February 2020

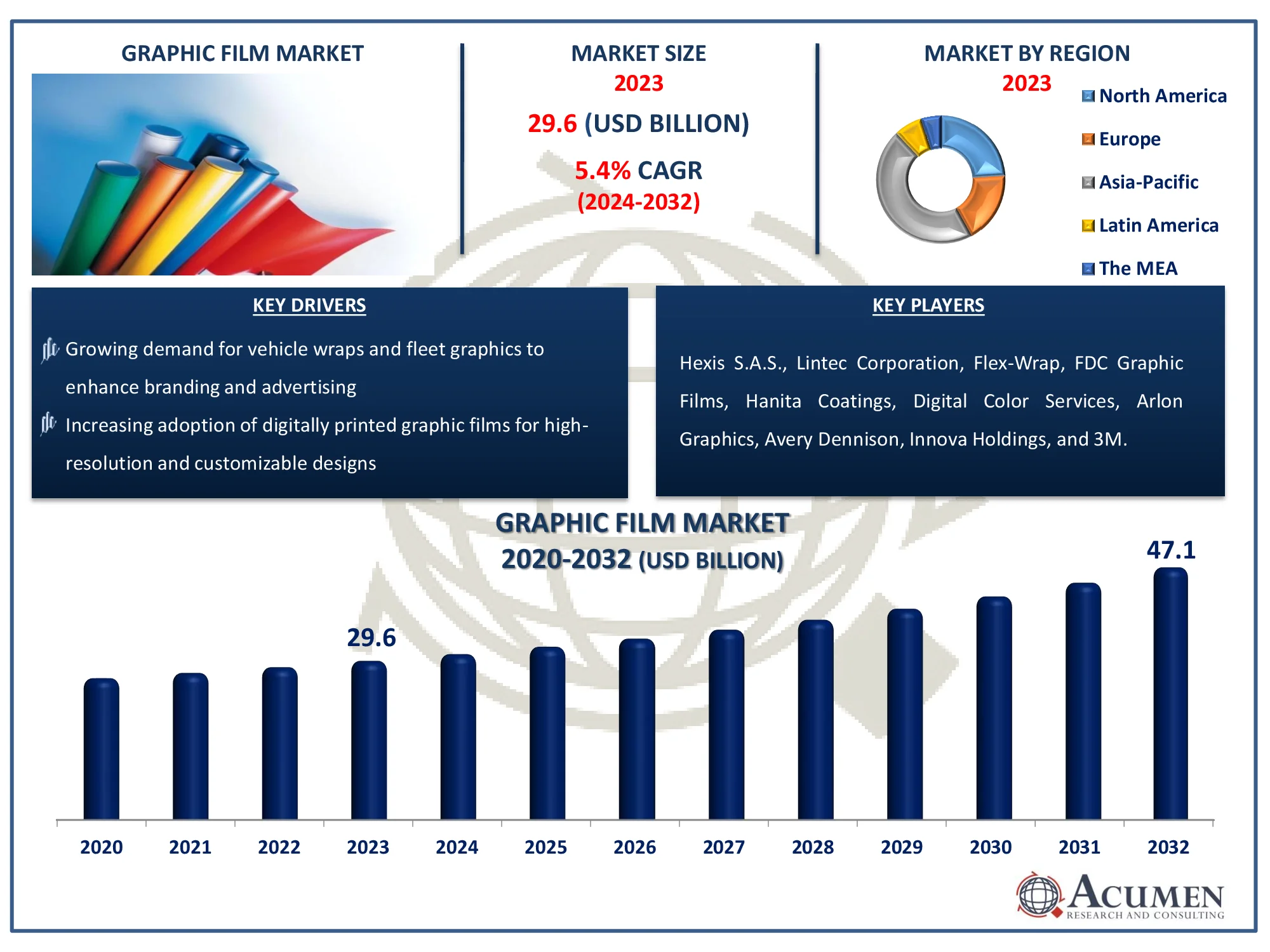

The Global Graphic Film Market Size accounted for USD 29.6 Billion in 2023 and is estimated to achieve a market size of USD 47.1 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032

The Global Graphic Film Market Size accounted for USD 29.6 Billion in 2023 and is estimated to achieve a market size of USD 47.1 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032

A sheet or a sheet of polymer compounds is the graphic film which is used for protection against weather conditions and for promotional purposes, applied to the surface. Currently, due to the massive use of graphic films by global manufacturers, the automotive industry is a major driver for the growth of graphic film market. Advertising companies often fund graphic films extensively and a film is regarded as a way to advertise and reveal a subject effectively. Increasing adoption and rapid growth of the global graphic film market is responsible due to its parametric factors such as durability and effective.

