April 2025

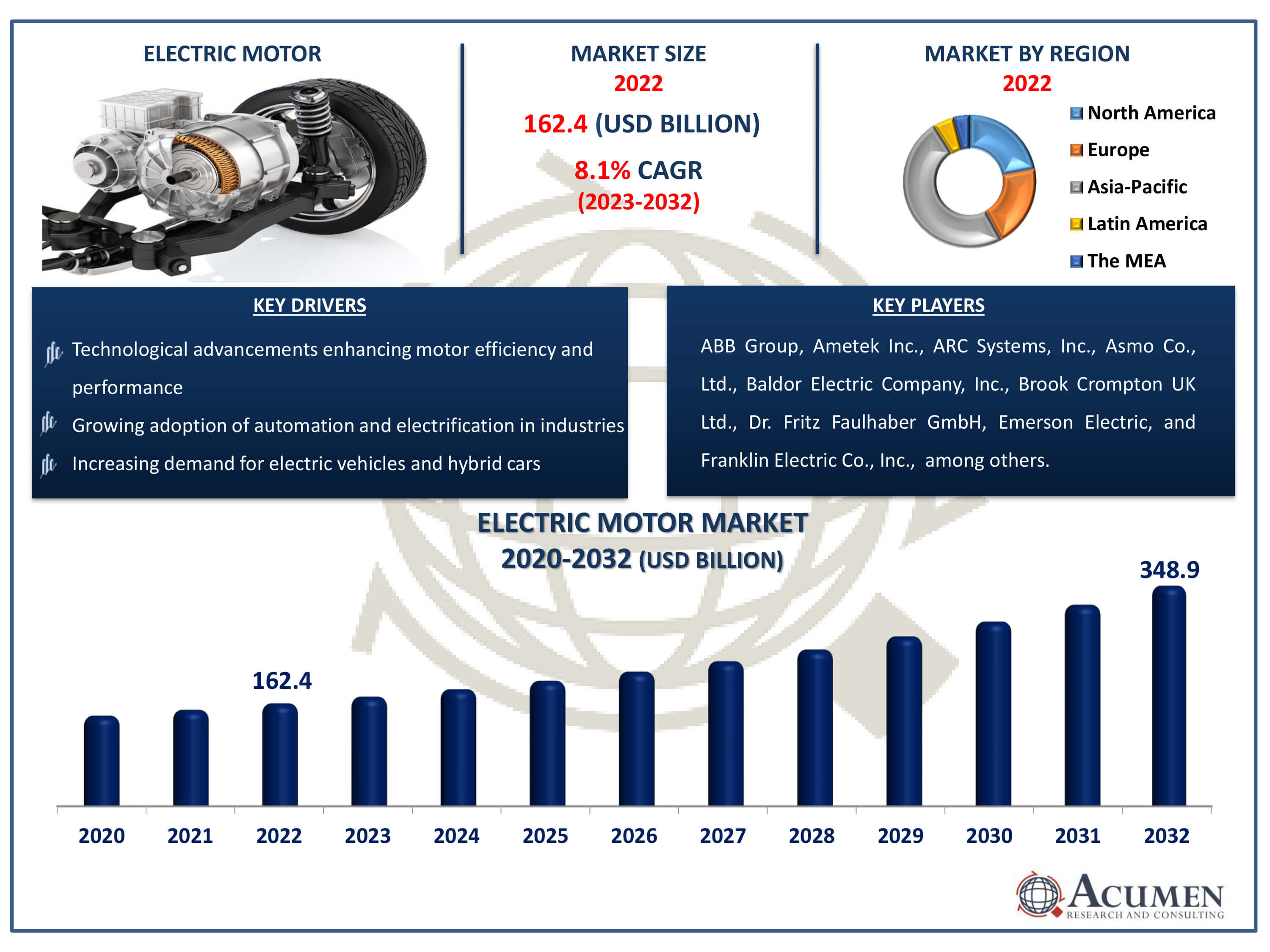

Electric Motor Market Size accounted for USD 162.4 Billion in 2022 and is estimated to achieve a market size of USD 348.9 Billion by 2032 growing at a CAGR of 8.1% from 2023 to 2032.

The Electric Motor Market Size accounted for USD 162.4 Billion in 2022 and is estimated to achieve a market size of USD 348.9 Billion by 2032 growing at a CAGR of 8.1% from 2023 to 2032.

Electric Motor Market Highlights

An electro-mechanical device, an electric motor uses the interaction of magnetic and electric fields to transform electrical energy into mechanical energy. AC motors and DC motors are the two primary categories of electric motors. DC motors run on direct current, whereas AC motors use alternating current. A number of factors are contributing to the huge growth of the electric motor market. Electric motors are becoming more and more popular than traditional combustion engines due to their increased motor efficiency, energy savings, and environmental considerations. Furthermore, the market is expanding due to the growing tendency in industries towards electrification and automation. In the electric motor market forecast period, it is anticipated that government programs promoting renewable energy sources and electric vehicles would open up profitable opportunities for the electric motor business.

