February 2024

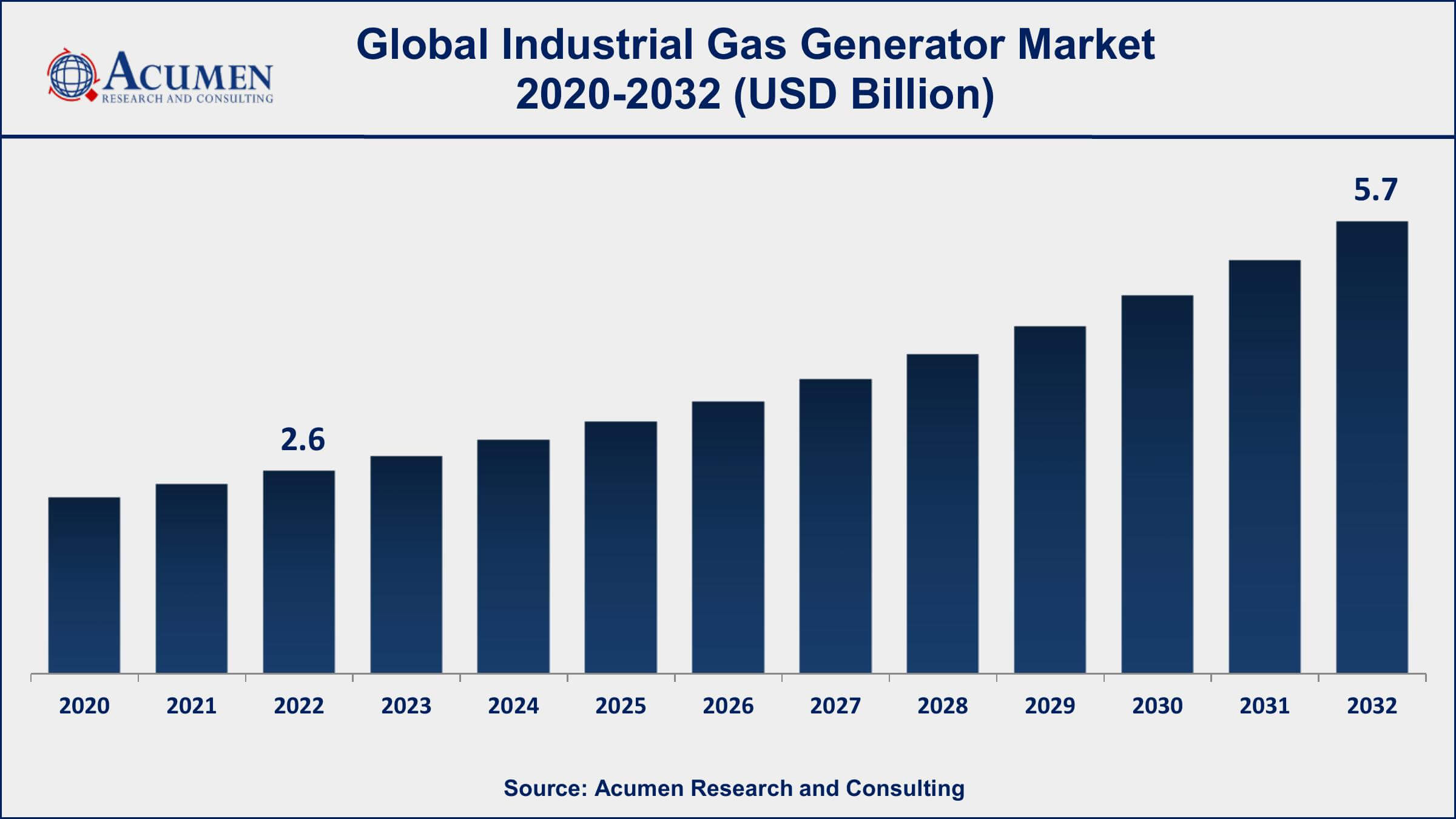

Industrial Gas Generator Market Size accounted for USD 2.6 Billion in 2022 and is projected to achieve a market size of USD 5.7 Billion by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

The Global Industrial Gas Generator Market Size accounted for USD 2.6 Billion in 2022 and is projected to achieve a market size of USD 5.7 Billion by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

Industrial Gas Generator Market Highlights

An industrial gas generator is a power generation system that utilizes natural gas, biogas, or other gaseous fuels to produce electricity. These generators are designed to meet the demanding power needs of industrial facilities, including manufacturing plants, oil and gas operations, data centers, hospitals, and various other sectors. Industrial gas generators offer several advantages, such as high efficiency, cleaner emissions compared to diesel generators, and the ability to leverage a readily available fuel source like natural gas.

