October 2024

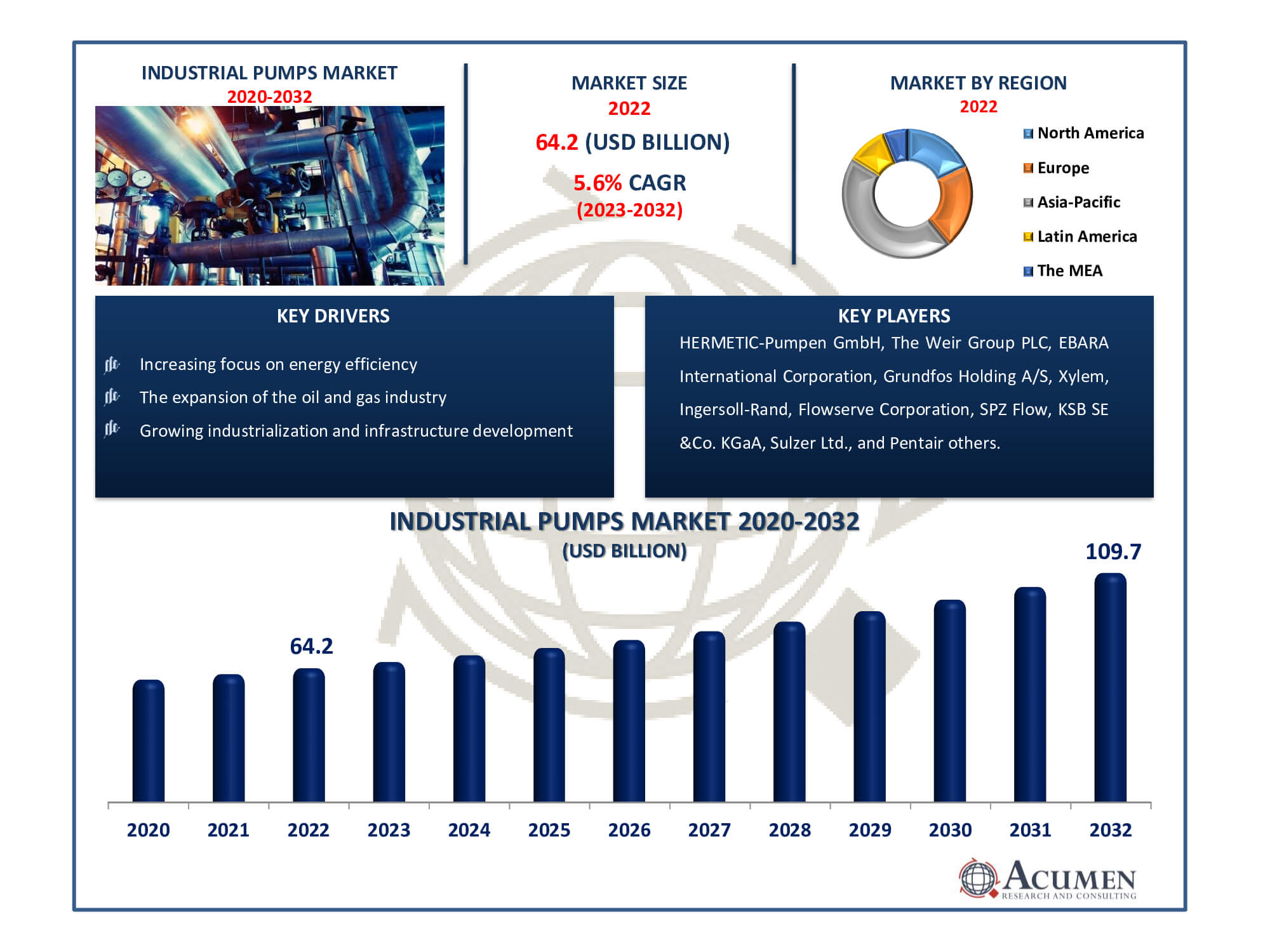

Industrial Pumps Market Size accounted for USD 64.2 Billion in 2022 and is estimated to achieve a market size of USD 109.7 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

The Industrial Pumps Market Size accounted for USD 64.2 Billion in 2022 and is estimated to achieve a market size of USD 109.7 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Industrial Pumps Market Highlights

Industrial pumps are crucial in various sectors for the movement of fluids between locations. They come in a wide range of shapes, sizes, and capacities. Industrial pumps are broadly categorized into two types: centrifugal pumps, also known as rotodynamic pumps, and positive displacement pumps. Centrifugal pumps are further classified into axial, mixed flow, and radial types, while positive displacement pumps include piston, screw, sliding valve, and rotating lobe types. It is of utmost importance that these pumps meet performance and reliability standards. For instance, pump failure in a refrigeration system can lead to overheating and significant equipment damage. Manufacturing, agriculture, and construction are among the industries served by the industrial pump market. It provides fluid transfer solutions, assuring the efficient operation of machinery and processes. The market's expansion is being driven by rising industrialization and the demand for dependable fluid-handling equipment.

