June 2023

Graphite Market Size accounted for USD 25.9 Billion in 2022 and is estimated to achieve a market size of USD 48.4 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

The Graphite Market Size accounted for USD 25.9 Billion in 2022 and is estimated to achieve a market size of USD 48.4 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

Graphite Market Highlights

Graphite is a smooth, lustrous form of carbon that can carry electricity. It is frequently used in lead pencils, electrolytic anodes, and as a lubricant. It also functions as a moderator in nuclear reactors and is a necessary component in the production of batteries. For example, 23% of the world's graphite is needed for battery manufacture. Furthermore, China, India, Brazil, and Canada make substantial contributions to world graphite production. Graphite is typically classified into two types: alpha graphite and beta graphite.

Global Graphite Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Graphite Market Report Coverage

| Market | Graphite Market |

| Graphite Market Size 2022 | USD 25.9 Billion |

| Graphite Market Forecast 2032 |

USD 48.4 Billion |

| Graphite Market CAGR During 2023 - 2032 | 6.6% |

| Graphite Market Analysis Period | 2020 - 2032 |

| Graphite Market Base Year |

2022 |

| Graphite Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AMG, EPM Group, Eagle Graphite, Graphite India Limited, Asbury Carbons, GrafTech International Ltd., NIPPON GRAPHITE INDUSTRIES CO. LTD., Imersys Qingdao Tennry Carbon Co., Ltd., NORTHERN GRAPHITE CORPORATION, Syrah Resources Limited, SGL Carbon, SHOWA DENKO K.K., Tokai Carbon Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Graphite Market Insights

The graphite sector is expanding rapidly due to increased demand for natural and synthetic graphite, which is utilized as active anode materials in lithium-ion batteries. This spike is being driven by the developing battery business, emphasizing the critical role graphite plays in addressing the increasing demands of this energy storage technology. Furthermore, the increasing steel sector increases up demand for graphite. For example, the European Steel Association (EUROFER) updated its 2022 prediction for steel product consumption in the European Union. Instead of the previously estimated 3.2% rise in regional metal consumption, the February 2022 prediction predicts a 1.9% fall. This change is anticipated to enhance demand for graphite in the metallurgical industry.

The world graphite supply has issues since it is heavily reliant on a few significant producers, primarily China. This concentration exposes the supply chain to geopolitical instability and trade disruptions. Export limitations or changes in output from these important sources can cause shortages and price increases, affecting industries such as electric cars, aviation, and battery manufacture. Furthermore, as the emphasis on cleaner energy and the use of electric cars grows, so does demand for particular graphite materials such as flake graphite for electric vehicle batteries and synthetic graphite for lithium-ion battery electrodes. This increased demand stresses the supply chains for these minerals, possibly compromising their availability and, as a result, the manufacture of graphite-based goods.

The global demand for lithium-ion battery cells is predicted to increase from around 700 gigawatt-hours in 2022 to 4,700 gigawatt-hours by 2030. China and Europe are expected to boost this demand, especially through the electric transportation industry. For example, in April 2022, the Chinese manufacturer of lithium battery materials Shanshan Corporation announced additional investment from its 4 planned investors: Amperex Technology Limited (ATL), Wending Investment, BYD, and the Kunlun Fund, totaling USD 477 million. Furthermore, graphite is a sustainable and readily available carbon source with unique heat and power properties. Graphite is an environmentally friendly material used in 3D printing. Furthermore, graphite may be utilized to create strong, electrically conductive materials. Overall, the expanding need for lithium-ion batteries, as well as the debut of additive manufacturing, will create opportunities throughout the projected period.

Graphite Market Segmentation

The worldwide market for graphite is segmented into type, application, and region.

Graphite Market By Type

According to the graphite industry analysis, synthetic graphite dominates the graphite market. Petroleum coke undergoes high-temperature baking to produce synthetic products, a process that presents challenges. It is employed in the manufacturing of products requiring an extremely pure ingredient, with a purity level exceeding 99 percent carbon. Moreover, Synthetic graphite finds diverse applications, serving roles in friction, foundry operations, electrical carbons, fuel cell bi-polar plates, coatings, electrolytic processes, corrosion products, conductive fillers, rubber and plastic compounds, as well as drilling applications. Due to this diverse application synthetic graphite holds the largest segment in the graphite industry.

Graphite segmentation By Application

According to the graphite market forecast, the refractories segment is expected to lead in the coming years. Refractories within the graphite market involve utilizing graphite to create heat-resistant linings for industrial processes with high temperatures, such as steel manufacturing. This specific application relies on graphite's remarkable ability to withstand heat. A noteworthy trend in this sector is the rising preference for graphite-based refractories to enhance durability and performance in critical applications. As industries look for ways to handle high temperatures better, the use of graphite in heat-resistant applications keeps growing. Graphite becomes crucial for processes that need to withstand very hot conditions in different types of manufacturing.

