October 2022

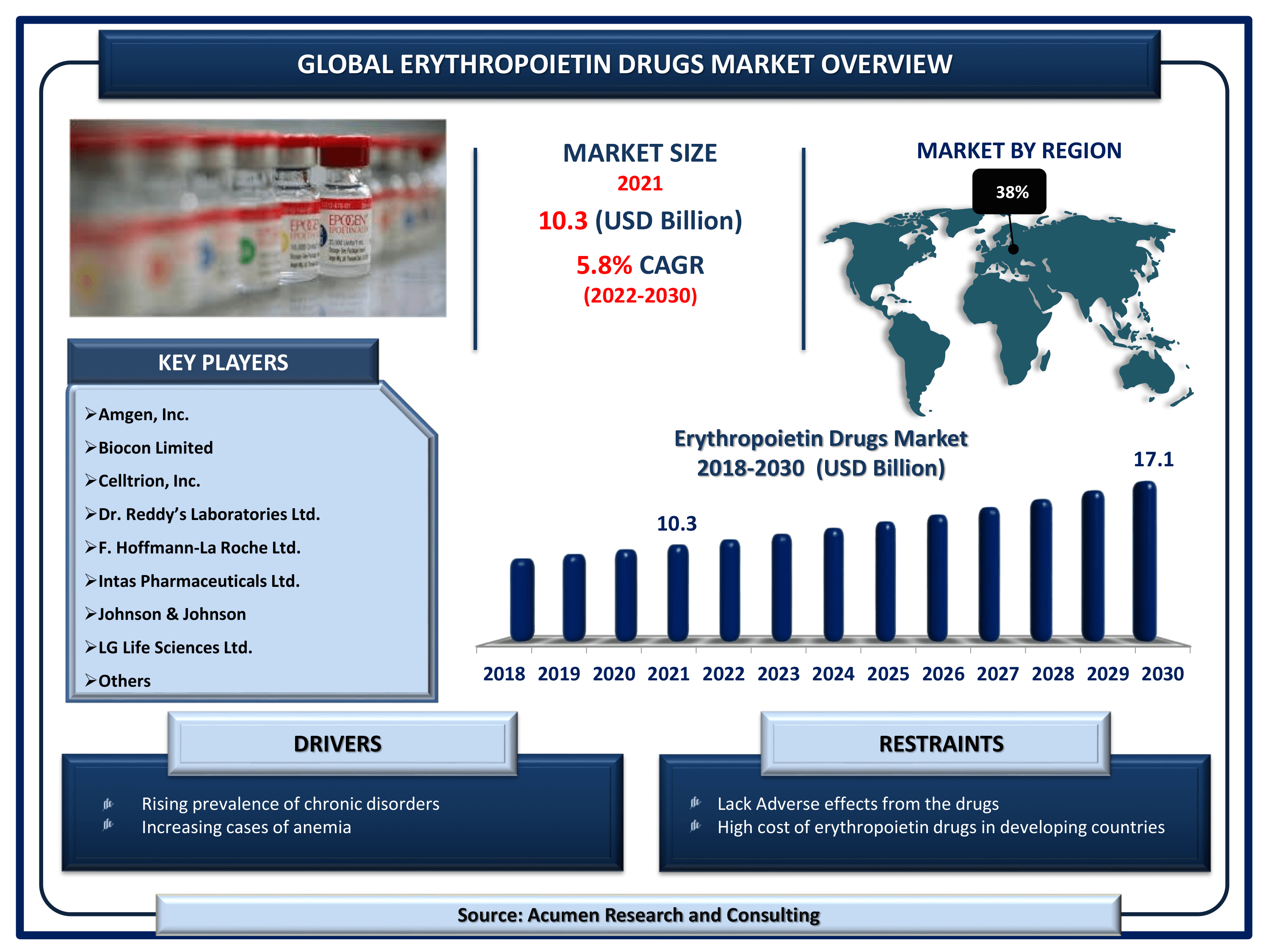

Erythropoietin Drugs Market Size accounted for USD 10.3 Billion in 2021 and is projected to achieve a market size of USD 17.1 Billion by 2030 rising at a CAGR of 5.8% from 2022 to 2030.

