March 2024

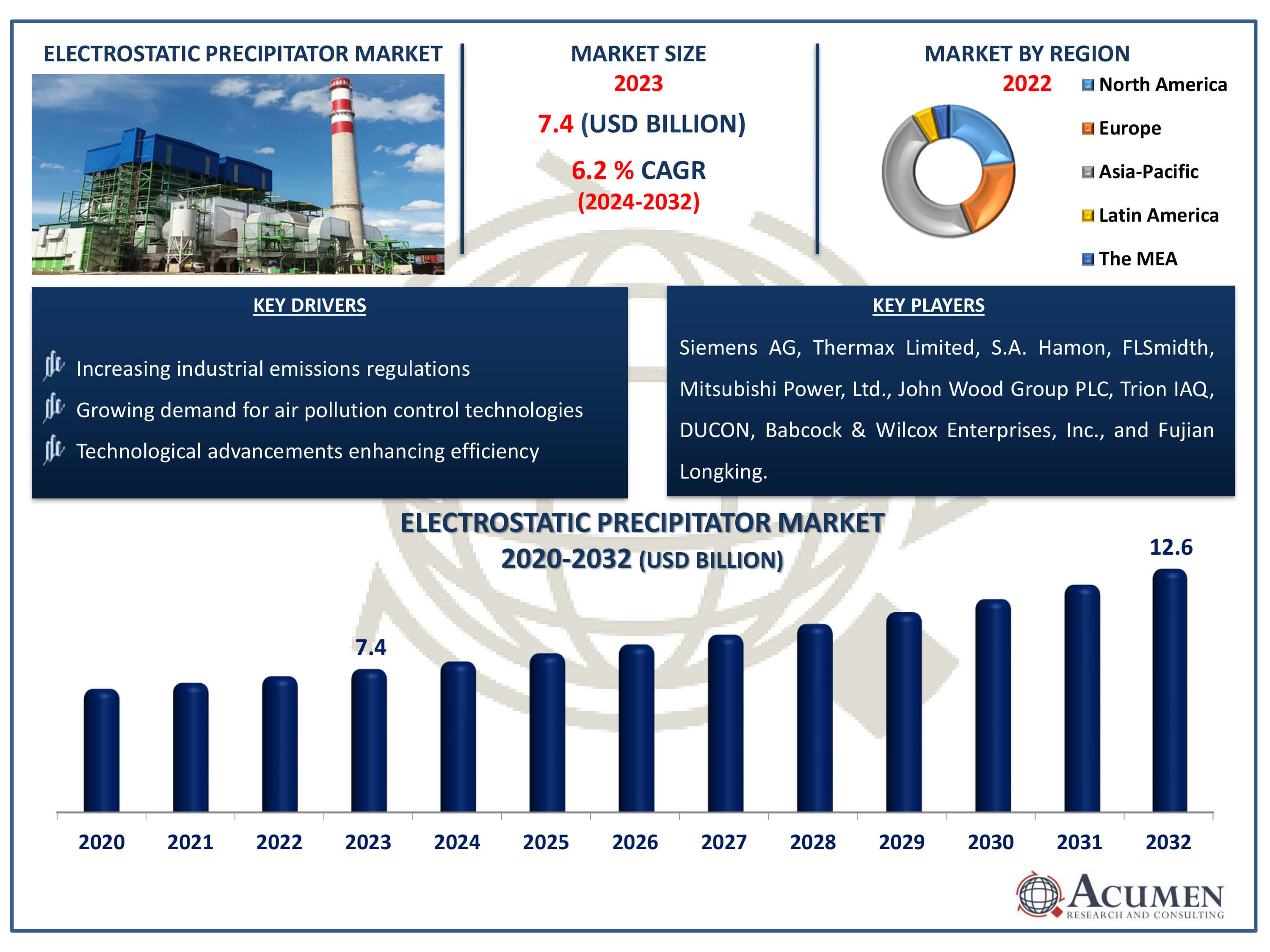

Electrostatic Precipitator Market Size accounted for USD 7.4 Billion in 2023 and is estimated to achieve a market size of USD 12.6 Billion by 2032 growing at a CAGR of 6.2% from 2024 to 2032.

