July 2024

Gluten-Free Products Market (By Product: Bakery Products, Prepared Food, Pasta & Rice, Desserts & Ice-creams, Dairy/Dairy Alternatives, Meats/Meats Alternatives, Condiments, Seasonings, Spreads, Others; By Source: Plant, Animal; By Distribution Channel: Online, Specialty Stores, Convenience Stores, Supermarkets & Hypermarkets, Others) - Global Industry, Share, Analysis, Trends and Forecast 2026 - 2035

The global gluten-free products market size accounted for USD 8.21 billion in 2025 and is estimated to reach around USD 18.81 billion by 2035 growing at a CAGR of 8.7% from 2025 to 2035.

Gluten-free foods and beverages lack gluten, a protein found in wheat, barley, and rye. These items are crucial for people who have celiac disease, gluten sensitivity, or wheat allergies, as gluten can have negative health consequences. Rice, corn, quinoa, and almond flour are among the components used by manufacturers to develop gluten-free alternatives. These items include anything from bread and spaghetti to snacks and desserts, allowing consumers to eat a variety of foods without worrying about gluten. Additionally, innovations in taste, texture, and nutritional value are expanding their appeal beyond medical necessity. As a result, gluten-free offerings are becoming mainstream across retail, food service, and e-commerce platforms.

| Coverage | Detail |

| Gluten-Free Products Market Size 2026 | USD 8.87 Billion |

| Gluten-Free Products Market Forecast 2035 | USD 18.81 Billion |

| Gluten-Free Products Market CAGR During 2026 - 2035 | 8.7% |

| Segments Covered | By Product, By Source, By Distribution Channel, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Dr. Schär, Barilla G. e R. Fratelli S.p.A, The Kraft Heinz Company, Conagra Brands, Inc., Seitz glutenfrei, The Hain Celestial Group, Ecotone, General Mills Inc., Siete Foods, and Kellogg Co. |

As more people are diagnosed with celiac disease and non-celiac gluten sensitivity, the demand for gluten-free products is increasing. According to the Celiac Disease Foundation, studies discovered that the incidence of celiac disease in the twenty-first century is significantly higher in women and children than in men. The rate among women is 17.4 per 100,000 person-years, whereas it is 7.8 per 100,000 person-years for men. The incidence among children is much greater, at 21.3 per 100,000 person-years, compared to 12.9 per 100,000 person-years in adults. Over the last few decades, these rates have risen steadily, by an average of 7.5% per year. This growing health concern is a fundamental reason for the consistent global expansion of the gluten-free food market.

In addition to medical need, many customers are turning to gluten-free alternatives as part of a larger commitment to healthy living. The World Health Organization (WHO) highlights the importance of a balanced diet in maintaining general health and nutrition, as well as protecting against chronic noncommunicable diseases like heart disease, diabetes, and cancer. The World Health Organization suggests a diversified diet reduced in salt, sugar, and harmful fats. Similarly, the Centers for Disease Control and Prevention (CDC) emphasizes the numerous benefits of good nutrition, such as increased life expectancy, improved skin, teeth, and eye health, stronger muscles, increased immunity, better bone health, lower risk of chronic diseases, support for healthy pregnancies, improved digestion, and weight maintenance. Gluten-free diets are becoming increasingly popular, even among persons who do not have gluten-related diseases.

Despite their popularity, gluten-free products frequently have higher production costs due to the requirement for specific ingredients and manufacturing techniques, resulting in higher retail prices and limited availability for price-sensitive consumers. However, increasing innovation in gluten-free baking and snack production is accelerating gluten-free food market growth. For example, in December 2023, Oreo, a Mondelez International, Inc. brand, introduced gluten-free golden cookies. These include peanut butter Cakesters, a chocolate soft snack cake filled with peanut butter-flavored crème that will become a permanent addition to the Oreo line. Black and white cookies created with golden Oreo cookies and chocolate and vanilla crème filling were introduced as a limited-time offering. These developments provide new opportunities for gluten-free brands to enter and succeed in emerging market areas.

