April 2023

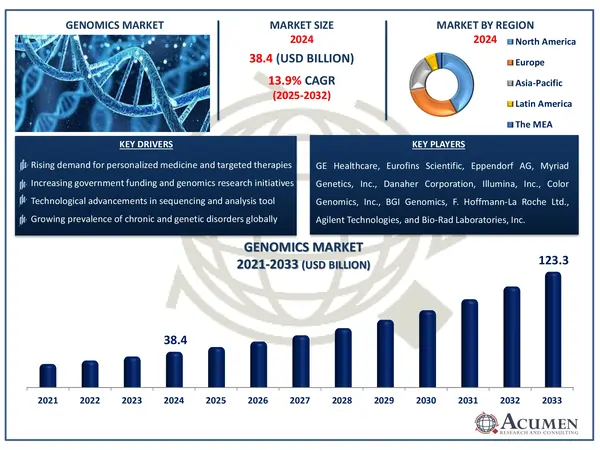

The Global Genomics Market Size accounted for USD 38.4 Billion in 2024 and is estimated to achieve a market size of USD 123.3 Billion by 2033 growing at a CAGR of 13.9% from 2025 to 2033.

The Global Genomics Market Size accounted for USD 38.4 Billion in 2024 and is estimated to achieve a market size of USD 123.3 Billion by 2033 growing at a CAGR of 13.9% from 2025 to 2033.

Genomics is the branch of biology that examines the structure, function, evolution, mapping, and editing of genomes, or the full set of DNA within an organism. Unlike genetics, which studies individual genes and their roles in inheritance, genomics examines all genes as a whole and how they interact with one another and the environment. It analyzes and interprets genetic data using cutting-edge technologies such as DNA sequencing, bioinformatics, and gene editing. Genomic research is crucial for better understanding diseases, developing targeted treatments, enhancing agricultural quality, and encouraging customized medicine. It promotes breakthroughs in diagnostics, medication research, and health prediction, empowering scientists and healthcare practitioners to make more precise and informed decisions based on a person's genetic makeup.

|

Market |

Genomics Market |

|

Genomics Market Size 2024 |

USD 38.4 Billion |

|

Genomics Market Forecast 2033 |

USD 123.3 Billion |

|

Genomics Market CAGR During 2025 - 2033 |

13.9% |

|

Genomics Market Analysis Period |

2021 - 2033 |

|

Genomics Market Base Year |

2024 |

|

Genomics Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product & Services, By Technology, By Application, By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

GE Healthcare, Eurofins Scientific, Eppendorf AG, Myriad Genetics, Inc., Danaher Corporation, Illumina, Inc., Color Genomics, Inc., BGI Genomics, F. Hoffmann-La Roche Ltd., Agilent Technologies, and Bio-Rad Laboratories, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Genomics uses a combination of recombinant DNA, DNA sequencing methods, and bioinformatics to sequence, assemble, and analyze the structure and function of genomes. Increasing government spending on development present biotechnology infrastructure and focus on various collaborative works for introduction of innovative solutions are major factors expected to drive the growth of global market. In addition, major players focus on lowering the sequencing cost, coupled with inclination towards enhancing the product portfolio are factors expected to support the growth of target market.

Major players focus on developing the business their inclination towards increasing customer base and enhance the profit ration this is expected to augment the growth of target market.

However, concerns sucg as the high cost of genetic equipment and a lack of experienced personnel pose expenses and risks. This product introduction is expected to help the company expand its customer base and gain revenue share. In 2020, the firm purchased Lineage, a supplier of genetic diagnosis services for juvenile neurodevelopment diseases including autism spectrum disorder. This acquisition will assist the company to expand its product portfolio and improve revenue.

In 2020, Nebula Genomics a global provider of privacy-focused personal genomics service launched direct-to-consumer whole genome sequencing. This launch is expected to help the company to increase the revenue share. In addition, unavailability of developed infrastructure in developing countries is expected to challenge the growth of target market. Rapid technological advancements by major players and focus on use of genomics in specialized/personalized medicine are factors expected to create new opportunities for players operating in the target market over the genomics market forecast period.

The worldwide market for genomics is split based on product & services, technology, application, end use, and geography.

