January 2021

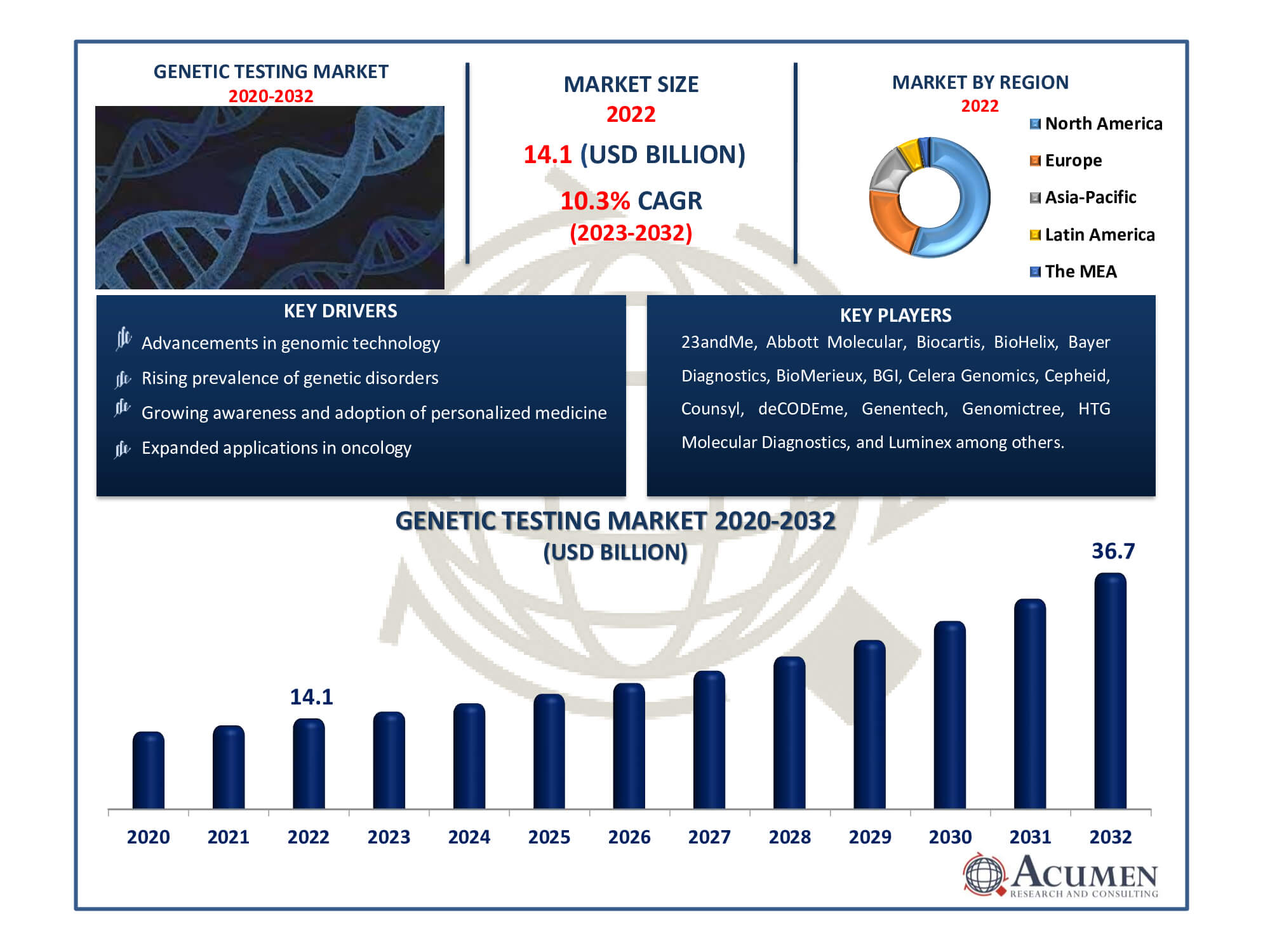

Genetic Testing Market Size accounted for USD 14.1 Billion in 2022 and is estimated to achieve a market size of USD 36.7 Billion by 2032 growing at a CAGR of 10.3% from 2023 to 2032.

