June 2022

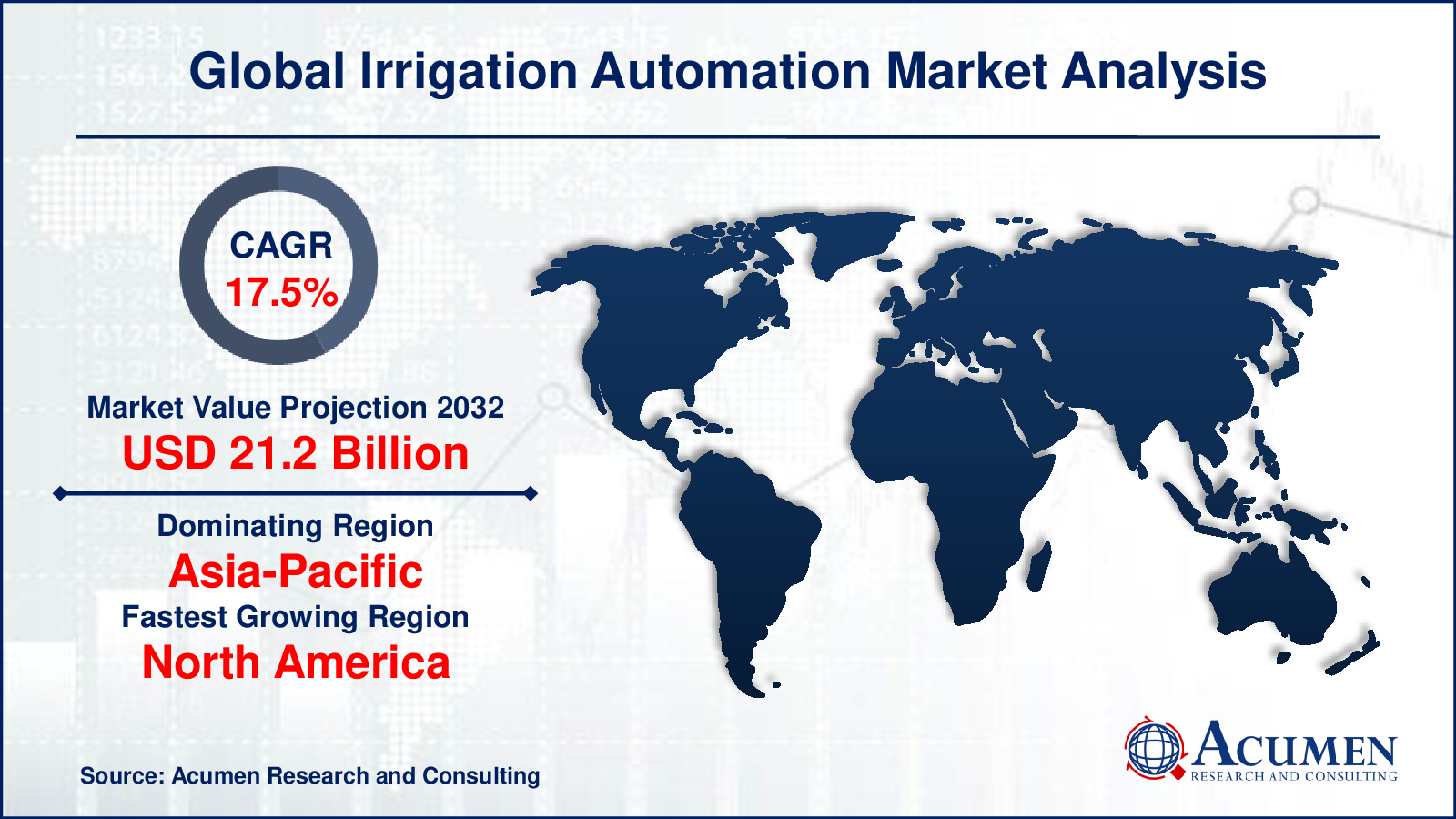

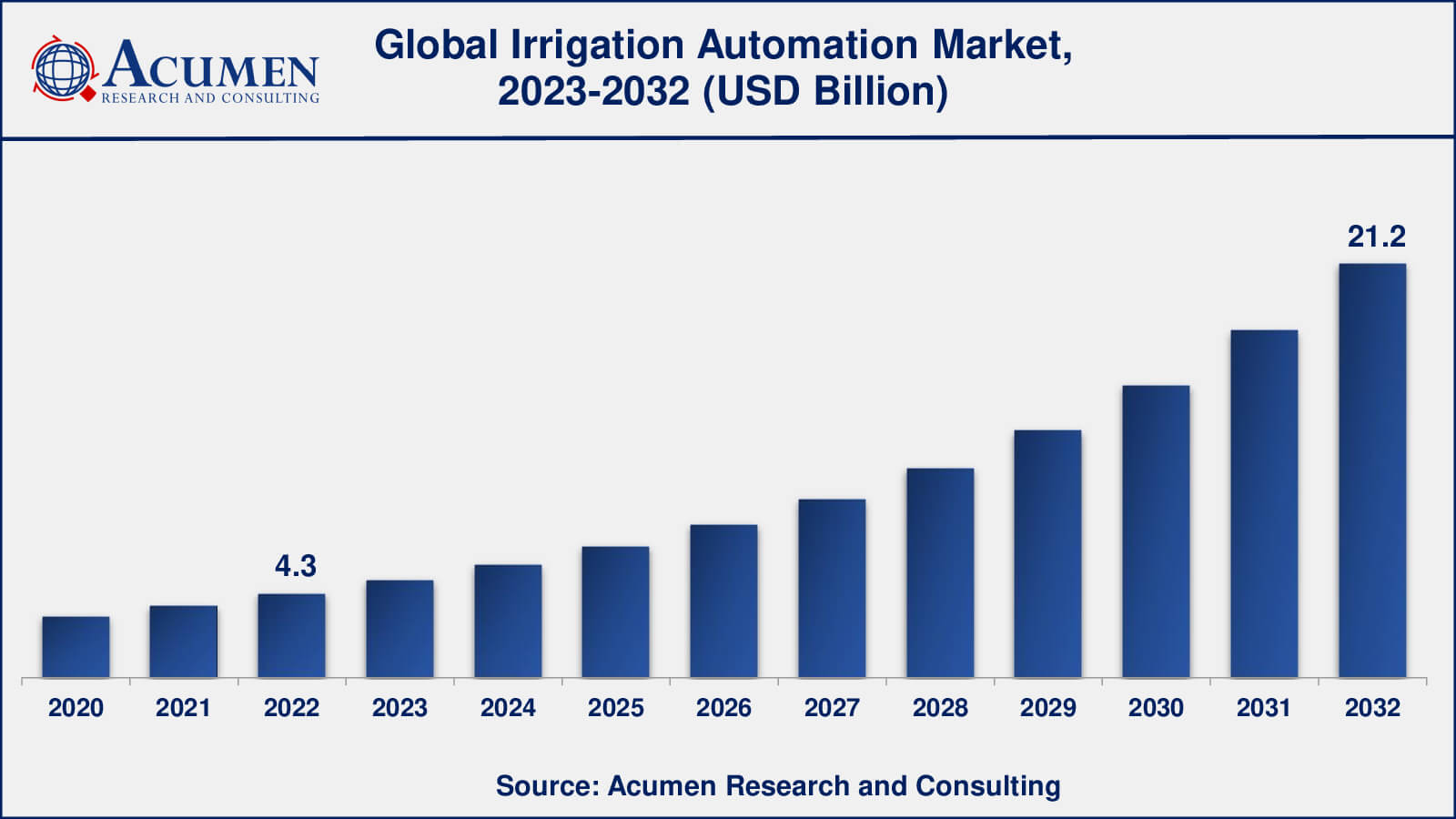

Irrigation Automation Market size was valued at USD 4.3 Billion in 2022 and is projected to reach USD 21.2 Billion by 2032 mounting at a CAGR of 17.5% from 2023 to 2032.