According to genomics industry analysis, consumables are the largest segment due to their widespread use in various genomic processes. These include reagents, kits, enzymes, and other chemical solutions used in processes like as DNA extraction, amplification, sequencing, and analysis. Consumables are vital for laboratories, research institutions, and clinical diagnostics since they are used repeatedly in each experiment, as opposed to instruments, which are generally purchased just once. The expanding usage of high-throughput sequencing technology, as well as increased genetic testing volumes, has significantly raised the demand for these commodities. Furthermore, innovations in test design and reagent composition continue to enhance efficiency and accuracy, resulting in higher demand. As genomics becomes more integrated into personalized medicine and routine diagnostics, the consumables category is expected to maintain its dominant market position.

PCR (polymerase chain reaction) has the biggest market share of any genomics technology due to its vast use, high sensitivity, and cost-effectiveness. PCR is widely used for gene amplification, mutation detection, and pathogen identification, making it an essential tool in research, diagnostics, and clinical settings. Its quick turnaround time and ability to deliver accurate results from small DNA samples increase its usefulness. Furthermore, advances in quantitative PCR (qPCR) and digital PCR (dPCR) have increased its precision and scalability, making it perfect for high-throughput genomics research. Its ability to deal with a wide range of sample types and integrate with other genomic operations solidifies PCR's dominance in academic and commercial genomics applications.

Diagnostics has a sizable revenue share in the genomics market, owing to the growing demand for early disease identification and personalized treatment options. Genomic diagnostics detects genetic mutations, biomarkers, and predispositions associated with a wide range of diseases, including cancer, rare genetic disorders, and infectious diseases. The increasing use of next-generation sequencing (NGS) and PCR-based techniques has improved diagnosis accuracy and reduced turnaround time, driving demand in clinical settings. Furthermore, the incorporation of genetics into routine health screenings, as well as the increased emphasis on preventative healthcare, help to enhance its market presence. Government initiatives and commercial investments in genetic testing infrastructure also contribute to the global adoption of genomic diagnostics, reinforcing its status as a significant revenue-generating application.

According to genomics market forecast, research centres, as well as academic and government institutes, make important contributions to the industry income because to their critical role in supporting innovation and foundational research. These organizations frequently undertake large-scale genomic research, such as population studies, genome mapping, and disease pathway investigations, which necessitate significant investment in advanced technologies and platforms. They are well-positioned to conduct long-term studies that commercial entities may not prioritize because they are funded by the government. Collaborations with the healthcare and biotech industries result in research discoveries being translated into practical applications. The continuous focus on developing national genetic databases and expanding precision health programs enhances research and academic institutions' strong market presence in this field.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

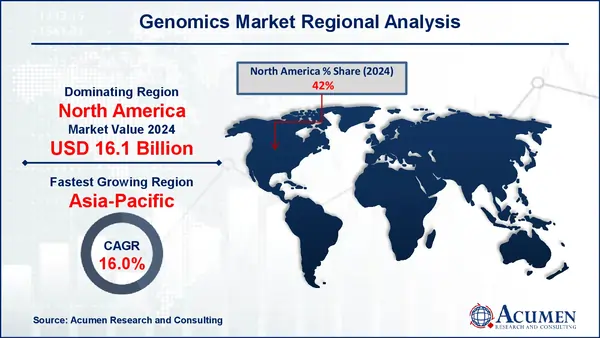

The market in North America is expected to account for major revenue share due to high government spending on biotechnology sector. In addition, presence of large number of players operating in the country and focus on introduction of innovative service & solutions in order to attract new customers are factors expected to support the growth of target market. Moreover, increasing business acquisition activities in order to strengthen the business is another factor expected to impact the growth of target market.

The Asia-Pacific region is emerging as the fastest-growing sector in the genomics market forecast period, driven by rapid advancements in healthcare infrastructure, rising investments in life sciences, and growing awareness of personalized medicine. Countries like China, India, Japan, and South Korea are rapidly boosting funding for genomic research and development activities, thanks to favorable government policies and smart partnerships between the public and commercial sectors. Furthermore, the region's expanding frequency of chronic and hereditary disorders has increased the demand for sophisticated diagnostic technologies and precision treatment choices. Expanding biotechnology and pharmaceutical industries, as well as a growing pool of competent experts, are all helping to drive market expansion. Increasing the affordability of genetic technology encourages wider usage across populations.

Some of the top genomics companies offered in our report include GE Healthcare, Eurofins Scientific, Eppendorf AG, Myriad Genetics, Inc., Danaher Corporation, Illumina, Inc., Color Genomics, Inc., BGI Genomics, F. Hoffmann-La Roche Ltd., Agilent Technologies, and Bio-Rad Laboratories, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

May 2021

January 2024

July 2024