February 2023

Hyperscale Data Center Market (By Component: Hardware, Software, Services; By Power Capacity: 20 MW To 50 MW, 50 MW To 100 MW, 100 MW to 150 MW, 150 MW and Above; By Organization Size: Large Enterprises, Small and Medium Enterprises; By End Use: Cloud Providers, Colocation Providers, Enterprises) - Global Industry Analysis, Size, Share, Analysis, Trends and Forecast 2026 - 2035

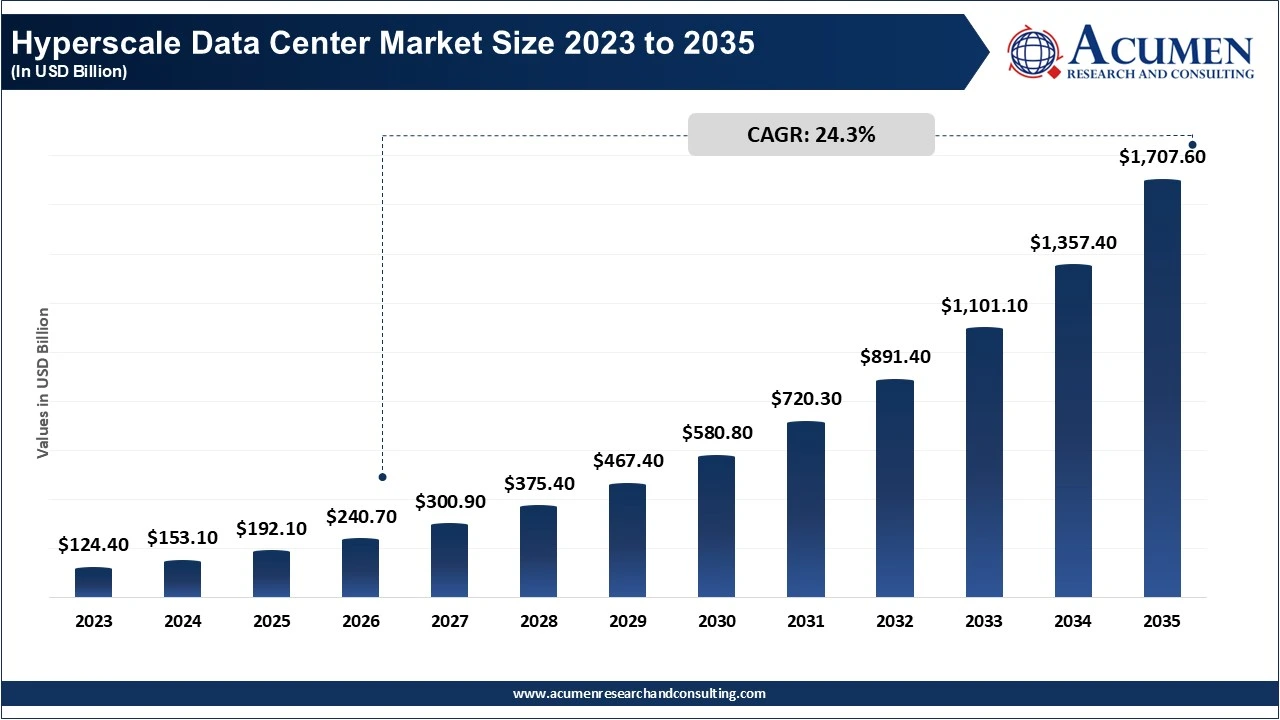

The global hyperscale data center market size accounted for USD 192.1 billion in 2025 and is projected to attain around USD 1,707.6 billion by 2035, registering a CAGR of 24.3% from 2026 to 2035. The growing adoption of AI and high-performance computing workloads is fueling the demand of hyperscale data centers. In addition, the proliferation of sustainability and green data center initiatives is opportunistic for the market growth.

Hyperscale data center refers to a large-scale data center that provides extreme scalability and can handle large volumes of workloads in collaboration with its high-performance network infrastructure, network connectivity, and low latency. A hyperscale data center requires a location that can accommodate all the hardware associated with the data center, such as at least 5000 servers and over thousands of miles of connection hardware. This type of data center can also be referred to as a cloud data center, which refers to a very large, centralized, and highly efficient customized computing facility that is controlled by a single management entity. Increasing adoption of cloud, IoT, and big data among industry verticals drives the demand for hyperscale data centers.

