November 2021

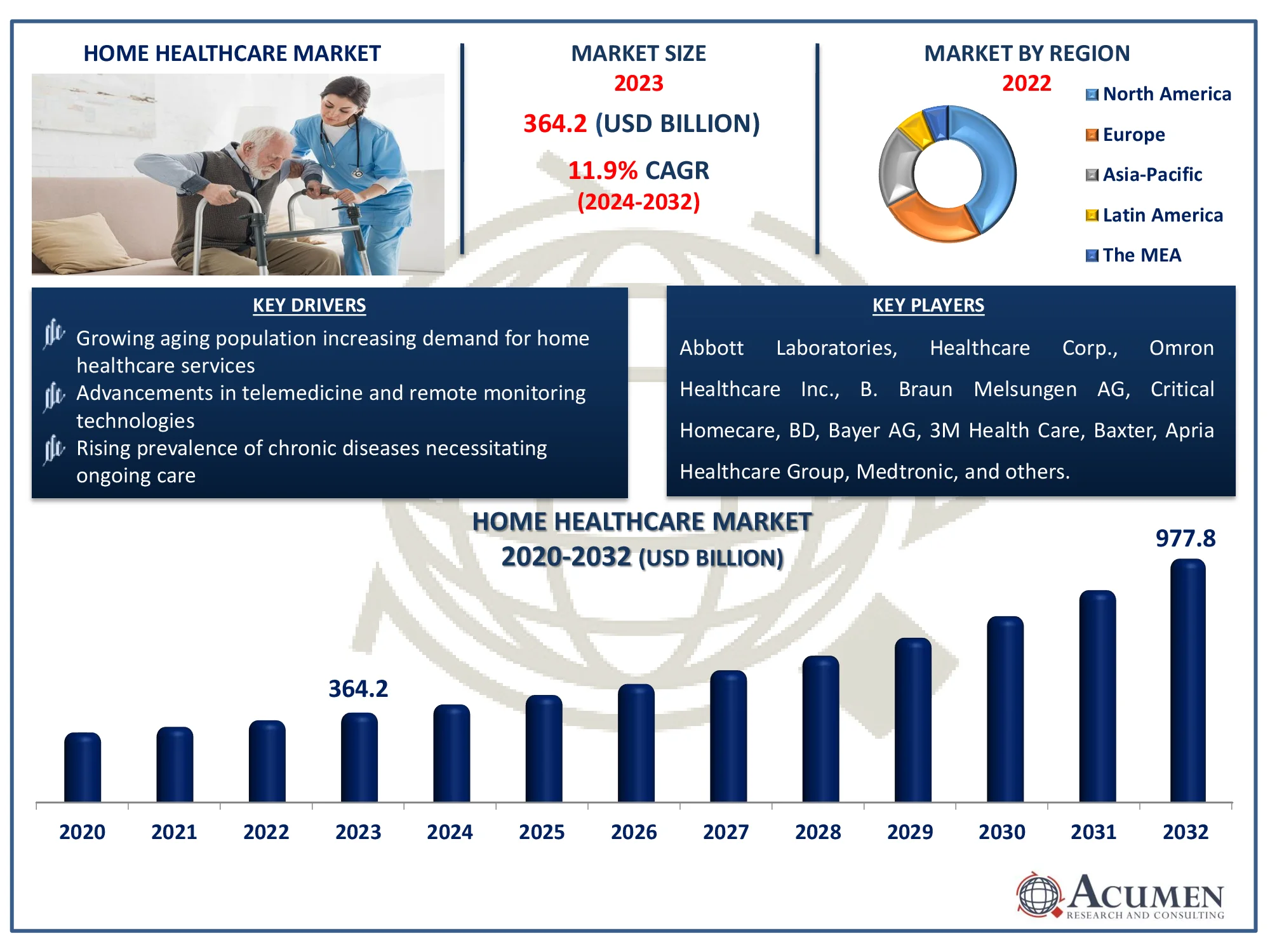

The Global Home Healthcare Market is expected to grow from USD 364.2 Billion in 2023 to USD 977.8 Billion by 2032, at a CAGR of 11.9%. Learn about key trends and market dynamics

The Global Home Healthcare Market Size accounted for USD 364.2 Billion in 2023 and is estimated to achieve a market size of USD 977.8 Billion by 2032 growing at a CAGR of 11.9% from 2024 to 2032.

Home Healthcare Market Highlights

Home healthcare encompasses a wide range of medical and non-medical treatments delivered in a patient's home to promote, preserve, or recover health and alleviate the symptoms of sickness or disability. It include skilled nursing care, physical therapy, speech therapy, occupational therapy, and assistance with activities of daily living (ADLs) such as bathing, dressing, and meal preparation. The applications of home healthcare are many, including post-surgical recovery, chronic illness management, senior care, and palliative care. It is intended to provide individualized, convenient care that enables patients to remain in their homes, maintain independence, and improve their quality of life. This method lowers hospital readmissions and healthcare costs while giving comfort and support to patients and their families.