The Global Erythropoietin Drugs Market Size accounted for USD 10.3 Billion in 2021 and is projected to achieve a market size of USD 17.1 Billion by 2030 rising at a CAGR of 5.8% from 2022 to 2030. Growing incidences of chronic disorders in the world is the primary factor boosting the global erythropoietin drugs market share. In addition to that, the growing trend of commercialization for erythropoietin drugs is a popular erythropoietin drugs market trend that will fuel the industry demand from 2022 to 2030.

Erythropoietin Drugs Market Report Statistics

The kidney produces erythropoietin (EPO), which is used to make red blood cells. Erythropoietin-stimulating agents are frequently used to treat people with chronic kidney disease and anemia. EPO, which is produced naturally by the kidneys, is also available as a pharmaceutical. EPO stimulates red blood cell production in bone marrow and regulates the concentration of red blood cells and hemoglobin in the blood. This is advantageous for athletes because red blood cells transport oxygen to cells, including muscle cells, allowing them to function more effectively.

Global Erythropoietin Drugs Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Erythropoietin Drugs Market Report Coverage

| Market | Erythropoietin Drugs Market |

| Erythropoietin Drugs Market Size 2021 | USD 10.3 Billion |

| Erythropoietin Drugs Market Forecast 2030 | USD 17.1 Billion |

| Erythropoietin Drugs Market CAGR During 2022 - 2030 | 5.8% |

| Erythropoietin Drugs Market Analysis Period | 2018 - 2030 |

| Erythropoietin Drugs Market Base Year | 2021 |

| Erythropoietin Drugs Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Drug Class, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amgen, Inc., Biocon Limited, Celltrion, Inc., Dr. Reddy’s Laboratories Ltd., F. Hoffmann-La Roche Ltd., Intas Pharmaceuticals Ltd., Johnson & Johnson, LG Life Sciences Ltd., Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Big calls for "Recombinant Erythropoietin Stimulating Agents"

When transfusions are not an option, such as when the patient is unable to or refuses a transfusion, recombinant erythropoietin may be administered. Recombinant erythropoietin is a synthetic version of naturally occurring erythropoietin. It is created by cloning the erythropoietin gene. Erythropoietin-stimulating agents are recombinant erythropoietin drugs (ESAs). These drugs are administered via injection (shot) and work by increasing the production of red blood cells. These cells are then released into the bloodstream from the bone marrow. There are two ESAs on the market in the United States: epoetin alfa (Procrit,® Epogen®) and darbepoietin alfa (Aranesp®). ESAs are typically prescribed to patients with chronic (long-term) kidney disease or end-stage renal (kidney) disease. Because they can't produce enough erythropoietin, these patients usually have low hemoglobin levels. ESAs are also prescribed to cancer patients. Anemia is common in these patients, which can be caused by chemotherapy.

Erythropoietin Drugs Market Dynamics

Rising prevalence of anemia in patients propel the demand for erythropoietin drugs worldwide

Anemia is a condition in which the number of red blood cells or the concentration of hemoglobin within them is less than normal. Anemia is a serious global public health issue that disproportionately affects children and pregnant women. According to the World Health Organization (WHO), 42% of children under the age of five and 40% of pregnant women worldwide are anemic. Correcting anaemic conditions in the patient group necessitates increasing Hb, and correcting anemia necessitate improving platelet function. Epoetin may also be used to prevent or treat anemia caused by surgery or medications (for example, zidovudine) used to treat other conditions such as HIV or cancer.