The market for industrial gas generators has been experiencing steady growth in recent years. Factors contributing to this growth include the increasing demand for reliable and uninterrupted power supply, growing industrialization across regions, and a greater emphasis on cleaner and more sustainable energy solutions. Industrial gas generators provide a reliable and efficient power backup option, particularly in areas with a well-established natural gas infrastructure. Additionally, the transition towards cleaner energy sources has driven the adoption of industrial gas generators as they offer reduced emissions compared to diesel generators. Stringent environmental regulations and the need for reduced carbon footprints have further boosted the demand for gas-based power generation systems. Moreover, advancements in technology have led to the development of more efficient and reliable industrial gas generators, which have attracted the attention of industries looking for dependable and cost-effective power solutions.

Global Industrial Gas Generator Market Trends

Market Drivers

Market Restraints

Market Opportunities

Industrial Gas Generator Market Report Coverage

| Market | Industrial Gas Generator Market |

| Industrial Gas Generator Market Size 2022 | USD 2.6 Billion |

| Industrial Gas Generator Market Forecast 2032 | USD 5.7 Billion |

| Industrial Gas Generator Market CAGR During 2023 - 2032 | 8.5% |

| Industrial Gas Generator Market Analysis Period | 2020 - 2032 |

| Industrial Gas Generator Market Base Year | 2022 |

| Industrial Gas Generator Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-Use, And By Geography |

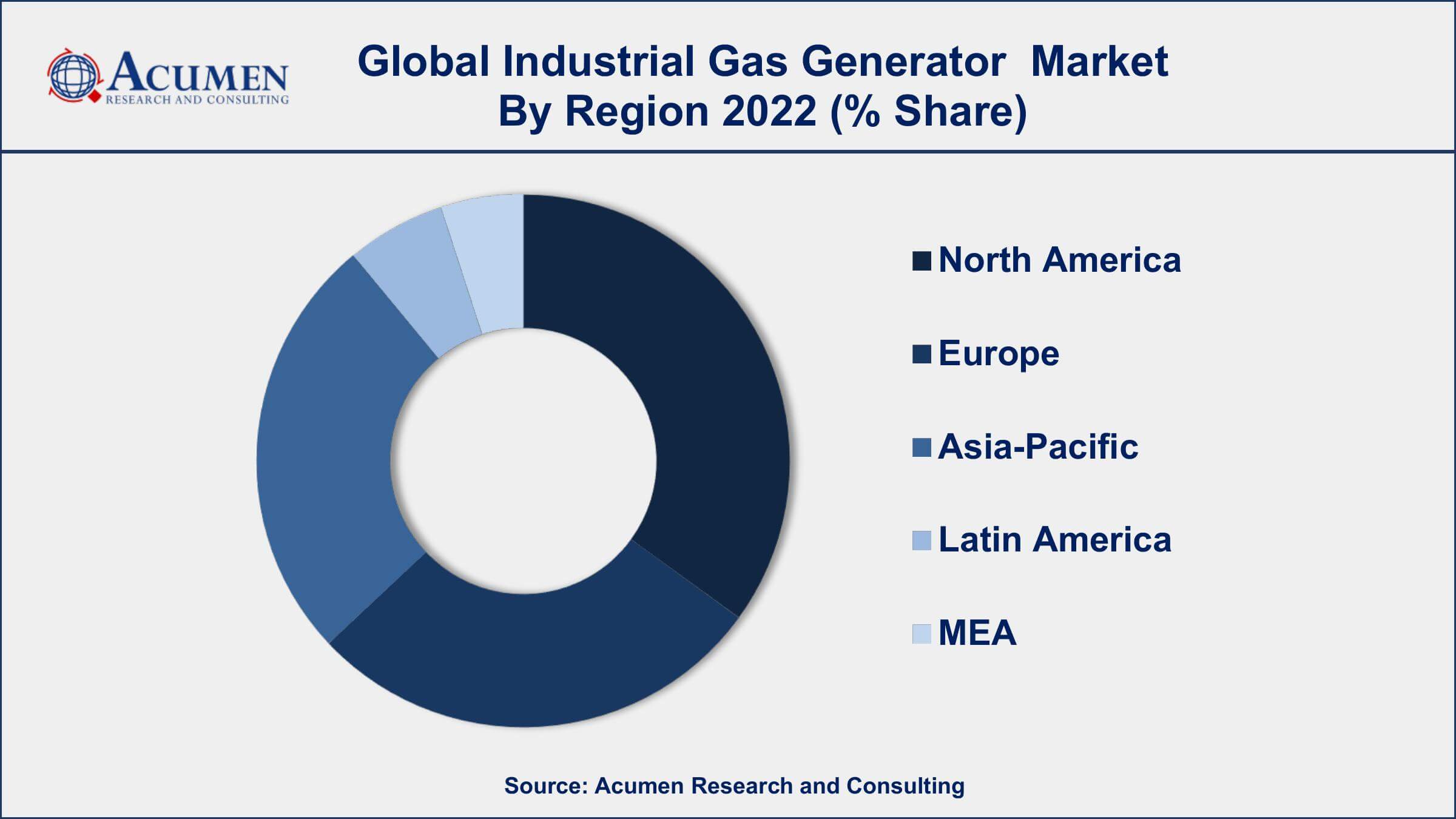

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Wärtsilä Corporation, MTU Onsite Energy GmbH (a subsidiary of Rolls-Royce Power Systems), Kohler Co., Himoinsa S.L., Mitsubishi Heavy Industries, Ltd., Yanmar Holdings Co., Ltd., and Doosan Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

An industrial gas generator is a power generation system that uses gaseous fuels, such as natural gas, biogas, or propane, to produce electricity. These generators are specifically designed to meet the high power demands of industrial applications, where a reliable and continuous power supply is crucial. Industrial gas generators are available in various sizes and configurations, ranging from portable units to large-scale installations, depending on the power requirements of the application.

