January 2021

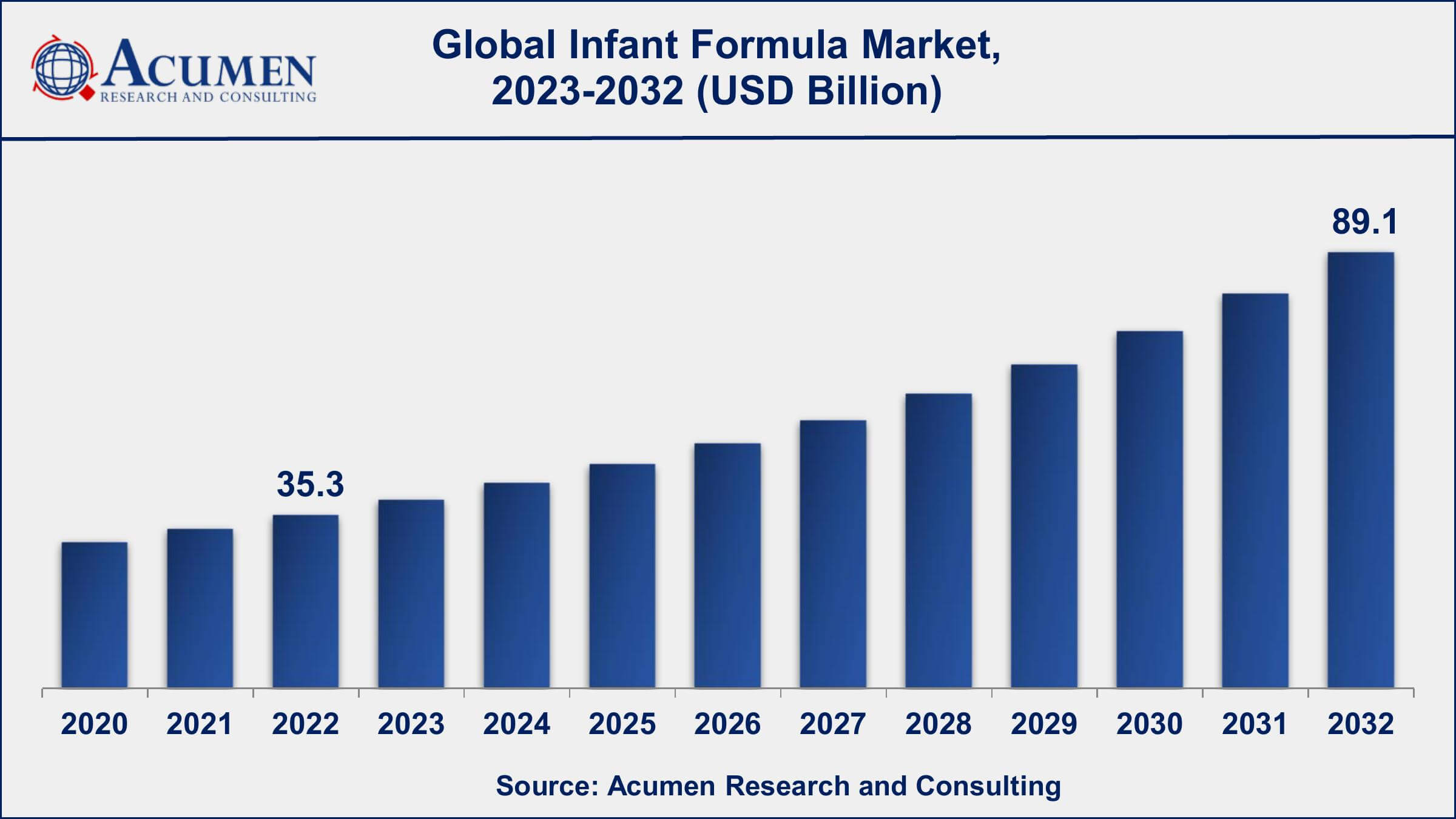

Infant Formula Market Size collected USD 35.3 Billion in 2022 and is set to achieve a market size of USD 89.1 Billion in 2032 growing at a CAGR of 9.8% from 2023 to 2032.

The Global Infant Formula Market Size collected USD 35.3 Billion in 2022 and is set to achieve a market size of USD 89.1 Billion in 2032 growing at a CAGR of 9.8% from 2023 to 2032.

