July 2022

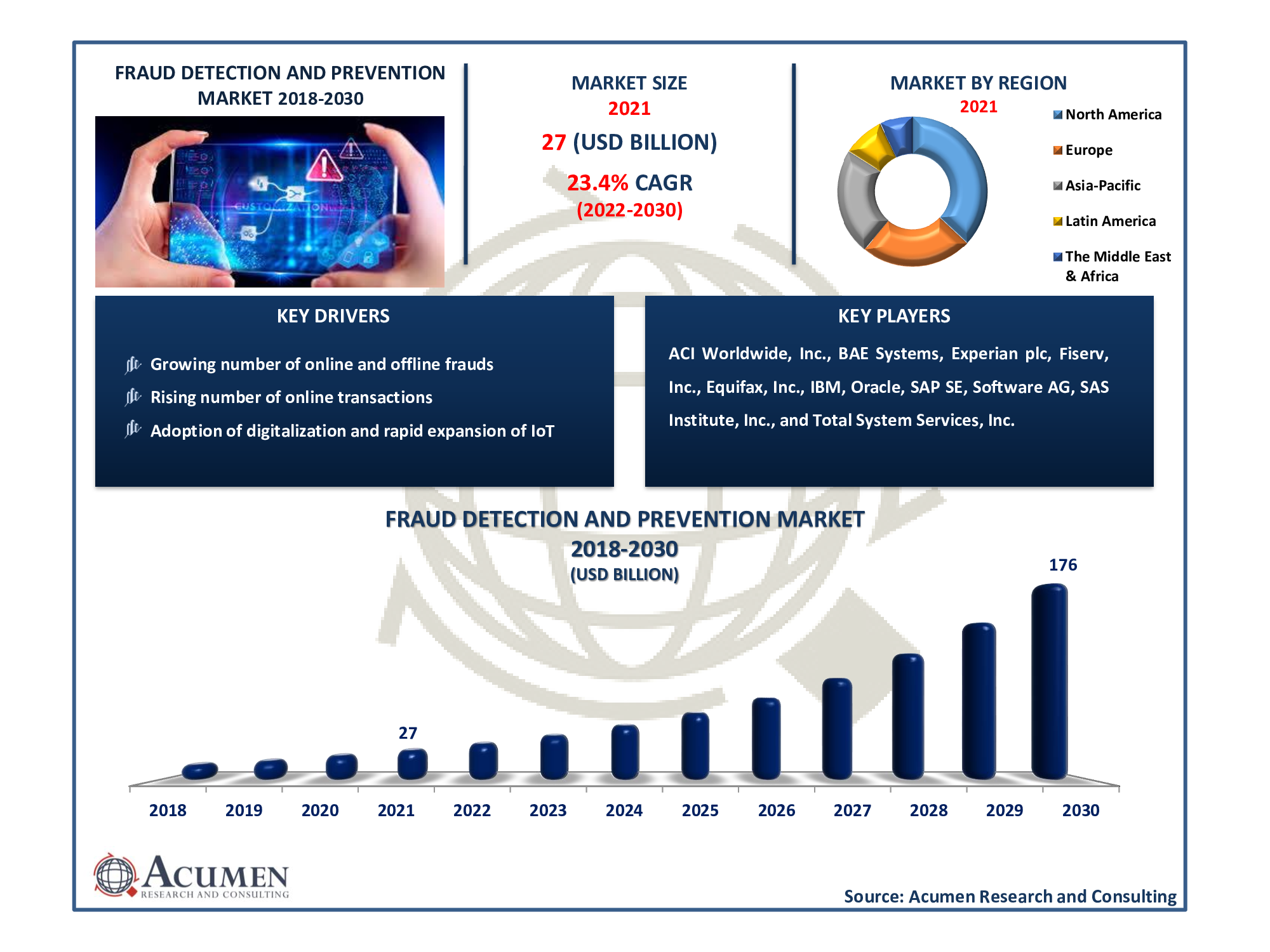

Fraud Detection and Prevention Market Size accounted for USD 27 Billion in 2021 and is projected to reach USD 176 Billion by 2030, with a significant CAGR of 23.4%

The Global Fraud Detection and Prevention Market Size accounted for USD 27 Billion in 2021 and is projected to reach USD 176 Billion by 2030, with a significant CAGR of 23.4% from 2022 to 2030.

The COVID-19 pandemic has been a prominent fraud detection and prevention market trend across the world. The number of fraudulent cases surged on account of the covid-19 pandemic, which was due to the mandatory work-from-home and growth in online payments. The increasing number of online transactions is directly proportional to the increased number of frauds. This factor has lifted up the worldwide fraud detection and prevention market revenue. Fraud detection and prevention is an activity undertaken to detect and prevent attempts to obtain money or property through deception.

