February 2020

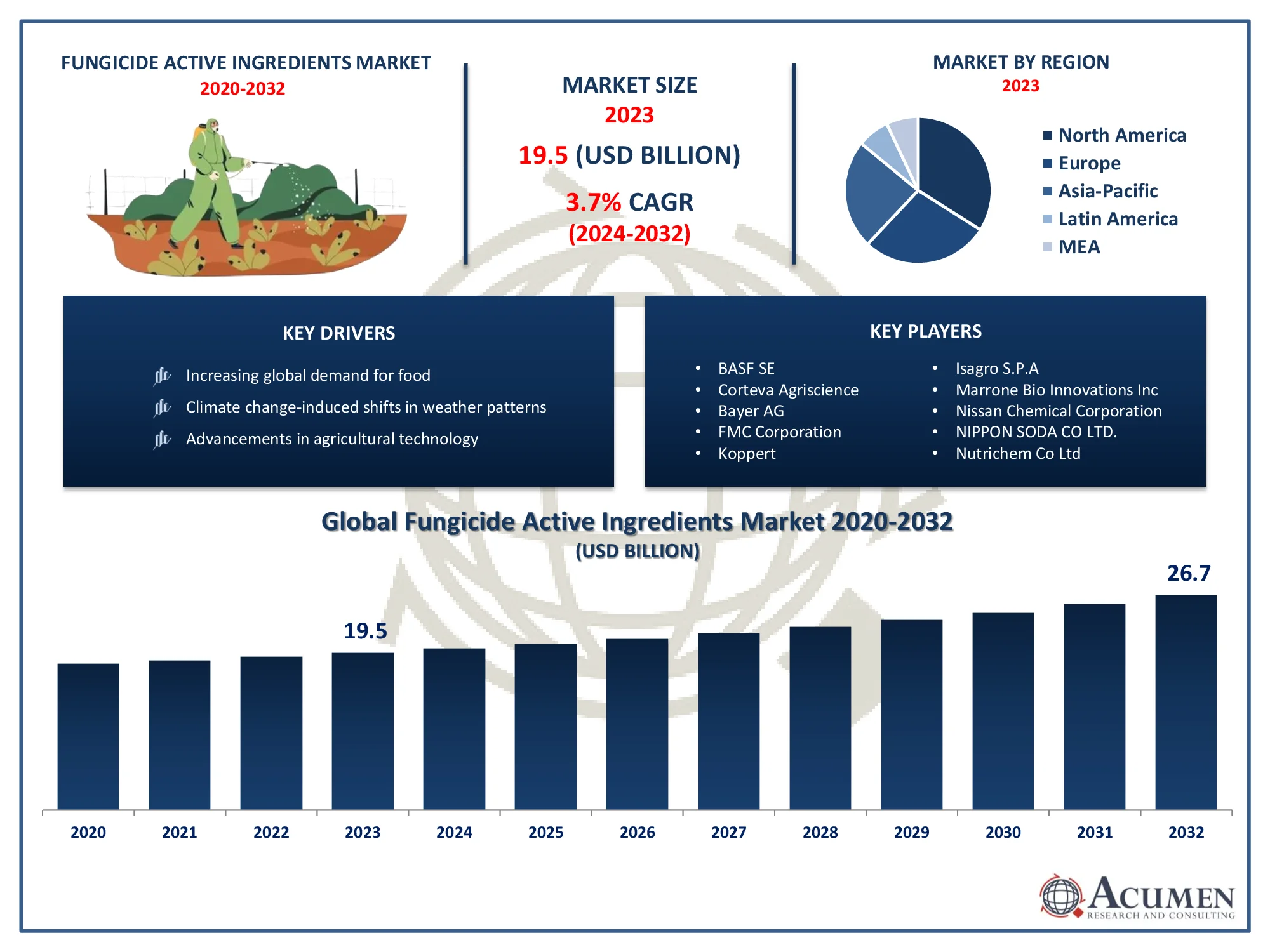

The Global Fungicide Active Ingredients Market, valued at USD 19.5 Billion in 2023, is expected to grow to USD 26.7 Billion by 2032, driven by increasing demand and industry advancements.

