July 2023

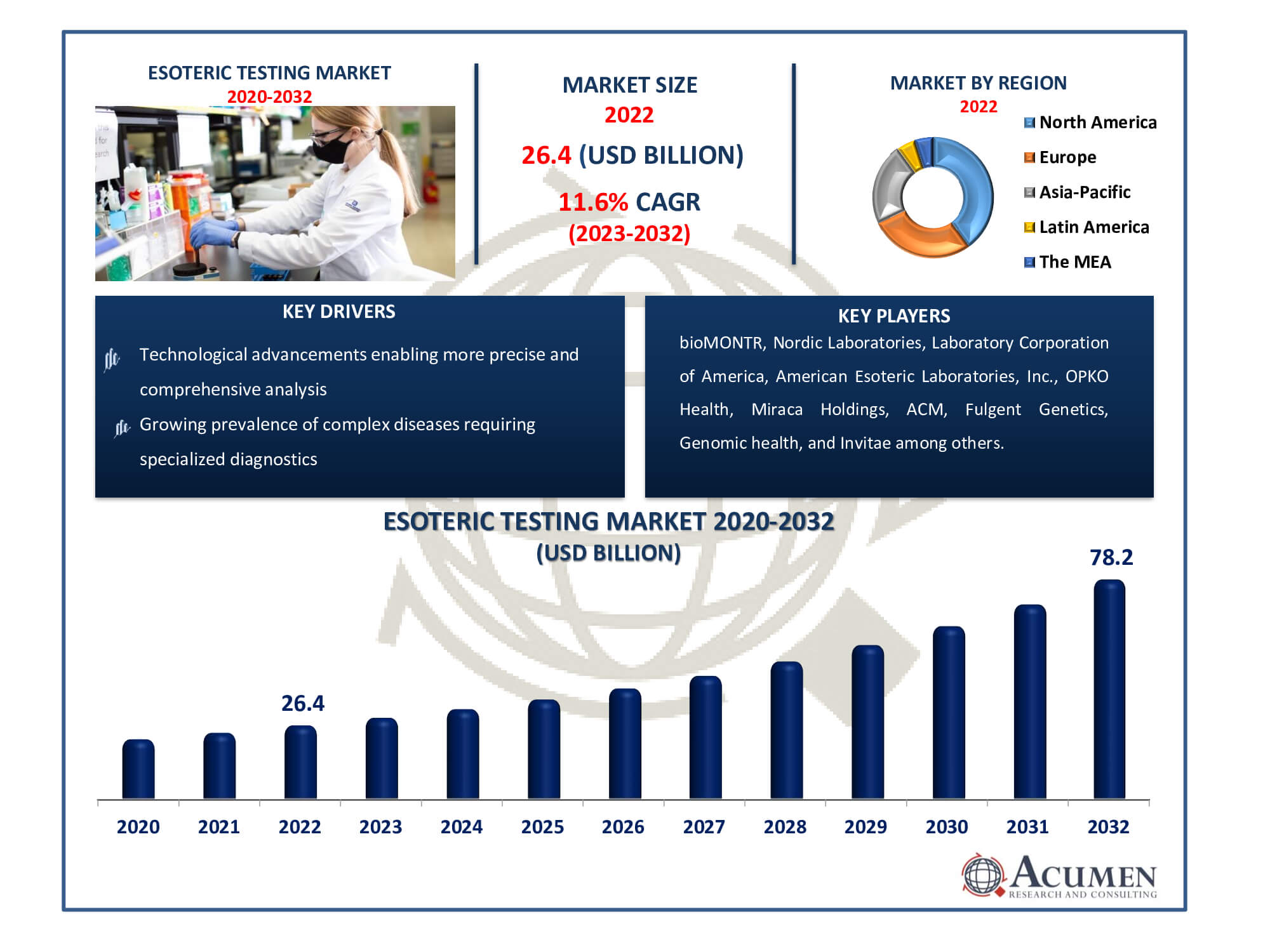

Esoteric Testing Market Size accounted for USD 26.4 Billion in 2022 and is estimated to achieve a market size of USD 78.2 Billion by 2032 growing at a CAGR of 11.6% from 2023 to 2032.

The Esoteric Testing Market Size accounted for USD 26.4 Billion in 2022 and is estimated to achieve a market size of USD 78.2 Billion by 2032 growing at a CAGR of 11.6% from 2023 to 2032.

Esoteric Testing Market Highlights

Analysis of 'rare' molecules or substances constitutes esoteric testing, distinct from routine clinical laboratory procedures. These tests are only performed when additional information is essential to complement routine laboratory tests, aiding in accurate disease diagnosis, prognosis, treatment selection, and supervision. Esoteric testing entails intricate chemical and instrumental analyses conducted by qualified personnel in specialized and independent laboratories, given its high complexity and cost. Medical laboratories or hospitals cannot conduct these tests in-house due to their complexity. Esoteric testing is governed by stringent regulatory frameworks and is not part of regular testing protocols.