|

Market |

Graphic Film Market |

|

Graphic Film Market Size 2023 |

USD 29.6 Billion |

|

Graphic Film Market Forecast 2032 |

USD 47.1 Billion |

|

Graphic Film Market CAGR During 2024 - 2032 |

5.4% |

|

Graphic Film Market Analysis Period |

2020 - 2032 |

|

Graphic Film Market Base Year |

2023 |

|

Graphic Film Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product Type, By Film Type, By Manufacturing Process, By Printing Technology, By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Hexis S.A.S., Lintec Corporation, Flex-Wrap, FDC Graphic Films, Hanita Coatings, Digital Color Services, Arlon Graphics, Avery Dennison, Innova Holdings, and 3M. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A major factor flourishing the growth of market is due to increasing adoption of graphic film in variant applications such as advertising industries, vehicle wraps for automotives, and advertising & promotional posters, which are also expected to grow during forecast period. Furthermore, the other factors such as rising adoption for graphic film in construction and industrial sectors due to its basic properties such as cost-effectiveness, recyclability, high durability, and others are likely to propel the growth of market during forecast period. Also, advancement in graphic film technology specifically in digital films is the factors that are the opportunities supporting growth of the graphic film market over forecast period.

However, the factors that may hinder the graphic films market growth during forecast period is due to the high raw material prices and stringent policies regarding disposal of plastics. The polyvinyl chloride segment holds the largest market share of the global graphic film market. Due to its ease of printing, versatility, longevity, recycling and a variety of applications, this segment is witnessing high growth in the market.

Graphic Film Market Segmentation

Graphic Film Market SegmentationThe worldwide market for graphic film is split based on product type, film type, manufacturing process, printing technology, end use, and geography.

According to graphic film industry analysis, polyvinylchloride (PVC) has the largest market share due to its superior durability, flexibility, and cost-effectiveness. PVC films are very resistant to environmental factors such as UV exposure, moisture, and temperature fluctuations, making them suitable for both indoor and outdoor applications. Their flexibility to adhere to a variety of surfaces makes them ideal for car wraps, advertising displays, and architectural graphic applications. Furthermore, advances in PVC formulations, such as the creation of eco-friendly and non-toxic alternatives, have bolstered its supremacy. The material's versatility with various printing techniques, such as digital, screen, and flexographic printing, increases its demand across sectors. These criteria, taken together, position PVC as the main product type in the graphic film market.

Opaque graphic films account for a significant share of the market. These films are distinguished by their ability to totally block light and visibility, making them the ideal solution for applications that require both privacy and brilliant, dramatic visuals. This opacity is critical in applications like as car wraps, where the film not only changes the appearance of the vehicle, but also protects the original paint. Opaque films in signage and banners make printed visuals stand out against any background. Furthermore, these films offer a robust layer of protection to the underlying surfaces, extending their longevity. The adaptability of opaque films extends into interior design, where they are used to create dividers or ornamental components with a strong, bold color display.

Calendered generates the greatest revenue in the market due to its affordability, durability, and versatility. This production technique involves pressing and rolling the material under high pressure, resulting in films of consistent thickness and smooth finishes. Calendered films are popular for signage, automobile wraps, promotional displays, and floor graphics because to their great printability and resilience against wear. Furthermore, these films are highly flexible and easy to apply on a variety of surfaces, making them an excellent choice for short- to medium-term applications. Their lower cost compared to cast films encourages wider application across industries. Because of these benefits, calendered films are the most profitable area in the graphic film market.

Flexography has evolved as a dominant printing process in the market, owing to its versatility and cost effectiveness. This technology makes use of flexible printing plates, which enable for printing on a broad variety of substrates, including different types of graphic films. Flexography's ability to handle long print runs makes it excellent for large-scale production, contributing to its market dominance. Furthermore, advancements in flexographic printing, such as improved ink formulations and plate materials, have resulted in print quality comparable to other methods. Its compatibility with several ink types, including UV-curable and solvent-based inks, contributes to its appeal. Flexography is a popular technique in the graphic film industry due to its ability to print over uneven surfaces.