The Fungicide Active Ingredients Market Size accounted for USD 19.5 Billion in 2023 and is projected to achieve a market size of USD 26.7 Billion by 2032 growing at a CAGR of 3.7% from 2024 to 2032.

Fungicide Active Ingredients Market Highlights

Fungicides are chemical compounds or biological organisms used to kill or inhibit the growth of fungi that cause diseases in plants. The active ingredients in fungicides vary widely and can include synthetic chemicals like azoles, strobilurins, and triazoles, as well as natural compounds like copper and sulfur. These active ingredients work by disrupting fungal cell processes, inhibiting growth, or outright killing the fungi.

The market for fungicides has been steadily growing due to several factors. One significant driver is the increasing demand for food globally, leading to expanded agricultural activities and the need to protect crops from fungal diseases. Additionally, climate change has brought about shifts in weather patterns, creating environments conducive to fungal infections, thus necessitating more extensive fungicide use. Furthermore, advancements in agricultural technology and the development of more effective and environmentally friendly fungicides have spurred market growth by providing farmers with better tools to protect their crops. The fungicide market is also influenced by regulatory factors and consumer preferences for safer and more sustainable agricultural practices.

Global Fungicide Active Ingredients Market Trends

Market Drivers

Market Restraints

Market Opportunities

Fungicide Active Ingredients Market Report Coverage

| Market | Fungicide Active Ingredients Market |

| Fungicide Active Ingredients Market Size 2022 |

USD 19.5 Billion |

| Fungicide Active Ingredients Market Forecast 2032 | USD 26.7 Billion |

| Fungicide Active Ingredients Market CAGR During 2023 - 2032 | 3.7% |

| Fungicide Active Ingredients Market Analysis Period | 2020 - 2032 |

| Fungicide Active Ingredients Market Base Year |

2022 |

| Fungicide Active Ingredients Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Type, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Corteva Agriscience, Bayer AG, FMC Corporation, Koppert, Isagro S.P.A, Marrone Bio, Innovations Inc, Nissan Chemical Corporation, NIPPON SODA CO LTD., Nutrichem Co Ltd, Nufarm, and Sumitomo Chemical Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fungicide active ingredients are chemical compounds or biological agents specifically designed to control and eliminate fungal pathogens that pose threats to plants. These active ingredients can be synthetic chemicals, such as azoles, strobilurins, and triazoles, or naturally occurring substances like copper and sulfur. Each active ingredient works through different mechanisms, including disrupting fungal cell processes, inhibiting growth, or outright killing the fungi. The choice of fungicide active ingredient depends on various factors, including the type of fungal disease, the target crop, environmental considerations, and regulatory requirements. Fungicides find applications across a wide range of agricultural sectors, including crop production, horticulture, forestry, and turf management. In crop production, fungicides are crucial for protecting crops from fungal diseases that can devastate yields and quality. They are commonly used on cereals, fruits, vegetables, and other cash crops to prevent diseases such as powdery mildew, rusts, blights, and rot.

The market for fungicide active ingredients has witnessed significant growth driven by several factors. One key factor is the increasing global demand for food due to population growth and changing dietary habits. With more land being cultivated to meet this demand, the risk of fungal diseases affecting crops also rises, necessitating the use of fungicides. Additionally, climate change has brought about unpredictable weather patterns, creating environments favorable for fungal infections. This has led farmers to rely more heavily on fungicides to protect their crops and ensure yields. Furthermore, advancements in agricultural technology have played a crucial role in driving the growth of the fungicide active ingredients market. Research and development efforts have led to the discovery and formulation of more effective and targeted fungicidal compounds. These advancements have not only improved the efficacy of fungicides but have also contributed to the development of environmentally friendly alternatives, addressing concerns about the impact of chemical pesticides on ecosystems.

Fungicide Active Ingredients Market Segmentation

The global fungicide active ingredients market segmentation is based on product, type, end use, and geography.

