March 2025

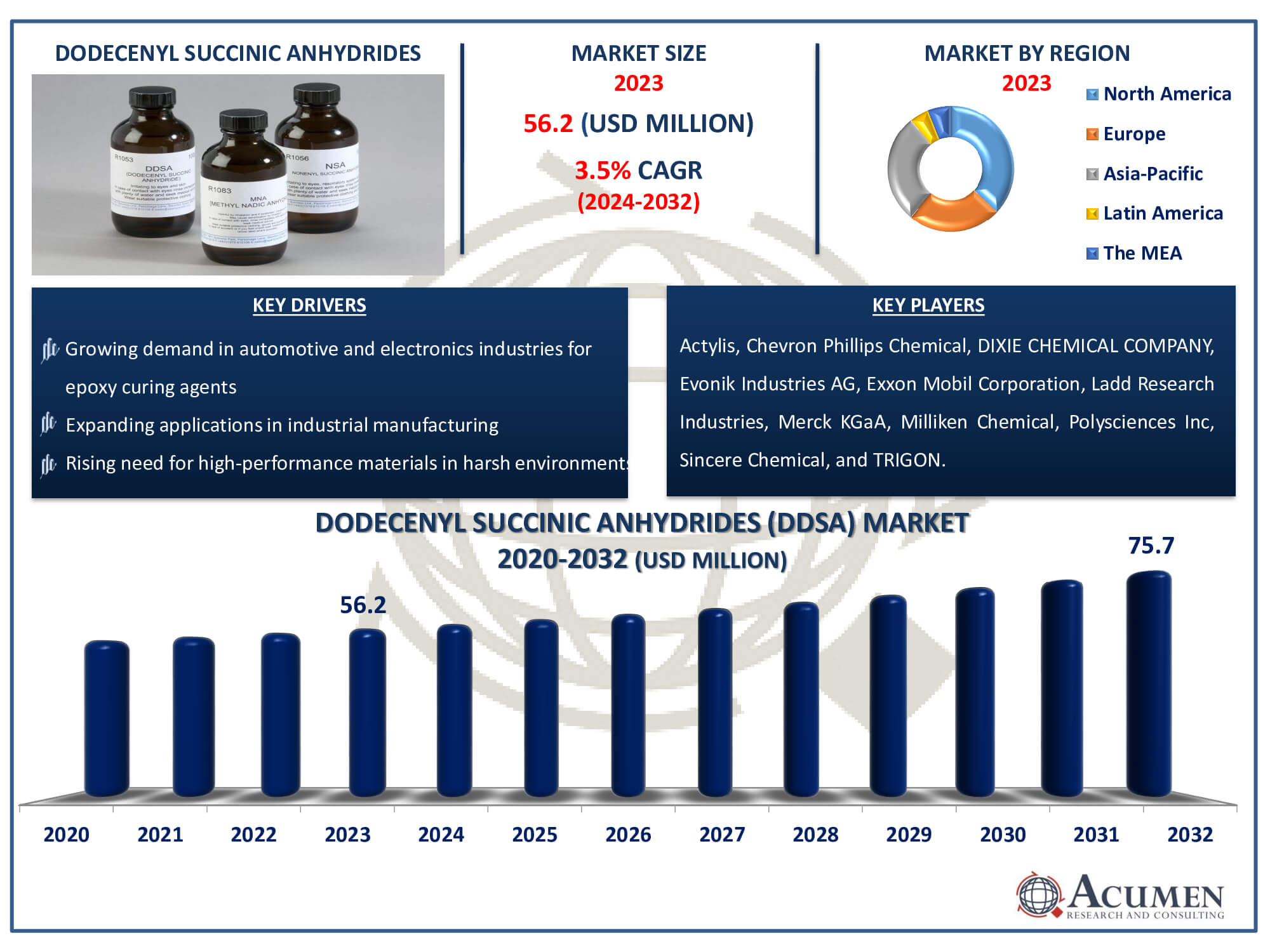

The Dodecenyl Succinic Anhydride Market Size was USD 56.2 Million in 2023 and is projected to reach USD 75.7 Million by 2032, expanding at a CAGR of 3.5% from 2024 to 2032.

The Dodecenyl Succinic Anhydride Market Size accounted for USD 56.2 Million in 2023 and is estimated to achieve a market size of USD 75.7 Million by 2032 growing at a CAGR of 3.5% from 2024 to 2032.

Dodecenyl Succinic Anhydride Market Highlights

Dodecenyl Succinic Anhydride (DDSA) is an organic chemical that results from the reaction of succinic anhydride and dodecene. It is a popular curing agent for epoxy resins because to its strong reactivity, low viscosity, and great thermal stability. These qualities make DDSA ideal for applications that require long-lasting and heat-resistant materials, such as coatings, adhesives, and sealants.