The Global Genetic Testing Market Size accounted for USD 14.1 Billion in 2022 and is estimated to achieve a market size of USD 36.7 Billion by 2032 growing at a CAGR of 10.3% from 2023 to 2032.

Genetic Testing Market Highlights

Genetic testing involves studying genes within cells and tissues, aiding in the understanding of various genetic disorders such as cancer, sickle cell anemia, cystic fibrosis, Down syndrome, and more. This examination explores the application of genetic tests in developing individualized medicine and treating conditions like cancer. It highlights diverse techniques like genomic hybridization, fluorescence in situ hybridization, karyotyping, and others for detecting genetic abnormalities and cancers. These methods encompass cytogenetic testing, chromosome analysis, biochemical trials, molecular testing, and DNA sequencing. They utilize products such as kits, media, reagents, and other essentials for genetic testing.

Global Genetic Testing Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Genetic Testing Market Report Coverage

| Market | Genetic Testing Market |

| Genetic Testing Market Size 2022 | USD 14.1 Billion |

| Genetic Testing Market Forecast 2032 | USD 36.7 Billion |

| Genetic Testing Market CAGR During 2023 - 2032 | 10.3% |

| Genetic Testing Market Analysis Period | 2020 - 2032 |

| Genetic Testing Market Base Year |

2022 |

| Genetic Testing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Product, By Technology, By Application, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 23andMe, Abbott Molecular, Biocartis, BioHelix, Bayer Diagnostics, BioMerieux, BGI, Celera Genomics, Cepheid, Counsyl, deCODEme, Genentech, Genomictree, HTG Molecular Diagnostics, Luminex, MolecularMD, IntegraGen, LabCorp diagnostics, Myriad, Natera, PacBio, Pathway Genomics, Qiagen, and Roche Diagnostic |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Genetic Testing Market Insights

In the near future, the global genetic testing market is poised for substantial growth due to the increasing prevalence of genetic disorders, cancerous diseases, and the rising acceptance of personalized medicinal products. Advancements in genetic testing techniques, particularly in genetic oncology testing, will significantly propel market expansion in the forecasted period. However, concerns regarding standardization in genetic testing-based diagnoses and stringent regulatory approvals might pose obstacles to market growth. Conversely, untapped emerging markets in developing countries present lucrative opportunities for market players. These factors are expected to contribute to an increased global market share for genetic testing.

The genetic testing market is experiencing substantial growth due to increasing awareness and investments in this field. Genetic testing involves analyzing human DNA, RNA, chromosomes, or related products, aiding in the detection of genotype, phenotype, or mutation-related diseases. These tests are utilized for clinical purposes, including the detection of karyotype abnormalities.

Genetic testing offers several advantages, notably the early detection of genetic abnormalities at around 8 to 10 weeks of gestation and the ability to determine the fetus's sex. Consequently, the popularity of genetic testing is on the rise, driven by increased awareness and advancements in the field. Among various genetic tests, screening for genetic mutations in the Cystic Fibrosis gene's trans-membrane conductance regulator gene (CFTR) stands as the most common procedure in genetic testing.

Genetic Testing Market Segmentation

The worldwide market for genetic testing is split based on type, product, technology, application, end-user, and geography.

Genetic Testing Types

According to genetic testing industry analysis, the market segments into prenatal, newborn, diagnostic tests, pharmacogenomic tests, and others based on type. Presently, the diagnostic test segment leads the market in 2022, and its dominance is forecasted to persist. This dominance stems from heightened human health awareness and increased mortality rates globally due to genetic diseases. Conversely, during the genetic testing indystry forecast period, the pharmacogenomic test segment is expected to exhibit the most effective compound annual growth rate. This trend is primarily driven by pharmaceutical companies increasingly leveraging these tests in drug discovery and development processes.

