July 2023

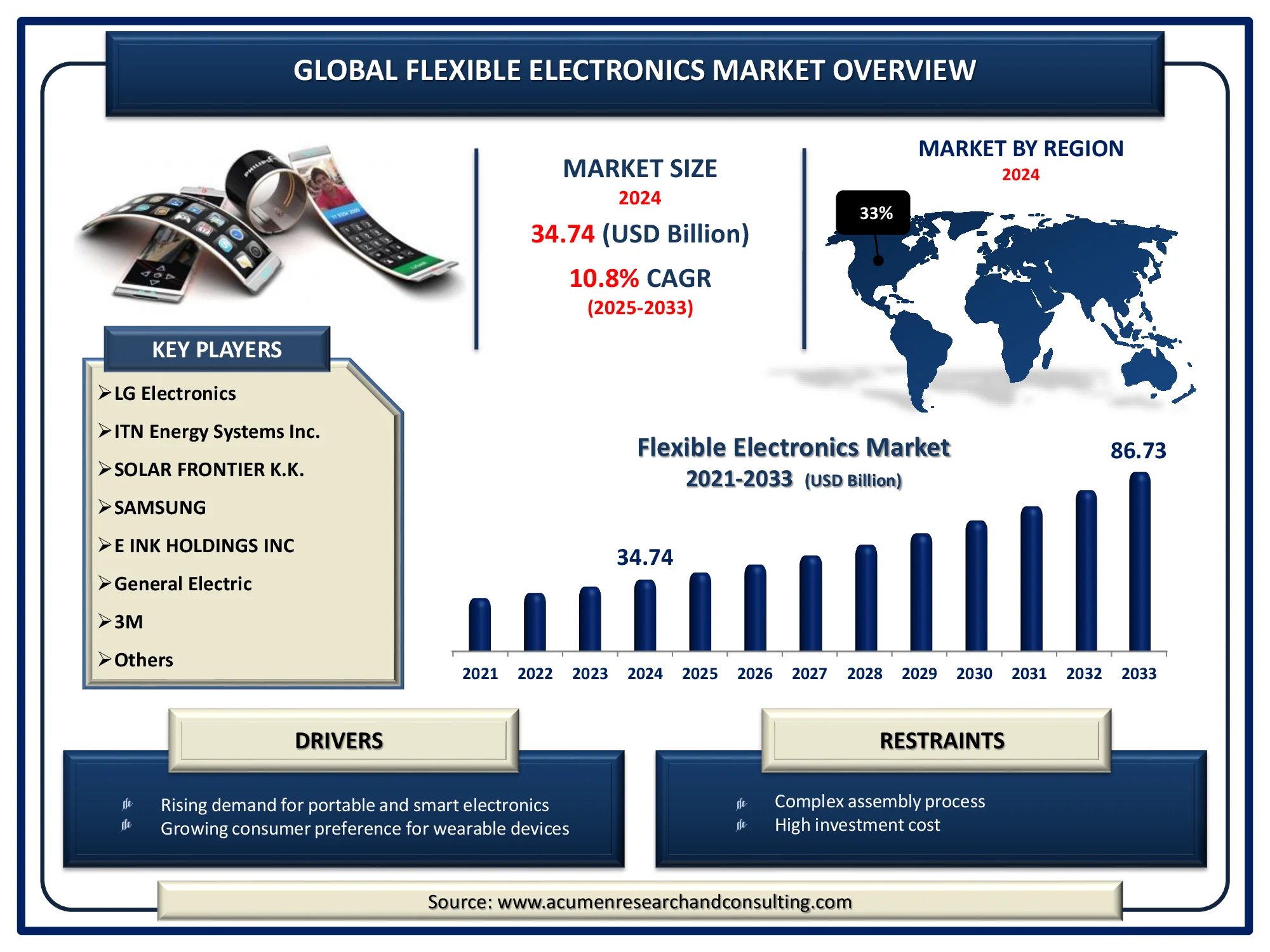

The Global Flexible Electronics Market Size accounted for USD 34.74 Billion in 2024 and is estimated to achieve a market size of USD 86.73 Billion by 2033 growing at a CAGR of 10.8% from 2025 to 2033.

