May 2023

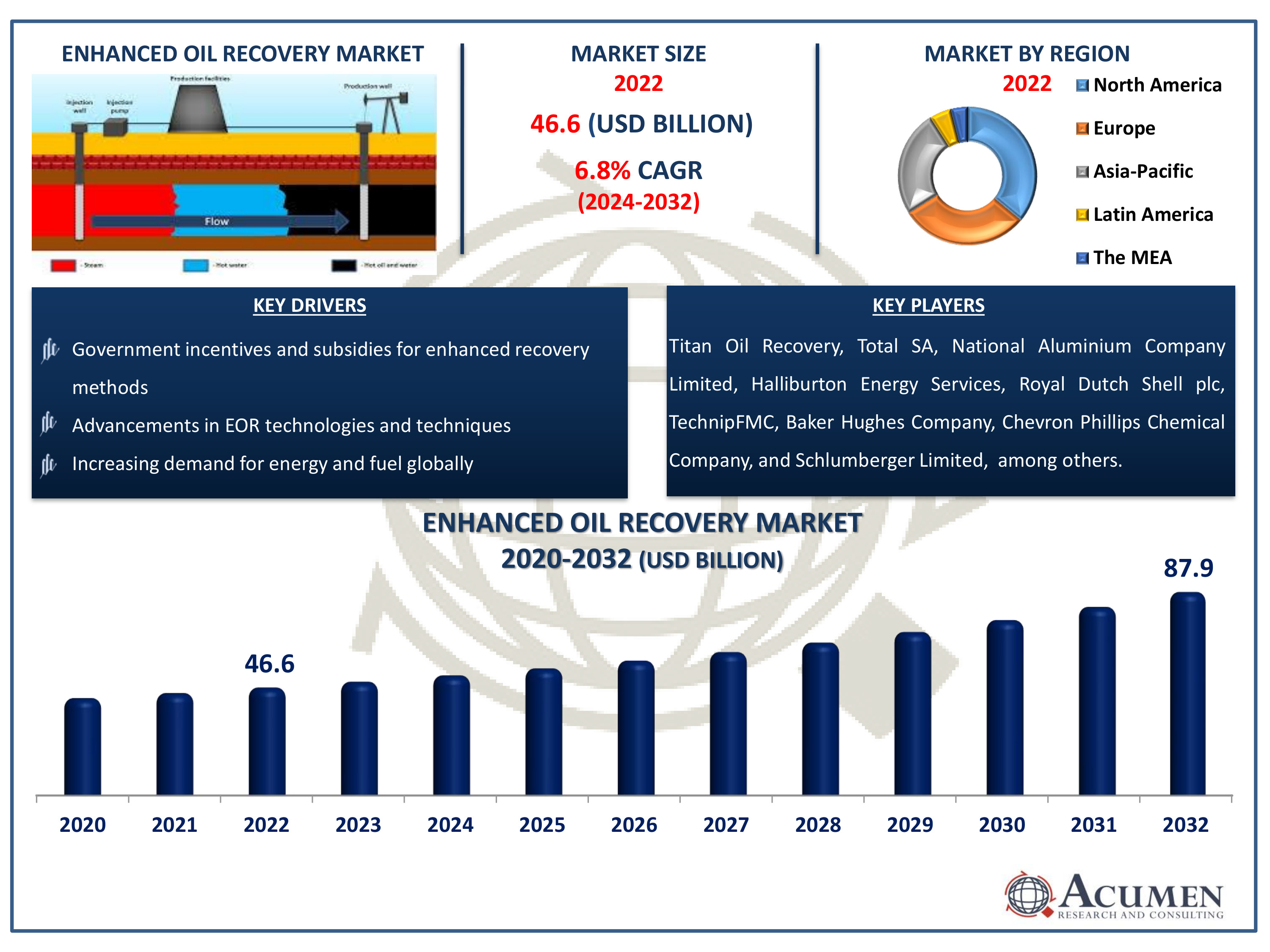

Enhanced Oil Recovery Market Size Accounted For USD 46.6 Billion in 2022 and is estimated to achieve a market size of USD 87.9 Billion by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

The Enhanced Oil Recovery Market Size Accounted For USD 46.6 Billion in 2022 and is estimated to achieve a market size of USD 87.9 Billion by 2032 growing at a CAGR of 6.8% from 2024 to 2032.

Enhanced Oil Recovery Market Highlights

The term "Enhanced Oil Recovery" (EOR) refers to sophisticated techniques for extracting crude oil that are not amenable to traditional procedures. EOR, sometimes referred to as tertiary recovery, is applied following the application of primary and secondary recovery techniques. While secondary recovery can yield 20% to 60% of the oil in the reservoir, primary recovery usually removes just 5% to 15% of it. An extra 35% to 75% of the oil in the reservoir may be extracted thanks to enhanced oil recovery (EOR) processes, which include thermal, chemical, and gas injection procedures. EOR enhances output from ageing oil fields and helps maximize total oil recovery by utilizing advanced technologies like CO2 flooding and polymer flooding. This helps promote more effective and sustainable resource management.