Global Industrial Pumps Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Industrial Pumps Market Report Coverage

| Market | Industrial Pumps Market |

| Industrial Pumps Market Size 2022 | USD 64.2 Billion |

| Industrial Pumps Market Forecast 2032 | USD 109.7 Billion |

| Industrial Pumps Market CAGR During 2023 - 2032 | 5.6% |

| Industrial Pumps Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Position, By Driving Force, By End User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | HERMETIC-Pumpen GmbH, The Weir Group PLC, EBARA International Corporation, Grundfos Holding A/S, Xylem, Ingersoll-Rand, Flowserve Corporation, SPZ Flow, KSB SE &Co. KGaA, Sulzer Ltd., Pentair, Iwaki Co. Ltd., ITT, INC., Schlumberger Limited, Vaughan Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Pumps Market Insights

Industrial pumps are expected to witness continued growth in utilization across various applications, including wastewater treatment and chemicals, throughout the forecast period. Positive market growth is anticipated due to increased infrastructure development investments in several regions. Additionally, advancements in technology are likely to further drive market expansion. The growing demand for industrial pumps in various end-use sectors, along with the development of advanced plants, is expected to boost market demand. Notably, the global oil industry has experienced significant growth in crude oil production, particularly in the Middle East, Africa, and North America, contributing significantly to the increased demand for industrial pumps during the forecast period.

Rising customer expectations in recent decades have led to increased global investment in enhancing the quality of industrial pumps and the adoption of advanced process control. Industrial pump manufacturers in the region have raised their costs to improve energy efficiency, which is expected to drive demand for more energy-efficient industrial pumps over the projected period.

The high starting cost is one limitation in the industrial pumps market. Industrial pumps can be costly to buy and install. This expense can be prohibitively expensive for smaller enterprises or industries with limited resources. While these pumps provide long-term benefits and efficiency, the initial expenditure can be difficult. It is crucial to note, however, that the initial expense is frequently outweighed by the long-term savings and performance enhancements afforded by these pumps.

Industrial Pumps Market Segmentation

The worldwide market for industrial pumps is split based on product, position, driving force, end user industry, and geography.

Industrial Pump Products

As per our industrial pumps market analysis, centrifugal pumps dominate the industry due to their extensive use in utilities and production units store floors. Their continued presence in the manufacturing sector is a key factor for market growth. In the coming years, rotary pumps are expected to gain importance as a power source for hydraulic control equipment. Reciprocating pumps are projected to represent a significant share of total sales. Diaphragm pumps, known for their versatility in handling various fluids, are ideal for applications like water and wastewater metering and conveyors. This segment is expected to drive market growth in response to population growth, industrial development, and increased focus on wastewater treatment.

Industrial Pump Positions

According to the industrial pumps market forecast, non-submersible position is expected to be the largest from 2023 to 2032. This is due to the increased usage of non-submersible pumps in a variety of industrial applications such as manufacturing, agriculture, and construction. They are located outside of the fluid they are pumping, making them adaptable to a variety of applications. Submersible pumps, on the other hand, are often employed for specialised tasks such as groundwater pumping or wastewater treatment. Non-submersible pumps are the market's dominant segment due to their widespread use in various sectors and adaptability to various fluid types.

Industrial Pump Driving Forces

As per the industrial pumps industry analysis, the electrical driven category is the largest. This is mostly due to the benefits of electrical-driven pumps, which include ease of use, efficiency, and precision in managing flow rates. They are frequently utilised in a variety of industries that require a steady and regular power source, including as manufacturing and municipal applications. Engine-driven pumps, on the other hand, are commonly utilised in places where electrical power is not readily available, like as building sites or isolated areas. However, because electricity is widely available in most industrial settings, electrical-driven pumps dominate the market.

Industrial Pump End User Industries

The water & wastewater sector is the largest in the industrial pumps market, owing to the crucial requirement for pumps in water treatment and wastewater management. The oil & gas section is the second largest, owing to the energy industry's need for fluid management. Water and wastewater application are critical in a wide range of industries, including municipalities and industrial facilities, resulting in a significant need for pumps. Pumps are required for fluid transfer and processing in the oil and gas industry due to its large extraction and processing processes. Because of their critical responsibilities in maintaining clean water and powering the energy industry, these two segments dominate.

Industrial Pumps Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Industrial Pumps Market Regional Analysis

Asia-Pacific is expected to dominate the market, driven by remarkable growth in end-use industries such as oil and gas and water and wastewater treatment. Population expansion and a thriving industrial sector in countries like China and India are significant factors contributing to this dominance.

Europe, as the second-largest regional market, held a share of more than 20% in revenue. The demand for pumps from major end-users like chemicals, petrochemicals, and food and beverages continues to drive growth. Additionally, strict regulations aimed at reducing water pollution are expected to boost demand for industrial pumps.

North America, the third-largest market, is influenced by key sectors like water and wastewater treatment, construction, and oil and gas. Furthermore, technological advancements in pumping systems are anticipated to fuel market growth in North America over the forecast period.

Western Europe is expected to experience slow and stagnant market growth with low industrial output. In contrast, Eastern Europe is likely to see relatively stronger growth, driven by increased industrial production in the chemical and water processing industries. Additionally, expenses for industrial pumps in the Middle East are projected to rise due to investments in desalination plants, leading to increased pump sales in this region.

Industrial Pumps Market Players

Some of the top industrial pumps companies offered in our report includes HERMETIC-Pumpen GmbH, The Weir Group PLC, EBARA International Corporation, Grundfos Holding A/S, Xylem, Ingersoll-Rand, Flowserve Corporation, SPZ Flow, KSB SE &Co. KGaA, Sulzer Ltd., Pentair, Iwaki Co. Ltd., ITT, INC., Schlumberger Limited, Vaughan Company.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2024

July 2022

February 2023

June 2022