The Global Flexible Electronics Market Size accounted for USD 34.74 Billion in 2024 and is estimated to achieve a market size of USD 86.73 Billion by 2033 growing at a CAGR of 10.8% from 2025 to 2033.

Flexible electronics is the technology for arranging electronic circuitry by mounting the electronic devices on a platform of flexible substrates such as PEEK (Polyether Ether Ketone), polyimide or transparent conductive polyester film. Flexible electronics is more flexible and unbreakable so it is preferred for the small electronics devices which make it easy to mount a circuit in the small devices. Integrating a rigid active plastic display can be achieved in flexible electronics. Flexible electronics have witnessed considerable growth in the last few years, ranging from the extensive applications in flexible OLED electronics and flexible solar cell arrays which are made-up on a plastic substrate. Flexible circuits are simpler to assimilate into the end product and also tend to be lesser in weight. Their demand is stimulated by constant technological development in the field of electronics. Furthermore, the surging demand for smart and lightweight wearable devices is the current trend in the flexible electronics market.

|

Market |

Flexible Electronics Market |

|

Flexible Electronics Market Size 2024 |

USD 34.74 Billion |

|

Flexible Electronics Market Forecast 2033 |

USD 86.73 Billion |

|

Flexible Electronics Market CAGR During 2025 - 2033 |

10.8% |

|

Flexible Electronics Market Analysis Period |

2021 - 2033 |

|

Flexible Electronics Market Base Year |

2024 |

|

Flexible Electronics Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Palo Alto Research Center LLC, MFLEX, LG Electronics, ITN Energy Systems Inc., SOLAR FRONTIER K.K., SAMSUNG, E INK HOLDINGS INC, General Electric, 3M, and First Solar. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The growing awareness regarding the benefits of using flexible electronics in diverse applications is one of the key factors predicted to promote the growth of global market in near future. The rising use of thin-film solar modules and growing acceptance of wearable devices and smartphones are anticipated to drive the global market. Conversely, the existence of recognized substitutes like inflexible products is likely to act as a factor restraining the global flexible electronics market. Additionally, the flexible printed circuits are designed and made for particular application, the price of circuit design, photographic plate, and wiring is high.

Moreover, flexible electronics is the latest technology, so it has a quite difficult manufacturing process which is time consuming and expensive. On the other hand, the increasing need for improvements in terms of technology for a wider end use adoption such as defense and healthcare sector is projected to offer lucrative opportunities in near future. The increasing government support for renewable energy projects and lighting technologies are expected to tender promising opportunities for the market players. Furthermore, rising implementation of flexible devices in healthcare applications is going to be a significant factor that will boost the industry revenue in the flexible electronics market forecast period.

The worldwide market for flexible electronics is split based on type, application, and geography.