Rising Need for Data Processing and Storage Capabilities

Increasing Demand for Cloud Computing Solutions

High Cost of Energy

Grid Limitations and Power Availability Constraints

Integration of Generative AI

Adoption of Advanced Cooling and Energy-Efficient Technologies

| Attribute | Details |

| Hyperscale Data Center Market Size 2025 | USD 192.1 Billion |

| Hyperscale Data Center Market Forecast 2035 | USD 1,707.6 Billion |

| Hyperscale Data Center Market CAGR During 2026 – 2035 | 24.3% |

| Analysis Period | 2023 – 2035 |

| Base Year | 2025 |

| Forecast Data | 2026 – 2035 |

| Segments Covered | By Component, By Power Capacity, By Organization Size, By End Use, and By Geography |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amazon Web Services, Inc., Cisco Systems, Inc., IBM Corporation, Oracle Corporation, Arista Networks, Inc., Microsoft Corporation, Google, Inc., Intel Corporation, NVIDIA Corporation, and Ericsson, Inc. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

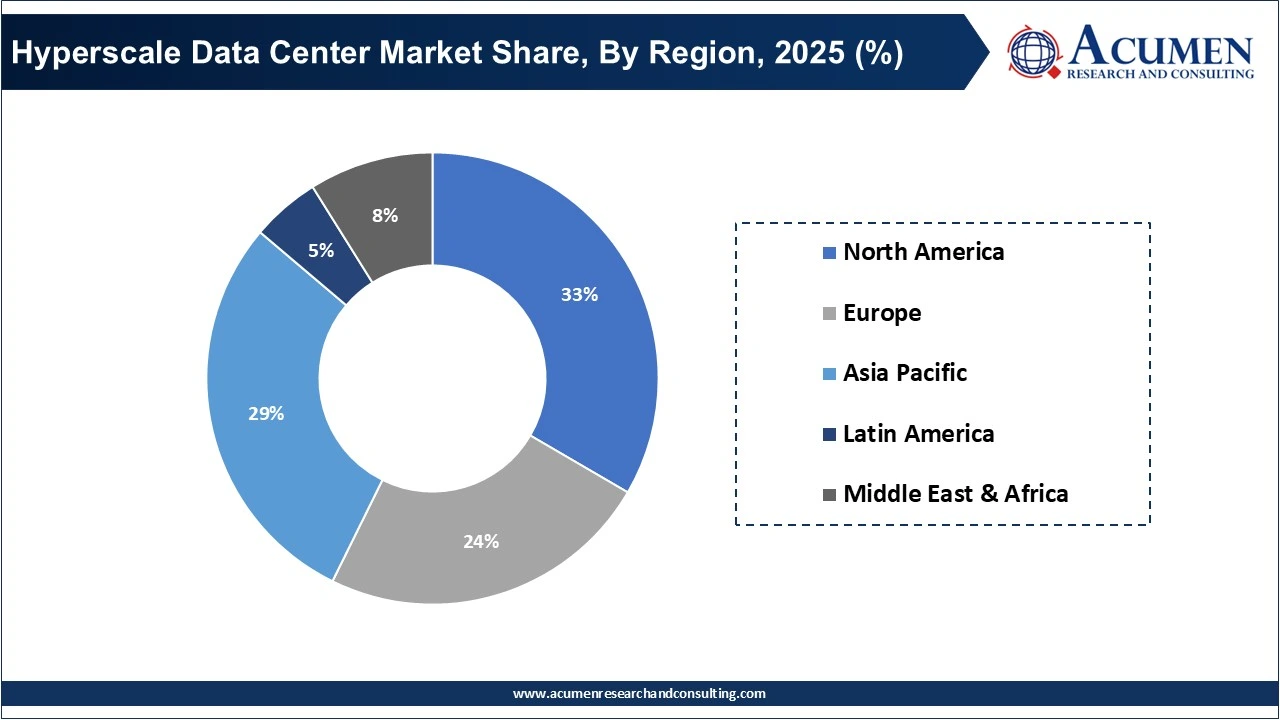

North America dominated the hyperscale data center market by garnering a major market share in 2025. This is attributed to the well-established presence of prominent technology players, widespread acceptance of new technologies, well-developed IT infrastructure, and effective efforts in digital transformation. The presence of a well-developed IT infrastructure impacts positively in promoting a large adoption of this technology. Also, a large number of technology firms facilitate a highly competitive market.

