October 2024

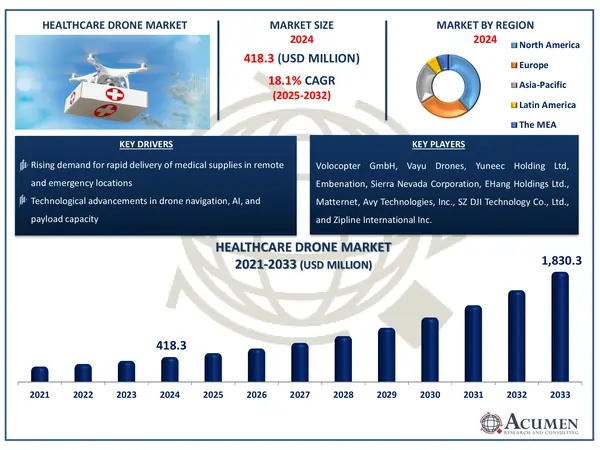

The Global Healthcare Drone Market Size accounted for USD 418.3 Million in 2024 and is estimated to achieve a market size of USD 1,830.3 Million by 2033 growing at a CAGR of 18.1% from 2025 to 2033.

The Global Healthcare Drone Market Size accounted for USD 418.3 Million in 2024 and is estimated to achieve a market size of USD 1,830.3 Million by 2033 growing at a CAGR of 18.1% from 2025 to 2033.

Increased awareness of healthcare drones is likely to fuel demand in developing economies, and enhancing business growth. Government implemented several initiatives and programs to raise awareness among healthcare professionals in underdeveloped economies of the availability of high quality medical drones. Owing to several associated benefits, government encourages the use of healthcare drones. In order-critical situations, drones can also act as a defender. It launched a new device that could request for a drone in case of an outbreak it pressing a button to help save lives in a crisis; Google took a step forward in 2016 to provide the medical center in good time. The system can also play a key role in the delivery of test samples to far-off laboratories. Bloods and stools in labs far from far distant places are used by drones such as Vayu in many parts of Madagascar for research.

Increased awareness of healthcare drones is likely to fuel demand in developing economies, and enhancing business growth. Government implemented several initiatives and programs to raise awareness among healthcare professionals in underdeveloped economies of the availability of high quality medical drones. Owing to several associated benefits, government encourages the use of healthcare drones. In order-critical situations, drones can also act as a defender. It launched a new device that could request for a drone in case of an outbreak it pressing a button to help save lives in a crisis; Google took a step forward in 2016 to provide the medical center in good time. The system can also play a key role in the delivery of test samples to far-off laboratories. Bloods and stools in labs far from far distant places are used by drones such as Vayu in many parts of Madagascar for research.

|

Market |

Threadlocker Market |

|

Healthcare Drone Market Size 2024 |

USD 418.3 Million |

|

Healthcare Drone Market Forecast 2033 |

USD 1,830.3 Million |

|

Healthcare Drone Market CAGR During 2025 - 2033 |

18.1% |

|

Healthcare Drone Market Analysis Period |

2021 - 2033 |

|

Healthcare Drone Market Base Year |

2024 |

|

Healthcare Drone Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Function, By Range, By Application, By End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Volocopter GmbH, Vayu Drones, Yuneec Holding Ltd, Embenation, Sierra Nevada Corporation, EHang Holdings Ltd., Matternet, Avy Technologies, Inc., SZ DJI Technology Co., Ltd., and Zipline International Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rural and rural people sometimes face major challenges to acquiring timely medical supplies. Healthcare drones meet this demand by bringing medications, vaccines, and blood supplies to remote locations where regular transportation infrastructure is inadequate or unreliable. This capability reduces delivery times from hours to minutes in emergency situations. Healthcare facilities face increasing pressure to cut operational costs. Drone delivery systems offer significant cost reductions over traditional transportation methods, particularly for time-sensitive, light medical payloads. Healthcare providers can save money while providing better service by reducing their reliance on ground transportation and improving supply chains.

Recent advancements in flight control systems, battery technology, and autonomous navigation have greatly enhanced drone capabilities. Modern healthcare drones feature longer flight ranges, larger payload capacities, and advanced obstacle avoidance algorithms, making them more suitable for complex medical delivery scenarios, particularly in tough environments. The combination of drone technology and telemedicine offers a major opportunity to transform healthcare delivery. Aside from transporting medical supplies, drones with diagnostic capabilities could supplement virtual consultations by delivering point-of-care testing devices and returning samples for analysis, resulting in comprehensive remote care solutions that break down geographical barriers to quality healthcare access.

Healthcare Drone Market Segmentation

Healthcare Drone Market SegmentationThe worldwide market for healthcare drone is split based on type, function, range, application, end user, and geography.

According to healthcare drone industry analysis, rotary-wing drones are expected to continue their dominant market position in the healthcare drone sector. Their popularity arises from a number of major operational advantages that are consistent with healthcare delivery requirements. These drones provide greater vertical takeoff and landing (VTOL) capabilities, removing the need for runways or specialized launch infrastructure, which is a significant advantage for hospital-based operations with limited space.

