February 2020

Geographic Information System Market Size accounted for USD 11.6 Billion in 2022 and is projected to achieve a market size of USD 41.3 Billion by 2032 growing at a CAGR of 13.7% from 2023 to 2032.

The Global Geographic Information System (GIS) Market Size accounted for USD 11.6 Billion in 2022 and is projected to achieve a market size of USD 41.3 Billion by 2032 growing at a CAGR of 13.7% from 2023 to 2032.

Report Key Highlights

A Geographic Information System (GIS) is a computer-based system designed to capture, store, analyze, manage, and display geographical data. GIS allows users to visualize, interpret, and analyze data in ways that were not previously possible, making it a powerful tool for decision-making across a wide range of industries, including urban planning, transportation, natural resource management, and emergency management.

The GIS market value has seen significant growth in recent years, driven by increasing demand for location-based services, advancements in GIS technology, and the growing need for efficient data management and analysis. The increasing use of GIS in various industries is expected to drive market growth in the coming years. For example, the use of GIS in the healthcare industry is expected to grow significantly, as healthcare organizations increasingly rely on location-based data to optimize patient care and manage healthcare resources. Additionally, the growing adoption of GIS in the agriculture industry is expected to create new opportunities for GIS vendors, as farmers use GIS to optimize crop yields and reduce environmental impact.

Global Geographic Information System Market Trends

Market Drivers

Market Restraints

Market Opportunities

Geographic Information System Market Report Coverage

| Market | Geographic Information System Market |

| Geographic Information System Market Size 2022 | USD 11.6 Billion |

| Geographic Information System Market Forecast 2032 | USD 41.3 Billion |

| Geographic Information System Market CAGR During 2023 - 2032 | 13.7% |

| Geographic Information System Market Analysis Period | 2020 - 2032 |

| Geographic Information System Market Base Year | 2022 |

| Geographic Information System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Function, By Industry vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ESRI, Hexagon AB, Autodesk, Inc., Trimble Inc., Bentley Systems, Inc., Pitney Bowes Inc., SuperMap Software Co., Ltd., Topcon Corporation, Caliper Corporation, GIS Cloud Ltd., Blue Marble Geographics, and Harris Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The geographic information system market growth is driven by the adoption of LIDAR imagery and airborne devices for mapping and collecting data. GIS software is becoming a crucial tool for combining maps and geospatial information as it provides tools and functions to retrieve, store, display, analyze, and manage all types of spatial and geographic data. Development of urbanization and smart cities, application of geospatial technology with major technologies for growing adoption of GIS solutions in transportation, and business intelligence are the key factors for market growth. Infrastructure development and urban planning require accurate mapping and graphing of geographic areas. GIS can accurately evaluate construction projects such as a sewer, canals, dams, bridges, industrial parks, power plants, and water management. For civil engineering applications, geospatial tools are integrated with computer-aided design (CAD). The high cost of geographic data collection and geospatial solutions poses a major challenge to the growth of the geographic information system market value. The use of mapping technologies has been growing rapidly in infrastructure, construction, defense and security, transportation, forestry, agriculture, and the environment. Smart city and urban planning development programs in developing countries like India and China can subsidize the market growth of the mapping function of geographic information systems.

Geographic Information System Market Segmentation

Geographic Information System Market Segmentation

The global geographic information system market segmentation is based on component, function, industry vertical, and geography.