Aside from its principal usage in epoxy curing, DDSA is used in a variety of industrial applications because of its potential to improve the performance of completed products. It is appreciated in the automotive and electronics industries for its ability to produce components that can endure high temperatures and harsh conditions. The compound's versatility and effectiveness have made it an important material in the manufacturing sector, driving its steady demand and market growth.

Global Dodecenyl Succinic Anhydride Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Dodecenyl Succinic Anhydride Market Report Coverage

| Market | Dodecenyl Succinic Anhydride Market |

| Dodecenyl Succinic Anhydride Market Size 2022 | USD 56.2 Billion |

| Dodecenyl Succinic Anhydride Market Forecast 2032 | USD 75.7 Billion |

| Dodecenyl Succinic Anhydride Market CAGR During 2023 - 2032 | 3.5% |

| Dodecenyl Succinic Anhydride Market Analysis Period | 2020 - 2032 |

| Dodecenyl Succinic Anhydride Market Base Year |

2022 |

| Dodecenyl Succinic Anhydride Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Actylis, Chevron Phillips Chemical, DIXIE CHEMICAL COMPANY, Evonik Industries AG, Exxon Mobil Corporation, Ladd Research Industries, Merck KGaA, Milliken Chemical, Polysciences Inc, Sincere Chemical, and TRIGON. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Dodecenyl Succinic Anhydride Market Insights

Several major factors drive the dodecenyl succinic anhydride (DDSA) market, highlighting its importance across a wide range of sectors. To begin, DDSA is becoming increasingly popular in the automotive and electronics industries due to its effectiveness as an epoxy curing agent. Its high reactivity, low viscosity, and great thermal stability make it perfect for creating long-lasting components that can endure extreme temperatures and harsh circumstances. Furthermore, the growing use of DDSA in industrial manufacturing, notably in coatings and adhesives, is fueling market growth as businesses seek materials with improved performance and lifespan.

However, the market has some constraints that may impede its expansion. Fluctuations in raw material prices have a substantial impact on DDSA production costs, making it difficult for manufacturers to keep prices consistent. Furthermore, the availability of alternative curing agents creates a competitive threat, since firms may choose cheaper or more easily available alternatives. Stringent environmental restrictions on chemical manufacture also provide a barrier, requiring companies to spend in compliance and sustainable practices, potentially increasing operational expenses.

Despite these challenges, the DDSA industry offers significant prospects for future growth. Innovations in DDSA formulations for advanced applications can offer up new utilization opportunities, increasing its attractiveness across a wide range of sectors. Expanding into emerging markets in Asia-Pacific presents a substantial potential due to fast industrialization and rising demand for high-performance materials in these regions. Furthermore, agreements with research institutions to create sustainable production processes can help companies reduce their environmental effect while also meeting legal requirements, encouraging a favorable DDSA market outlook.

Dodecenyl Succinic Anhydride Market Segmentation

The worldwide market for dodecenyl succinic anhydride is split based on type, application, and geography.

Dodecenyl Succinic Anhydrides DDSA Market By Type

According to the dodecenyl succinic anhydride industry analysis, the market was dominated by the kind with a purity of 98%. This supremacy is due to its excellent balance of performance and cost-effectiveness, which makes it ideal for a variety of industrial applications, particularly as an epoxy curing agent in the automotive and electronics industries. The Purity 98% type has a high reactivity and thermal stability, which are important features for demanding applications, making it preferred above other purity levels.

Dodecenyl Succinic Anhydrides DDSA Market By Application

According to our dodecenyl succinic anhydride (DDSA) market forecast, the epoxy resin curing agent is predicted to be the dominant application. This application leads the market because to DDSA's strong reactivity and great thermal stability, both of which are required for the production of durable and heat-resistant epoxy resins. These features make DDSA an excellent choice for the automotive and electronics industries, where powerful and dependable curing agents are essential.