Rotary-wing designs' hovering capabilities allows for precise delivery to specific locations, such as hospital rooftops or designated receiving areas, while taking up minimal space. Their mobility in congested urban locations and ability to traverse complex delivery scenarios make them ideal for last-mile medical logistics. Furthermore, the stable flight qualities of multi-rotor designs create ideal circumstances for conveying sensitive medical payloads that require little disturbance during transit.

The delivery and logistics category is expected to create the highest revenue in the healthcare drone market. This segment's domination is due to the immediate and palpable demand for rapid medical supply delivery to remote or hard-to-reach places, as well as during emergencies. Healthcare providers are rapidly noticing the significant cost advantages over traditional delivery methods, particularly for time-sensitive deliveries.

The capacity of delivery drones to significantly cut transportation times for important medical products such as blood samples, pharmaceuticals, vaccines, and even organs has made them indispensable in global healthcare systems. This market has also attracted significant investment from healthcare providers, pharmaceutical companies, and logistical partners, all of whom perceive clear returns. Furthermore, many regions have developed legislative frameworks expressly for medical delivery drones, which has accelerated acceptance.

According to healthcare drone industry analysis, medium range (20-100 km) drones are showing the most considerable growth in the market. This category strikes an optimal balance between operational efficiency and technological feasibility, making it highly attractive for healthcare applications. Medium range drones can serve multiple facilities within regional healthcare networks while maintaining reasonable battery life and payload capacity.

These drones effectively bridge the gap between cities and suburban or semi-rural areas, which frequently lack fast access to specialist medical supplies or laboratory services. Healthcare systems find this range especially useful for inter-facility transfers, regional blood banks, and pharmaceutical distribution networks. Furthermore, regulatory frameworks are progressively tolerating medium-range flights while implementing adequate safety precautions. While short-range drones face competition from ground transportation, and long-range models face substantial technical and legal obstacles, medium-range drones represent the ideal balance of current healthcare infrastructure integration and return on investment.

Pharmaceutical transportation is the largest application area in the healthcare drone market. This dominance stems from the important requirement for fast, dependable delivery of medications, vaccines, blood samples, and other temperature-sensitive medical items, particularly to remote or congested places where traditional transportation is difficult. The pharmaceutical transport application has grown in popularity as healthcare organizations attempt to optimize supply chains and eliminate delivery delays, which can have a direct influence on patient outcomes. Major pharmaceutical corporations and healthcare providers have invested extensively in drone delivery infrastructure, seeing significant cost reductions and efficiency benefits over traditional distribution methods.

Hospitals and clinics are the largest end-user category in the healthcare drone market forecast period. Primary healthcare delivery hubs have the most pressing demand for drone technology to increase operational efficiency and patient care. These organizations use drones for important activities such as transporting lab samples between facilities, delivering emergency drugs within hospital networks, and transporting medical supplies across campuses. Hospitals and clinics have the financial means to invest in drone infrastructure and can show a clear return on investment by lowering courier costs and improving patient outcomes. Their extensive ties with equipment vendors, as well as regulatory experience, help to speed drone integration relative to other market segments, solidifying their position as the main end user in this expanding market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

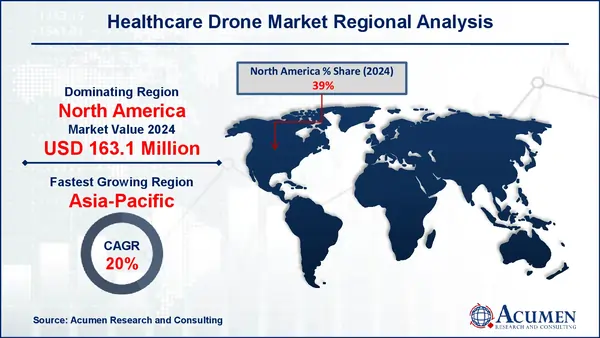

Healthcare Drone Market Regional Analysis

Healthcare Drone Market Regional AnalysisThe healthcare drone market demonstrates varied development across global regions, with North America currently holding the dominant position. This leadership stems from the region's cutting-edge healthcare infrastructure, supportive regulatory frameworks in the United States and Canada, and substantial investment in healthcare technology innovation. North American healthcare organizations have implemented numerous successful pilot programs focused on medical deliveries to rural and underserved communities. The strong presence of major drone manufacturers alongside healthcare innovators has created a robust ecosystem for continued advancement in this space.

The Asia-Pacific region represents the healthcare drone market's fastest-growing territory, driven by several regional advantages. Countries with challenging geographical features, such as Indonesia and the Philippines, have embraced drone technology as a solution to longstanding healthcare delivery challenges. China and Japan lead substantial initiatives in urban medical delivery programs, while government investments across the region support broader healthcare modernization efforts that include drone integration. The extensive rural populations throughout Asia-Pacific create natural demand for improved healthcare access solutions, and comparatively flexible regulatory environments in certain countries have enabled accelerated implementation timelines.

Some of the top healthcare drone companies offered in our report include Volocopter GmbH, Vayu Drones, Yuneec Holding Ltd, Embenation, Sierra Nevada Corporation, EHang Holdings Ltd., Matternet, Avy Technologies, Inc., SZ DJI Technology Co., Ltd., and Zipline International Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2024

November 2024

June 2024

April 2021