April 2021

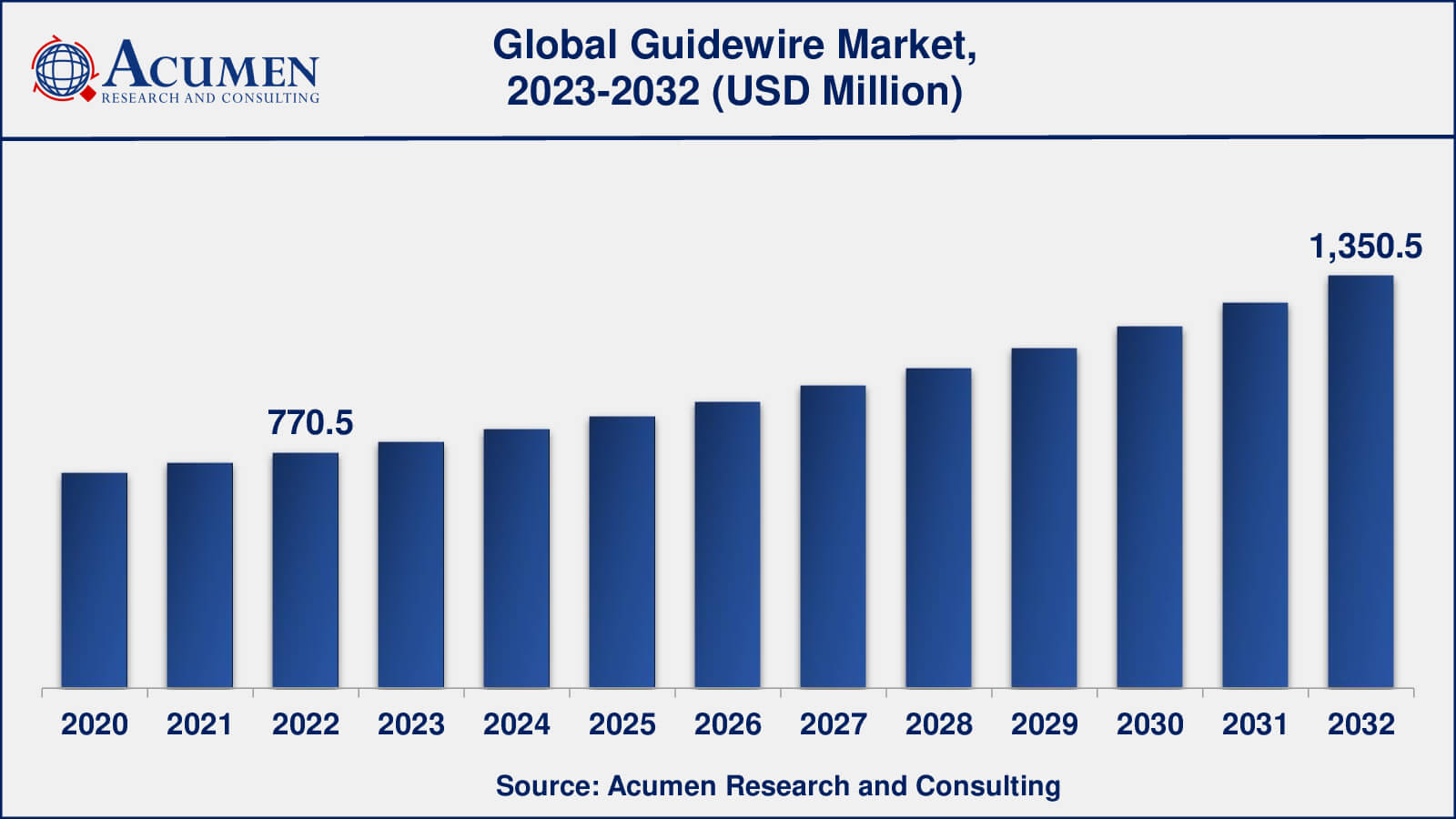

Guidewire Market Size collected USD 770.5 Million in 2022 and is set to achieve a market size of USD 1,350.5 Million in 2032 growing at a CAGR of 5.9% from 2023 to 2032.

The Global Guidewire Market Size collected USD 770.5 Million in 2022 and is set to achieve a market size of USD 1,350.5 Million in 2032 growing at a CAGR of 5.9% from 2023 to 2032.

Guidewire Market Statistics

A guidewire refers to a flexible and thin tube (medical device) that is used to guide various catheter-based products for placement in the desired treatment location or a diseased artery. The femoral artery at the groin is the most common insertion point for the catheter and guidewire. In addition to this, coronary arteries and brachial arteries are the additional possible points where a guidewire can be inserted.