Dodecenyl Succinic Anhydride Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Dodecenyl Succinic Anhydride Market Regional Analysis

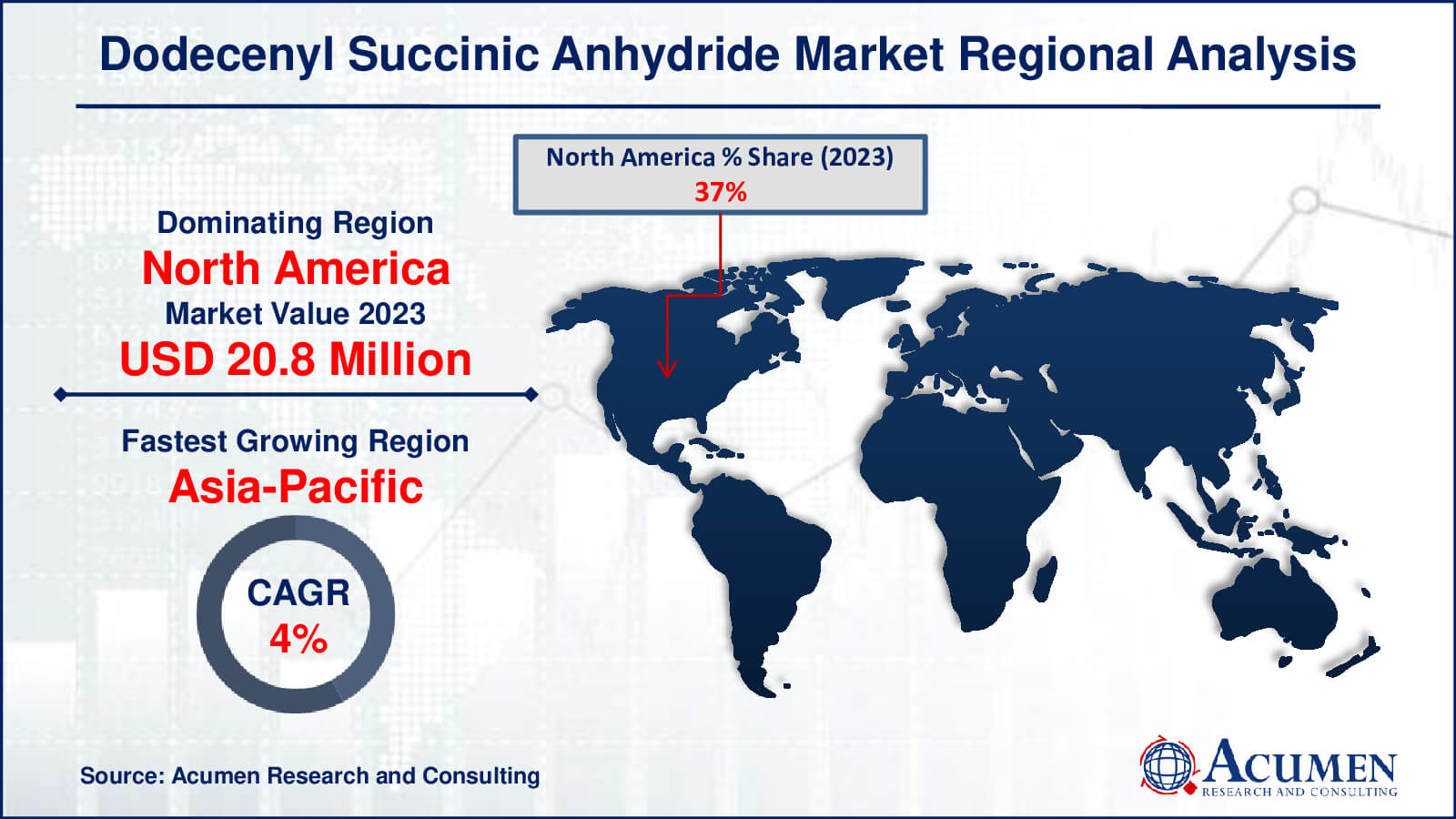

The dodecenyl succinic anhydride (DDSA) market showcases significant regional variations in demand and growth rates. In 2023, North America dominates the market with an estimated value of USD 20.8 million, driven by the extensive use of DDSA in the automotive and electronics industries. The region's advanced industrial infrastructure and ongoing research and development activities aimed at enhancing product applications and performance also contribute to its dominance.

In Europe, the DDSA market is expected to reach USD 18.93 million by 2032, driven by stringent environmental regulations and a strong focus on sustainable chemical manufacturing practices. The Asia-Pacific region, meanwhile, is characterized by rapid industrialization and increasing demand for high-performance materials, with a notable market share and higher CAGR compared to other regions. The growing manufacturing sectors in countries like China and India are significant contributors to this growth, underscoring the region's potential for future market expansion.

Dodecenyl Succinic Anhydride Market Players

Some of the top dodecenyl succinic anhydride companies offered in our report includes Actylis, Chevron Phillips Chemical, DIXIE CHEMICAL COMPANY, Evonik Industries AG, Exxon Mobil Corporation, Ladd Research Industries, Merck KGaA, Milliken Chemical, Polysciences Inc, Sincere Chemical, and TRIGON.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2025

January 2018

October 2020

February 2024