Fraud Detection and Prevention Market Growth Drivers:

Fraud Detection and Prevention Market Restraints:

Fraud Detection and Prevention Market Opportunities:

Fraud Detection and Prevention Market Report Coverage:

| Market | Fraud Detection and Prevention Market |

| Fraud Detection and Prevention Market Size 2021 | USD 27 Billion |

| Fraud Detection and Prevention Market Forecast 2030 | USD 176 Billion |

| Fraud Detection and Prevention Market CAGR During 2022 - 2030 | 23.4% |

| Fraud Detection and Prevention Market Analysis Period | 2018 - 2030 |

| Fraud Detection and Prevention Market Base Year | 2021 |

| Fraud Detection and Prevention Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Component, By Fraud Type, By Deployment Model, By Organization Size, By Industry Vertical, And By Region |

| Fraud Detection and Prevention Market Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ACI Worldwide, Inc., BAE Systems, Experian plc, Fiserv, Inc., Equifax, Inc., IBM, Oracle, SAP SE, Software AG, SAS Institute, Inc., and Total System Services, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Fraud Detection and Prevention Market Dynamics

The fraud detection and prevention market value is on a rise owing to the growing digitalization and increasing implementation of IoT. The proliferation of new payment channels and digitalization has provided fraudsters with numerous opportunities to commit crimes. According to UK Finance, £754 million was thieved from bank customers in the first half of 2021, a 30% increase over the same period in 2020. Our global fraud detection and prevention industry analysis also notes that automated bot hacks have been on the rise, and artificial identity fraud has skyrocketed as bad actors proceed to use stolen identities to access fake bank accounts.

Industry 4.0 has aided the rise of e-commerce, resulting in the spread of digital payment. In Industry 4.0, physical and IoT devices are linked with digital systems, allowing for better cooperation across the ecosystem, improving processes, and quickly growing. Even more enterprises and businesses incorporate this new industrial revolution. Regrettably, keeping pace with this growth, the cyberattacks rate in digital payments is moving upward. Indeed, considerable financial losses caused by the increasing movement of fraudulent transactions force the financial industry to constantly improve fraud detection systems.

An increasing number of online transactions and rapid growth in mobile banking have opened several ways to attempt fraud activities and steal money from customers' back accounts. The increased use of smartphones for transactions is a prominent factor driving the growth of fraud detection and prevention solutions, especially in emerging markets. Mobile phone loss or theft frequently results in the loss or theft of payment credentials and provides reliable access to personal details like home address, email address, banking details, and stored payment information. Typically, fraud prevention solutions monitor transactional aspects such as location, device identification, and network. However, rising complexity of frauds and hackers exploring advanced ways to access bank accounts, personal details, etc. are hindering standard fraud detection and prevention solutions industry. Moreover, the advent of artificial intelligence (AI), and machine learning (ML) will allow these solution providers to get a superior hold on detecting and preventing national and international frauds.

Fraud Detection and Prevention Market Segmentation

The global fraud detection and prevention market is segmented based on component, fraud type, deployment model, organization size, industry vertical, and region.

Fraud Detection and Prevention Market By Component

Based on our fraud detection and prevention industry analysis, the solutions segment accounted for the maximum share throughout the forecast period from 2022 to 2030. The rise in security breaches and cyber-attacks, as well as an increase in online fraud, are among the key factors driving the solutions market. On the other hand, the services segment grew at the fastest rate during the same period. The increased prevalence of cybercrime and the increased demand for security services all across the world are gaining traction in the market in the coming years.

Fraud Detection and Prevention Market By Fraud Type

According to our fraud detection and prevention forecast, the fraud types related to payment are anticipated to hold a substantial market share from 2022 to 2030. This is primarily because the consumers' growing preference for e-wallets and cashless payment methods has opened doors for scammers. These applications' flaws or vulnerabilities may allow quick access to banking and financial reserves. However, the identity theft segment will witness the fastest growth rate in the coming years as identity theft can lead to personal details, unauthorized access to places, and many other severe threats.

Fraud Detection and Prevention Market By Deployment Model

The on-premise segment captured the utmost market share based on the deployment model. The on-premises deployment mode is a conventional strategy in which solutions are set up and run from clients' internal servers. Platforms, applications, frameworks, and data are completely under an organization's control with on-premises solutions, which can be managed and handled by their IT staff. Meanwhile, the cloud segment will gain a significant impetus on account of the efficient integration of 5G networks, blockchain, AI, and ML.