The Electrostatic Precipitator Market Size accounted for USD 7.4 Billion in 2023 and is estimated to achieve a market size of USD 12.6 Billion by 2032 growing at a CAGR of 6.2% from 2024 to 2032.

Electrostatic Precipitator Market Highlights

An electrostatic precipitator (ESP) is a filtration device that removes fine particles, such as dust and smoke, from a flowing gas using the force of an induced electrostatic charge. ESPs are widely used in industrial processes to control air pollution by capturing particulate matter from exhaust gases in power plants, cement plants, steel mills, and other manufacturing facilities.

Global Electrostatic Precipitator Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Electrostatic Precipitator Market Report Coverage

| Market | Electrostatic Precipitator Market |

| Electrostatic Precipitator Market Size 2022 | USD 7.4 Billion |

| Electrostatic Precipitator Market Forecast 2032 |

USD 12.6 Billion |

| Electrostatic Precipitator Market CAGR During 2024 - 2032 | 6.2% |

| Electrostatic Precipitator Market Analysis Period | 2020 - 2032 |

| Electrostatic Precipitator Market Base Year |

2022 |

| Electrostatic Precipitator Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Technology, By Design, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Siemens AG, Thermax Limited, Hamon, FLSmidth, Mitsubishi Power, Ltd., John Wood Group PLC, Trion IAQ, DUCON, Babcock & Wilcox Enterprises, Inc., and Fujian Longking. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electrostatic Precipitator Market Insights

The increasing demand for air pollution control technologies is significantly driving the growth of the electrostatic precipitator market. As regulatory standards for air quality become more stringent worldwide, industries are investing in efficient solutions to reduce particulate emissions. For instance, in 2022, ProcessBarron, a U.S. manufacturer specializing in air and gas handling products, established a wholly-owned subsidiary in Toronto, Canada. This new subsidiary aims to provide electrostatic precipitator and air pollution control services, primarily through its Southern Field-Environmental Elements division. Electrostatic precipitators, known for their high efficiency in removing fine particles from exhaust gases, are becoming a preferred choice in power plants, manufacturing units, and other industrial applications. This heightened focus on environmental sustainability and regulatory compliance is boosting the adoption of electrostatic precipitators, propelling market growth.

Competition from alternative air purification technologies hampers the electrostatic precipitator market growth. The growth of the electrostatic precipitator (ESP) market is being hindered by the emergence of alternative pollution control technologies like fabric filters and wet scrubbers. These newer technologies offer several advantages over traditional ESPs. Fabric filters, for instance, provide highly efficient particle removal across a wide range of particle sizes, and wet scrubbers can effectively capture both particulate matter and gaseous pollutants. Additionally, these alternatives are often more adaptable to varying industrial conditions and can be more cost-effective in terms of installation and maintenance can become significant hurdle for market.

The expansion in emerging markets, driven by rapid industrial growth, presents a significant opportunity for the electrostatic precipitator market. For instance, in 2021, FLSmidth and Thyssenkrupp Industrial Solutions AG agreed to buy Thyssenkrupp's mining and mineral processing division. This merger will result in a global mining technology leader, expanding customer connections and product offerings while boosting geographic coverage. As these regions industrialize, there is an increasing need to control air pollution and fulfill with stringent environmental regulations. Electrostatic precipitators, which effectively remove particulate matter from industrial emissions, are in high demand to ensure cleaner air and sustainable industrial practices. This surge in industrial activities, coupled with the rising focus on environmental protection, is expected to boost the adoption of electrostatic precipitators, thus creating substantial growth opportunities in these markets.

Electrostatic Precipitator Market Segmentation

The worldwide market for electrostatic precipitator is split based on Technology, design, end use, and geography.

