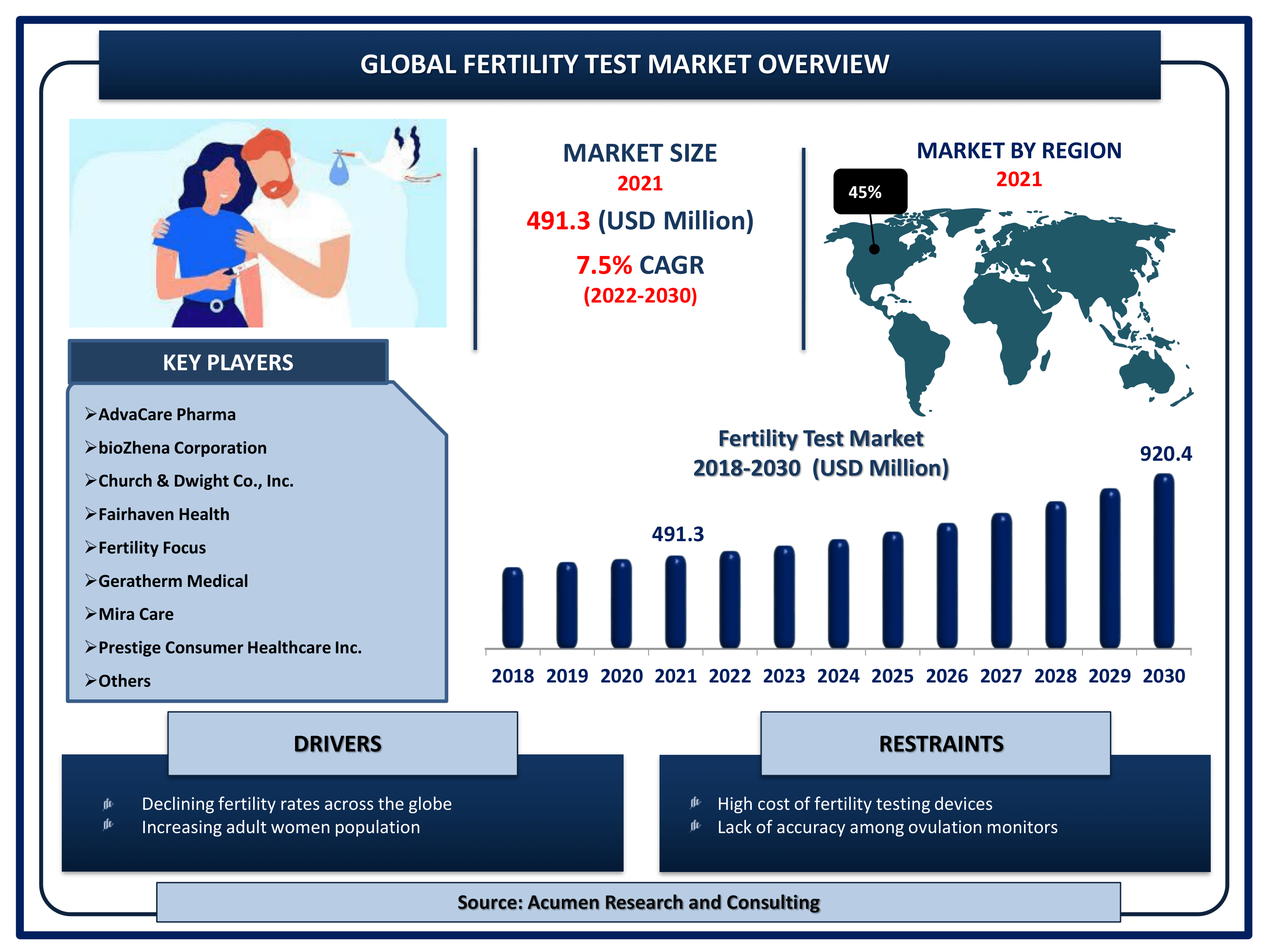

The Global Fertility Test Market Size accounted for USD 491.3 Million in 2021 and is projected to achieve a market size of USD 920.4 Million by 2030 rising at a CAGR of 7.5% from 2022 to 2030. The demand for fertility testing has been growing exponentially due to the declining fertility rates in the world. The rising case of infertility among women and men is a primary aspect that is driving the fertility test market value. Some of the prominent factors fueling the fertility testing market include changing lifestyles, increasing awareness about infertility, and growing cases about infertile men. Furthermore, advancement in infertility treatments is a popular fertility test market trend that will boost the industry demand during the projected timeframe from 2022 to 2030.