Global Enhanced Oil Recovery Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Enhanced Oil Recovery Market Report Coverage

| Market | Enhanced Oil Recovery Market |

| Enhanced Oil Recovery Market Size 2022 | USD 46.6 Billion |

| Enhanced Oil Recovery Market Forecast 2032 |

USD 87.9 Billion |

| Enhanced Oil Recovery Market CAGR During 2024 - 2032 | 6.8% |

| Enhanced Oil Recovery Market Analysis Period | 2020 - 2032 |

| Enhanced Oil Recovery Market Base Year |

2022 |

| Enhanced Oil Recovery Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Titan Oil Recovery, Total SA, National Aluminium Company Limited, Halliburton Energy Services, Inc, Royal Dutch Shell plc, TechnipFMC plc, Baker Hughes Company, Chevron Phillips Chemical Company LLC, Schlumberger Limited, and China National Petroleum Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Enhanced Oil Recovery Market Insights

The anticipated growth is driven by the increase in old wells combined with rising oil demand. Major players are focused on developing innovative technologies. For example, British Petroleum's low salinity water flood technology, LoSal, enables oil release from clay and can accelerate market growth. When primary and secondary recovery methods prove unproductive, EOR technologies are employed. These technologies adjust oil and rock characteristics, as well as reservoir flow patterns, using tertiary extraction methods. This application increases capital investments and is expected to lead to further technological advances in the enhanced oil recovery industry forecast period. Enhanced oil recovery mobilizes immovable residual oil through chemical, thermal, or physical means. Methods such as reservoir repressurization and artificial airlifts enhance liquid hydrocarbon production, contributing to market growth during the forecast period.

In recent years, Thermal Enhanced Oil Recovery (TEOR) has been the most important technology for extracting oil from maturing petroleum pools. Chemical recovery and gas injection are also advancing at a significant pace due to their economic and technological benefits. Companies are working to expand oil extraction facilities and techniques in anticipation of growing oil demand in the enhanced oil recovery market forecast period. Given the challenges of onshore crude extraction, businesses have begun extracting oil from offshore sources, positively impacting market growth. Fluctuating crude oil prices pose challenges for oilfield service businesses to maintain cash flow and profits, potentially limiting market development. However, companies are investing heavily in R&D to create better resources, produce petroleum more efficiently, and improve market recovery strategies.

Enhanced Oil Recovery Market Segmentation

The worldwide enhanced oil recovery (EOR) market is split based on technology, application, and geography.

Enhanced Oil Recovery (EOR) Market Technology

According to enhanced oil recovery industry analysis, in 2022, thermal systems led the market in oil production, accounting for more than 42% of total production. Thermal EOR is the most common technique used in countries like Venezuela, Indonesia, and Brazil, where it has seen significant success. The expansion of exploration and production operations in Asian nations is expected to drive rapid growth in heat technology. The CAGR for injection procedures is projected to grow over the forecast period due to its various advantages, such as increasing pressure within the reservoir, which enhances petroleum production. This growth is likely to be most pronounced in the USA and Canada.

The chemical technique employs surfactants and polymers to boost oil well output. This approach requires a thorough understanding of the regeneration factors, high chemical costs, and the behavior of chemical substances in oil reservoirs to avoid failed projects. In the Asia-Pacific and North America regions, this technique is being increasingly adopted due to a large number of depleted reservoirs with high concentrations of hydrocarbons.

Enhanced Oil Recovery (EOR) Market Application

Onshore applications dominated the market in 2022, accounting for over 90% of total production. The offshore application segment, however, is projected to grow in terms of revenue over the enhanced oil recovery (EOR) industry forecast period. Many mature onshore basins in countries such as Saudi Arabia, China, and Russia have experienced declining production rates. There is a high demand for EOR market in the near future for extracting recoverable residual hydrocarbons and increasing gas production in these areas.

Given the continuous expansion of offshore wells in deep and high seas such as the Gulf of Mexico, North Sea, South China Sea, and Persian Gulf, the adoption of advanced technology for offshore petroleum extraction is expected to increase during the forecast period. Nevertheless, the techno-economic feasibility of EOR market in offshore investments is still being evaluated due to the limited number of operators in the space. Despite the challenges, the demand for tertiary recovery techniques is anticipated to increase in the coming years, driven by rapid technological advancements and the sharp decline in production costs.