Global Home Healthcare Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Home Healthcare Market Report Coverage

| Market | Home Healthcare Market |

| Home Healthcare Market Size 2022 |

USD 364.2 Billion |

| Home Healthcare Market Forecast 2032 | USD 977.8 Billion |

| Home Healthcare Market CAGR During 2023 - 2032 | 11.9% |

| Home Healthcare Market Analysis Period | 2020 - 2032 |

| Home Healthcare Market Base Year |

2022 |

| Home Healthcare Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Indication, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, Healthcare Corp., Omron Healthcare Inc., B. Braun Melsungen AG, Critical Homecare, BD, Bayer AG, 3M Health Care, Baxter, Apria Healthcare Group, Medtronic, Roche diagnostics Corp., Almost Family Inc., Nxstage Medical, Inc., Odyssey Healthcare Inc., Cardinal Health Inc., Air Liquide, Amedisys, Inc., Arcadia Health Care, and Omron Healthcare Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Home Healthcare Market Insights

In recent decades, life expectancy has increased dramatically over the world. Sociodemographic and mobility trends have an impact on home care demands, as doe’s demographic change, resulting in an increase in demand for home care facilities. A variety of legislative shifts and priorities put pressure on home care. There is policy support to ensure that home-based solutions benefit individuals, their families, and society as a whole. According to the World Health Organization (WHO), the development of home nursing and home assistance is linked to the emergence of complex welfare, social security, and healthcare systems that have followed different trajectories and resulted in different patterns of funding and provision within each country.

Furthermore, the majority of European countries, including Belgium, France, Italy, Portugal, Spain, and the United Kingdom, have an organizational model in which the healthcare component of home care is integrated into a healthcare system as a distinct component. In other countries, including Denmark, Sweden, and Finland, policymakers realized the benefits of providing home healthcare under a single organization managed by local governments.

The home healthcare market languished prior to COVID-19, but the situation has changed as COVID-19 fuels the expansion of the total sector. According to a research released by the National Academy of Sciences, nursing homes and other long-term care institutions account for a disproportionate amount of COVID-19 cases and fatalities worldwide. As of August 2020, nursing homes were responsible for 40% of COVID-19-related deaths in the United States. Furthermore, with 49% of nursing home cases attributed to cross-facility staff movement, close attention to highly connected nursing facilities are necessary. Such issues have a long-term impact on the global home healthcare business.

With staff in short supply, seniors frequently wait months for home healthcare, putting many people at danger of not receiving medical treatment. However, the home healthcare market as a whole is evolving in the aftermath of COVID-19. For the record, the US president launched a $400 billion infrastructure plan to expand home and community-based long-term care services, allowing patients to be treated at home and in proper healthcare facilities. States are also sponsoring home care programs, such as Maine (US), to provide home healthcare services to persons who are not eligible for Medicaid, in the hopes of avoiding seniors from needing Medicaid coverage later. Such aspects open up attractive potential for the global home healthcare market to expand.

Home Healthcare Market Segmentation

The worldwide market for home healthcare is split based on component, indication, and geography.

Home Healthcare Components

According to the home healthcare industry analysis, the primary drivers markets are skilled nursing, physical therapy, and personal care assistance. These services are designed to meet the needs of elderly patients and people with chronic illnesses, allowing them to manage their health at home. With an older population and a growing preference for at-home care, demand for these services is expanding. Furthermore, home healthcare services are a more affordable option to hospital stays and long-term care institutions. As a result, services now account for the majority of the home healthcare sector.

Home Healthcare Indications

According to the home healthcare market forecast, the business is shifting toward treatments for neurological and mental diseases. This is due to an increase in the number of people living with illnesses such as Alzheimer's, Parkinson's, and depression, all of which require continuing care. Home healthcare enables patients to receive tailored care in a comfortable setting. This trend is becoming more prevalent as the population ages and the demand for mental health services increases. As a result, these conditions currently dominate the home healthcare market.