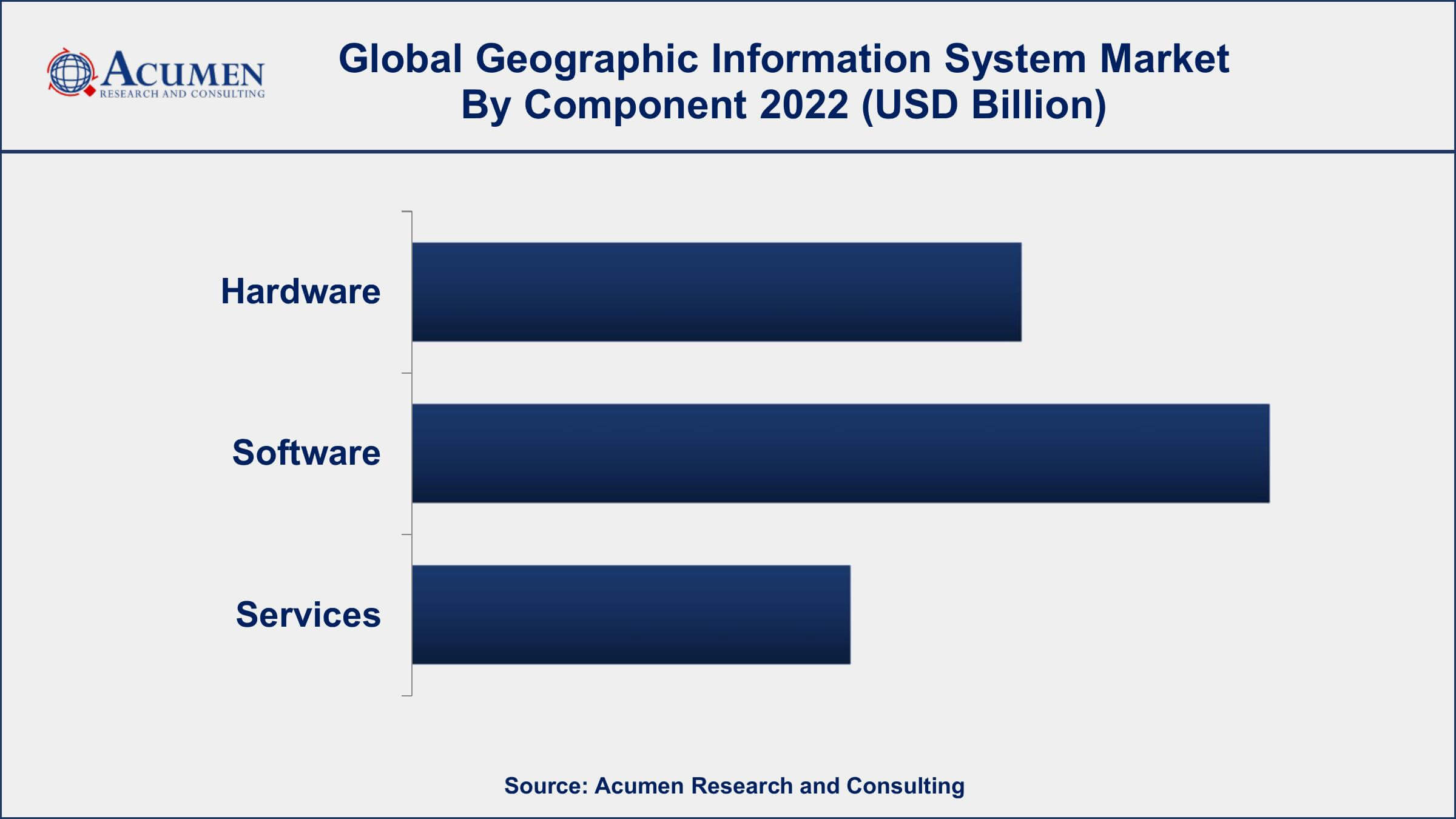

Geographic Information System Market By Component

According to the geographic information system industry analysis, the services segment accounted for the largest market share in 2022. The software segment includes desktop, web-based, and mobile GIS software that provides various functionalities such as data management, analysis, and visualization. One of the key drivers for the growth of the GIS software segment is the increasing adoption of cloud-based GIS solutions. Cloud-based GIS software offers several advantages, such as easy scalability, cost-effectiveness, and ease of access from anywhere with an internet connection. The cloud-based GIS software segment is expected to witness significant growth in the coming years. Another factor contributing to the growth of the GIS software segment is the increasing demand for spatial data analytics. GIS software enables organizations to analyze large amounts of location-based data to gain insights into various phenomena, such as urban planning, natural resource management, and disaster management.

Geographic Information System Market By Function

In terms of functions, the mapping segment is expected to witness significant growth in the coming years. Mapping refers to the creation of visual representations of geographical data, such as maps and charts, to enable better decision-making and understanding of geographical phenomena. The mapping segment is expected to continue its growth trajectory due to the increasing demand for accurate and detailed geographical data. One of the key drivers for the growth of the mapping segment is the increasing demand for location-based services. Location-based services rely on accurate and detailed maps and geographical data to provide users with relevant information based on their location. With the increasing adoption of location-based services, the demand for accurate and up-to-date mapping data is also increasing.

Geographic Information System Market By Industry vertical

According to the geographic information system market forecast, the oil and gas segment is expected to witness significant growth in the coming years. GIS is used in the oil and gas industry to manage spatial data related to exploration, production, and transportation, enabling organizations to make informed decisions based on location-based data. One of the key drivers for the growth of the GIS market in the oil and gas industry is the increasing demand for accurate and up-to-date geographical data. GIS technology enables organizations to collect, analyze, and visualize large amounts of spatial data to optimize exploration and production activities, such as well site selection, reservoir management, and pipeline routing. Furthermore, the growing demand for energy and the increasing complexity of oil and gas operations is expected to provide new opportunities for GIS vendors.