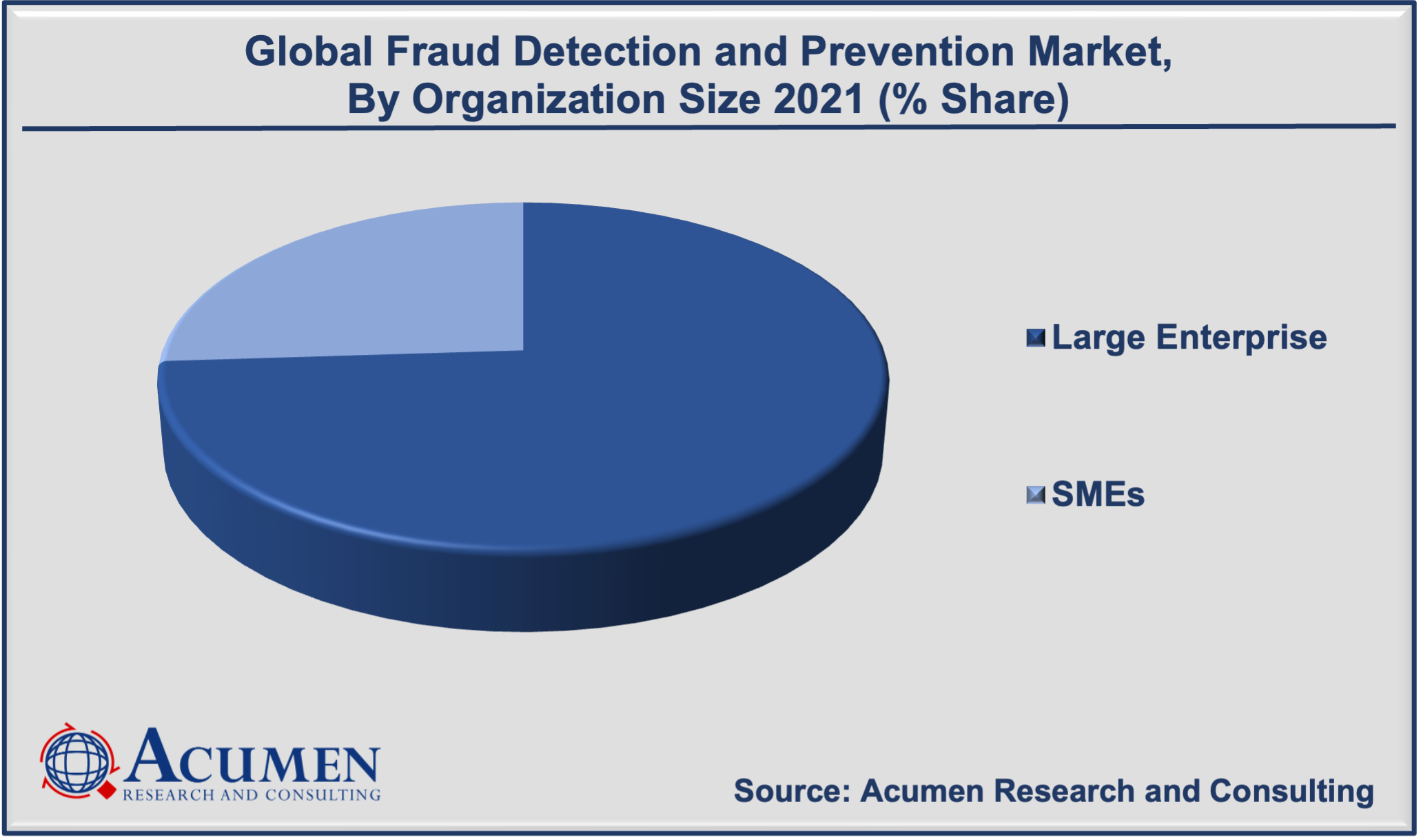

Fraud Detection and Prevention Market By Organization Size

The large enterprise segment dominated the organization size segment in 2021 and is expected to maintain its dominance throughout the forecast timeframe. This is because of the emergence of disruptive digital technologies such as IoT, increased frequency and sophistication of cyber-attacks, and stringent data protection. During the projection period, the small and medium-sized enterprises (SMEs) segment is expected to grow at an exceptional CAGR. The growth is primarily due to an increase in demand for security solutions, as well as an increase in the number of start-ups in Germany, Canada, Israel, and Brazil among other places.