Global Electric Motor Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Electric Motor Market Report Coverage

| Market | Electric Motor Market |

| Electric Motor Market Size 2022 | USD 162.4 Billion |

| Electric Motor Market Forecast 2032 | USD 348.9 Billion |

| Electric Motor Market CAGR During 2023 - 2032 | 8.1% |

| Electric Motor Market Analysis Period | 2020 - 2032 |

| Electric Motor Market Base Year |

2022 |

| Electric Motor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Type, By Power Output, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB Group, Ametek Inc., ARC Systems, Inc., Asmo Co., Ltd., Baldor Electric Company, Inc., Brook Crompton UK Ltd., Dr. Fritz Faulhaber GmbH, Emerson Electric, Franklin Electric Co., Inc., Maxon Motors AG, Regal Beloit Corporation, Rockwell Automation, Inc., and Siemens AG |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electric Motor Market Insights

The increasing usage of electric motors across major industries, particularly in automobile production, is driving the market value. The growing commercial and residential sectors, coupled with the rising demand for HVAC (Heating, Ventilation, and Air Conditioning) applications and motor-driven household appliances, are accelerating the market value. The rapid growth in the agricultural sector and the transition toward energy-efficient motors further support the market value. Meanwhile, expanding demand for electric vehicles in emerging economies and the growing robotics technology across the globe are likely to create potential opportunities over the electric motor industry forecast period from 2023 to 2032

Throughout the projected period, brushed DC motors' high maintenance costs will likely be a major barrier to market expansion. In order to transport electrical current to the rotor, brushed DC motors use brushes and a commutator, which over time causes wear and tear. Periodic replacement of these brushes is necessary, which raises maintenance costs and causes user downtime. Furthermore, when the brushes are in use, they produce heat and friction, which might lower the motor's dependability and efficiency. Because they require less maintenance and have longer operating lifespans, alternative motor technologies including brushless DC motors and AC induction motors are a good choice for industries and applications that demand high performance and continuous operation. The difficulty for makers of brushed DC motors to maintain their competitiveness in the market is further increased by the potential long-term cost savings associated with these alternative motors, which may offset their higher initial cost.

Electric Motor Market Segmentation

The worldwide market for electric motor is split based on component, type, power output, application, and geography.

Electric Motor Components

According to electric motor industry analysis, owing to its vital function in transforming electrical energy into mechanical energy, the rotor sector is gaining the greatest share of the market. In order to provide the rotational motion needed for a variety of applications across industries, the rotor, the motor's moving part, works with the stator. Further propelling its widespread acceptance are improvements in motor performance, efficiency, and dependability brought about by developments in rotor design, materials, and manufacturing techniques. Further strengthening this segment's market domination are advancements in rotor technology, such as the creation of permanent magnet rotors and high-efficiency designs. The need for superior rotors is growing, emphasizing their role as a major growth driver in the electric motor market as industries place a premium on energy economy and operational excellence.

Electric Motor Types

The AC motors category leads the electric motor market because of its broad application in a variety of sectors and end-use situations. Strongness, dependability, and affordability are just a few of the benefits that make AC motors the ideal option for a variety of applications. Furthermore, AC motors suit a variety of needs in the commercial, residential, and industrial domains thanks to their exceptional performance traits, which include high torque, efficiency, and speed control skills. Their dominance in the industry is further supported by developments in AC motor technology, such as sensor less vector control and variable frequency drives, which further increase their efficiency and adaptability. The need for AC motors is anticipated to be high, maintaining their dominant position in the electric motor industry as long as industries continue to place a high priority on sustainability and energy efficiency.

Electric Motor Power Outputs

The market for electric motors is dominated by the fractional HP output category because of its broad use across many sectors. These motors, typically ranging from a few watts to a few horsepower, find broad application in various consumer appliances, HVAC systems, pumps, fans, and small industrial. Their small size, affordability, and adaptability make them very popular for jobs requiring a moderate power output. Furthermore, fractional HP motors' increased performance and efficiency as a result of technological and design breakthroughs have cemented their position as the industry standard for a wide range of industrial and commercial applications.

Electric Motor Applications

By application, the motor vehicle segment registered the maximum share in 2022 and is projected to maintain its dominance over the estimated period from 2023 to 2032. The increasing investment in electric vehicles and the automobile industry is primarily driving the market value. Furthermore, the inclination towards energy-efficient solutions in the automobile sector of emerging economies is further supporting the market value.