The applications of industrial gas generators are diverse and span across multiple industries. One of the primary applications is in manufacturing plants, where a consistent power supply is essential for operating machinery and equipment. Industrial gas generators are commonly used in industries such as automotive, chemical, food and beverage, pharmaceuticals, and textiles, among others. Another significant application is in the oil and gas industry. Gas generators play a vital role in upstream, midstream, and downstream operations, providing power for drilling rigs, pumping stations, pipeline compression, and refining processes. These generators offer reliable power solutions in remote and off-grid locations, ensuring uninterrupted operations in the oil and gas sector.

The industrial gas generator market has been experiencing significant growth and is expected to continue expanding in the coming years. Several factors are driving this growth including, the increasing demand for reliable and uninterrupted power supply in industrial sectors is a major driver. Industrial facilities, such as manufacturing plants, data centres, and oil and gas operations, require a consistent power source to ensure smooth operations and minimize downtime. Industrial gas generators offer a reliable solution, providing a steady power supply with fewer interruptions compared to other generator types. Additionally, the transition towards cleaner and more sustainable energy sources is fueling the growth of the industrial gas generator market.

Industrial Gas Generator Market Segmentation

The global industrial gas generators market segmentation is based on type, end-use, and geography.

Industrial Gas Generator Market By Type

In terms of types, the 501KW to 1MW segment has seen significant growth in the recent years. This segment caters to the power generation needs of various industries, including small to medium-sized manufacturing facilities, commercial buildings, and healthcare facilities. One of the key drivers behind the growth of this segment is the increasing demand for backup power solutions in these industries. Reliable and uninterrupted power supply is crucial for maintaining operations and minimizing downtime. The 501KW to 1MW gas generators offer an optimal power range for these applications, providing sufficient capacity to meet the power requirements of medium-sized facilities. These generators serve as backup power sources during grid outages or can be used as the primary power source in remote or off-grid locations. Moreover, the transition towards cleaner energy sources has also contributed to the growth of this segment.

Industrial Gas Generator Market By End-Use

According to the industrial gas generator market forecast, the petroleum and gas industry segment is expected to witness significant growth in the coming years. The petroleum and gas industry relies heavily on uninterrupted and reliable power supply to support various operations, including drilling, exploration, refining, and production. Industrial gas generators have emerged as a preferred choice within this segment due to their ability to utilize natural gas, a readily available fuel source, for power generation. One of the key drivers behind the growth of industrial gas generators in the petroleum and gas industry segment is the increasing exploration and production activities worldwide. As the demand for oil and gas continues to rise, companies are expanding their operations to extract resources from challenging locations, such as deepwater reserves or unconventional shale formations. These remote and offshore locations often lack access to reliable grid power, making gas generators an essential part of the energy infrastructure. Gas generators provide on-site power generation capabilities, enabling operations to proceed smoothly even in remote or off-grid locations. Furthermore, the petroleum and gas industry is under increasing pressure to reduce its environmental footprint and adopt cleaner energy solutions.

Industrial Gas Generator Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Industrial Gas Generator Market Regional Analysis

North America dominates the industrial gas generator market for several reasons, positioning it as a prominent player in the industry. North America has a well-developed industrial sector with diverse industries such as manufacturing, oil and gas, healthcare, and data centers. These industries have a significant demand for reliable power supply, making industrial gas generators an essential component of their operations. The region's strong industrial base drives the demand for gas generators, contributing to the dominant market position in North America. Furthermore, North America benefits from a well-established natural gas infrastructure. The region has abundant natural gas reserves and an extensive pipeline network, ensuring a consistent and reliable supply of fuel for gas generators. Natural gas is a cleaner and more environmentally friendly alternative to diesel or gasoline, aligning with the growing emphasis on sustainable and greener energy solutions. The availability of ample natural gas resources and a robust infrastructure gives North America a competitive edge in the industrial gas generator market.

Industrial Gas Generator Market Player

Some of the top industrial gas generator market companies offered in the professional report include Caterpillar Inc., Cummins Inc., Generac Holdings Inc., Wärtsilä Corporation, MTU Onsite Energy GmbH (a subsidiary of Rolls-Royce Power Systems), Kohler Co., Himoinsa S.L., Mitsubishi Heavy Industries, Ltd., Yanmar Holdings Co., Ltd., and Doosan Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2024

April 2021

February 2024

June 2024