Infant Formula Market Report Statistics

Infant formula refers to a food product usually designed to meet the nutritional needs of infants of the age group between 0 to 12 months. Infant formula is generally used as an alternative to a mother’s breast milk and contains essential ingredients which are present in breast milk. Infant formula is globally available in powders, ready-to-use, and liquid forms. Several types of infant formula such as prebiotic infant formula, organic infant formula, soy-based formula, lactose-free formula, and non-genetically modified organisms’ infant formula are widely available in the market. Infant formula products are suitable for children under one year of age. These products vary in nutrients, taste, price, ability, and quality from region to region.

Global Infant Formula Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Infant Formula Market Report Coverage

| Market | Infant Formula Market |

| Infant Formula Market Size 2022 | USD 35.3 Billion |

| Infant Formula Market Forecast 2032 | USD 89.1 Billion |

| Infant Formula Market CAGR During 2023 - 2032 | 9.8% |

| Infant Formula Market Analysis Period | 2020 - 2032 |

| Infant Formula Market Base Year | 2022 |

| Infant Formula Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Ingredient, By Form, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amara Baby Food, Arla Foods, Ella's Kitchen Group, Baby Gourmet, Green Monkey, Friso, Hero Group, Healthy Sprouts Foods, Meiji, Morinaga, One Earth Farms, Nurture (Happy Family), Plum Organics, Parent's Choice, Stonyfield Farm and Sprout Foods. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Infant Formula Market Growth Factors

The rise in birth rate, the increase in several working mothers, and innovations in technology especially in packaging are some of the crucial factors accelerating the growth of the global market for infant formula. Choosing the correct and most suitable infant formula product is one of the important decisions undertaken by working parents across the globe. An increase in women's participation in employment has in turn led to increasing demand for infant formula in both developing and developed economies. Also, the increase in demand for organic and natural infant formula products implies the rapidly changing perception of consumers toward infant formula products. The most widely used infant formula product is infant milk formula which is made of cow’s milk mixed with minerals, vitamins, vegetable oils, and carbohydrates. Modified infant formula contains the important and necessary vitamins and nutrients including iron which helps in the prevention of anemia among infants and aids the babies to grow properly.

One of the key factors driving the global infant formula market is the rapidly increasing health concerns among working parents. Most parents are inclined towards optimal dietary and health nutrition products to ensure their babies’ efficient development and growth. Also, parents are widely choosing packaged foods for their babies and packaged infant formulas as an alternative to breastfeeding. Working parents are willingly ready to spend on expensive and high-quality baby food products to ensure their well-being. This growth in nutritional concerns has accelerated the infant formula providers and vendors to come up with various natural and organic products which are relatively safer and more nutritional as compared to other conventional foods.

Infant Formula Market Segmentation

The worldwide market for infant formula is categorized based on product type, ingredient, form, distribution channel, and geography.

