May 2021

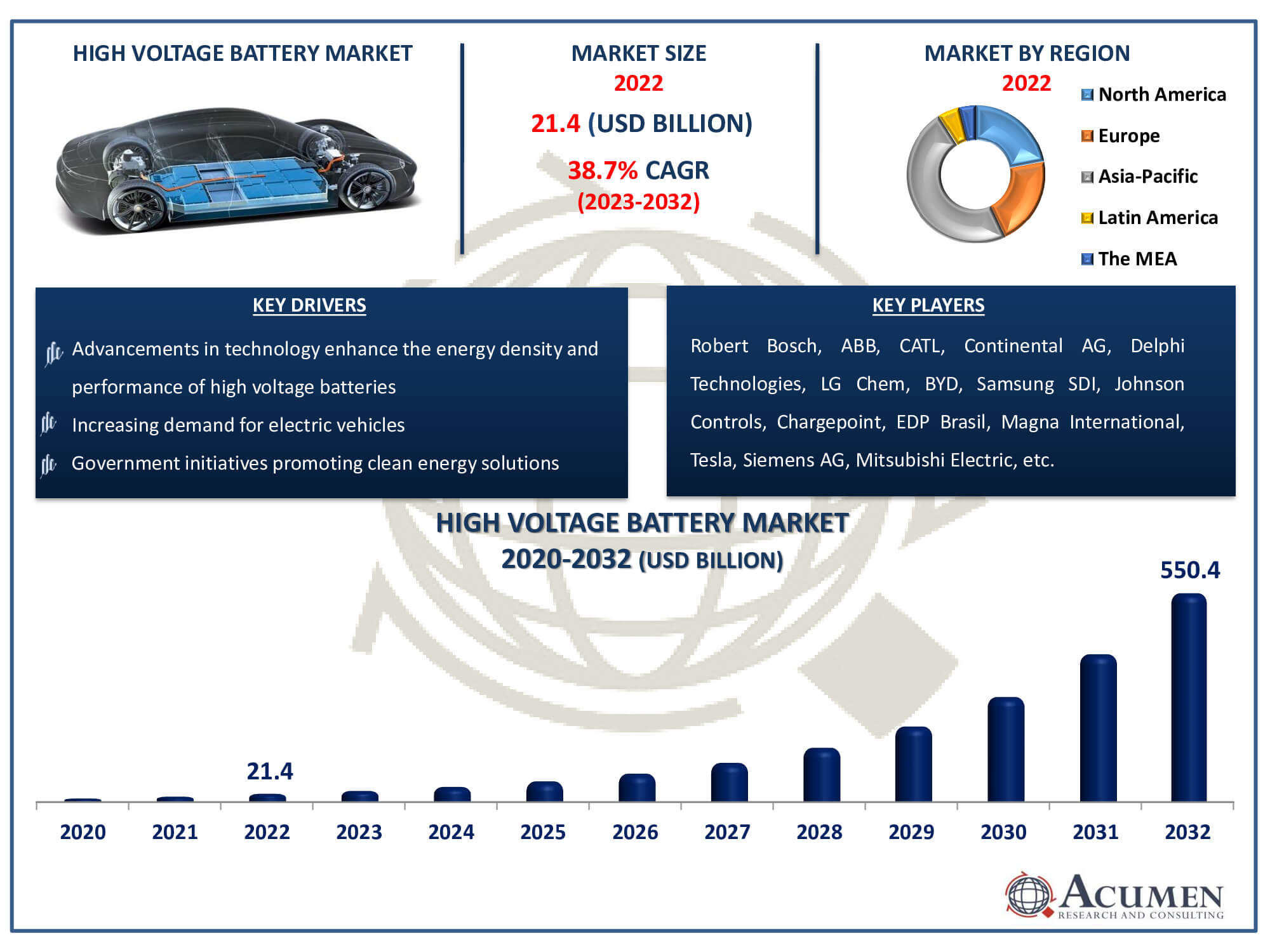

High Voltage Battery Market Size accounted for USD 21.4 Billion in 2022 and is estimated to achieve a market size of USD 550.4 Billion by 2032 growing at a CAGR of 38.7% from 2023 to 2032.

The High Voltage Battery Market Size accounted for USD 21.4 Billion in 2022 and is estimated to achieve a market size of USD 550.4 Billion by 2032 growing at a CAGR of 38.7% from 2023 to 2032.

High Voltage Battery Market Highlights

A high voltage battery is specifically designed to power electric motors, boasting high energy density and discharge platforms. These batteries can deliver more capacity under the same usage conditions, resulting in a longer battery life and increased power output. The growing need for effective and sustainable power sources in the automotive and industrial sectors is propelling the high voltage battery market's explosive expansion and innovation. The switch to greener energy sources has made high voltage batteries, which are meant to run electric motors, essential. The electric propulsion systems landscape is being revolutionized by these batteries, which offer a prolonged lifespan and better power delivery due to their amazing energy density and high discharge platforms. The high voltage energy storage industry is undergoing a paradigm transition as manufacturers work tirelessly to provide state-of-the-art technologies that meet and beyond the ever-evolving demands for longevity, performance, and environmental sustainability.