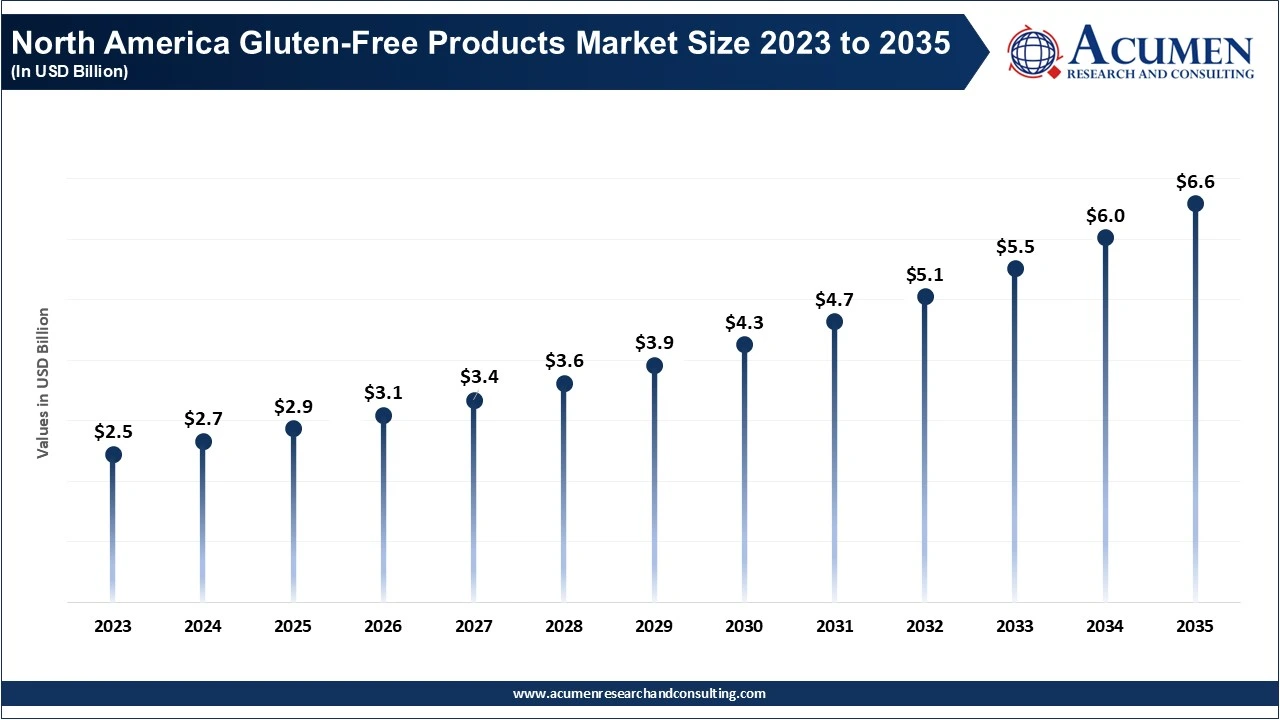

The North America dominates the gluten-free product market, driven by widespread knowledge of celiac disease and gluten sensitivity. Major brands are continually innovating to accommodate the growing consumer demand for high-quality gluten-free choices. In May 2024, Mondelēz International debuted the first gluten-free Chips Ahoy! cookie, targeting around 25% of Americans with gluten-free diets. This introduction follows the company's previous debut into the gluten-free market with Oreo Gluten Free Cookies. The region's strong health-conscious culture and well-developed retail infrastructure contribute to widespread product availability, reinforcing North America's dominance in the gluten-free food market.

The North America gluten-free products market size valued at USD 2.87 billion in 2025 and is forecasted to reach around USD 6.02 billion by 2035.

Meanwhile, the Asia-Pacific region's gluten-free food market is expanding rapidly, owing to increased awareness of celiac disease. For example, the Post Graduate Institute of Medical Education and Research (PGIMER) in Chandigarh marked Celiac Disease Day with a dedicated program aimed at raising awareness, emphasizing early diagnosis, strict dietary management, and comprehensive psychosocial support for affected children, according to Voice of Healthcare. Furthermore, growing urbanization and the influence of Western dietary patterns are driving more consumers in the region to follow gluten-free diets.

Gluten-Free Products Market Revenue, By Region (USD Billion)

| Region | 2024 | 2025 | 2026 |

| North America | 2.67 | 2.87 | 3.10 |

| Europe | 2.13 | 2.30 | 2.48 |

| Asia-Pacific | 1.83 | 1.97 | 2.13 |

| Latin America | 0.53 | 0.57 | 0.62 |

| MEA | 0.46 | 0.49 | 0.53 |

The worldwide market for gluten-free products is split based on product, source, distribution channel, and geography.

The bakery products dominate the market due to the significant demand for daily staples such as bread, cookies, and cakes. For example, the USDA Foreign Agricultural Service, in analyzing China's expanding bakery sector, notes that the current per capita consumption of baked goods in China is 7.2 kilograms per year, compared to 22.5 kilograms in Japan and 40.2 kilograms in the United States.

Gluten-intolerant consumers search out safe and tasty alternatives to typical wheat-based baked goods. Manufacturers responded with new formulas that closely resemble the flavor and texture of traditional baked items. As a result, gluten-free bread items have emerged as the gluten-free food market’s largest and most developed section.