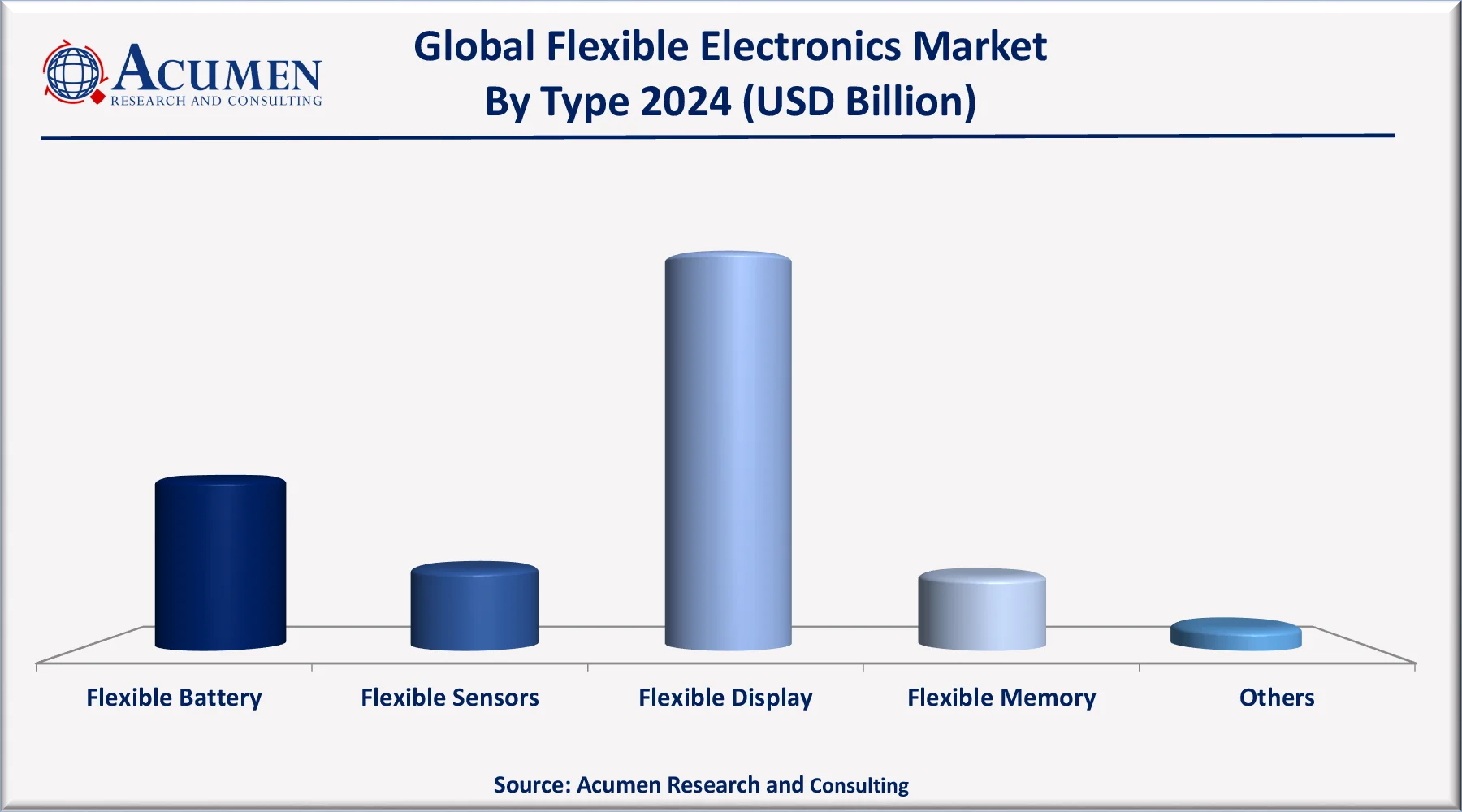

According to flexible electronics industry analysis, on the basis of type, the flexible display segment achieved maximum market share in 2024. A strong penetration of smartphones, tablets, notebooks, desktops and e-readers will fuel demand in the next 9 years. It is expected that growth in this segment will benefit from features like electricity efficiency and rapid micro-second pixel switching speeds. In the future, demand for flexible display panels, particularly OLED display panels, is expected to rise. Apple and Samsung have begun to incorporate flexible OLED displays into their flagship devices, such as the iPhone X and XS series as well as the Samsung Galaxy S and Note series.

In 2024, consumer electronics generated the maximum revenue in the application segment and is expected to continue its trend over the flexible electronics market forecast period from 2025 to 2033. It is primarily due in smart watches, laptops, e-papers, e-books, etc. to the widespread application of this technology. Additionally, in 2024, the automotive industry accounted notable of total sales and is projected to see steady growth over the next nine years. It is expected that the technology will revolutionize car designs, from the dashboard to the center console. On the other hand, healthcare industry is expected to attain the fastest CAGR throughout the projected years. The increasing prevalence of diseases and the growing geriatric population are major factors encouraging the implementation of intelligent and innovative devices that stimulates the growth of flexible electronics throughout the healthcare industry.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