Genetic Testing Products

The consumables segment dominates the genetic testing market due to its critical role in the execution of numerous tests. Consumables include reagents, testing kits, and sample collection tools that are required for genetic analysis. Their importance stems from their capacity to provide precise and quick testing processes while also providing reliability and consistency in outcomes. As the demand for genetic testing grows in the healthcare, research, and pharmaceutical sectors, the consumables segment maintains its prominence by providing the essential materials required for comprehensive and precise genetic analyses, highlighting its market dominance.

Genetic Testing Technologies

As per the genetic testing market analysis, the molecular testing sector leads the industry due to its precision and adaptability in examining DNA, RNA, and genes at the molecular level. Molecular testing, which employs procedures such as PCR, DNA sequencing, and hybridization, allows for a thorough evaluation of genetic variants, mutations, and disease risks. Its capacity to quickly offer very specific and accurate results has driven it to prominence. The versatility of this market across many applications, such as oncology, infectious illnesses, and pharmacogenomics, drives its expansion. As personalised medicine gains pace, molecular testing continues to play an important role in driving improvements and expanding possibilities in understanding genetic intricacies and diseases with unprecedented depth and precision.

Genetic Testing Applications

The health and wellness-predisposition/risk/tendency category controls the majority of the genetic testing market due to its numerous applications in personalised healthcare. This part provides information into an individual's susceptibility to certain health issues, supporting proactive health management. It enables early intervention and lifestyle changes by analysing genetic risks for diseases such as diabetes, cardiovascular disease, and cancer. It also provides information about pharmaceutical reactions and susceptibility to specific illnesses, allowing for more personalised healthcare plans. With increased public interest in preventative health measures, this segment's emphasis on personalised risk assessment and wellness solutions solidifies its leadership position in the genetic testing environment.

Genetic Testing End-Users

Hospitals and clinics account for the majority of the genetic testing market due to their vital role in healthcare delivery. These are the key points of contact for patients, and genetic tests are frequently performed for a variety of purposes, including disease diagnosis, risk assessment, and personalised therapy planning. Hospitals and clinics are the favoured choice for genetic testing due to their accessibility, comprehensive facilities, and integration with healthcare services. Furthermore, the presence of qualified medical experts in these locations ensures proper testing, result interpretation, and appropriate patient counselling, further cementing their supremacy in this sector.