Global High Voltage Battery Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

High Voltage Battery Market Report Coverage

| Market | High Voltage Battery Market |

| High Voltage Battery Market Size 2022 | USD 21.4 Billion |

| High Voltage Battery Market Forecast 2032 | USD 550.4 Billion |

| High Voltage Battery Market CAGR During 2023 - 2032 | 38.7% |

| High Voltage Battery Market Analysis Period | 2020 - 2032 |

| High Voltage Battery Market Base Year |

2022 |

| High Voltage Battery Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Voltage, By Battery Type, By Battery Capacity, By Driving Range, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Robert Bosch, ABB, CATL, Continental AG, Delphi Technologies, LG Chem, BYD, Samsung SDI, Johnson Controls, Chargepoint, EDP Brasil, Magna International, Tesla, Siemens AG, Mitsubishi Electric, and Nissan Motor Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

High Voltage Battery Market Insights

The increasing investments by manufacturers and favorable government support for electric vehicles are primary drivers of high-voltage battery market growth. The rising demand for higher voltage systems among end-users propels market expansion. Additionally, increased government spending on smart cities projects, particularly in emerging economies, accelerates market value. Growing environmental concerns further boost the demand for electric vehicles, with high voltage batteries gaining traction in the market. Moreover, the rising demand for fast charging and the increasing electrification of trucks are factors projected to create potential opportunities over the high-voltage battery market forecast period.

On the flip side, the high development cost is a major factor expected to limit growth to some extent during the forecast period from 2023 to 2032. This cost barrier prevents widespread acceptance, especially when it comes to renewable energy and electric vehicle initiatives. The significant upfront cost serves as a disincentive for producers and consumers alike, so restricting the overall potential for advancement in high voltage battery technology.

The growing emphasis on energy efficiency worldwide presents a strong potential and fosters a favorable atmosphere for the growth of the high-voltage battery market. High voltage batteries are becoming more and more necessary to support grid storage and improve energy management as businesses and governments place a higher priority on sustainability. Manufacturers have a strategic advantage when high voltage systems are integrated into renewable energy projects and smart grids. By working together, developing new technologies, and focusing research, high voltage batteries have even more potential to advance energy-efficient solutions and make a positive impact on the environment.

High Voltage Battery Market Segmentation

The worldwide market for high voltage battery is split based on voltage, battery type, battery capacity, driving range, vehicle type, and geography.

High Voltage Battery Voltages

According to high voltage battery industry analysis, the 400v–600v sector emerges as the dominant force in the industry. Its extensive use in a variety of industries, particularly in electric cars and renewable energy systems, is what has led to its ubiquity. The voltage range of 400v to 600v satisfies the needs of many applications while striking a balance between practicality and efficiency. Its widespread use in electric vehicles from passenger cars to commercial trucks places it in a flexible and desirable position. The market's preference for this voltage range is a reflection of its versatility, best-in-class performance, and compatibility with changing industry needs for effective high-voltage battery solutions.

High Voltage Battery Types

The market for high voltage batteries is dominated by the lithium nickel manganese cobalt oxide (NMC) category. This superiority is attributable to the efficiency and adaptability of NMC batteries, which make them a top option for a variety of applications, most notably electric automobiles. To meet changing market expectations, the Lithium NMC chemistry achieves a balance between energy density, power output, and lifespan. Its importance is highlighted by the fact that it is widely used in electric vehicles, from passenger cars to fleets of commercial vehicles. The market's understanding of the critical role this type of battery plays in creating high-performance, energy-efficient solutions is shown in the dominance of the NMC category.

High Voltage Battery Capacities

The >300 kWh sector holds the largest share of the high voltage battery market due to its wide range of applications and broad capacity. This category satisfies the increasing need for high-energy storage solutions, particularly in industrial applications, renewable energy projects, and electric cars. Because of its large capacity, it is a recommended option for industries and enterprises needing a reliable and long-lasting power source. The significance of the >300 kWh sector highlights the market's reaction to the growing need for high-capacity, scalable energy storage solutions, which is in line with the worldwide movement towards efficient and sustainable power systems. Because of its leadership, this market segment is positioned to be a major force behind innovation and market expansion.

High Voltage Battery Driving Ranges

In terms of high voltage battery market analysis, the category with driving ranges greater than 550 miles holds the biggest share. this dominance is a result of the effort to overcome range anxiety and the rising demand for electric vehicles with longer ranges. The >550 miles sector becomes more popular as greater journeys on a single charge are prioritised by consumers and industries. This is made possible by developments in energy density and battery technology, which enable such significant ranges. This sector highlights the vital role that high voltage batteries play in pushing the limits of driving range and encouraging broader adoption of sustainable transportation, reflecting the market's response to the changing needs of electric car customers.

High Voltage Battery Vehicle Types

As the largest category, the bus segment has the highest market share for high voltage batteries. The global trend towards sustainable urban mobility solutions and the growing electrification of public transit are driving this dominance. To reduce emissions and improve the effectiveness of public transport, governments and municipalities all around the world are providing incentives for electric buses. The leadership of the bus segment is further supported by developments in battery technology, which offer longer battery life and quicker charging periods. Consequently, there is a significant increase in the market need for high voltage batteries designed to satisfy the demanding energy needs of electric buses, which is a critical step in the direction of environmentally friendly transportation options.