Electrostatic Precipitator Technology

According to the electrostatic precipitator industry analysis, dry technology is anticipated to dominate the electrostatic precipitator market due to its efficiency in removing fine particulate matter from industrial emissions. This method leverages high-voltage electrical fields to charge and collect dust particles on collector plates, without the need for water, making it cost-effective and environmentally friendly. Its advantages include lower maintenance requirements, adaptability to various industrial applications, and effectiveness in capturing a wide range of particle sizes, which is increasingly important for meeting stringent environmental regulations. Moreover, wet segment expected to be a fastest growing segment in market due to their removing capacity and key players also focusing on innovations in wet technology. For instance, EcoSpray, an Italian business, will introduce the Wet Electrostatic Precipitator (WESP) in 2021, a unique device for eliminating particulates and black smoke from passenger ships and boats.

Electrostatic Precipitator Design

The plate segment is the largest design category in the electrostatic precipitator market and it is expected to increase over the industry due to its superior efficiency in removing particulate matter from industrial exhaust gases. Plate-type ESPs consist of flat, vertical collection surfaces where charged particles are drawn to and captured. This design allows for a larger collection area and facilitates easier cleaning and maintenance, improving operational efficiency and durability. Additionally, plate ESPs can handle a wide range of particle sizes and compositions, making them versatile for various industrial applications, such as power generation, cement production, and steel manufacturing. The combination of effective particulate removal and robust performance positions the plate design as a dominant segment in the ESP market.

Electrostatic Precipitator End Use

According to the electrostatic precipitator industry forecast, power generation segment dominates the electrostatic precipitator market.This projection stems from the increasing global demand for electricity, driving a parallel surge in power generation activities across various sources such as coal, natural gas, and renewable energy. ESPs play a critical role in mitigating air pollution by efficiently removing particulate matter from flue gases emitted during power generation processes. With stringent environmental regulations mandating cleaner emissions, the adoption of ESPs is becoming imperative for power plants worldwide. Additionally, technological advancements are enhancing the efficiency and adaptability of ESPs, further bolstering their appeal to power generation facilities seeking cost-effective and environmentally sustainable solutions.