The promotional and advertisement category is expected to be the largest in the graphic film market forecast period because of the increased demand for visually appealing marketing materials. Businesses across industries utilize graphic films to produce eye-catching banners, posters, vehicle wraps, and retail displays that increase brand visibility. Because of their versatility, these films may be used on a wide range of surfaces, including walls, windows, and floors, making them an excellent choice for advertising campaigns. Furthermore, advances in printing technology have enabled high-resolution images and brilliant colors, enhancing their appeal. As corporations engage more in outdoor and transit advertising, the demand for durable and weather-resistant films grows, cementing this segment's market dominance.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

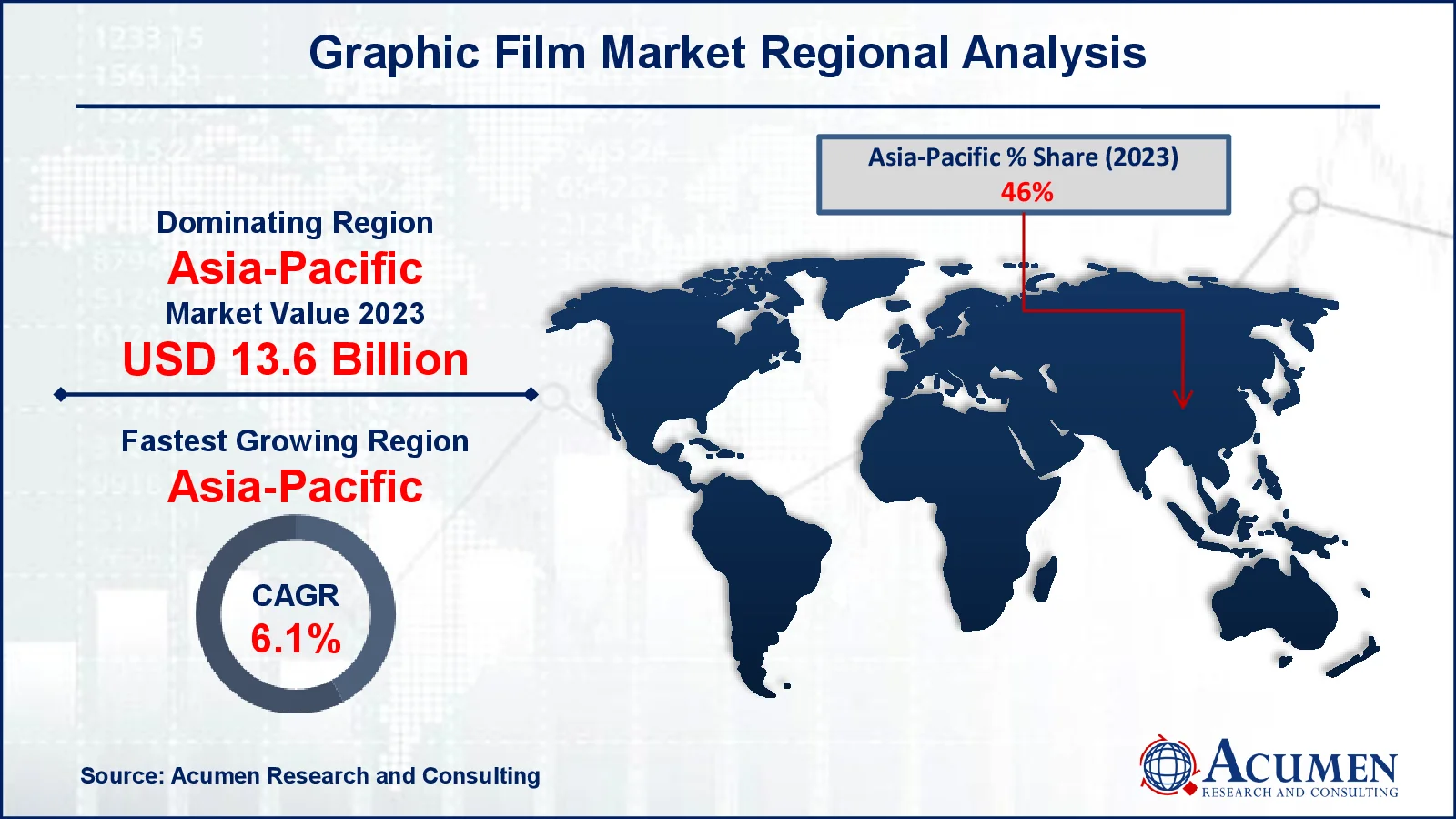

Graphic Film Market Regional Analysis

Graphic Film Market Regional AnalysisThe graphic film market analysis is provided for major regional markets including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. For each region, the market size for different segments has been covered under the scope of report. Asia-Pacific accounted for the largest market in terms of revenue for graphic film. The rapid urbanization, rising disposable incomes, economy growth and foreign direct investment (FDI) are the factors that are responsible for the market development. In the country level market, China accounted for the largest market share for graphic film. The rise can be attributed to technological advances, population growth and high market availability. Other regions, including North America and Europe, are expected to contribute tremendous growth for the market.

Some of the top graphic film companies offered in our report includes Hexis S.A.S., Lintec Corporation, Flex-Wrap, FDC Graphic Films, Hanita Coatings, Digital Color Services, Arlon Graphics, Avery Dennison, Innova Holdings, and 3M.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2020

May 2025

April 2025

June 2024