Cancerization of Erythropoietin biosimilars bolsters the growth of global market

Biosimilar epoetins were approved for the first time in 2007, and a wealth of data has been accumulated over the last decade. So far, the EMA has approved two biosimilar epoetins (fewer than five different Cancer names). These agents are approved only if extensive analytical and clinical testing demonstrates that they are of comparable quality, safety, and efficacy to the reference medicine, and real-world studies provide additional evidence that biosimilar epoetins are an effective and well-tolerated option for the treatment of chemotherapy-induced anemia in cancer patients. Furthermore, in May 2018, the United States Food and Drug Administration approved "Retacrit (epoetin alfa-epbx)" as a biosimilar to "Epogen/Procrit (epoetin alfa)" for the treatment of anemia caused by chronic kidney disease, chemotherapy, or zidovudine use in HIV patients. Retacrit is also approved for use before and after surgery to reduce the likelihood of needing red blood cell transfusions due to blood loss during surgery.

Impact of COVID-19 on global erythropoietin drugs market

The COVID-19 outbreak has disrupted workflows in the health care sector around the world. The disease has forced a number of industries, including several sub-domains of health care, to temporarily close their doors. However, there has been a positive impact and increase in demand for various medical services, including erythropoietin. According to researchers at the Max Planck Institute of Experimental Medicine in Göttingen, erythropoietin (EPO) is a drug for anemia and can be effective against COVID-19. They claim that when SARS-CoV-2 attacks the brain, the growth aspect of erythropoietin can prevent serious disease development and protect people from long-term neurological effects. Primary case studies indicate that erythropoietin has a beneficial effect. Scientists are currently planning a randomised clinical trial to systematically investigate the effects of using erythropoietin to treat COVID-19.

Erythropoietin Drugs Market Segmentation

The worldwide erythropoietin drugs market is split based on Drug Class, Product, application, and geography.