Global Esoteric Testing Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Esoteric Testing Market Report Coverage

| Market | Esoteric Testing Market |

| Esoteric Testing Market Size 2022 | USD 26.4 Billion |

| Esoteric Testing Market Forecast 2032 | USD 78.2 Billion |

| Esoteric Testing Market CAGR During 2023 - 2032 | 11.6% |

| Esoteric Testing Market Analysis Period | 2020 - 2032 |

| Esoteric Testing Market Base Year |

2022 |

| Esoteric Testing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Test Type, By Technology, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Laboratory Corporation of America, bioMONTR, American Esoteric Laboratories, Inc., OPKO Health, Nordic Laboratories, Miraca Holdings, ACM, Fulgent Genetics, Genomic health, Invitae, Mayo Medical Labors, Arup Laboratories, and Myriad Genetics. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Esoteric Testing Market Insights

The market is anticipated to be driven over the esoteric testing industry forecast period by heightened awareness and responsiveness towards early disease diagnosis and treatment of rare and complex diseases. According to the European Commission, nearly 27 to 36 million individuals in Europe are affected by rare diseases. In developing countries, rapid advancements in the healthcare sector and the proliferation of sophisticated laboratories providing advanced services will bolster industry growth. Additionally, the increasing number of baby boomers susceptible to various chronic conditions will significantly contribute to the industry's development.

The rising prevalence of chronic infectious diseases such as cancer and diabetes is expected to drive the demand for esoteric testing in the coming years. Additionally, technological advancements, including automation in antidote procedures, standardization of advanced devices, and analysis systems, will further propel the growth of esoteric testing. The increasing need for proteomics and genomics, coupled with augmented investments in developing innovative detection solutions for bodily functions, will stimulate business expansion. The rising demand for personalized genomics solutions in healthcare, driven by predictions and assessments of therapy responses and pharmaceutical growth, contributes to this increased demand. However, stringent regulations and a shortage of experts in emerging economies are expected to impede industry growth within the esoteric testing market forecast timeframe.

Esoteric Testing Market Segmentation

The worldwide market for esoteric testing is split based on test type, technology, end-user, and geography.

Esoteric Testing Test Types

According to the esoteric testing industry analysis, the infectious disease testing segment accounted for approximately 20% of the market in 2022 due to the high prevalence of infectious diseases and the escalating demand for advanced molecular tests. The availability of immunology laboratory services catering to each medical specialty is anticipated to positively impact sector growth.

Over the esoteric testing industry forecast period, increased awareness about early disease diagnosis and treatment, coupled with the rising incidence of cancer, will propel the esoteric oncology market. Notably, Quest Diagnostics' BRCAvantage, an esoteric testing development, will significantly influence patients with hereditary breast and ovarian cancer syndrome (HBOC), a group at higher cancer risk.

Esoteric Testing Technology

The chemiluminescence esoteric technology market dominated the global industry in 2022. It is projected to grow largest percent compound annual growth rate (CAGR) due to its high efficiency and the requirement for small sample sizes. This technology, known for its superior sensitivity and accuracy, is expected to further stimulate business growth, particularly with low analyte concentrations.

In 2022, the ELISA Esoteric Technology market held noteworthy market share due to its increasing application in detecting various analytes. ELISA serves as a common technique in basic research, drug discovery, and high-performance laboratory screening. The sector anticipates sales growth through new biomarker discoveries, leading to the availability of new targets.

Esoteric Testing End-Users

Within the esoteric testing market, the independent and reference laboratories segment is the largest. These labs provide specialized diagnostic services and reference testing to different healthcare practitioners, all while operating independently of hospital-based facilities. Their popularity is a result of the wide range of testing services they offer, which address complex and uncommon diagnostic requirements that go beyond the purview of standard clinical evaluations.

In terms of esoteric testing market analysis, Numerous esoteric testing, such as molecular, genetic, and specialised assays, are available from these independent laboratories. These tests are essential for precise diagnosis and customised treatment regimens. Their independence lets them concentrate solely on complex and sophisticated testing procedures, guaranteeing accuracy and dependability in their evaluations.

A subset of independent facilities known as reference laboratories work with clinics, research centres, and healthcare institutions around the world to provide specialised testing services from their central hubs. They are essential for intricate diagnoses and research projects due to their wide networks and proficiency in esoteric testing.