Electrostatic Precipitator Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

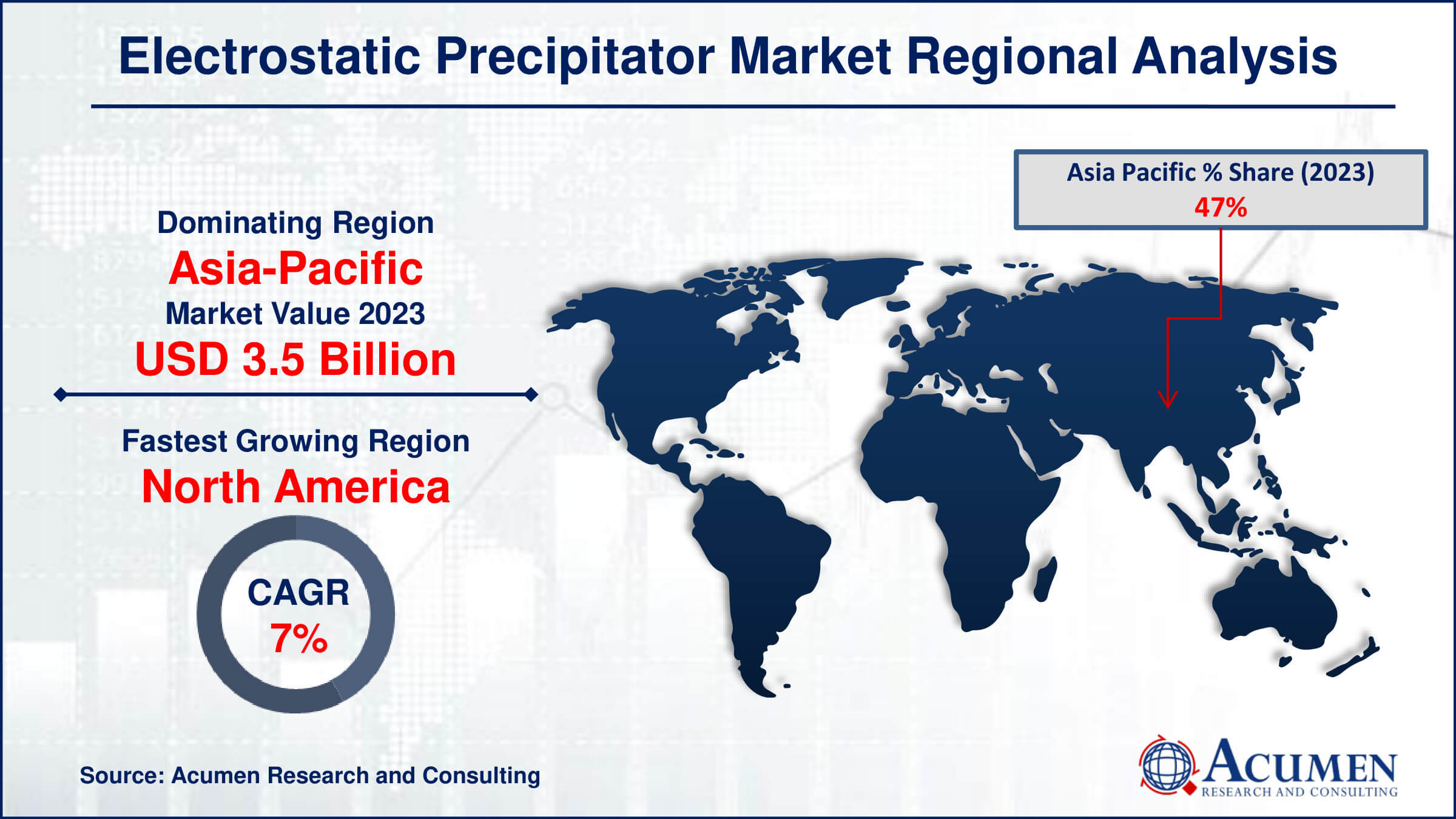

Electrostatic Precipitator Market Regional Analysis

For several reasons, The Asia-Pacific region dominates the electrostatic precipitator market due to its rapid industrialization and urbanization, which drive high demand for air pollution control equipment. Countries like China and India, with their substantial investments in power generation, steel manufacturing, and cement production, contribute significantly to market growth. Additionally, stringent environmental regulations and increasing awareness of air quality issues further bolster the adoption of electrostatic precipitators in the region. Moreover, advancements by key companies further contribute to the growth. For instance, in 2022, General Electric Company introduced a technology solution aimed at reducing carbon emissions. The program entails technical studies to integrate Selective Catalytic Reduction (SCR) technology systems, successfully lowering nitrogen oxide (NOx) and carbon monoxide (CO) emissions by more than 90%, exceeding World Bank emission standards. As a result, the combination of economic growth and regulatory measures ensures the Asia Pacific's dominance in this market.

North America is the fastest-growing region in the electrostatic precipitator market due to increased industrial activities, stringent environmental regulations, and growing awareness of air pollution control. For instance, in March 2016, the EPA (Environmental Protection Agency) announced the National Gas STAR Methane Challenge Program, which allows oil and gas firms to make, track, and demonstrate ambitious pledges to reduce methane emissions. Furthermore, the region's demand is driven by sectors such as power generation, manufacturing, and cement, which require efficient air filtration systems. Investments in advanced technologies and government initiatives further boost market growth.

Electrostatic Precipitator Market Players

Some of the top electrostatic precipitator companies offered in our report include Siemens AG, Thermax Limited, Hamon, FLSmidth, Mitsubishi Power, Ltd., John Wood Group PLC, Trion IAQ, DUCON, Babcock & Wilcox Enterprises, Inc., and Fujian Longking.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2024

March 2023

September 2023

December 2020