January 2025

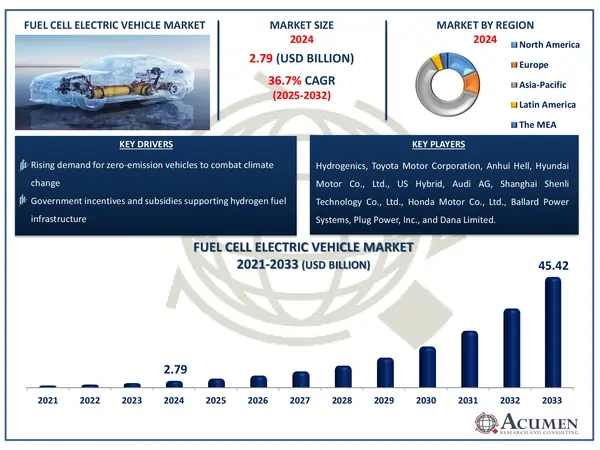

The Global Fuel Cell Electric Vehicle (FCEV) Market Size accounted for USD 2.79 Billion in 2024 and is estimated to achieve a market size of USD 45.42 Billion by 2033 growing at a CAGR of 36.7% from 2025 to 2033.

The Global Fuel Cell Electric Vehicle (FCEV) Market Size accounted for USD 2.79 Billion in 2024 and is estimated to achieve a market size of USD 45.42 Billion by 2033 growing at a CAGR of 36.7% from 2025 to 2033.

A fuel cell electric vehicle (FCEV) is a type of electric vehicle that employs a hydrogen-powered fuel cell to generate electricity for propulsion. Unlike battery electric vehicles (BEVs), which store energy in massive batteries, FCEVs generate electricity via an electrochemical reaction of hydrogen and oxygen, producing only water vapor as a byproduct. This clean energy technique makes FCEVs both eco-friendly and efficient. They have faster refilling times than BEVs and are ideal for long-distance travel and heavy-duty use. The fuel cell stack, hydrogen tank, electric motor, and power control unit are all critical components. FCEVs are gaining popularity as a sustainable mobility alternative, particularly in commercial transport, due to their great energy efficiency, zero tailpipe emissions, and increased global investment in hydrogen infrastructure and clean energy technology.

|

Market |

Fuel Cell Electric Vehicle (FCEV) Market |

|

Fuel Cell Electric Vehicle (FCEV) Market Size 2024 |

USD 2.79 Billion |

|

Fuel Cell Electric Vehicle (FCEV) Market Forecast 2033 |

USD 45.42 Billion |

|

Fuel Cell Electric Vehicle (FCEV) Market CAGR During 2025 - 2033 |

36.7% |

|

Fuel Cell Electric Vehicle (FCEV) Market Analysis Period |

2021 - 2033 |

|

Fuel Cell Electric Vehicle (FCEV) Market Base Year |

2024 |

|

Fuel Cell Electric Vehicle (FCEV) Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Vehicle, By Range, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Hydrogenics, Toyota Motor Corporation, Anhui Hell, Hyundai Motor Co., Ltd., US Hybrid, Audi AG, Shanghai Shenli Technology Co., Ltd., Honda Motor Co., Ltd., Ballard Power Systems, Hyster-Yale Materials Handling, Plug Power, Inc., and Dana Limited. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Increased demand to reduce carbon emission rates to boost air quality has a beneficial impact on the market share of electric vehicles in fuel cells. Increased environmental issues relating to automotive emissions led to increased use of fuel cell electric vehicle (FCEV). Shifting the preference for the introduction of advanced technology in heavy-duty freight trucks would further improve commodity penetration for well-organized vehicle efficiency. For instance, in November 2018, Nikola Company has launched a 120 kW hydrogen powered electric truck with better fuel economy. The market for hydrogen powered vehicles is growing in customer demand and increased mobility requirements. Rapid urbanization and widespread development give potential prospects for the use of environmentally friendly automobiles.

The fuel cell electrical vehicle demand growth is driven by lucrative economic growth and high living standards over the planned period. Governments create numerous research initiatives and sponsored projects focused primarily on designing novel fuel cell solutions. Multiple organizations, including the FCH JU, are funding fuel cell and hydrogen energy research, technological creation and demonstration events. The advancement of successful hygiene manufacturing technologies, while helping to decrease the total fuel cell production costs, is being supported by joint programmers and initiatives.

Europe fuel cells electric vehicle is likely to show substantial development due to government-sponsored supporting programmers to build fuel cell vehicle and construct hydrogen refueling stations with zero emissions. Projects such as the European Cities Renewable Hydrogen Clean Hydrogen in European Cities (CHIC) and the Joint Initiative for hydrogen Vehicles (JIVE) are aimed at marketing fuel cell-electric buses and at further increasing regional fuel cell electric vehicle production. Additionally, improved e-bike connectivity to high-traffic areas supports the growth of this market over the forecast period.