Fertility Test Market Report Statistics

- Global fertility test market revenue is estimated to reach USD 920.4 Million by 2030 with a CAGR of 7.5% from 2022 to 2030

- North America fertility test market share accounted for over 45% shares in 2021

- According to recent estimates, idiopathic infertility affects more than 25% of infertile males

- Asia-Pacific fertility test market growth will register fastest CAGR from 2022 to 2030

- Based on application, female fertility products gathered over 75% of the overall market share in 2021

- Growing consumption of alcohol and cigarettes will fuel the global fertility testing devices market value

Fertility refers to the ability to conceive and bear a child. Pregnancy begins with the fertilization of an egg by a sperm cell, but male and female bodies must go through several steps before a healthy pregnancy is possible. Infertility affects men and women equally, according to the American Society for Reproductive Medicine, so both partners should be tested. Fertility testing to determine the cause of infertility in women may entail a medical history discussion, blood tests, and minimally invasive procedures. When testing fails to reveal a specific cause, the diagnosis is "unexplained infertility," which affects 15 to 30% of infertile couples, according to the National Institutes of Health.

Global Fertility Test Market Dynamics

Market Drivers

- Declining fertility rates across the globe

- Increasing adult women population

- Rising government initiatives to promote fertility testing

- Growing awareness for fertility testing

Market Restraints

- High cost of fertility testing devices

- Lack of accuracy among ovulation monitors

Market Opportunities

- Increasing sales of fertility testing devices from online sales channels

- Advent of combined kits for dual testing of ovulation and pregnancy

Fertility Test Market Report Coverage

| Market | Fertility Test Market |

| Fertility Test Market Size 2021 | USD 491.3 Million |

| Fertility Test Market Forecast 2030 | USD 920.4 Million |

| Fertility Test Market CAGR During 2022 - 2030 | 7.5% |

| Fertility Test Market Analysis Period | 2018 - 2030 |

| Fertility Test Market Base Year | 2021 |

| Fertility Test Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Mode of Purchase, By Product, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AdvaCare Pharma, bioZhena Corporation., Church & Dwight Co., Inc., Fairhaven Health, Fertility Focus, Geratherm Medical, Mira Care, Prestige Consumer Healthcare Inc., Sensiia, and Swiss Precision Diagnostics GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

COVID-19 impact on fertility testing market

According to the BRITISH COLUMBIA MEDICAL JOURNAL, unlike viruses like rubella, chickenpox, or the Zika virus, there is no evidence that COVID-19 causes birth defects. Expectant mothers who become infected with COVID-19 must be closely monitored due to the immunosuppression and increased respiratory demands of pregnancy. COVID-19 in pregnancy can increase the risk of preterm birth and growth restriction in the baby. In a study of 38 men with COVID-19 in China, 15.8% had detectable virus in their sperm. Furthermore, preliminary evidence suggested that COVID-19 did not pass from mother to child before birth. However, a recent case in the United States discovered evidence of in uterus transmission, but the risk of neonatal infection remains very low, at less than 2%.

Fertility Test Market Dynamics

New Developments in Fertility Testing Market

According to a report published by the American Association for the Advancement of Science (AAAS), researchers at Ben-Gurion University of the Negev (BGU) are working on a new, single-dose treatment that may improve both male and female fertility. The new treatment increases the expression of telomerase, the enzyme responsible for the maintenance of DNA sequences at the tip of a chromosome (called telomeres), that affect cell lifespan and contribute to infertility. The novel treatment re-elongates telomeres and protects cells from damage, increasing cell viability and increasing the chances of fertilization, embryo generation, and implantation. The treatment is given in a single dose and wears off within 24 hours. The compound was tested on mice and found to have no toxic effects. The compound also showed a protective effect on the ovaries and testes of mice exposed to radiation, implying that it may be able to protect and improve fertility in women and men undergoing cancer radiation therapy.