Enhanced Oil Recovery Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Enhanced Oil Recovery Market Regional Analysis

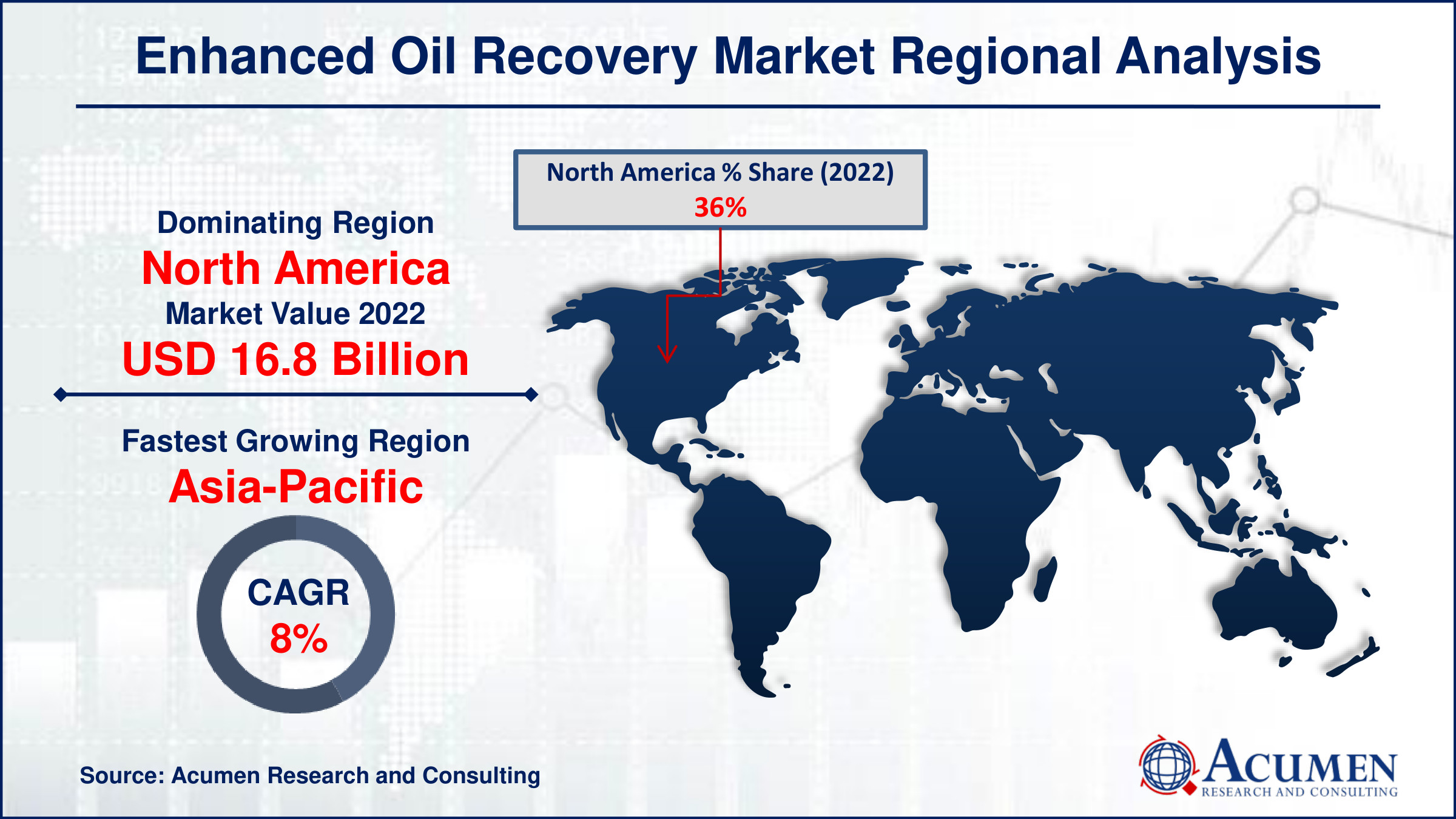

In terms of enhanced oil recovery market analysis, in 2022, North America led the global industry with a total market share of over 36% in 2022 and is expected to experience significant growth over the forecast period. The region's large adoption of tertiary extraction techniques is evident due to a high number of mature wells and concerns about peak oil production in the U.S. For example, Chevron North Sea Ltd. launched phase I of the caption enhanced oil recovery project to extend the subsea area by drilling six long-reach injection wells. The project's primary goal is to extensively utilize polymer technology to improve production. Over the next few years, gas EOR, particularly CO2 injection, will likely be widely implemented in depleted oil fields. Favorable government policies related to carbon capture and storage (CCS) and underground CO2 injection in the U.S. are expected to further boost the use of EOR market technologies.

The Asia Pacific region is anticipated to increase its revenues by more than 8% CAGR during the enhanced oil recovery (EOR) market forecast period. The growing demand for oil in Indonesia, China, and India, combined with numerous aging wells, is expected to drive regional development. To increase domestic oil production, the governments of these countries are likely to promote market growth. Global players in the region employ competitive strategies and continually pursue advanced EOR methods to maintain necessary production levels. For instance, Solvay established an innovation center in Singapore, focusing on the development of advanced EOR solutions.

Enhanced Oil Recovery (EOR) Market Players

Some of the top enhanced oil recovery companies offered in our report includes Titan Oil Recovery, Total SA, National Aluminium Company Limited, Halliburton Energy Services, Inc, Royal Dutch Shell plc, TechnipFMC plc, Baker Hughes Company, Chevron Phillips Chemical Company LLC, Schlumberger Limited, and China National Petroleum Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2023

February 2024

March 2023

January 2025