June 2021

Drive By Wire Market (By Vehicle Type: Passenger Cars, Commercial Vehicles, Off-Highway Vehicles, EVs; By Component: Actuator, Electronic Control Unit, Engine Control Module, Electronic Throttle Control Module, Electronic Transmission Control Unit, Feedback Motor, Parking Pawl, Sensors, Others; By Application: Throttle By Wire, Shift By Wire, Brake-By-Wire System, Steer-By-Wire System, Park-By-Wire System) - Global Industry Analysis, Size, Share, Trends and Forecast 2025 - 2033

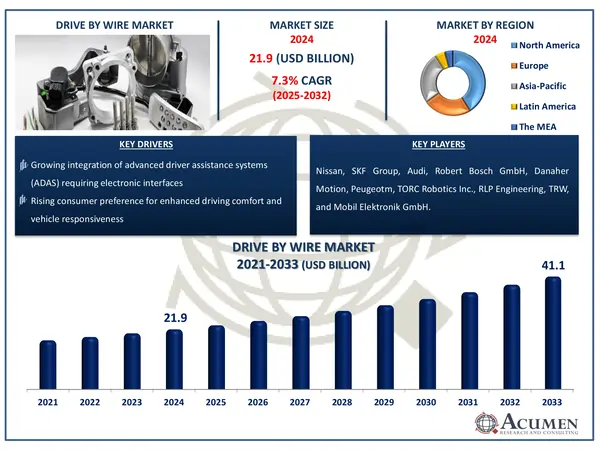

The global drive by wire market size accounted for USD 21.9 billion in 2024 and is estimated to exceed around USD 41.1 billion by 2033 growing at a CAGR of 7.3% from 2025 to 2033. Emerging applications in commercial vehicle fleets seeking operational efficiency is a popular drive by wire market trend that fuels the industry demand. Drive by wire (DBW), also known as electronic throttle control (ETC) or X-by-wire technology, is a sort of vehicle control system that relies on electronic interfaces rather than traditional mechanical links. These systems electronically translate driver commands (acceleration, braking, and steering) into actuators that control vehicle functions. This technology eliminates physical connections between driver controls and vehicle components, instead relying on sensors, electronic control units, and electromechanical actuators to interpret commands and carry out related duties. The primary advantages include higher precision, decreased mechanical complexity, improved packing flexibility, advanced safety feature integration, and potential weight reductions. Throttle-by-wire, brake-by-wire, steer-by-wire, and shift-by-wire systems are popular current implementations, with uses ranging from aircraft (fly-by-wire) to marine vessels.

The drive by wire (DBW) market is experiencing substantial transformation driven by technological advancement and shifting automotive industry paradigms. This evolution is characterized by the progressive replacement of conventional mechanical control systems with sophisticated electronic interfaces that enhance vehicle performance, safety, and efficiency. According to the U.S. Department of Energy, modern drive-by-wire systems can improve fuel efficiency by up to 15% compared to traditional mechanical linkages. Stringent emissions regulations around the world are propelling market growth, forcing manufacturers to develop precise electronic control systems that improve fuel efficiency while minimizing environmental impact. The European Commission's Regulation (EU) 2019/631 mandates an average COâ‚‚ emissions target of 95g/km for new passenger cars, encouraging the adoption of electronic and digital controls. Concurrently, the rapid development of electric vehicles and self-driving technologies has resulted in extraordinary demand for enhanced DBW systems, as these applications rely on electrical rather than mechanical control.

Consumer tastes are shifting toward vehicles with improved driving dynamics, comfort, and adjustable performance profiles, all of which are readily available through DBW technologies. Furthermore, integrating these technologies makes it easier to incorporate advanced driver assistance systems (ADAS), which accelerates market growth even further. However, significant concerns remain. High implementation costs continue to limit widespread adoption in low-cost automobile segments. System dependability issues and cybersecurity concerns create technical problems that need continuous innovation. According to the U.S. National Highway Traffic Safety Administration (NHTSA), more than 15% of recalls between 2021 and 2023 involved electronic control systems, underscoring the importance of reliability in DBW technologies. Furthermore, the change will demand significant investment in specialized maintenance infrastructure and technician training.

Established automotive suppliers and rising technology companies both do significant R&D in the competitive landscape. Strategic collaborations between traditional automakers and online businesses are becoming more common, quickening innovation cycles and opening up new market opportunities. Geographically, developed automotive markets have the highest adoption rates, while emerging economies have enormous growth potential as vehicle production capabilities improve. For example, India reported 1.4 million electric car sales in 2023, accounting for approximately 6.3% of total vehicle sales, owing in part to DBW-compatible platforms funded under the FAME II program.

| Area of Focus | Details |

| Market Size 2024 | USD 21.9 Billion |

| Market Forecast 2033 | USD 41.1 Billion |

| Market CAGR During 2025 - 2033 | 7.3% |

| Segments Covered | By Vehicle Type, By Component, By Application, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nissan, SKF Group, Audi, Robert Bosch GmbH, Danaher Motion, Peugeotm, TORC Robotics Inc., RLP Engineering, TRW, and Mobil Elektronik GmbH. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The worldwide market for drive by wire is split based on vehicle type, component, application, and geography.