"Assisted Reproductive Technologies" Best Option for Fertility Testing

Age-related infertility is becoming more common in today's society because, for a variety of reasons, many women wait until their 30s to start families. According to the ASRM, American Society for Reproductive Medicine, a woman's best reproductive years are in her 20s. Fertility gradually declines in the 30s, especially after the age of 35. A healthy, fertile 30-year-old woman has a 20% chance of becoming pregnant each month she tries. By the age of 40, a woman's chance is less than 5% per cycle, which means that less than 5 out of every 100 women are expected to be successful each month. If an underlying cause of infertility is discovered, the clinical care provider may recommend a specific treatment. Advanced infertility therapies such as super ovulation with timed intrauterine insemination (SO/IUI) or in vitro fertilization (IVF) may be recommended in cases of unexplained infertility or when traditional treatments have failed. In women over the age of 40, the success rate of SO/IUI is typically less than 5%. This compares to a success rate of around 10% for women aged 35 to 40. IVF is more effective, but it also has relatively low success rates in women over 40, typically less than 20% per cycle.

Fertility Test Market Segmentation

The worldwide fertility test market is split based on mode of purchase, product, application, end-user, and geography.

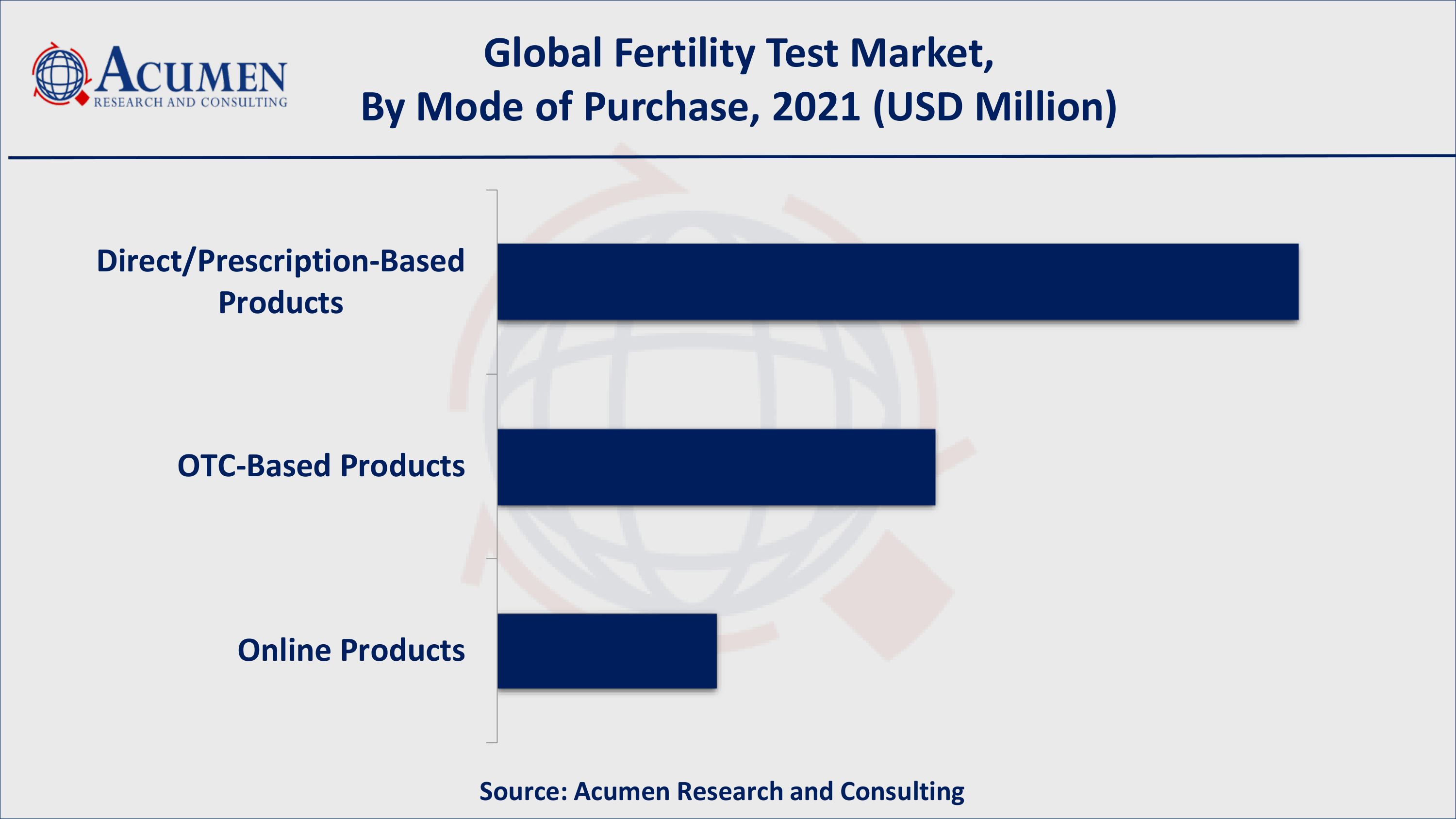

Fertility Test Market By Mode of Purchase

- Direct/Prescription-Based Products

- OTC-Based Products

- Online Products

According to our fertility test industry analysis, the OTC segment accounts for the majority of the global fertility testing market in terms of mode of purchase. OTC dominated the market in the past and will continue to do so during the forecast period. This is due to patients' preference for self-monitoring of healthcare conditions, increased initiatives by market players to raise fertility awareness, and a growing preference for confidentiality and accessibility of test results.