High Voltage Battery Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

High Voltage Battery Market Regional Analysis

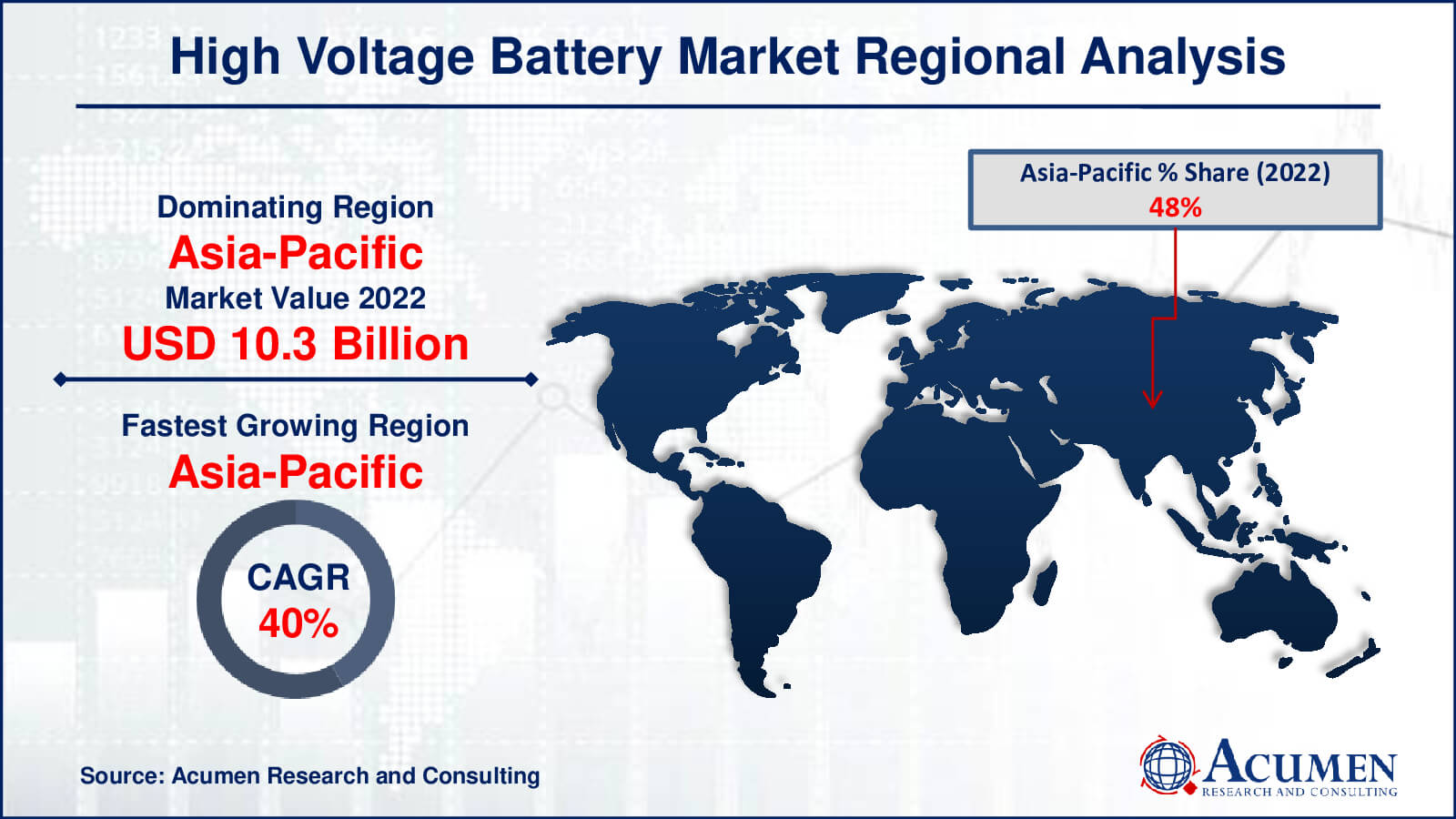

In 2022, the Asia-Pacific region claimed the highest share in the global high voltage battery market in terms of value. Projections indicate that the region will sustain its dominance from 2023 to 2032. Key economies such as Japan, China, and India significantly contribute to the regional market value, with China being a major driver of the increasing demand for high voltage batteries. The market is witnessing heightened investments by major players in response to the growing demand for electric vehicles. Furthermore, the region is expected to undergo the fastest growth, characterized by a substantial Compound Annual Growth Rate (CAGR %) throughout the high voltage battery market forecast period.

High Voltage Battery Market Players

Some of the top high voltage battery companies offered in our report include Robert Bosch, ABB, CATL, Continental AG, Delphi Technologies, LG Chem, BYD, Samsung SDI, Johnson Controls, Chargepoint, EDP Brasil, Magna International, Tesla, Siemens AG, Mitsubishi Electric, and Nissan Motor Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2021

August 2023

December 2023

May 2020