March 2021

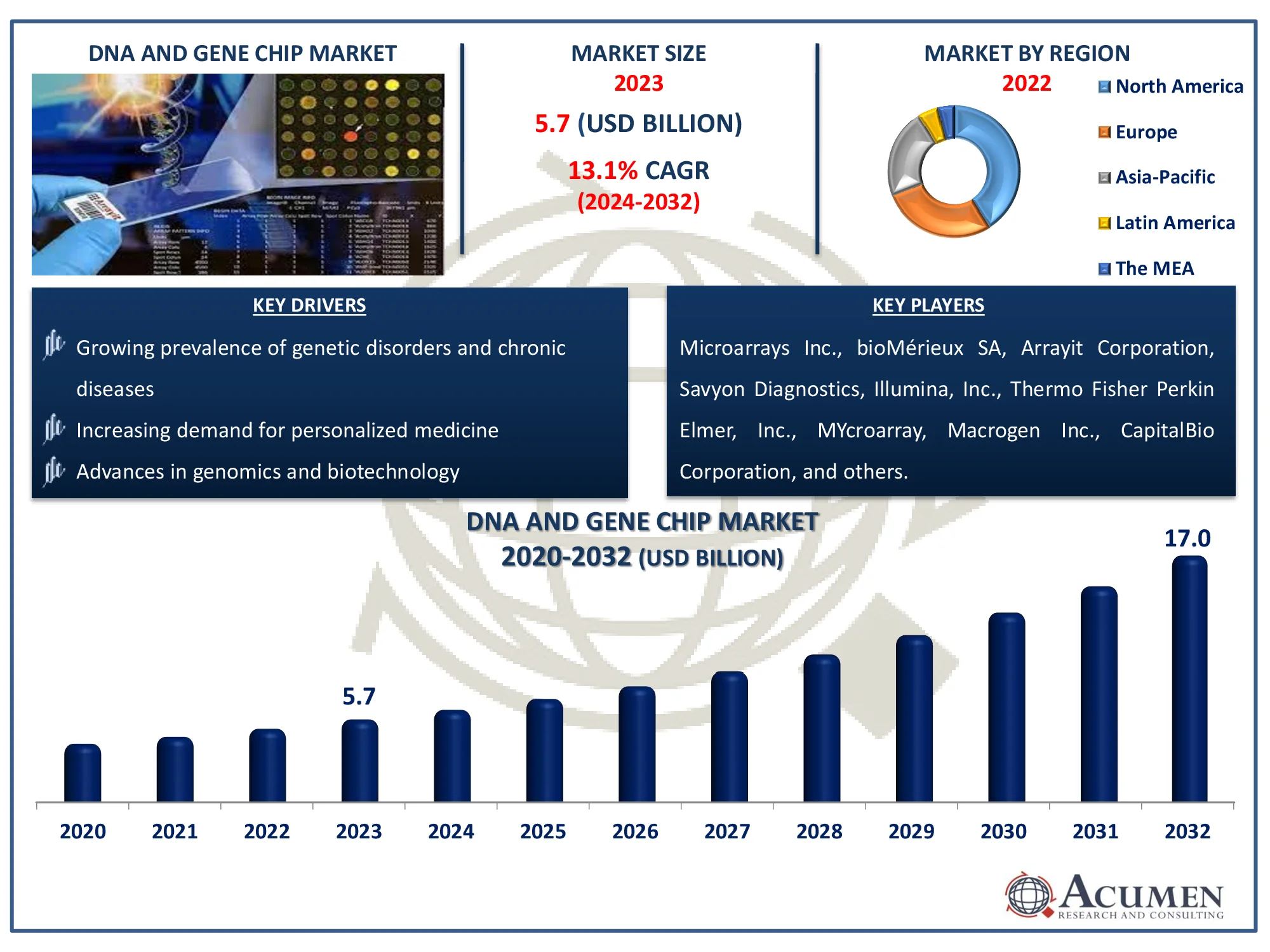

The DNA and Gene Chip Market is set to expand from USD 5.7 Billion in 2023 to USD 17.0 Billion by 2032, driven by advancements in genomics and diagnostics.

The Global DNA and Gene Chip Market Size accounted for USD 5.7 Billion in 2023 and is estimated to achieve a market size of USD 17.0 Billion by 2032 growing at a CAGR of 13.1% from 2024 to 2032.

DNA and Gene Chip Market Highlights

DNA and gene chips, also known as microarrays, are advanced tools used to analyze gene expression and genetic variations. They consist of a small glass or silicon chip with thousands of DNA probes attached, each representing a specific gene or genetic sequence. When a sample is applied to the chip, complementary DNA or RNA molecules bind to the probes, allowing researchers to detect and quantify gene activity or identify genetic mutations. Applications include studying gene expression patterns in diseases, such as cancer, and discovering genetic markers for various conditions. These chips are also used in personalized medicine to tailor treatments based on individual genetic profiles.