The global Irrigation Automation Market size was valued at USD 4.3 Billion in 2022 and is projected to reach USD 21.2 Billion by 2032 mounting at a CAGR of 17.5% from 2023 to 2032.

Irrigation Automation Market Highlights

Irrigation automation is the use of technology and systems to automate the process of watering plants and crops. It entails the use of sensors, controls, and actuators to monitor and regulate irrigation operations based on variables such as soil moisture levels, weather conditions, and plant needs.

One of the key reasons for the importance of irrigation automation is its ability to increase water efficiency in agricultural practices. Traditional irrigation systems can result in over- or under-watering, resulting in water waste and poor crop output. Water may be given precisely when and where it is required by automating irrigation systems, optimizing water consumption and minimizing waste.

Another significant benefit of irrigation automation is the capacity to improve crop health and output. Automated systems may monitor soil moisture levels and supply water in a targeted manner, ensuring that plants receive the appropriate amount of water at the appropriate time. This promotes healthy root development, lowers the risk of illnesses caused by overwatering or waterlogging, and leads to improved crop growth and output.

Global Irrigation Automation Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Irrigation Automation Market Report Coverage

| Market | Irrigation Automation Market |

| Irrigation Automation Market Size 2022 | USD 4.3 Billion |

| Irrigation Automation Market Forecast 2032 | USD 21.2 Billion |

| Irrigation Automation Market CAGR During 2023 - 2032 | 17.5% |

| Irrigation Automation Market Analysis Period | 2020 - 2032 |

| Irrigation Automation Market Base Year | 2022 |

| Irrigation Automation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Automation Type, By Component, By Irrigation Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Galcon, Hunter Industries, Jain Irrigation Systems, Lindsay Corporation, Nelson Irrigation, Netafim, Rain Bird Corporation, Rubicon Water, The Toro Company, and Valmont Industries Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Irrigation Automation Market Insights

One of the primary motivations is the growing shortage of water and the necessity for better water management in agricultural practices. As water resources become scarce and climate change alters rainfall patterns, there is a rising emphasis on water efficiency. Irrigation automation provides a solution by accurately distributing water to crops depending on their requirements, eliminating water waste, and assuring long-term water management.

Another driving factor is growing demand for increased crop production and output. Farmers are looking for strategies to maximize their agricultural output as the world's population grows and food demand rises. Irrigation automation is important in this area since it provides the proper quantity of water at the right time, fostering healthy plant development, and eventually enhancing agricultural yields. This factor has led to increased adoption of automation technologies in agriculture.

Sensor technology advancements and Internet of Things (IoT) applications have also led to the expansion of irrigation automation. Real-time data from sensors capable of monitoring soil moisture levels, weather conditions, and other pertinent characteristics may be used to automate irrigation systems. IoT connection offers remote monitoring and control, allowing farmers to manage irrigation operations from any location, increasing ease and efficiency.

Government measures encouraging sustainable agricultural practices have also fueled the irrigation automation business. Water conservation and sustainable agricultural practices are becoming increasingly important to governments throughout the world. They are putting rules, subsidies, and incentives in place to encourage farmers to use sophisticated irrigation systems, such as automation. These measures foster a favorable atmosphere for market growth.

However, various constraints may impede the general implementation of irrigation automation. The significant initial investment and installation expenses involved with automated systems are one of the key obstacles. Small-scale farmers with low financial means may be discouraged from embracing automation as a result of this. Technical difficulties and hurdles in system integration can also be stumbling blocks, necessitating specialized knowledge and experience for installation and maintenance.

Furthermore, a lack of information and opposition to shift from conventional irrigation practices might stymie automation uptake. Farmers who have been utilizing traditional methods for many years may be unwilling to move to automated systems, necessitating education and awareness-building activities.

Irrigation Automation Market Segmentation

The worldwide market for irrigation automation is split based on automation type, component, irrigation type, application, and geography.

Irrigation Automation Types

According to rehabilitation industry research, time-based services have been a key income generator in recent years. In the irrigation automation industry, time-based automation, in which irrigation schedules are created based on specified time intervals, has been a prevalent and frequently utilised strategy. While it may not be the industry leader in terms of advanced technology and precision, farmers have embraced time-based automation due to its simplicity and ease of deployment.