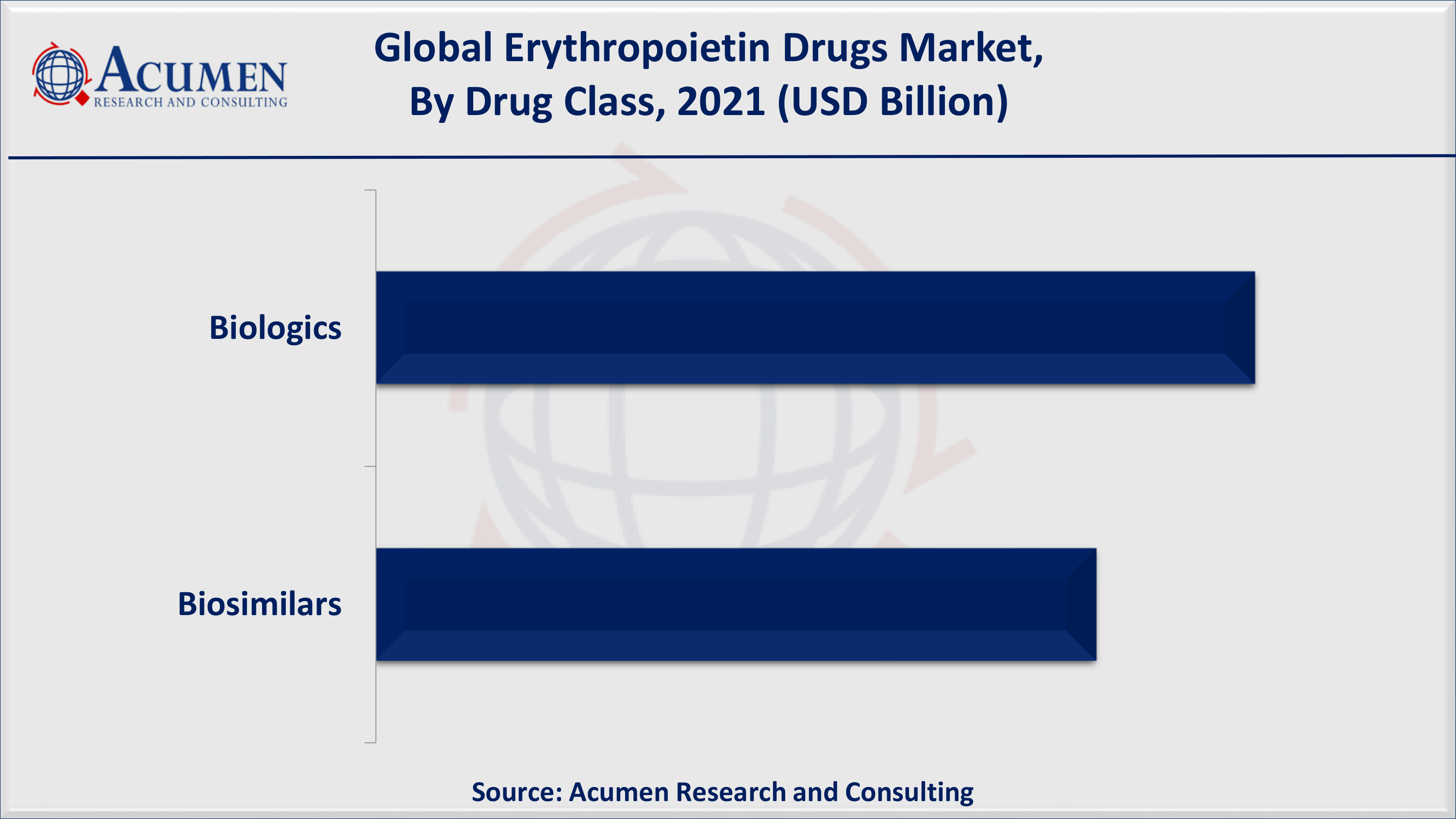

Erythropoietin Drugs Market By Drug Class

According to our erythropoietin drugs industry analysis, the biologics erythropoietin class is expected to dominate the global erythropoietin drugs market. This is because patents are protected. Another factor contributing to its dominance is the presence of a large patient population and a higher uptake of biologics. Due to the recent patent expiration of major brands such as Epogen, the biologics segment is expected to lose market share. This drug's patent exclusivity expired in May 2015, resulting in lower sales revenue for its manufacturer, Amgen Inc.

Erythropoietin Drugs Market By Product

As per erythropoietin drugs market forecast, epoetin-alfa will have reasonable market share from 2022 to 2030. Furthermore, there is a high usage rate in alleviating anemia in cancer and chronic renal failure patients. This was the first biologic to be approved by the US Food and Drug Administration for the treatment of anemia caused by CKD, cancer chemotherapy, and HIV treatment. Epoetin-alfa was patent-protected, limiting the production of any other recombinant human erythropoietin drug and assisting this segment to dominate in 2021.