Genetic Testing Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

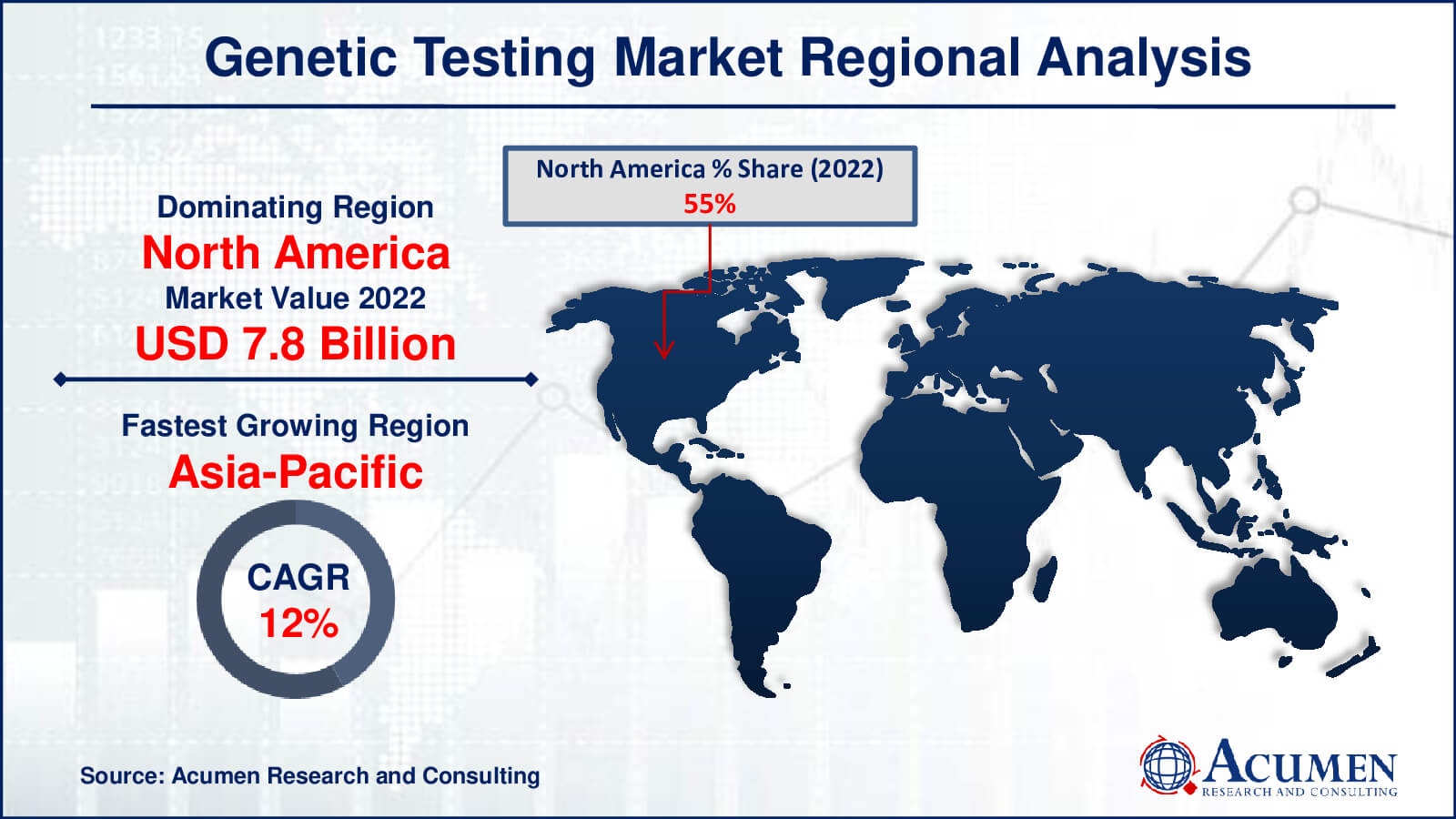

Genetic Testing Market Regional Analysis

The industry, which registered sales of US$ 7.8 billion in North America in 2022, is poised for substantial growth in the genetic testing market forecast period. This growth is attributed to the increasing incidence of genetic disorders such as cancer, Turner syndrome, neurofibromatosis, and spinal muscle atrophy. The introduction of new tests, driven by technological advancements, is expected to fuel the demand for genetic testing. Over the coming years, market expansion will be bolstered by advanced infrastructure, robust healthcare systems, and regulatory support, especially for direct-to-consumer genetic testing.

Asia-Pacific genetic test market is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 12%, primarily due to the rising prevalence of various cancers like prostate, breast, and lung cancer. Breast cancer, notably the most prevalent cancer among females in Asia-Pacific, is estimated to increase largest by 2030 according to the Pan American Health Organization (PAHO), with approximately 4,08,200 affected women. The accelerating regional growth will be driven by genetic tests facilitating early detection and prevention of cancer and other genetic conditions.

Genetic Testing Market Players

Some of the top genetic testing companies offered in our report includes 23andMe, Abbott Molecular, Biocartis, BioHelix, Bayer Diagnostics, BioMerieux, BGI, Celera Genomics, Cepheid, Counsyl, deCODEme, Genentech, Genomictree, HTG Molecular Diagnostics, Luminex, MolecularMD, IntegraGen, LabCorp diagnostics, Myriad, Natera, PacBio, Pathway Genomics, Qiagen, and Roche Diagnostic.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2021

August 2024

March 2024

May 2024