Irrigation is planned at predetermined intervals in time-based automation, such as every few days or once a week, independent of real moisture levels or weather conditions. This strategy is frequently appropriate for specific crops and places with stable water needs and predictable weather patterns.

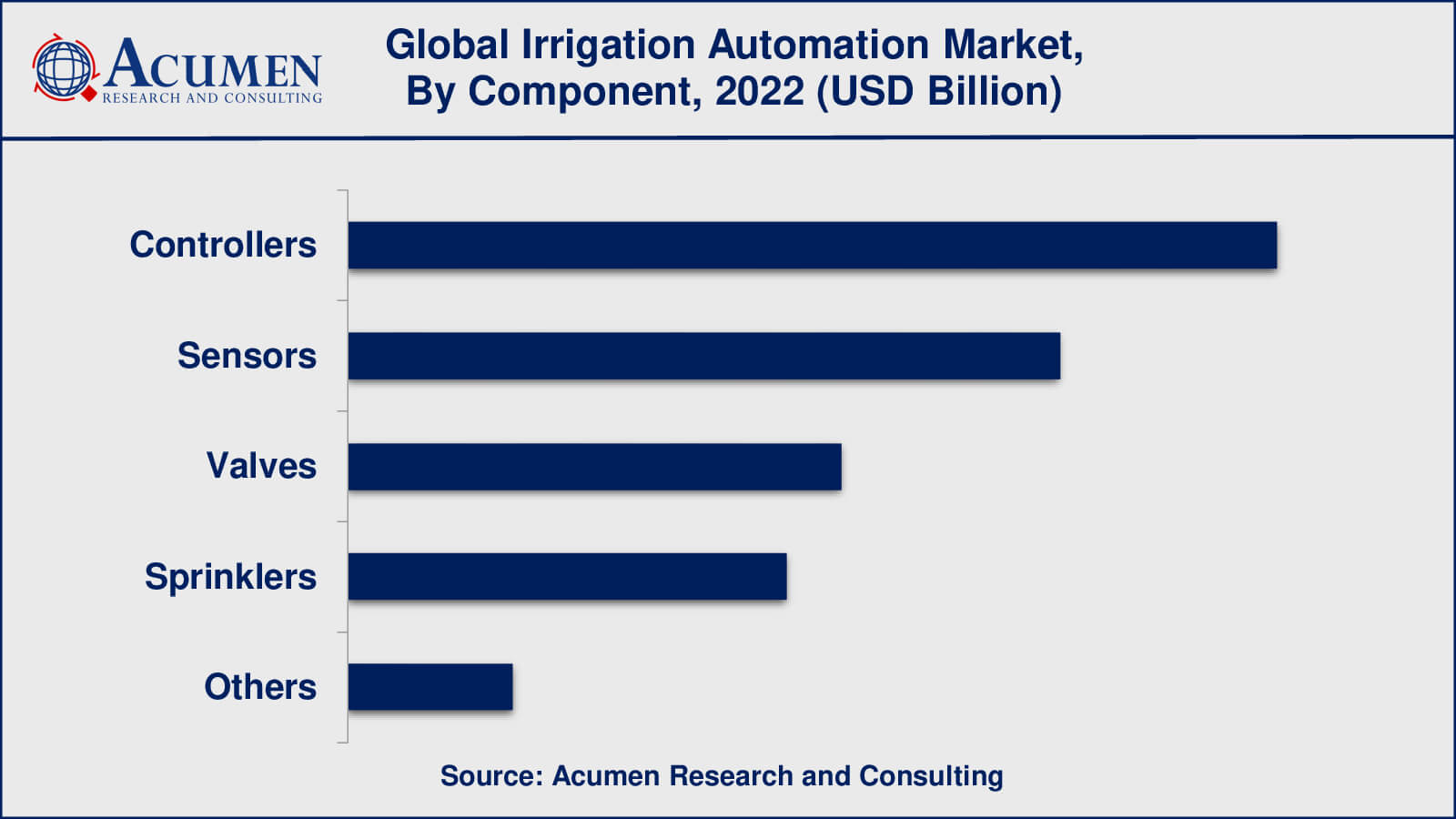

Irrigation Automation Components

In 2022, controllers sub-segment gathered utmost market share and are likely to do so in the coming years. In irrigation automation systems, controllers function as the central command units. They are in charge of receiving sensor inputs, analysing data, and managing the functioning of irrigation equipment. Irrigation controllers can be programmed to create irrigation schedules, modify watering durations, and activate valves based on a variety of criteria such as soil moisture levels, weather conditions, and crop requirements. They provide the intelligence and automation required for effective irrigation management.

Sensors, particularly soil moisture sensors, play an important role in irrigation automation. These sensors assess soil moisture content and offer data that helps irrigation choices. Another key component in irrigation automation is valves. These devices control the water flow in the irrigation system. Sprinklers are often employed in irrigation systems to provide water to crops or plants. Finally, the "Others" category includes many extra components and accessories that can be included in an irrigation automation system.

Irrigation Automation Irrigation Types

According to the irrigation automation market forecast, drip irrigation has been a dominant method in the irrigation automation market. Drip irrigation systems have grown in popularity due to their efficiency, accuracy, and water-saving qualities. Drip irrigation involves distributing water directly to plant roots via a network of tubes or pipes outfitted with emitters or drippers. This approach guarantees that water is supplied exactly to the root portions of the plants, minimising water waste due to evaporation or runoff. Drip irrigation is noted for its high water usage efficiency and is particularly useful in preserving water resources.

While drip irrigation is the industry leader in irrigation automation, sprinkler irrigation and surface irrigation are still commonly employed in a variety of agricultural applications. Sprinkler irrigation uses above sprinklers to distribute water over crops, whereas surface irrigation uses floods or furrow irrigation to provide water. Both of these technologies can be somewhat automated, although they may lack the accuracy and water-saving benefits of drip irrigation.

Other irrigation systems that are less common or particular to certain niche applications are included in the "Others" category. Subsurface irrigation, centre pivot irrigation, and aeroponic systems are examples of such approaches. While these systems have advantages, they presently do not dominate the irrigation automation industry.