Home Healthcare Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

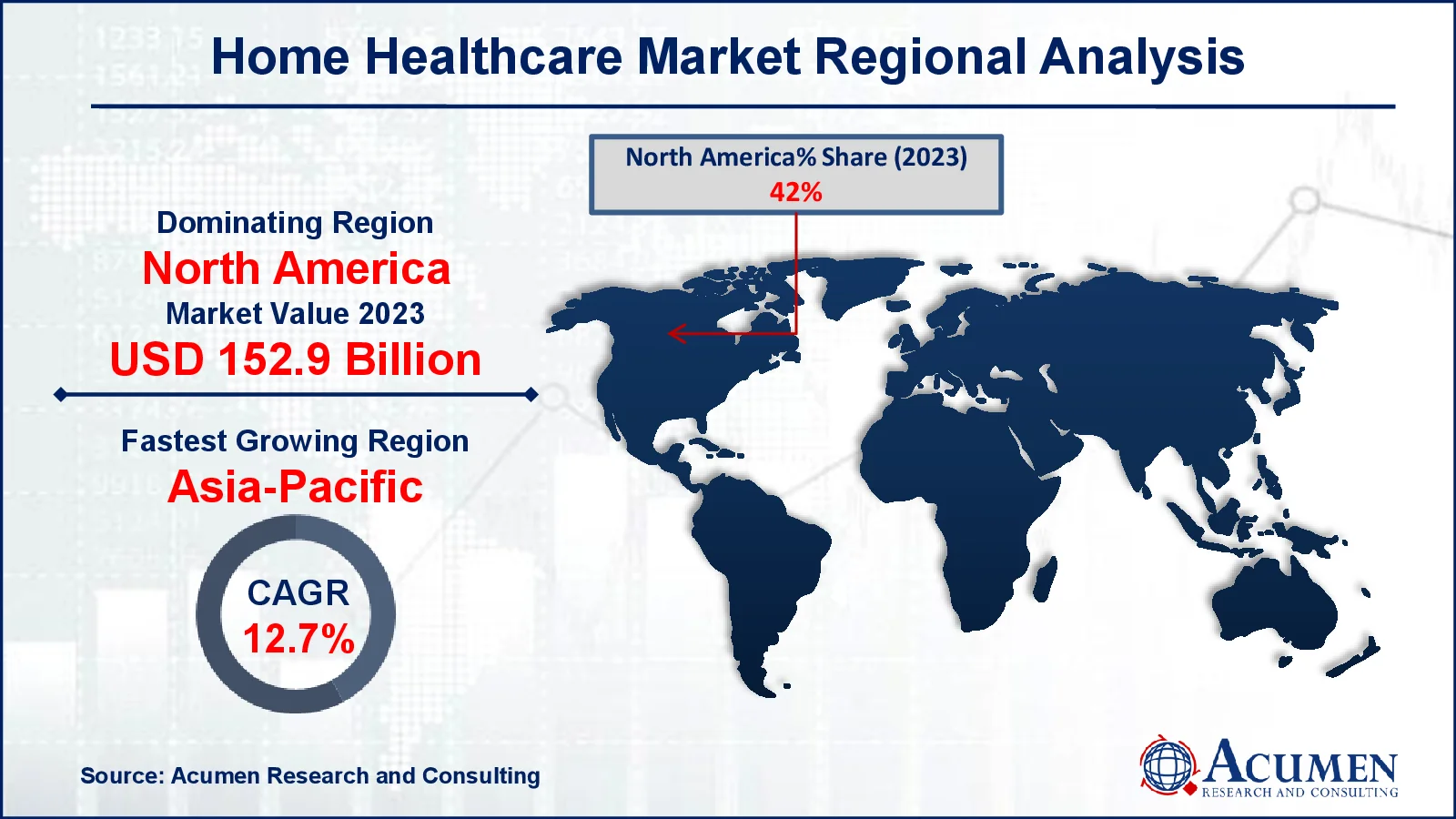

Home Healthcare Market Regional Analysis

For several reasons, North America dominates the home healthcare market, and this trend is expected to continue during the forecast period. In North America, the United States is a pioneering contributor to the home healthcare business. For instance, In June 2023, Amedisys decided to merge with Optum, a firm that specializes in offering a wide range of health services. Amedisys delivers personalized home health and hospice care, with over 11.2 million visits to patients' homes each year Favorable government policies, as well as increased government funding, are key variables that will have a long-term impact on the expansion of the home healthcare sector.

On the other hand, Asia-Pacific is predicted to rise rapidly in terms of CAGR for the home healthcare industry. The rising senior population, increasing respiratory-related illnesses and the large number of home healthcare organizations in APAC make it a potential sector for expansion. For instance, Sakra World Hospital and MyHealthcare joined in May 2022 to create a patient-centered digital health ecosystem. The platform offers to provide patients with access to all Sakra World Hospital, Sakra Premium Clinic, and Sakra Homecare services from the convenience of their own homes.

Home Healthcare Market Players

Some of the top home healthcare companies offered in our report include Abbott Laboratories, Healthcare Corp., Omron Healthcare Inc., B. Braun Melsungen AG, Critical Homecare, BD, Bayer AG, 3M Health Care, Baxter, Apria Healthcare Group, Medtronic, Roche diagnostics Corp., Almost Family Inc., Nxstage Medical, Inc., Odyssey Healthcare Inc., Cardinal Health Inc., Air Liquide, Amedisys, Inc., Arcadia Health Care, and Omron Healthcare Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2021

December 2024

June 2024

October 2021