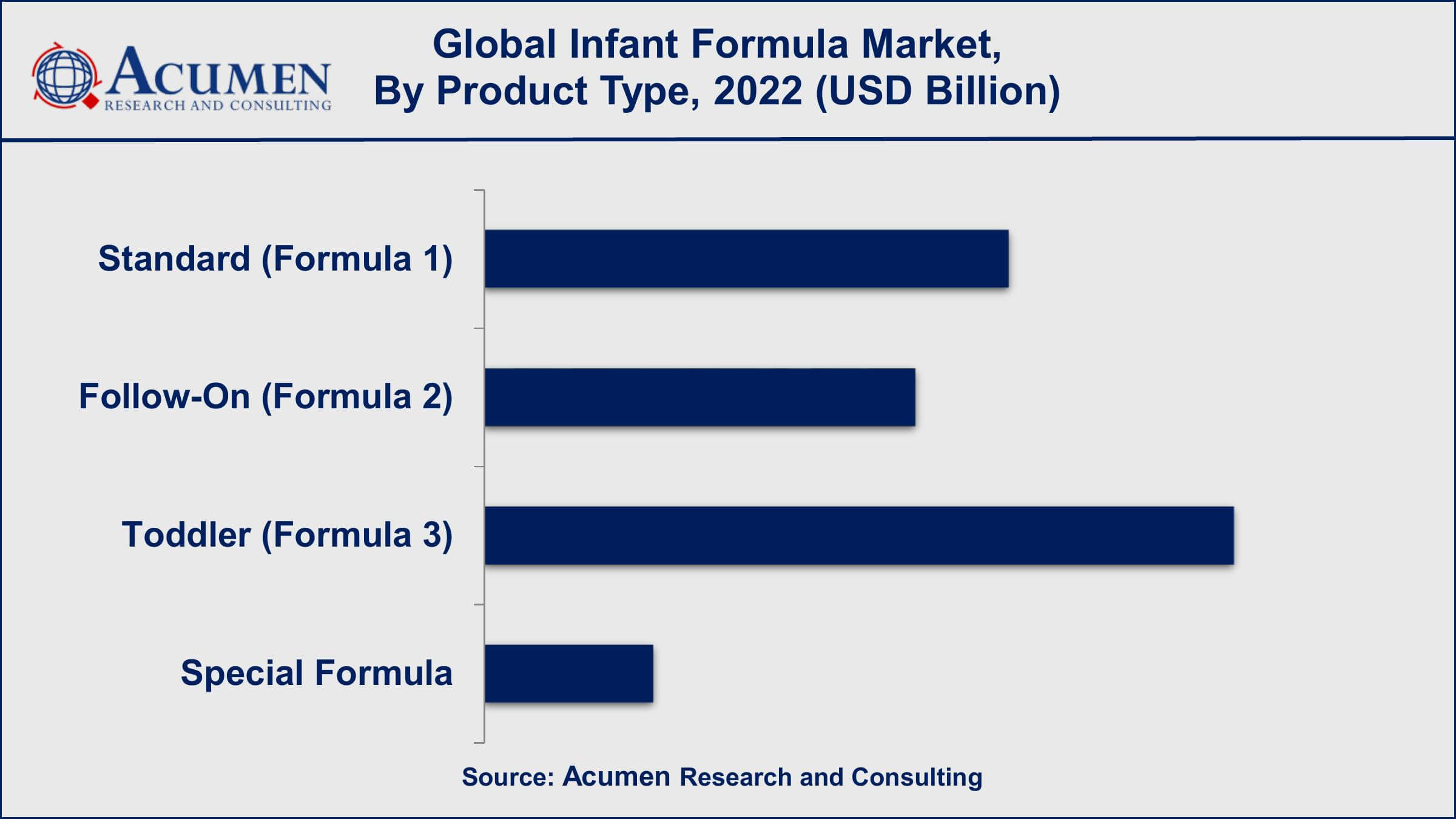

Infant Formula Product Type Outlook

The standard infant formula (Formula 1) tends to dominate the market globally, according to the infant formula market forecast. This is the most common type of infant formula, and it is usually given to healthy, full-term infants from birth to six months of age. Follow-on infant formula (Formula 2), which is typically used for infants aged six to twelve months, accounts for a sizable portion of the market. Toddler formula (Formula 3) is marketed for children over the age of 12 months and represents a smaller market segment. Special infant formula, such as hypoallergenic, soy-based, or lactose-free formulas, is a niche market that is growing in popularity due to rising demand for specialized products that cater to infants with specific nutritional needs or allergies.

Infant Formula Ingredient Outlook

According to an infant formula industry analysis, whey protein concentrate-based products are the most popular, followed by soy protein concentrate-based products. Protein hydrolysate-based products are also frequently used in infant formula, especially for babies who have allergies or digestive problems. It's important to note that the market share of these ingredients in infant formula can vary depending on factors like region, formulation, and brand.

Infant Formula Form Outlook

The powdered form segment controlled the vast majority of the global market. Powdered infant formula is more convenient, has a longer shelf life, and is easier to transport and store than liquid or ready-to-feed forms. However, the liquid and ready-to-feed form segments have been steadily growing in popularity due to their convenience, particularly for parents who are on the go or prefer not to mix formula themselves. These types of infant formula are also commonly used in hospitals and other medical settings where exact measurements are required. It's important to note that the popularity of different types of infant formula can vary depending on region and other factors like cultural practices and local regulations.