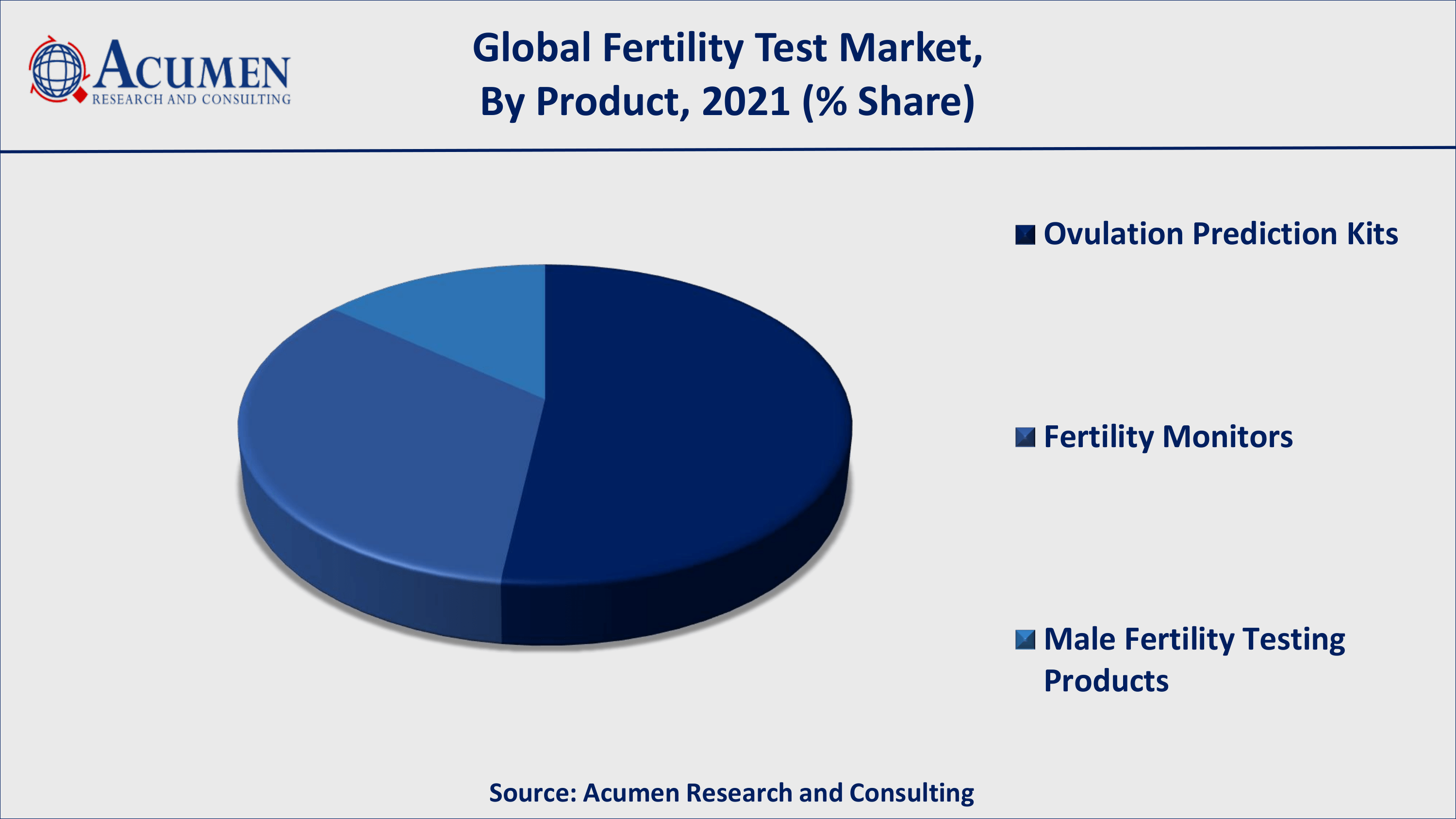

Fertility Test Market By Product

- Ovulation Prediction Kits

- Fertility Monitors

- Male Fertility Testing Products

By product, the ovulation prediction kits segment will account for the greatest share of the global fertility testing market. The ovulation prediction kits segment has a large share due to their increasing use, easy over-the-counter availability and low cost, and higher accuracy than natural fertility testing techniques such as calendar methods and cervical mucus monitoring.

Fertility Test Market By Application

- Female Fertility Products

- Male Fertility Products

According to fertility test market forecast, female fertility testing accounts for the largest share of the global fertility testing market and will continue to do so throughout the forecast period. This is due to declining female fertility rates, the availability of a variety of fertility testing options for females, an increase in gynecological issues in women (such as PCOD/PCOS), and the high cost of IVF procedures.

Fertility Test Market By End-User

- Home Care Settings

- Hospitals and Fertility Clinics

- Other End-Users

According to end-user, the home care settings segment is expected to grow at the fastest rate in the coming years. This segment's large share and rapid growth can be attributed to patients' preference for self-monitoring of healthcare conditions, easy access to fertility and ovulation monitors on e-commerce websites, the availability of user-friendly and easy-to-handle devices, and the growing preference for test result confidentiality.

Fertility Test Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Fertility Test Market Regional Analysis

North America Dominates; Asia Pacific Registers Fastest Growing CAGR for the Fertility Testing Market