Global DNA and Gene Chip Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

DNA and Gene Chip Market Report Coverage

| Market | DNA and Gene Chip Market |

| DNA and Gene Chip Market Size 2022 |

USD 5.7 Billion |

| DNA and Gene Chip Market Forecast 2032 | USD 17.0 Billion |

| DNA and Gene Chip Market CAGR During 2023 - 2032 | 13,.1% |

| DNA and Gene Chip Market Analysis Period | 2020 - 2032 |

| DNA and Gene Chip Market Base Year |

2022 |

| DNA and Gene Chip Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Application, By Product, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Microarrays Inc., bioMérieux SA, Arrayit Corporation, Savyon Diagnostics, Illumina, Inc., Thermo Fisher Scientific, Inc, Perkin Elmer, Inc., MYcroarray, Macrogen Inc., CapitalBio Corporation, Agilent Technologies, Greiner Bio One International GmbH, Asper Biotech, and Oxford Gene Technology. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

DNA and Gene Chip Market Insights

The DNA and gene chip market is experiencing significant growth driven by the increasing prevalence of genetic disorders and chronic diseases. For instance, an estimated 129 million people in the US are affected by at least one major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension, according to the US Department of Health and Human Services. These conditions often require advanced diagnostic and personalized treatment approaches, for which DNA and gene chips are crucial. These chips enable precise genetic analysis, facilitating early detection and tailored therapies, thus improving patient outcomes. As a result, the demand for DNA and gene chips continues to rise, reflecting their vital role in modern medical diagnostics and treatment planning.

The high costs associated with DNA and gene chip technologies present a significant restraint for the market due to several factors. Firstly, the initial investment in advanced equipment and materials required for manufacturing these chips is substantial. Additionally, the complexity of the technology necessitates specialized skills and training, further driving up operational costs. The expenses related to R&D and regulatory approvals also add to the overall financial burden. Moreover, limited reimbursement policies for genomic testing can hinder widespread adoption. Consequently, these financial barriers can slow down the market's growth and accessibility.

Expanding into emerging markets with growing healthcare infrastructure presents a significant opportunity for the DNA and gene chip market. For instance, according to Invest India, the Indian Medtech industry was valued at $10.63 billion in 2020 and is projected to grow to $50 billion by 2025. Expanding regions often face a high burden of genetic diseases and infectious illnesses, driving demand for advanced diagnostic tools. Improved healthcare systems facilitate the adoption of cutting-edge technologies, making gene chips more accessible and widely used. Furthermore, supportive government policies and increasing investments in healthcare infrastructure enhance market potential.

DNA and Gene Chip Market Segmentation

The worldwide market for DNA and gene chip is split based on application, product, end-user, and geography.

DNA and Gene Chip Applications

According to the DNA and gene chip industry analysis, the market is significantly driven by advancements in cancer diagnosis and treatment. These technologies enable precise genetic profiling of tumors, facilitating personalized treatment plans and early detection. The demand for targeted therapies and the rising prevalence of cancer have accelerated the adoption of gene chips in clinical settings. For instance, according to Down to Earth Organization, the minister noted that in 2023, India saw an estimated 1,496,972 cancer cases, up from 1,461,427 in 2022. Consequently, the market sees substantial investment and innovation focused on oncology applications.

DNA and Gene Chip Products

The consumables segment is the largest application category in the DNA and gene chip market due to their recurring demand in various research and diagnostic applications. These include reagents, microarrays, and other essential supplies that are frequently used in high-throughput genomic studies. The constant need for these items in laboratory workflows ensures a steady market demand. Additionally, advancements in biotechnology and personalized medicine further drive the consumption of these products. For instance, according to The Personalized Medicine Coalition, in 2023, the FDA approved 16 new personalized treatments for patients with rare diseases, a significant increase from the six approved in 2022. Among these new approvals, there are seven cancer drugs and three treatments for other diseases and conditions, which significantly accelerated growth of these products.

DNA and Gene Chip End-users

According to the DNA and gene chip industry forecast, academic and government research institutes dominate the market due to their substantial investment in genomic research and biotechnological advancements. These institutions often have access to significant funding and resources, enabling them to purchase advanced genomic technologies for large-scale studies. Their focus on exploring genetic variations, disease mechanisms, and personalized medicine drives demand for high-throughput DNA and gene chips. Furthermore, collaborations with pharmaceutical companies and participation in large genomic projects enhance their market influence.