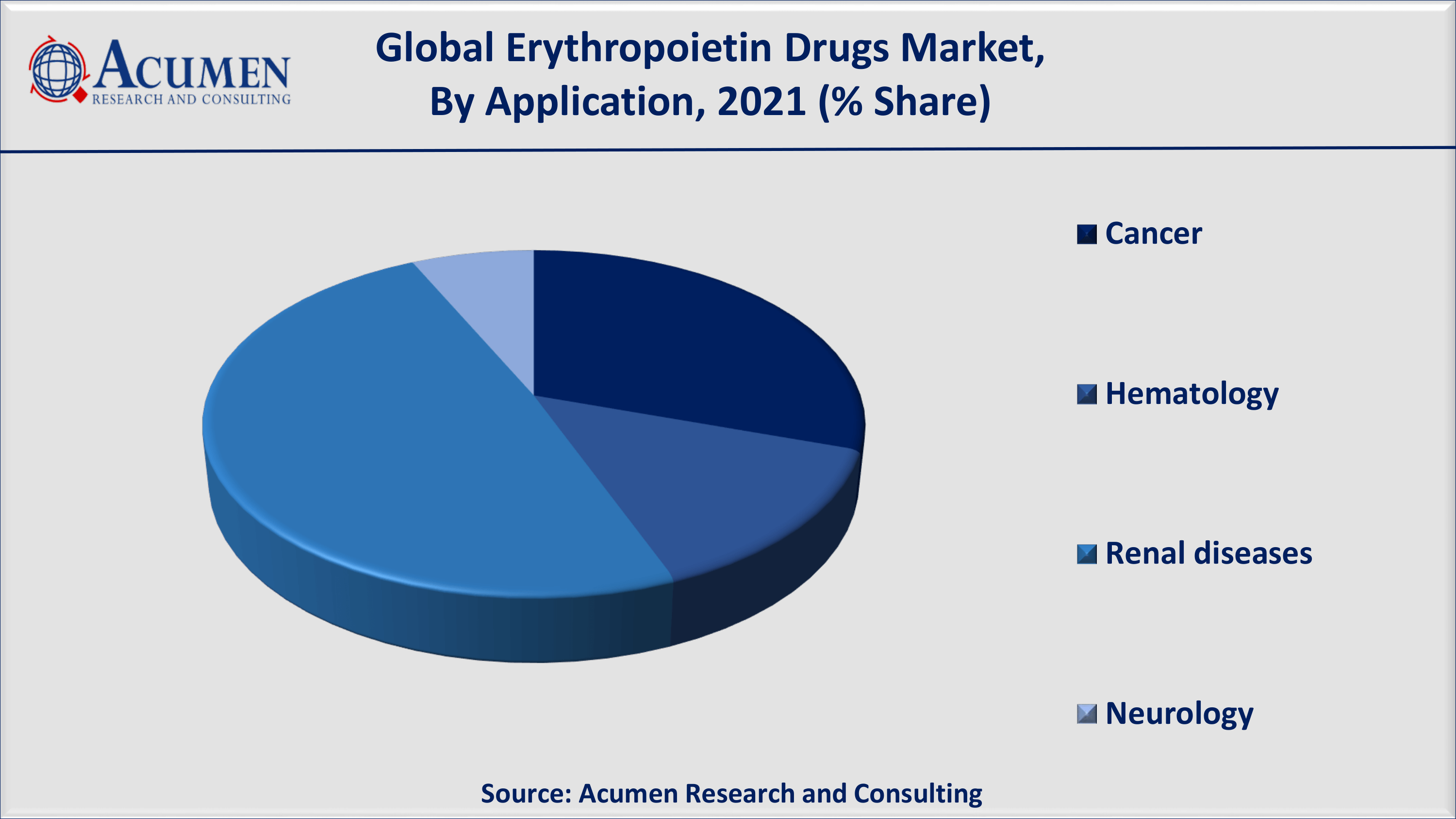

Erythropoietin Drugs Market By Application

In 2021, renal diseases have dominated the application market in the past and are expected to do so again during the forecast period. This is due to quick product approvals by authorized bodies. For example, the first erythropoietin drug, Epogen, was approved by the US Food and Drug Administration for the treatment of anemic indications associated with CKD.

Erythropoietin Drugs Market Regional Outlook

North America

Europe

Latin America

Asia-Pacific

The Middle East & Africa (MEA)

Erythropoietin Drugs Market Regional Analysis

Europe dominates; Asia Pacific Records Fastest Growing CAGR for the Global Erythropoietin Drugs Market

The market for erythropoietin drugs is dominated by Europe. The rising prevalence of chronic diseases such as cancer, chronic kidney disease (CKD), and HIV drives the demand for erythropoietin drugs. This is one of the major factors driving the growth of the global erythropoietin drugs market.

Asia Pacific, on the other hand, is expected to have the fastest growing CAGR in the coming years. This is due to the ongoing rise in the incidence of chronic diseases, as well as the high demand for low-cost therapeutics. Asia Pacific has sparked significant interest in many companies for the development of biosimilars, and the region is known for producing more biosimilars than any other region in the world.

Erythropoietin Drugs Market Players

Some of the key erythropoietin drugs companies in the market are Amgen, Inc., Biocon Limited, Celltrion, Inc., Dr. Reddy’s Laboratories Ltd., F. Hoffmann-La Roche Ltd., Intas Pharmaceuticals Ltd., Johnson & Johnson, LG Life Sciences Ltd., Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2022

March 2023

January 2025

July 2023