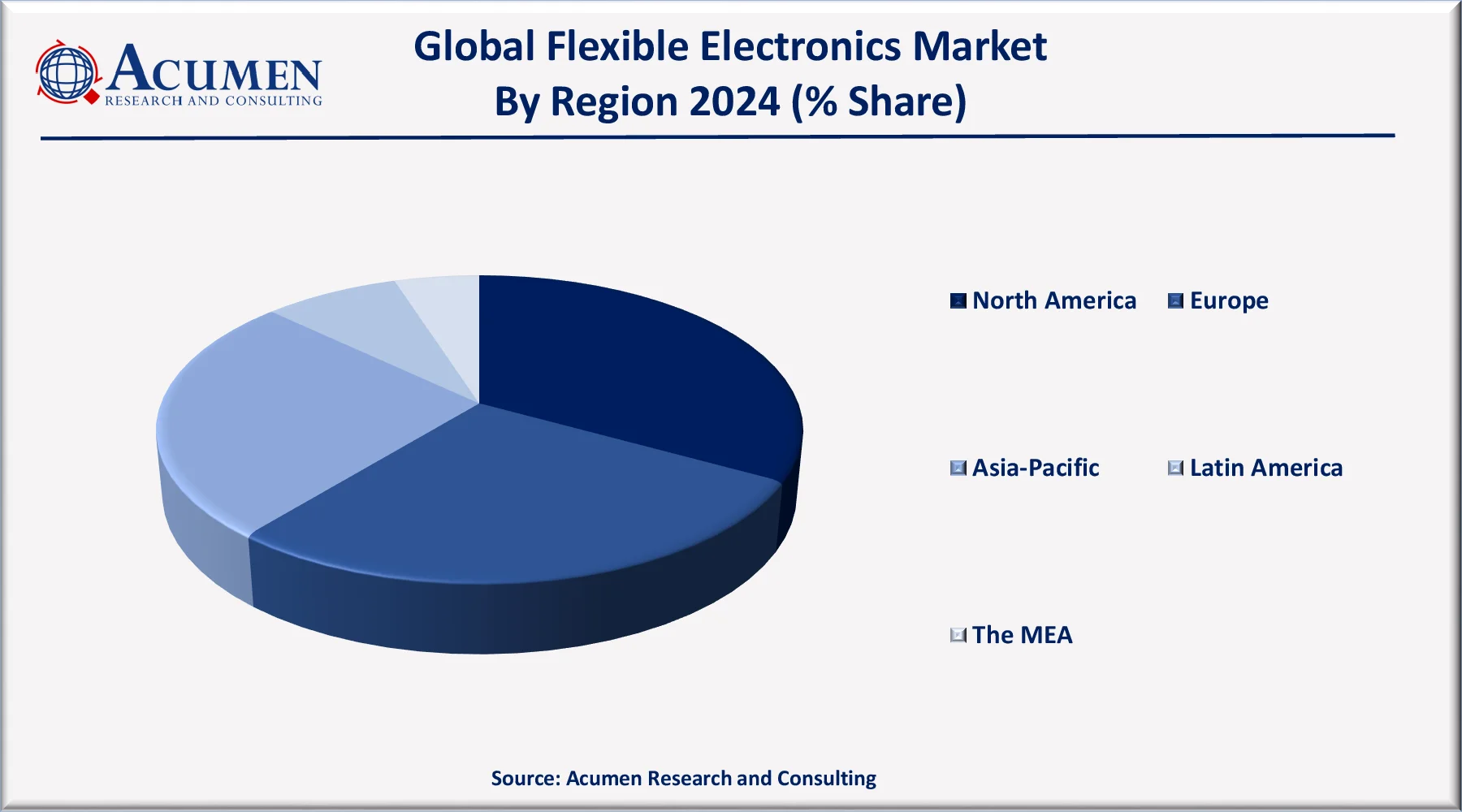

According to regional analysis, North America accounted for the majority of the global flexible electronics market share and is expected to grow significantly in the forecast period. The region is characterized by the presence of numerous research universities involved with technology-related topics in research projects. In addition, several key players with process technologies, competencies, equipment and intellectual property related to flexible electronics are expected to fuel regional market growth over the forecast period. Increasing consumer spending, positive economic outlook, and rising demand for consumer electronics are the key drivers for the flexible electronic market in this region.

However, the presence of Asian companies in the region would be a challenge for regional manufacturers. It is estimated that Asia-Pacific will witness a more than 11.7% CAGR from 2025 to 2033. It can be due to the presence of segments that are reliably important to the development of flexible electronic devices of several large industrial groups with specific manufacturing capabilities.

Some of the top flexible electronics companies offered in our report include Palo Alto Research Center LLC, MFLEX, LG Electronics, ITN Energy Systems Inc., SOLAR FRONTIER K.K., SAMSUNG, E INK HOLDINGS INC, General Electric, 3M, and First Solar.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

July 2023

August 2023

June 2022

June 2023