Fungicide Active Ingredients Market By Product

According to the fungicide active ingredients industry analysis, the azoxystrobin segment accounted for the largest market share in 2023. Azoxystrobin is a widely used fungicide belonging to the strobilurin class, known for its broad-spectrum activity against various fungal pathogens. Its popularity stems from its effectiveness in controlling a wide range of diseases across numerous crops, including cereals, fruits, vegetables, and turfgrass. One key driver of the growth of the azoxystrobin segment is its superior performance in disease management. Azoxystrobin offers both preventive and curative properties, effectively controlling fungal diseases by disrupting mitochondrial respiration in the pathogens. Its systemic action and long-lasting protection make it a preferred choice for farmers seeking reliable and consistent crop protection solutions. Additionally, azoxystrobin exhibits translaminar movement within plant tissues, providing thorough coverage and protection against foliar diseases.

Fungicide Active Ingredients Market By Type

In terms of types, the systematic segment is expected to witness significant growth in the coming years. Systemic fungicides are absorbed by the plant and transported to different parts, providing internal protection against fungal pathogens. This mode of action offers several advantages, including prolonged efficacy, rainfastness, and the ability to target diseases that may not be effectively managed by contact fungicides alone. As a result, systemic fungicides have become integral components of disease management programs in modern agriculture. The growth of the systemic segment can be attributed to several factors such as, the increasing demand for high-quality crops and consistent yields has driven farmers to adopt advanced disease control strategies, of which systemic fungicides play a crucial role. Systemic fungicides provide a preventive and curative approach to disease management, reducing the risk of yield losses due to fungal infections. Additionally, advancements in formulation technology have improved the efficacy and application convenience of systemic fungicides, making them more attractive to farmers.

Fungicide Active Ingredients Market By End Use

According to the fungicide active ingredients market forecast, the agriculture segment is expected to witness significant growth in the coming years. With intensification of agriculture, the risk of fungal diseases damaging crops has also increased, necessitating the use of fungicides for disease management. This trend is particularly evident in regions with large-scale commercial farming operations where crop protection is essential for maintaining productivity and profitability. Moreover, advancements in agricultural technology and farming practices have contributed to the growth of the agriculture segment in the fungicide market. Modern farming techniques such as precision agriculture, which involves the use of sensors, drones, and GPS technology, enable farmers to apply fungicides more efficiently and target specific areas of the field, reducing wastage and optimizing crop protection efforts. Additionally, the development of genetically modified (GM) crops with built-in resistance to pests and diseases has created new opportunities for integrated pest management strategies, where fungicides play a crucial role in preventing yield losses due to fungal infections.

Fungicide Active Ingredients Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Fungicide Active Ingredients Market Regional Analysis