| Region | Market Share, 2025 (%) | Key Highlights |

| North America | 33% | Dominant because of the robust presence of key tech players, high adoption of novel technologies, advanced IT infrastructure, and efficient initiatives in digital transformation. |

| Europe | 24% | Strict data protection laws (GDPR) and rapid digital transformation across public and private sectors are driving market growth. |

| Asia-Pacific | 29% | The region’s steady growth is driven by rapid digitization, and expansion of the IT sector. |

| MEA | 9% | MEA is observing heightened demand as governments and enterprises increase the pace of digitalization agendas and seek cost-efficient solutions. |

| Latin America | 5% | In Latin America, a growing trend is seen whereby SMEs are swiftly deploying localized digital applications. |

The Asia-Pacific market is expected to observe a significant growth throughout the forecast period. Digitization and development of the IT infrastructure are fueling the growth of the Asia-Pacific market. Large organizations in the Asia-Pacific are increasing the adoption of hyperscale data centers, which are used for the deployment and development of applications. Countries such as India, Japan, China, Australia, and South Korea are contributing significantly to the growth of the Asia-Pacific market.

The worldwide market for hyperscale data center is split based on component, power capacity, organization size, end use, and geography.

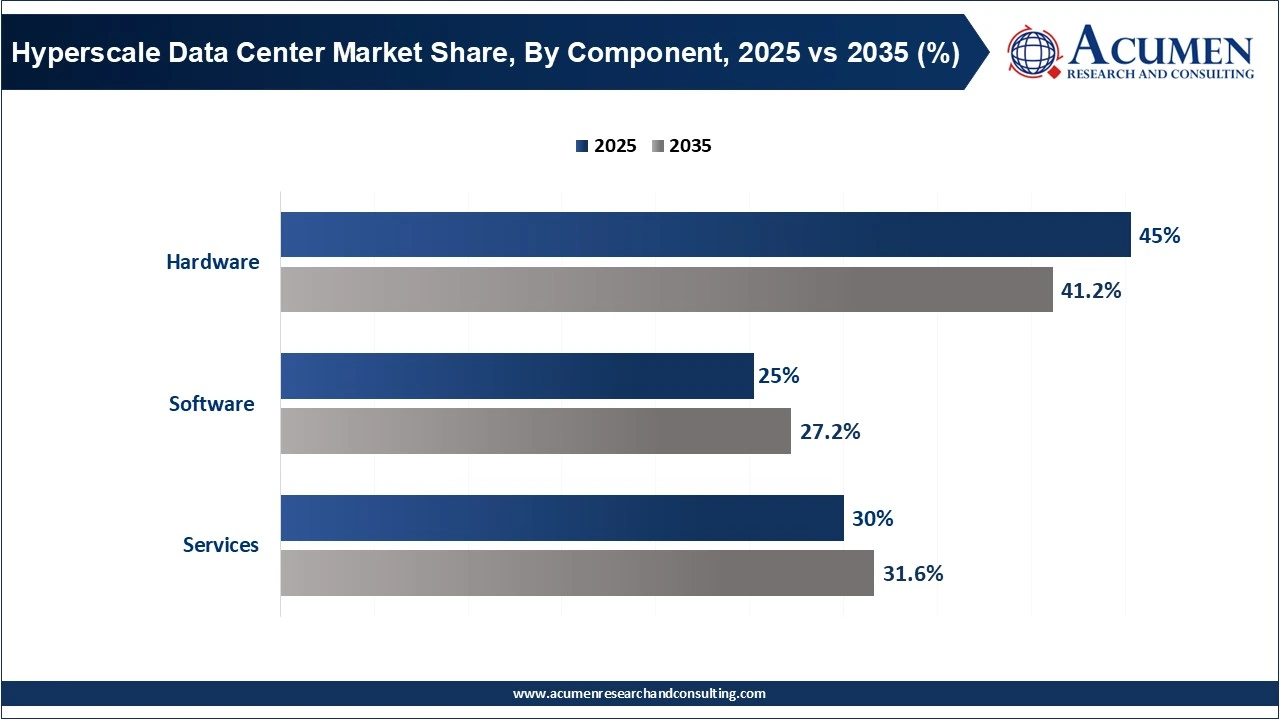

Based on component the market is segmented into hardware, software and services.