Graphite Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Graphite Market Regional Analysis

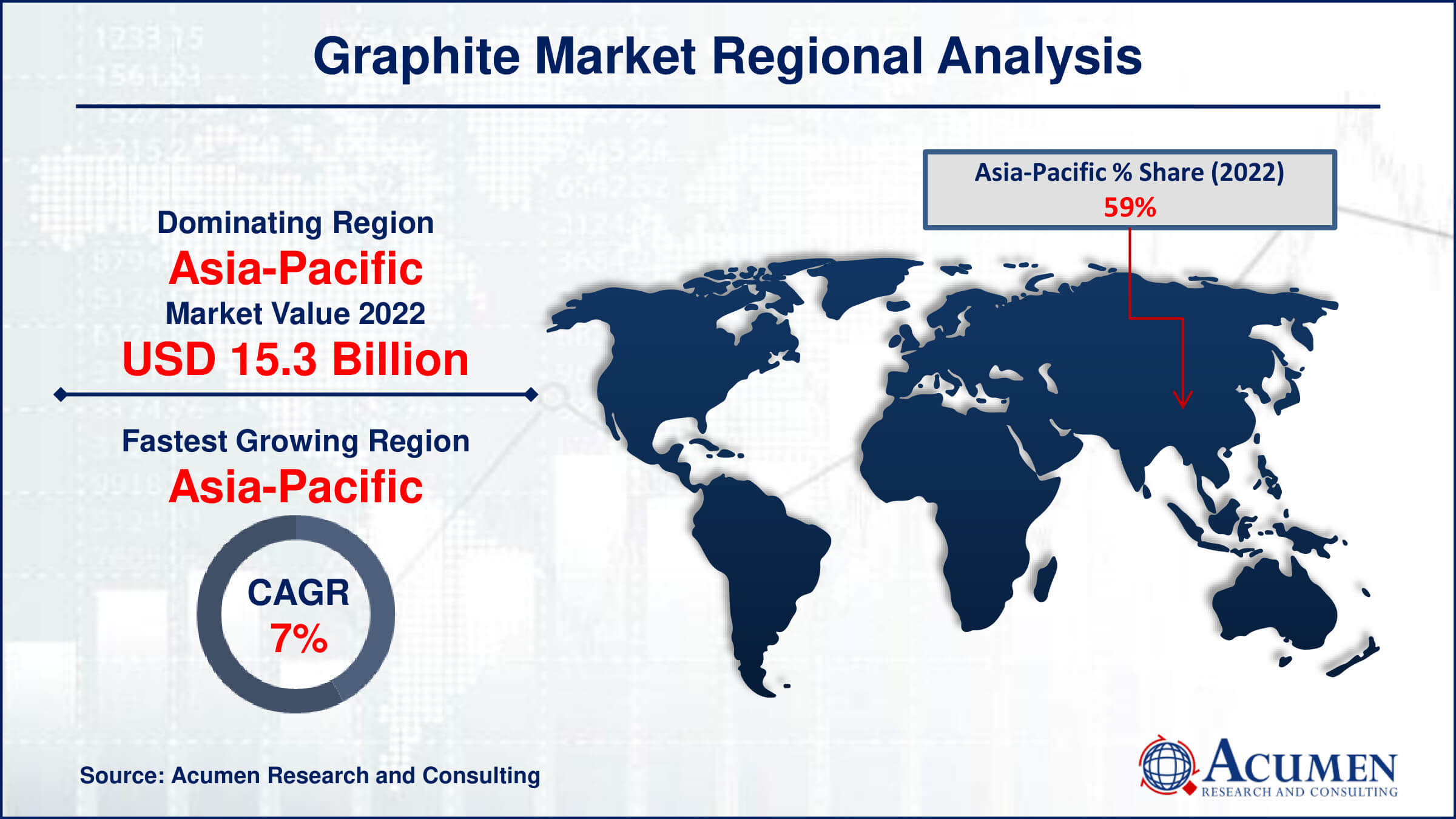

According to the regional analysis, the market is divided into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Asia-Pacific dominated the worldwide graphite market and is likely to be the fastest-growing sub-segment in the future years. The country is a major global consumer of graphite, with prospective markets in Japan, India, and South Korea. The need for graphite goods is widespread in developed countries, notably in Western Europe, the United States, Japan, and China. The natural graphite sector is controlled by Chinese companies. For example, in October 2020, Imerys announced intentions to enhance synthetic graphite production at its Bodio site in Switzerland. This expansion is intended to meet expanding demand in the lithium-ion battery markets of Asia, Europe, and North America.

Graphite Market Players

Some of the top graphite companies offered in our report includes AMG, EPM Group, Eagle Graphite, Graphite India Limited, Asbury Carbons, GrafTech International Ltd., NIPPON GRAPHITE INDUSTRIES CO. LTD., Imersys Qingdao Tennry Carbon Co., Ltd., NORTHERN GRAPHITE CORPORATION, Syrah Resources Limited, SGL Carbon, SHOWA DENKO K.K., Tokai Carbon Co., Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2023

January 2025

December 2022

March 2025