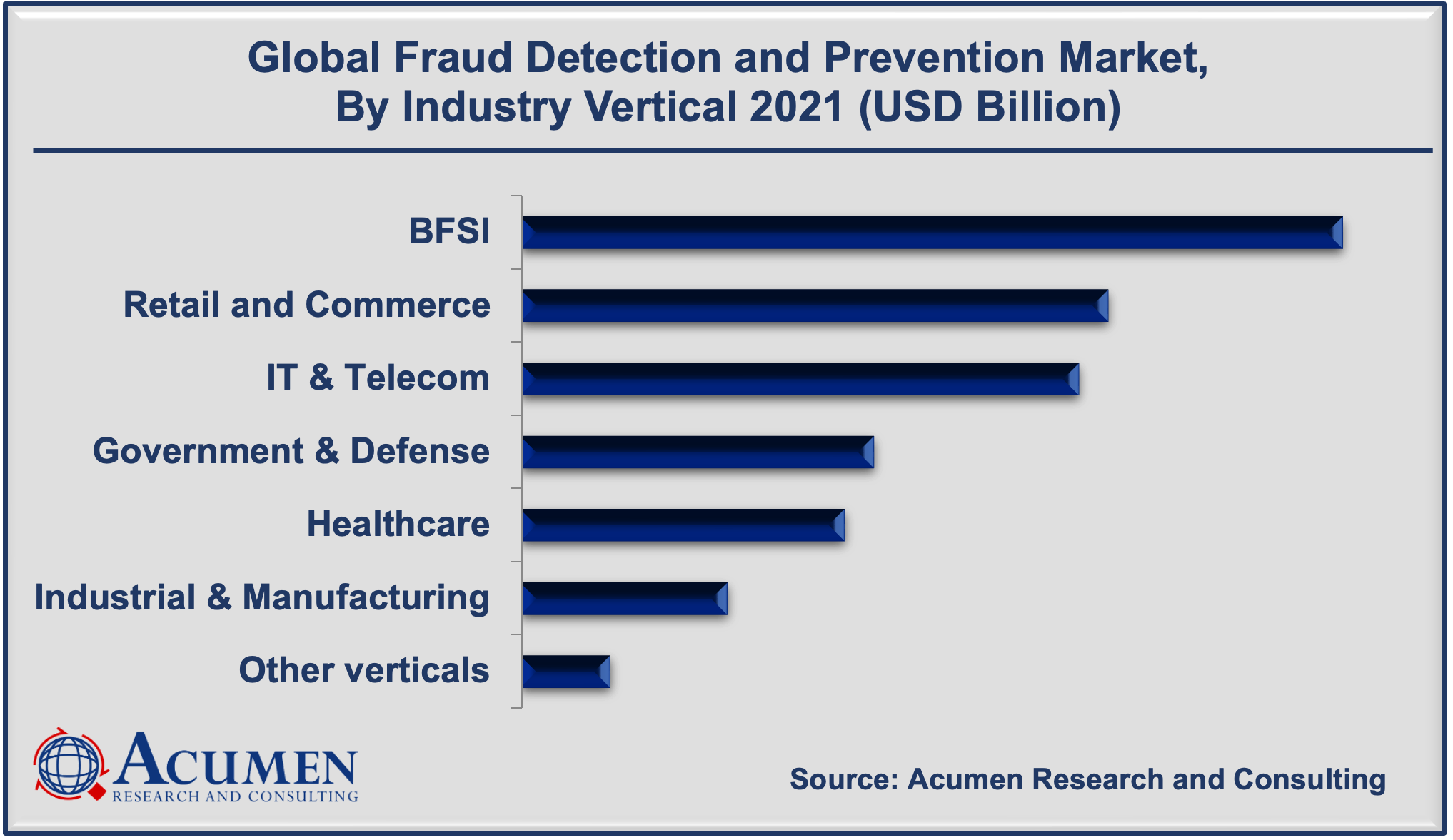

Fraud Detection and Prevention Market By Industry Vertical

Among all of them, the BFSI segment will have the largest market share in 2021. In the BFSI sector, the increase in cyber-attacks such as SMS phishing, card skimming, spyware & adware, social engineering, identity thefts, viruses & Trojans, website cloning, and cyberstalking has added to the adoption of fraud detection & prevention solutions. Furthermore, the retail & e-commerce segment grew significantly as established parties in the retail & e-commerce industry depend on digital platforms and electronic devices to improve customer experience.

Fraud Detection and Prevention Market Regional Overview

North America

Europe

Latin America

Asia-Pacific

The Middle East & Africa (MEA)

Growing Cases Of Money Laundering And Terrorist Financing Activities In North America Fuels The Regional Market Growth

The fraud detection and prevention market regional outlook reveals that the North America region occupied the largest market share all across the world. This is primarily attributed to the rise in mobile and web usage and growth in dependency on internet & social media platforms. Additionally, a rise in the number of cases comprising money laundering, payment frauds, and identity thefts in the US and Canada are also supporting the market growth. However, the Asia-Pacific region is projected to grow at the fastest rate due to the increased population dependency on online and mobile banking apps, and growing awareness among SMEs regarding fraud detection and prevention solutions.

Fraud Detection and Prevention Market Players

Some of the top vendors offered in the professional report include ACI Worldwide, Inc., BAE Systems, Experian plc, Fiserv, Inc., Equifax, Inc., IBM, Oracle, SAP SE, Software AG, SAS Institute, Inc., and Total System Services, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

July 2022

June 2024

March 2025

April 2023