FCEV suppliers focus strongly on collaborations and cooperation with vehicle manufacturers in order to expand their representation on the fuel cell electric vehicle (FCEV) market. For instance, in June 2020, Toyota set up a joint venture in China with five fuel cell development firms. Beijing Automotive Group Co., Dongfeng Motor Corp., China FAW Corp., Guangzhou Auto, and Beijing SinoHytec Co are joint venture firms. The joint venture is known as United Fuel Cell System R&D; with an estimated investment of US$ 46 Mn. Market players also focus in cooperation with other players in the industry the production of electric vehicle technology to strengthen their fuel cell EV market base. For instance, in January 2020, the engine Honda Co. Ltd. has worked on collaborative research for heavy-duty fuel cell-powered trucks with Isuzu Motor Ltd. The business plans to build in the span of two years a concept model and carry out road testing for this strategic partnership.

The worldwide market for fuel cell electric vehicle (FCEV) is split based on vehicle, range, and geography.

According to fuel cell electric vehicle industry analysis, passenger vehicles have emerged as the largest category of the market, owing to supporting government policies and rising customer demand. Under the FAME India Phase II initiative, the Indian government has earmarked incentives for 55,000 electric four-wheeler passenger automobiles, including strong hybrids, to encourage adoption in this category. As of December 1, 2023, subsidies of ₹5,228 crore were provided for the sale of 11,53,079 electric vehicles, including 14,818 four-wheelers. The Production-Linked Incentive (PLI) initiative, worth ₹25,938 crore, intends to increase local production of electric and hydrogen fuel cell vehicles, strengthening the passenger vehicle market. These measures demonstrate the government's commitment to advancing the deployment of clean energy vehicles, establishing passenger FCEVs as an important component of India's sustainable transportation scene.

In the fuel cell electric vehicle (FCEV) market, the short-range sector has emerged as a major revenue contributor, owing to its suitability for urban commuting and light-duty duties. Short-range FCEVs, which typically have ranges of 150-300 kilometers on a full hydrogen tank, are commonly used in densely populated cities where hydrogen refueling infrastructure is more readily available. These vehicles are frequently used as city delivery vans, taxis, or small cars, meeting the demand for low-emission transportation options in metropolitan settings.

The attraction for short-range FCEVs is further fueled by their quick refueling times and the growing emphasis on decreasing carbon footprints in urban contexts. As governments and industry continue to invest in hydrogen infrastructure and push clean energy solutions, short-range FCEV adoption is likely to rise, cementing their place as a significant section of the FCEV market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

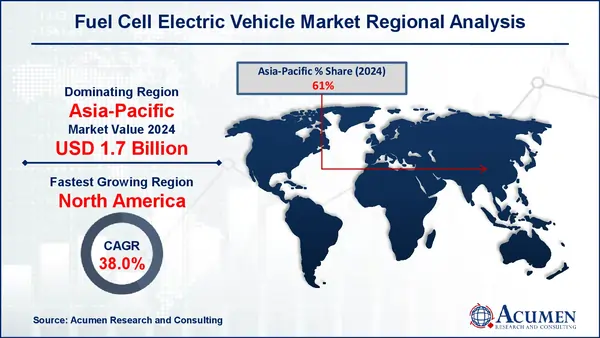

The Asia-Pacific region dominates the FCEV market because of the significant government support and infrastructure development. South Korea has devised a comprehensive hydrogen economy strategy aimed at deploying 2.9 million passenger cars, 80,000 taxis, 40,000 buses, and 30,000 trucks by 2040. By the end of 2023, China will have 354 hydrogen refueling stations to serve its huge fleet of fuel cell buses and trucks. Japan's hydrogen infrastructure continues to grow, with 167 public hydrogen fuel stations active as of May 2023.

North America is predicted to be the fastest expanding region throughout the FCEV market forecast period. The United States is making great progress, particularly in California, where the California Fuel Cell Partnership plans to build 1,000 hydrogen stations and deploy 1 million FCEVs by 2030. The federal government has allocated $1.9 billion for hydrogen industry development under the bipartisan infrastructure bill signed in December 2021. Canada's Hydrogen Strategy envisions operating over 5 million FCEVs nationwide by 2050, emphasizing the country's commitment to a hydrogen-based economy.

European countries are quickly adopting FCEVs, owing to tight emissions rules and environmental initiatives. Germany has launched hydrogen-powered passenger trains, and France plans to have up to 50,000 fuel cell passenger cars by 2028. Collaborations between automakers and infrastructure businesses are hastening the deployment of hydrogen refueling networks across the continent.

Some of the top fuel cell electric vehicle (FCEV) market companies offered in our report include Hydrogenics, Toyota Motor Corporation, Anhui Hell, Hyundai Motor Co., Ltd., US Hybrid, Audi AG, Shanghai Shenli Technology Co., Ltd., Honda Motor Co., Ltd., Ballard Power Systems, Hyster-Yale Materials Handling, Plug Power, Inc., and Dana Limited.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2025

October 2024

November 2024

August 2020