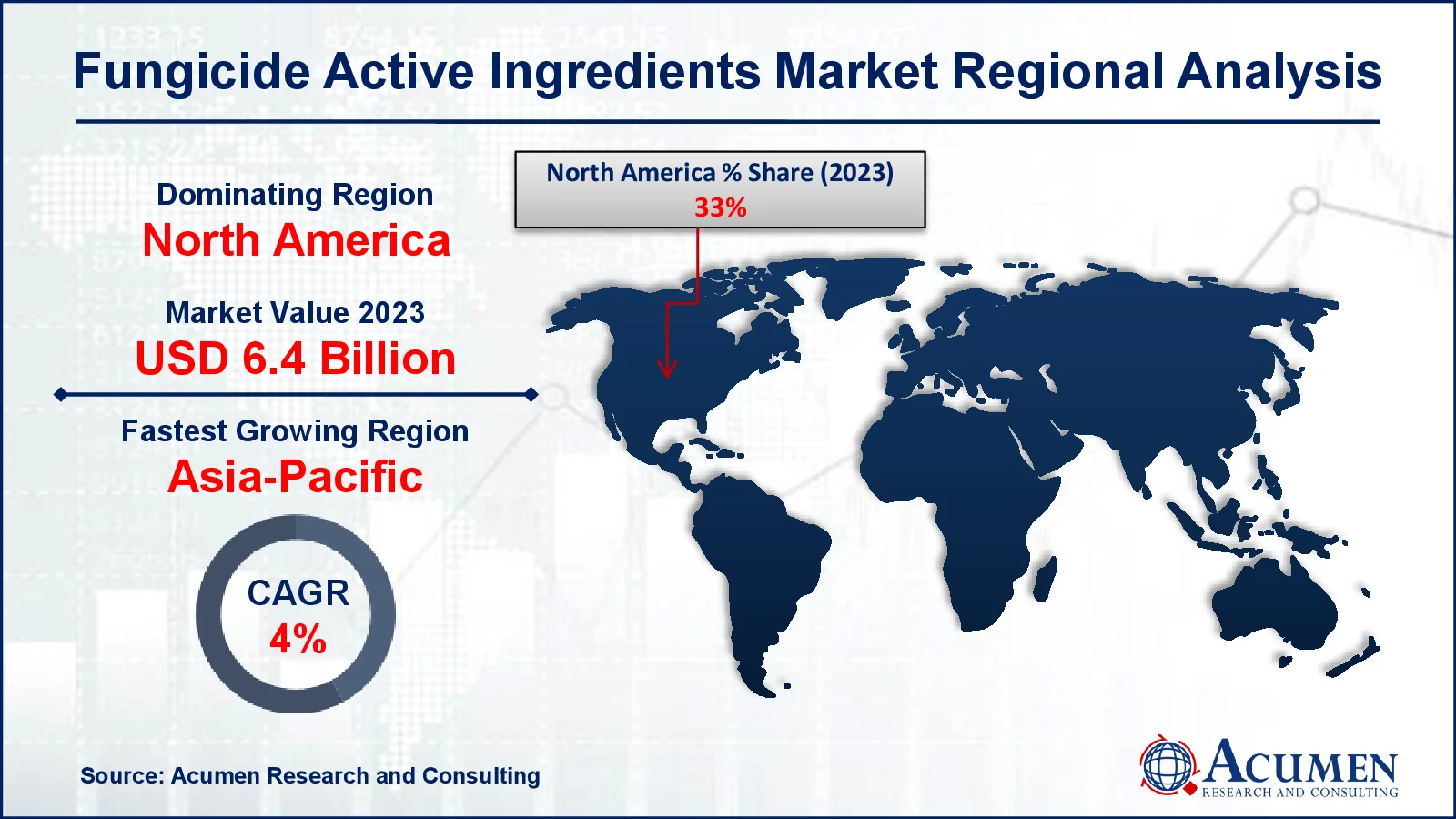

North America stands as a dominating region in the fungicide active ingredients market due to several key factors that contribute to its robust growth and market dominance. North America boasts a highly developed agricultural sector with advanced farming practices and technology adoption. This region is home to a large number of commercial farms cultivating a diverse range of crops, including grains, fruits, vegetables, and specialty crops. The need to protect these valuable crops from fungal diseases drives the demand for fungicide active ingredients. Moreover, North America benefits from extensive research and development activities conducted by leading agrochemical companies based in the region. These companies continuously innovate and introduce new fungicide formulations with improved efficacy, safety profiles, and environmental sustainability. The availability of a wide range of fungicide products tailored to the specific needs of North American crops contributes to the region's dominance in the market. Additionally, strong regulatory frameworks ensure the proper registration and use of fungicides, instilling confidence among farmers in the safety and effectiveness of these products. Furthermore, favorable government policies, subsidies, and support programs for agriculture in North America further bolster the growth of the fungicide active ingredients market.

Fungicide Active Ingredients Market Player

Some of the top fungicide active ingredients market companies offered in the professional report include BASF SE, Corteva Agriscience, Bayer AG, FMC Corporation, Koppert, Isagro S.P.A, Marrone Bio, Innovations Inc, Nissan Chemical Corporation, NIPPON SODA CO LTD., Nutrichem Co Ltd, Nufarm, and Sumitomo Chemical Co. Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2020

April 2023

March 2025

November 2024