DNA and Gene Chip Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

DNA and Gene Chip Market Regional Analysis

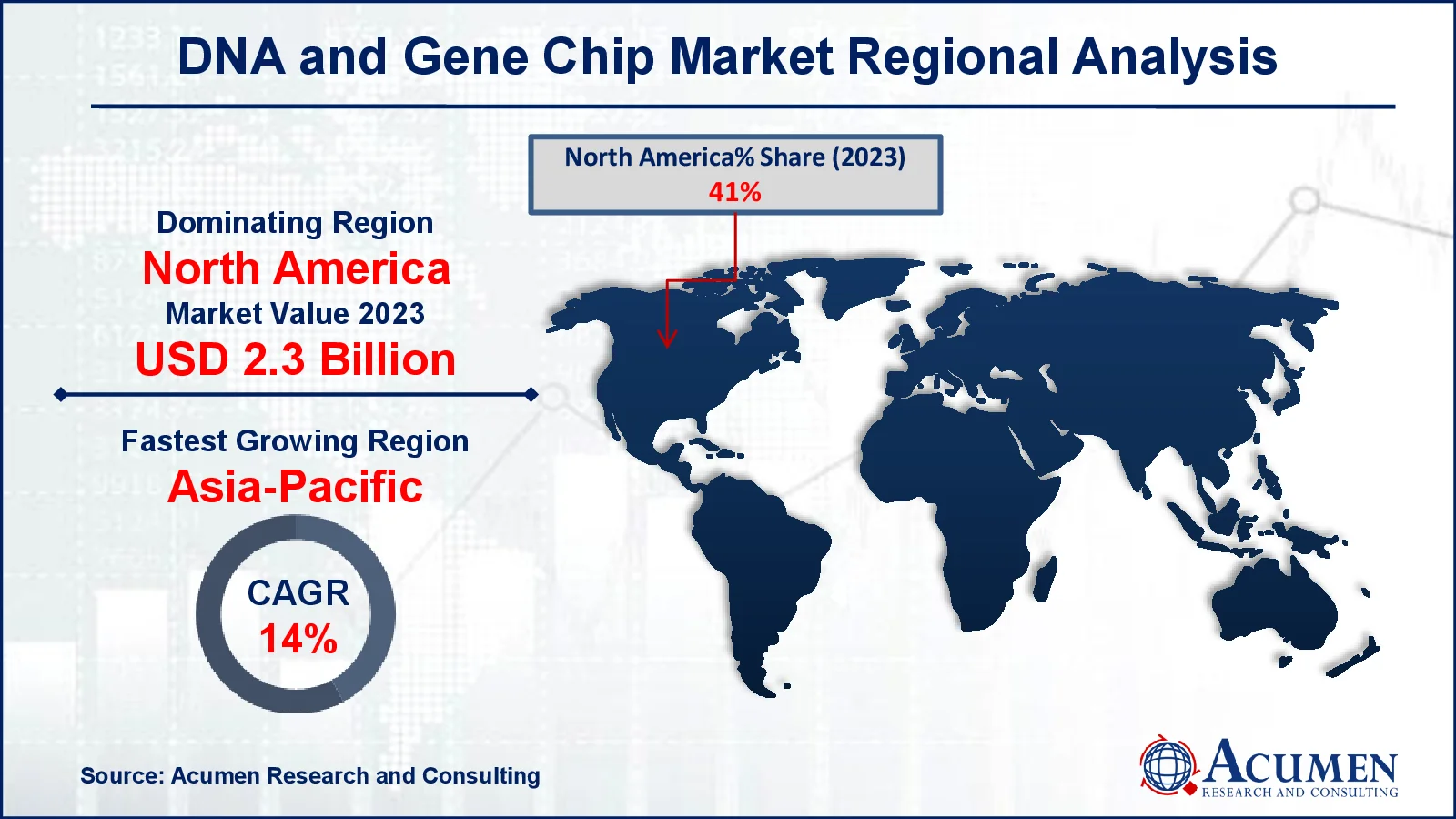

For several reasons, North America dominates the DNA and gene chip market due to its advanced research infrastructure and high investment in biotechnology. The region boasts numerous top-tier research institutions and biotech firms driving innovation and adoption of cutting-edge genetic technologies. Significant research and development efforts by major industry players are driving market growth. For instance, in September 2020, Cardea Bio and Nanosens Innovations collaborated to create a diagnostic device based on CRISPR-Cas9 technology, which incorporates a graphene transistor, known as the CRISPR-Chip. Additionally, a strong regulatory framework and favorable policies further propel North America's dominance in this field.

Asia-Pacific is expected to emerge as a promising market, recording the highest CAGR during the forecast period due to increased demand for research and development in genomic studies and rising biotechnology sector. For instance, in 2023, the Indian bioeconomy industry was valued at $137 billion. It is projected to grow to $150 billion by 2025 and $300 billion by 2030. This biotechnology sector’s expansion is driven by increasing demand both domestically and internationally. Additionally, growing awareness about genetic testing for disease risk assessment and prevention is anticipated to positively impact the region's market growth.

DNA and Gene Chip Market Players

Some of the top DNA and gene chip companies offered in our report include Microarrays Inc., bioMérieux SA, Arrayit Corporation, Savyon Diagnostics, Illumina, Inc., Thermo Fisher Scientific, Inc, Perkin Elmer, Inc., MYcroarray, Macrogen Inc., CapitalBio Corporation, Agilent Technologies, Greiner Bio One International GmbH, Asper Biotech, and Oxford Gene Technology.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2021

May 2024

March 2025

April 2021