The hardware segment dominated the hyperscale data center market in 2025. The growth is facilitated by increasing concerns related to data privacy and regulatory pressures that impacts the hardware landscape as well. Hyperscale data centers are required to ensure that regional data laws along with the security protocols are maintained, by integrating hardware-level encryption, securing boot process mechanisms, and maintaining superior physical security. These types of hardware innovations are thus considered vital for preserving data integrity and instilling confidence among enterprise clients, this presents a strong impetus toward continued investment and advancements in the hardware segment.

| Component | Market Share, 2025 (%) | Key Highlights |

| Hardware | 45% | Increasing concerns related to data privacy and regulatory pressures is boosting the market demand. |

| Software | 25% | The increasing need for smart data center management with the help of software-defined infrastructure is boosting the market demand. |

| Services | 29% | Demand for managed services, colocation partnerships, and lifecycle management services is rising as hyperscale operators seek to optimize costs and accelerate deployment timelines. |

According to the hyperscale data center industry analysis, in 2025, the 50 MW to 100 MW power capacity dominated the market. With the expansion of hyperscale providers into emerging markets and secondary data center hubs, the power capacities of the infrastructure supporting the data centers need to draw from large capacities to provide redundancy, low latency, and high availability. The power capacity ranging from 50 MW to 100 MW is in line with the future-proof strategy and the regional data sovereignty regulations.

| Power Capacity | Market Share, 2025 (%) | Key Highlights |

| 20 MW to 50 MW | 11% | Data centers in this range are increasingly deployed to support regional cloud expansion and edge computing needs, offering faster deployment and improved latency. |

| 50 MW to 100 MW | 33% | The power capacity ranging from 50 MW to 100 MW is in line with the future-proof strategy and the regional data sovereignty regulations. |

| 100 MW to 150 MW | 25% | Hyperscale operators are favoring this capacity range for large, centralized campuses that enable economies of scale and advanced energy-efficient infrastructure. |

| 150 MW and Above | 31% | Mega-scale data centers above 150 MW are emerging as a key trend, driven by massive AI workloads, GPU clusters, and long-term investments in renewable power sourcing. |

The large enterprises segment led the hyperscale data center sector owing to the growing adoption of these platforms for complex project handling, management, and data analytics. This can be attributed to the growing requirements for digital transformation, data-intensive applications, and scalable cloud infrastructure. Many large companies, including banks, manufacturing companies, telecommunication players, and the healthcare sector, are increasingly resorting to a cloud-first approach. This has led to the adoption of hyperscale data centers by companies for handling a huge amount of data and/or providing a resilient application or applications.

| Organization Size | Market Share, 2025 (%) | Key Highlights |

| Large Enterprises | 74% | Dominant because of the growing adoption of complex project handling, management, and data analytics. |

| Small and Medium-sized Enterprises | 26% | SMEs are increasingly adopting hyperscale cloud data center services to access scalable, cost-efficient computing power without heavy upfront infrastructure investments, supporting digital transformation and business agility. |

The cloud providers segment held the largest market share in 2025. Leading players like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Alibaba Cloud are heavily investing in the development of hyperscale data centers in order to handle the increasing workload of their customers, ensure high availability, and have a larger presence globally. These players need huge infrastructure that can scale to offer an ever-increasing number of services like virtual machines, databases, AI/ML platforms, and analytics solutions that run on hyperscale facilities.

| End Use | Market Share, 2025 (%) | Key Highlights |

| Cloud Providers | 62% | Leading players like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Alibaba Cloud are heavily investing in the development of hyperscale data centers in order to handle the increasing workload of their customers, ensure high availability, and have a larger presence globally. |

| Colocation Providers | 12% | Colocation providers are increasingly partnering with hyperscale operators and expanding high-density, scalable facilities to meet growing cloud and AI infrastructure demand. |

| Enterprises | 26% | Enterprises are shifting toward hybrid and multi-cloud strategies, driving greater reliance on hyperscale data centers for flexible, secure, and cost-efficient IT infrastructure. |

By Component

By Power Capacity

By Organization Size

By End Use

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2023

April 2025

April 2025

September 2023