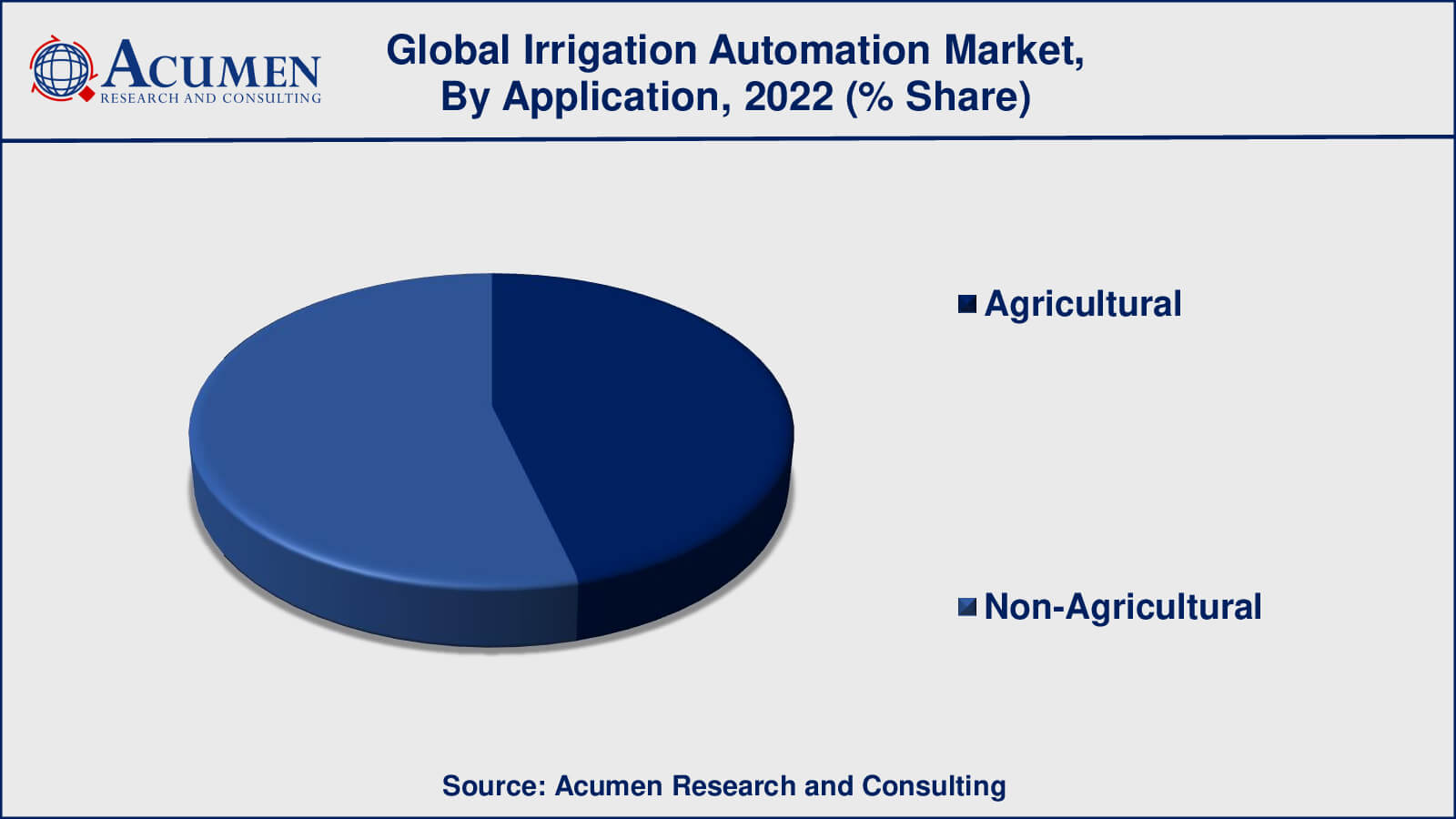

Irrigation Automation Applications

Non-agricultural application accounts for more than half of the market in 2022. Non-agricultural irrigation automation uses include landscape irrigation in residential or commercial settings, sports pitch irrigation and public parks. However, as compared to agricultural irrigation automation, these non-agricultural applications have a lesser market share. While these industries use irrigation automation systems for effective water management and sustaining healthy landscapes, the agricultural application retains market supremacy due to the huge scale of agricultural irrigation requirements globally.

Agricultural irrigation automation is important for optimising water utilisation, increasing crop output, and assuring sustainable agricultural practises. Irrigation automation systems are widely used by farmers and growers to efficiently control irrigation schedules, monitor soil moisture levels, and accurately administer water to plant root zones. Farmers may use automation to preserve water resources, reduce water waste, and lessen the environmental effect of irrigation practises.

Irrigation Automation Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Irrigation Automation Market Regional Analysis

The Asia-Pacific area has enormous potential for the irrigation automation market due to the availability of huge agricultural fields, a growing population, and rising food consumption. Countries such as China, India, and Australia are key market contributors, motivated by the desire to improve agricultural output and address water constraint issues. Government efforts, advances in agriculture technology, and an increase in the deployment of precision irrigation systems drive market growth in this area.

North America has a mature irrigation automation industry, owing to enhanced agricultural practices and the use of precision farming techniques. The United States and Canada are major market contributors, with an emphasis on water conservation, crop production increases, and agricultural efficiency. Market development is fueled by the existence of large irrigation automation firms, technical breakthroughs, and government efforts promoting sustainable agriculture.

Irrigation Automation Market Players

Some of the top irrigation automation companies offered in our report include Galcon, Hunter Industries, Jain Irrigation Systems, Lindsay Corporation, Nelson Irrigation, Netafim, Rain Bird Corporation, Rubicon Water, The Toro Company, and Valmont Industries Inc.

Irrigation Automation Industry Recent Developments

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2022

September 2022

June 2022

September 2023