The North America province, which includes major countries such as Canada and the United States, accounts for the largest share of the fertility testing market. This is due to factors such as the high prevalence of infertility, increased awareness of fertility testing among women, the increasing age of first-time pregnancies in women, and the easy availability of ovulation and fertility monitors via e-commerce websites.

On the other hand, Asia Pacific will have the fastest growing CAGR in the fertility testing market in the coming years. This is due to an increase in the number of women suffering from lifestyle disorders, increased funding/investment in the development of fertility and ovulation monitors, and a growing focus on the Asia Pacific fertility test market by both international and domestic players.

Fertility Test Market Players

Some of the key fertility test companies in the market are AdvaCare Pharma, bioZhena Corporation, Church & Dwight Co., Inc., Fairhaven Health, Fertility Focus, Geratherm Medical, Mira Care, Prestige Consumer Healthcare Inc., Sensiia, and Swiss Precision Diagnostics GmbH.

Frequently Asked Questions

The market size of fertility test market in 2021 was accounted to be USD 491.3 Million.

The projected CAGR of fertility test market during the analysis period of 2022 to 2030 is 7.5%.

The prominent players of the global fertility test market are AdvaCare Pharma, bioZhena Corporation, Church & Dwight Co., Inc., Fairhaven Health, Fertility Focus, Geratherm Medical, Mira Care, Prestige Consumer Healthcare Inc., Sensiia, and Swiss Precision Diagnostics GmbH.

North America held the dominating fertility test during the analysis period of 2022 to 2030.

Asia-Pacific region exhibited fastest growing CAGR for fertility test during the analysis period of 2022 to 2030.

Declining fertility rates across the globe, increasing adult women population, and rising government initiatives to promote fertility testing drives the growth of global fertility test market.

Based on mode of purchase, OTC-based products segment is expected to hold the maximum share fertility test market.