Gluten-Free Products Market Share, By Product, 2025 (%)

| Product | Market Share, 2025 (%) |

| Bakery Products | 29% |

| Prepared Food | 19% |

| Pasta & Rice | 14% |

| Desserts & Ice-creams | 17% |

| Dairy/Dairy Alternatives | 7% |

| Meats/Meats Alternatives | 6% |

| Condiments, Seasonings, Spreads | 5% |

| Others | 3% |

According to the source, plant-based sources dominated the gluten-free food market with around 65% share in 2025, because of the “extensive use of grains, pulses, oilseeds, starches” in gluten-free formulations, and rising consumer preference for plant-based, vegan, and allergen-free diets. The shift is driven by several factors: scalability and availability of plant-based raw materials, increasing vegan / flexitarian consumer base, health and dietary trends (fiber, lower allergens), and cost-effectiveness compared to many animal-based gluten-free alternatives.

Gluten-Free Products Market Share, By Source, 2025 (%)

| Source | Market Share, 2025 (%) |

| Plant | 65% |

| Animal | 35% |

On contrary, the animal-source segment remains relevant — especially for consumers seeking high-protein, nutrient-dense options (meat, dairy) that happen to be naturally gluten-free. Some processed meat products and dairy items continue to be part of the gluten-free offering under animal-source. Animal sourced gluten-free products contain critical elements such as protein, calcium, and vitamins, making them dependable choices for gluten-sensitive consumers. Because they require little processing to remain gluten-free, they are highly trusted and preferred.

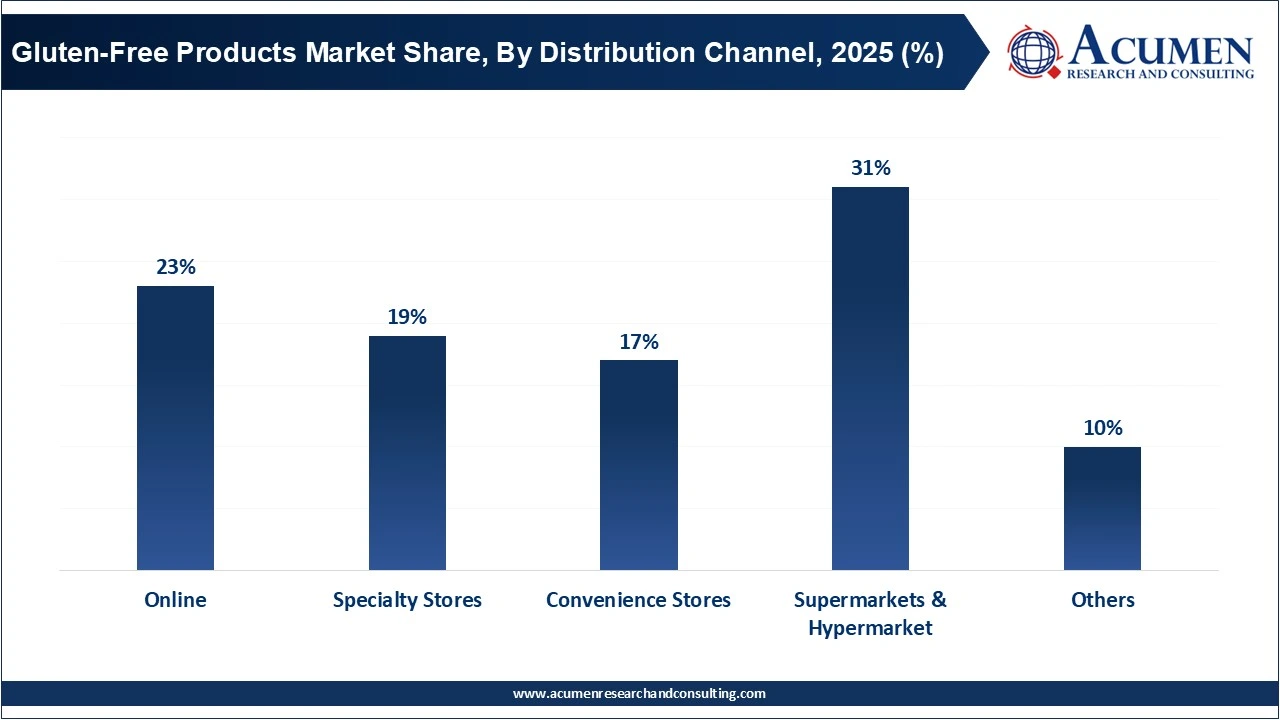

The supermarkets and hypermarkets top the market because they offer a diverse range of brands under one roof, increasing consumer convenience. Their extensive distribution networks and shelf space enhance the visibility and accessibility of gluten-free products. Consumers appreciate these outlets because they allow them to compare items, verify labels, and make informed purchasing decisions. Furthermore, attractive prices and organized gluten-free sections attract an increasing number of health-conscious customers.

By Product

By Source

By Distribution Channel

By Region

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Some of the top gluten-free products companies offered in our report include Dr. Schär, Barilla G. e R. Fratelli S.p.A, The Kraft Heinz Company, Conagra Brands, Inc., Seitz glutenfrei, The Hain Celestial Group, Ecotone, General Mills Inc., Siete Foods, and Kellogg Co.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

July 2024

December 2023

April 2025

July 2023