Global Guidewire Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Guidewire Market Report Coverage

| Market | Guidewire Market |

| Guidewire Market Size 2022 | USD 770.5 Million |

| Guidewire Market Forecast 2032 | USD 1,350.5 Million |

| Guidewire Market CAGR During 2023 - 2032 | 5.9% |

| Guidewire Market Analysis Period | 2020 - 2032 |

| Guidewire Market Base Year | 2022 |

| Guidewire Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Coating, Raw Materials, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Vascular, Asahi Intecc Co. Ltd., AngioDynamics Inc., B. Braun Melsungen, Codman Neurovascular, Boston Scientific, Cook Medical, Covidien, Cordis Corp, Medtronic, Inc, Terumo Medical Corporation and Stryker. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Guidewire Market Growth Factors

Many factors such as the rapidly increasing population along with rising incidences of heart diseases as well as other cardiovascular problems are the major driver for the guidewires market. Also, with the rise in the number of minimally invasive methods, the demand for guidewires is anticipated to witness positive growth in the coming years. Generally, the guidewires are produced from lost-cost stainless steel and a coil tip made of elastic in order to evade damage to the blood vessels. Since, the guidewires are recyclable in nature and thus for choosing raw material, the manufacturers often choose low-cost stainless steel. Many companies offer a wide variety of tip shapes and wire configurations for healthcare experts to decide on the perfect tool for surgical procedures. The biochemical properties of guidewires are another factor responsible for driving the growth of the guidewires market. Furthermore, rising awareness among patients regarding the advantages of minimally invasive procedures including less traumatic surgical experience, faster recovery, and reduced hospital stay is further expected to spur market growth.

Guidewire Market Segmentation

The worldwide market for guidewire is categorized based on product, coating, raw material, and geography.

Guidewire Industry Product Outlook

According to the guidewire industry analysis, the coronary guidewire market has been steadily growing due to the rising prevalence of cardiovascular diseases and the increasing use of minimally invasive procedures. Because of its high manoeuvrability and pushability, the hydrophilic guidewire segment has seen significant growth in the coronary guidewire market. The growing prevalence of peripheral artery diseases and the increasing adoption of minimally invasive procedures have driven the peripheral guidewire market. Because of its high flexibility and kink resistance, the nitinol guidewire segment has seen significant growth in the peripheral guidewire market.

Guidewire Industry Coating Outlook

Guidewire coatings are used for a variety of purposes, including reducing friction, improving lubricity, increasing visibility, and lowering the risk of infection. Coatings can be made from a variety of materials, including hydrophilic, hydrophobic, and antimicrobial coatings.

Again, it is important to note that Guidewire is not solely focused on medical devices for healthcare. As a result, determining which coating dominates the guidewire market is difficult. The market share for each type of coating varies depending on region, application, and product segment.

Having said that, hydrophilic coatings are commonly used on guidewires and are frequently regarded as the gold standard for reducing friction and improving manoeuvrability.

Guidewire Industry Raw Materials Outlook

As per the guidewire market forecast, the nitinol and stainless steel are expected to be the two most common raw materials in the manufacturing of guidewires. Nitinol is a shape memory alloy with high flexibility, kink resistance, and shape memory properties. In contrast, stainless steel is a more rigid material known for its strength and durability.

The use of nitinol in guidewires has increased in recent years due to its special characteristics, which make it well-suited for complex procedures and challenging anatomies. Nitinol guidewires are especially popular in neurovascular and peripheral procedures that require flexibility and shape memory. Stainless steel guidewires, on the other hand, are still widely used in coronary procedures requiring greater rigidity and pushability.

Guidewire Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Guidewire Market Regional Analysis

Geographically, the guidewires market is bifurcated into North America, Latin America, Europe, Asia-Pacific, and Middle East & Africa (MEA). North America is the leading market for guidewires whereas Europe holds the second position in terms of market share. The drivers for the growth of guidewires in these regions include the increase in the geriatric population and rising lifestyle diseases. In addition to this, the rising demand for minimally invasive surgeries, unique biochemical guidewire properties, and increasing preference for healthcare professionals for efficient medical device usage are the factors propelling the demand for the guidewire market.

Asia-Pacific is anticipated to experience potential growth for the guidewires market. The market for guidewires in the Asia-Pacific region is growing at a faster rate owing to the presence of a huge number of patients with peripheral vascular diseases that are expected to result in the rise in the volume of endovascular procedures in countries with dense populations particularly, China and India. Moreover, economic growth, improving healthcare amenities, rising disposable incomes, and initiatives by governments in economies including India and China are providing a huge base of the patient population with an approach to improved healthcare facilities at an inexpensive rate. The market for coronary guidewire is expected to dominate the market attributed to increasing incidences of peripheral vascular diseases during the coming years. Approximately 12 billion of America’s population suffers from peripheral arterial diseases, according to the American Heart Association estimates. Also, the neurovascular guidewires segment is expected to grow at a faster rate owing to the rising prevalence of neurovascular disorders coupled with increasing penetration rates due to advancements in technology.

Guidewire Market Players

Some of the guidewire companies include Abbott Vascular, Asahi Intecc Co. Ltd., AngioDynamics Inc., B. Braun Melsungen, Codman Neurovascular, Boston Scientific, Cook Medical, Covidien, Cordis Corp, Medtronic, Inc, Terumo Medical Corporation and Stryker.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2021

August 2024

January 2018

April 2024