concurrently with the food service industry.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

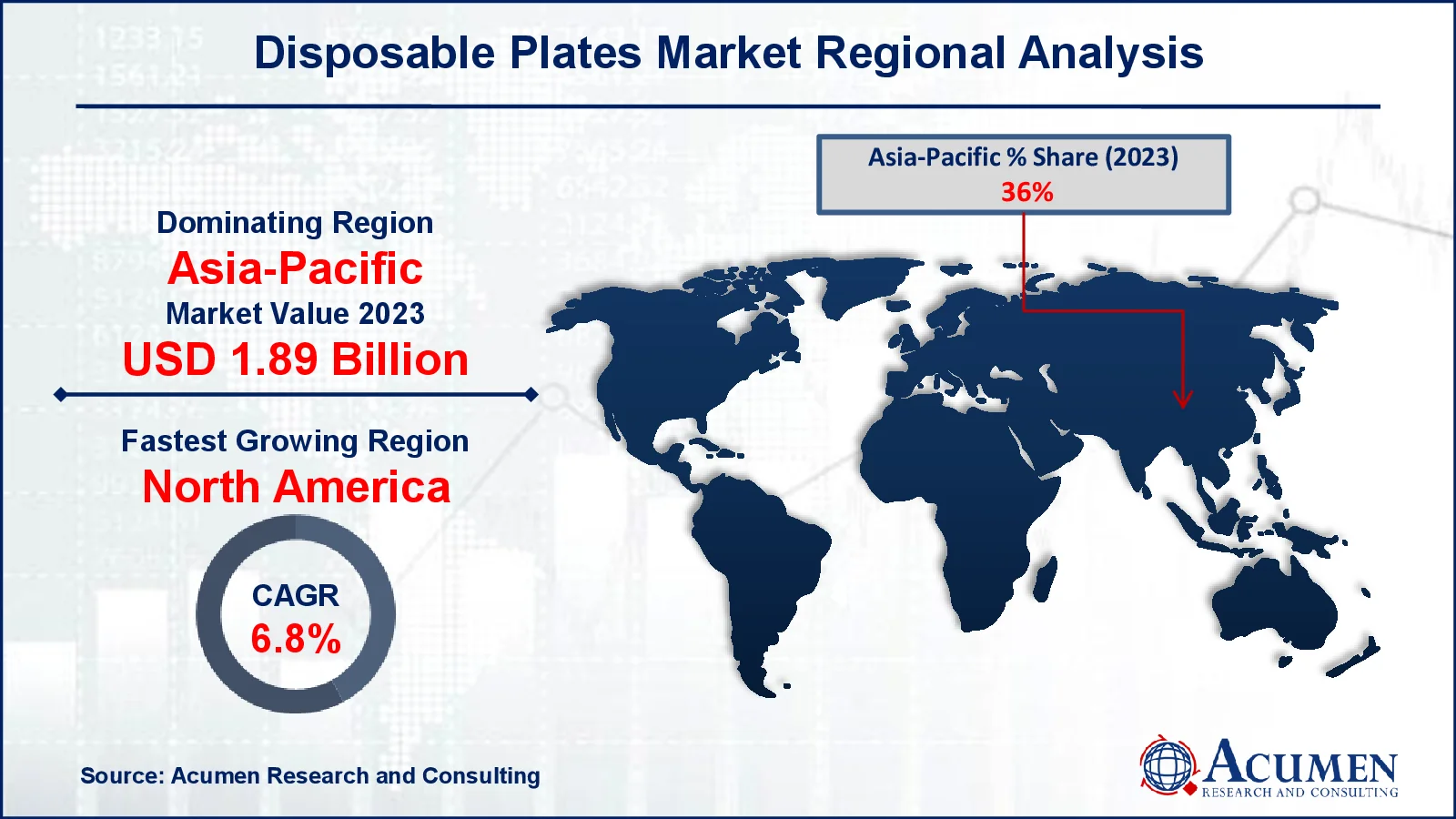

Disposable Plates Market Regional Analysis

Disposable Plates Market Regional AnalysisAsia-Pacific dominated the worldwide industry in the disposable plates market forecast period. The region is experiencing particularly rapid expansion as disposable plates become more popular. The increasing demand for disposable plates from restaurants, hospitals, and the commercial sector is primarily driving market expansion. Furthermore, Asia-Pacific is expected to expand the fastest between 2024 and 2032, owing to an increasing population and rising demand for packaged foods.

This growth in North America is also supported by the evolving consumer preferences for single-use, convenient dining solutions and increased spending on food service products. The market growth is further fueled by the food service industry’s transition to disposable tableware in response to hygiene standards and COVID-19 protocols. Rising disposable incomes and urbanization in Asia Pacific are fueling a growing need for convenient foods. During the projected period, the rise of organized retail sectors and food delivery platforms in China, India, and Japan is expected to open up considerable market potential.

Some of the top disposable plates companies offered in our report includes Be Green Packaging LLC, Fast Plast A/S, Polar Plastic Ltd., Genpak LLC, Duni AB, CKF Inc, Georgia-Pacific LLC, Huhtamaki Oyj, Vegware Ltd, Dopla Spa, and Poppies Europe Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2021

October 2024

July 2020

December 2023