The passenger car sector now has the largest market share among the industry's vehicle types, which include passenger cars, commercial vehicles, off-highway vehicles, and electric vehicles (EVs), and is expected to maintain this position during the drive by wire market forecast period. This dominant position is due to a number of factors, including increased global passenger car production volume, rising customer demand for sophisticated safety features and driving comfort, and the increasing integration of technological systems into modern vehicles. Furthermore, rigorous government pollution and fuel economy regulations have hastened the advancement of drive-by-wire technology in this category. Manufacturers are rapidly replacing obsolete mechanical components in passenger vehicles with electronic alternatives that save weight, increase fuel efficiency, and improve vehicle control.

Electronic control units (ECUs) are expected to develop the most rapidly among drive by wire market component categories in the future years. This remarkable rise is driven by the rising complexity of car electronics architecture, as well as the critical role ECUs play in handling many drive-by-wire systems at the same time. As automobiles incorporate more advanced driver assistance systems (ADAS) and autonomous driving features, the demand for complex ECUs with higher processing capabilities has increased. Furthermore, the incorporation of artificial intelligence and machine learning capabilities into these control units is hastening market progress. The ECU segment's expansion is further aided by ongoing miniaturization efforts and cost-cutting tactics implemented by automobile makers.

Throttle-by-wire generates the most revenue in the drive-by-wire business due to its extensive adoption in internal combustion engine (ICE) and hybrid vehicles. This technique replaces the mechanical throttle linkage with electronic sensors and actuators, resulting in more precise engine control, improved fuel efficiency, and lower emissions. Automakers choose throttle-by-wire systems due to their dependability, reactivity, and ease of integration with electronic stability control, cruise control, and other current car systems. The ongoing shift towards smarter and cleaner automotive solutions assures that throttle-by-wire remains the most popular application in DBW systems.

Meanwhile, shift-by-wire has a large market share due to its increasing presence in newer automatic gearbox automobiles. It replaces mechanical links in favor of electronic controls, resulting in smoother gear transitions, greater design freedom, and support for advanced driver aid systems. Shift-by-wire systems' compact form also helps to maximize cabin space, making them ideal for electric and premium automobiles. Despite not leading in overall sales, shift-by-wire remains a significant segment due to its functional and technological advantages in next-generation mobility solutions.

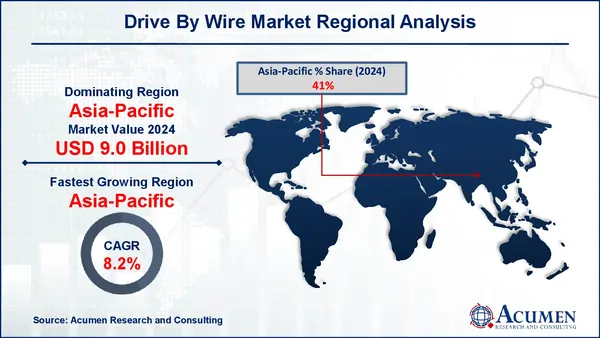

Asia-Pacific is the world's largest and fastest-growing drive-by-wire market. This dominance is partly due to the region's strong automobile manufacturing infrastructure, especially in China, Japan, South Korea, and India. China, in particular, has emerged as a hub for electric and self-driving car production, promoting widespread adoption of modern electronic systems such as drive-by-wire technology. Furthermore, Japan and South Korea have a long history of technological innovation and early adoption of smart automotive components, which contribute to regional growth.

According to drive by wire industry analysis, the surge in customer demand for fuel-efficient, technologically advanced automobiles in emerging nations, combined with supporting government policies promoting cleaner mobility options, is driving the drive-by-wire market. Incentives for electric car adoption and rigorous emission standards have pushed manufacturers to create lightweight and electronically controlled systems, making drive-by-wire a perfect fit.

Moreover, the growing middle-class population, increasing disposable incomes, and improving road infrastructure are contributing to the rising sales of passenger and commercial vehicles equipped with advanced driver assistance systems (ADAS). Investments in R&D, together with strategic alliances between automotive OEMs and technology providers in the region, are accelerating innovation. Given these considerations, Asia-Pacific not only leads the market in terms of volume but is also expected to grow at a rapid pace over the drive by wire market forecast period.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Some of the top drive by wire (DBW) market companies offered in our report includes Nissan, SKF Group, Audi, Robert Bosch GmbH, Danaher Motion, Peugeotm, TORC Robotics Inc., RLP Engineering, TRW, and Mobil Elektronik GmbH.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2021

September 2020

May 2020

July 2021