Electric Motor Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Electric Motor Market Regional Analysis

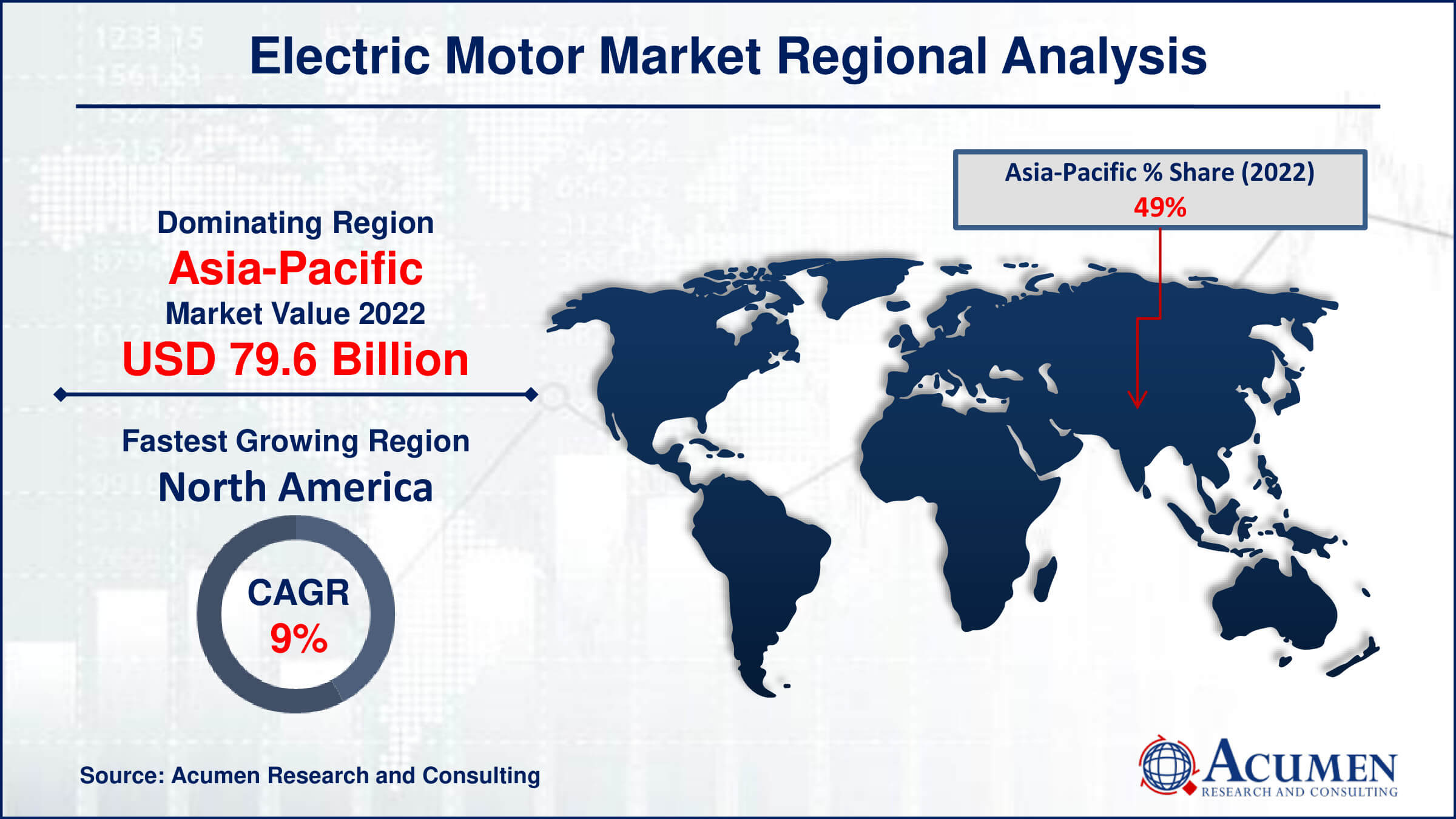

In terms of electric motor market analysis, Asia-Pacific led in 2022 in terms of value and is expected to maintain its dominance from 2023 to 2032. The region, driven by emerging economies like China and India, experiences rapid industrialization, rising disposable income, and commercial sector expansion. Increasing demand for electric vehicles and manufacturers' focus further accelerate regional market growth, supported by favorable government policies.

North America emerges as the fastest-growing region in the electric motor market. Technological innovations in automotive and manufacturing sectors are propelling the adoption of electric vehicles and industrial automation, driving the need for electric motors. Additionally, the region's increasing focus on sustainability and government support through regulations and incentives further stimulate market expansion. With its strong industrial base and technological advancement, North America is positioned to sustain the electric motor market's growth.

Electric Motor Market Players

Some of the top electric motor companies offered in our report includes ABB Group, Ametek Inc., ARC Systems, Inc., Asmo Co., Ltd., Baldor Electric Company, Inc., Brook Crompton UK Ltd., Dr. Fritz Faulhaber GmbH, Emerson Electric, Franklin Electric Co., Inc., Maxon Motors AG, Regal Beloit Corporation, Rockwell Automation, Inc., and Siemens AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2025

January 2019

June 2021

April 2021