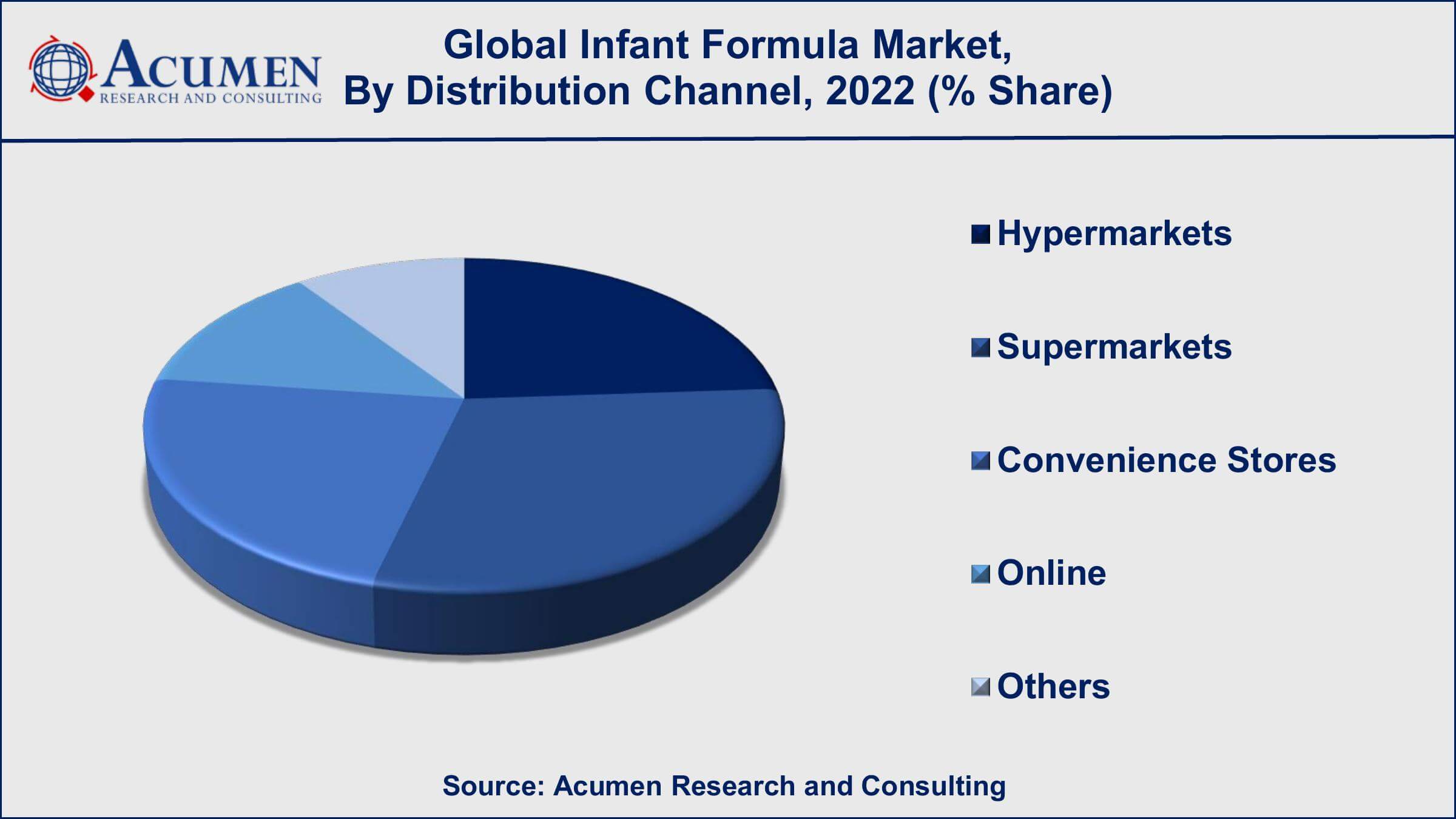

Infant Formula Distribution Channel Outlook

Supermarkets and hypermarkets dominated infant formula distribution, accounting for the vast majority of global market share. These retail stores stock a wide variety of infant formula brands and products, allowing parents to buy formula while doing their regular grocery shopping. Convenience stores and online channels also had significant market shares in infant formula, as they provide convenience and accessibility to busy parents who might not have the time to shop in larger retail stores.

Infant Formula Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Infant Formula Market Regional Analysis

Infant formula is a mature market in North America and Europe, where availability of the product and high levels of consumer awareness have led to relatively steady growth rates. These regions also have high safety and quality standards, which can drive demand for premium infant formula brands.

Asia-Pacific is the most populous and fastest-growing region for infant formula, owing to rising birth rates, urbanization, and rising disposable incomes. Due to its large population and strong demand for foreign brands, China is the region's and one of the world's largest markets for infant formula. Japan, South Korea, and India are also important markets in the region.

Infant Formula Market Players

Some of the global infant formula companies profiled in the report include Amara Baby Food, Arla Foods, Ella's Kitchen Group, Baby Gourmet, Green Monkey, Friso, Hero Group, Healthy Sprouts Foods, Meiji, Morinaga, One Earth Farms, Nurture (Happy Family), Plum Organics, Parent's Choice, Stonyfield Farm and Sprout Foods.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@acumenresearchandconsulting.com

January 2021

September 2023

January 2021

August 2018