Esoteric Testing Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

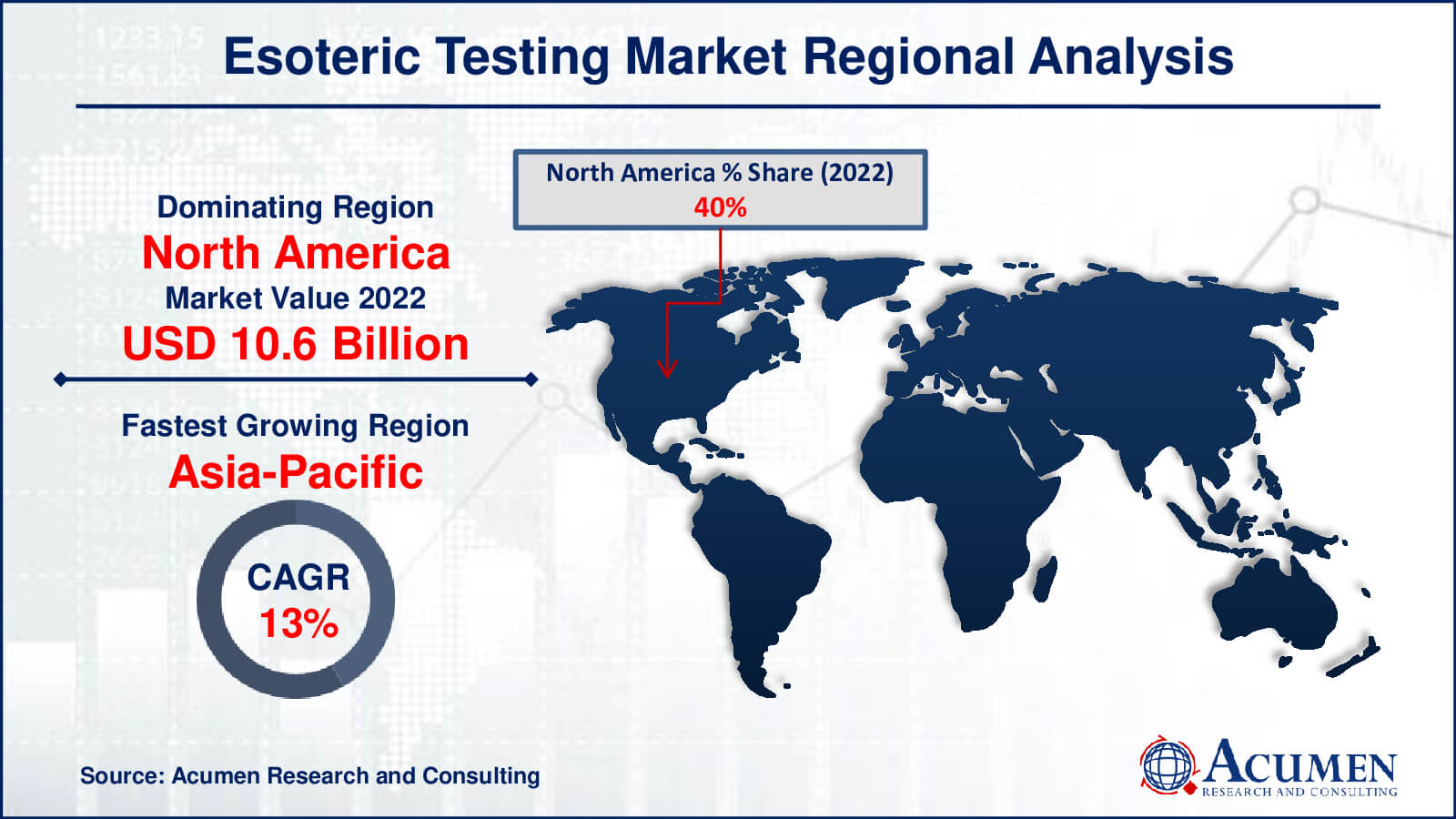

Esoteric Testing Market Regional Analysis

The largest regional market for esoteric testing is now North America. Numerous factors contribute to this supremacy, such as the region's strong healthcare system, technological developments, and a high frequency of chronic illnesses requiring specialized diagnostic techniques. Further strengthening North America's market dominance are significant investments in research and development, supportive government programmes, and the presence of important industry participants.

On the other hand, the esoteric testing market shows that Asia-Pacific is expanding at the quickest rate. Numerous causes, including a growing population, rising healthcare costs, and improvements in healthcare infrastructure across emerging countries, are driving the region's rapid expansion. In addition, the Asia-Pacific region's need for esoteric testing is fueled by the increased prevalence of chronic and infectious diseases as well as the adoption of cutting-edge diagnostic technology.

In terms of the esoteric testing market, Europe is the second-largest market. The advanced healthcare systems, significant investments in healthcare research, and growing emphasis on precision medicine highlight the significance of this region. The need for esoteric testing is fueled by Europe's well-established infrastructure and strategic partnerships between academic institutions and major industry actors, especially in the detection and treatment of uncommon and difficult diseases.

In spite of their different locations, these areas contribute equally to market expansion. The global expansion of the esoteric testing market is driven by technological advancements, growing awareness of personalized medicine and early disease diagnosis, and growing demand for sophisticated diagnostic instruments.

Esoteric Testing Market Players

Some of the top esoteric testing companies offered in our report include Laboratory Corporation of America, bioMONTR, American Esoteric Laboratories, Inc., OPKO Health, Nordic Laboratories, Miraca Holdings, ACM, Fulgent Genetics, Genomic health, Invitae, Mayo Medical Labors, Arup Laboratories, and Myriad Genetics.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

July 2023

January 2021

November 2020

June 2022