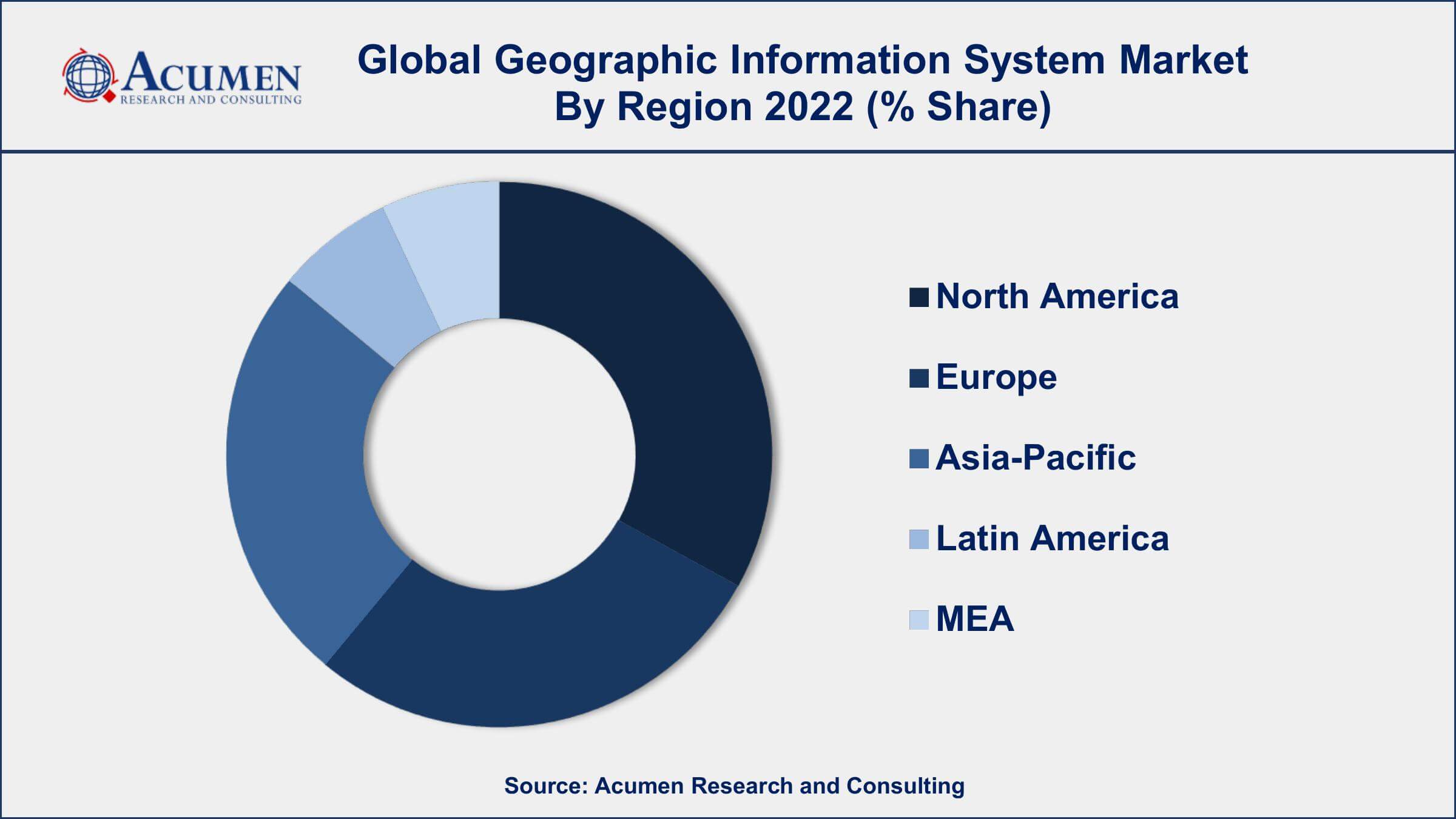

Geographic Information System Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Geographic Information System Market Regional Analysis

North America dominates the Geographic Information System (GIS) market due to several factors, including the presence of a large number of key players in the region, the high adoption of GIS in various industries, and the increasing demand for location-based services. One of the key reasons for the dominance of North America in the GIS market is the presence of a large number of key players in the region. The region is home to some of the largest GIS vendors, such as Esri, Hexagon AB, and Trimble, among others. These vendors have a strong presence in the region and offer a wide range of GIS solutions to cater to the needs of various industries.

Furthermore, the high adoption of GIS in various industries, such as government, transportation, and utilities, among others, has also contributed to the dominance of North America in the GIS market. GIS technology is becoming an essential tool for decision-making in these industries, enabling organizations to visualize and analyze geographical data to optimize resource management and improve efficiency.

Geographic Information System Market Player

Some of the top geographic information system market companies offered in the professional report include ESRI, Hexagon AB, Autodesk, Inc., Trimble Inc., Bentley Systems, Inc., Pitney Bowes Inc., SuperMap Software Co., Ltd., Topcon Corporation, Caliper Corporation, GIS Cloud Ltd., Blue Marble Geographics, and Harris Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2020

January 2024

April 2021

May 2022