April 2023

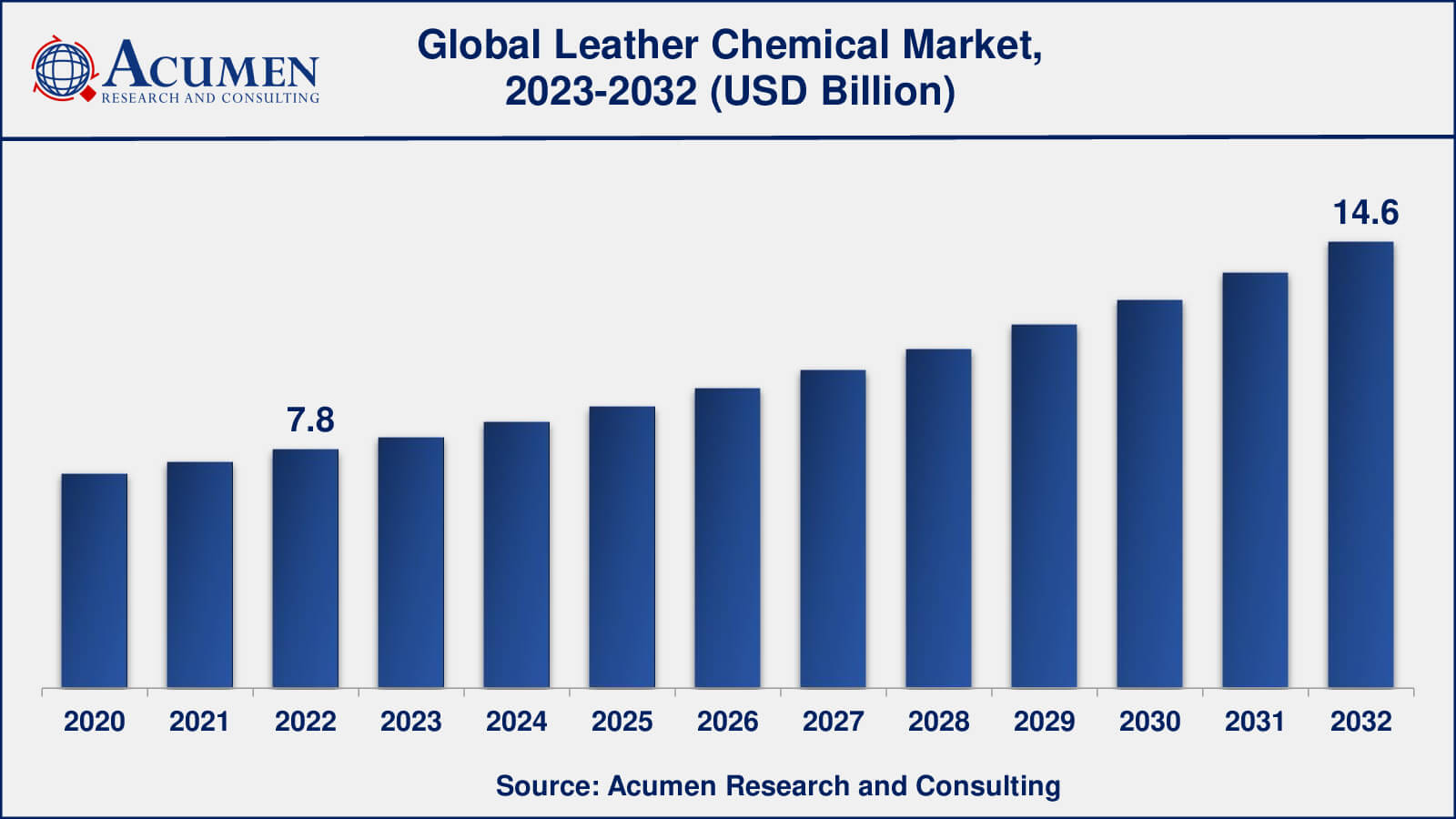

Leather Chemical Market Size accounted for USD 7.8 Billion in 2022 and is estimated to achieve a market size of USD 14.6 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

The Global Leather Chemical Market Size accounted for USD 7.8 Billion in 2022 and is estimated to achieve a market size of USD 14.6 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Leather Chemical Market Highlights

Leather chemicals are the products that are utilized for the treatment of animal hides in order to produce leather. These chemicals are necessary at various stages of leather processing that consist of beam house, tanning & finishing, fat liquors & water repellents, and drum dyeing. Leather chemicals are applied to leather products to improve their performance and functionality. They are essential in tanning, dyeing, and finishing processes, imparting desired properties to leather such as softness, durability, water resistance, flame retardancy, and colorfastness. The ability of leather chemicals to deliver the desired performance and functionality is an important consideration in their selection and use in leather processing. In the leather chemicals industry, sustainability is becoming increasingly important. There is a growing demand for eco-friendly and sustainable alternatives to leather production that reduce the environmental impact of the industry. To meet changing consumer preferences and regulatory requirements related to sustainability, leather chemical manufacturers are focusing on developing greener solutions such as bio-based chemicals, water-based products, and chemicals with lower environmental footprints.

Global Leather Chemical Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Leather Chemical Market Report Coverage

| Market | Leather Chemical Market |

| Leather Chemical Market Size 2022 | USD 7.8 Billion |

| Leather Chemical Market Forecast 2032 | USD 14.6 Billion |

| Leather Chemical Market CAGR During 2023 - 2032 | 6.5% |

| Leather Chemical Market Analysis Period | 2020 - 2032 |

| Leather Chemical Market Base Year | 2022 |

| Leather Chemical Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Process, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lanxess AG, BASF SE, TFL, Schill & Seilacher GmbH & Co., Balmer Lawrie & Co. Ltd., Clariant Chemicals Ltd., Pidilite Industries Ltd., ATC Chemicals, Texapel, Indofil Industries Ltd., Tytan, Elementis plc, DyStar, Zschimmer & Schwarz & Co KG, Lawrence International, Loving Group Ltd., Tasa Group International, Chemtan Company, Inc. and Stahl International BV. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Leather Chemical Market Insights

Increasing per capita income of individuals, growing consumer affluence, and growth in tourism industry are some of the key reasons which lead to the increase in demand for luxury and leather good items in the market. Fast changing fashion trends and increasing consumer awareness level towards luxury products further boosts the demand for leather goods in the market.

Additionally, advances in leather processing technologies and chemicals have improved the performance, quality, and durability of leather products. This has increased demand for leather chemicals that improve tanning, dyeing, and finishing processes, resulting in higher-quality leather products.

However, the leather industry is subject to stringent environmental, waste management and worker safety regulations. Compliance with these regulations can be costly and time-consuming, making it difficult for manufacturers and users of leather chemicals to develop and implement environmentally sustainable processes and products.

Furthermore, emerging economies, particularly in Asia Pacific and Latin America, are rapidly industrializing, driving up demand for leather chemicals used in the manufacture of leather goods. Rising manufacturing activities, expanding leather processing facilities, and favourable government policies are driving growth in these regions' leather chemicals markets.

Leather Chemical Market, By Segmentation

The worldwide market for leather chemical is split based on product, process, application, and geography.

Leather Chemical Products

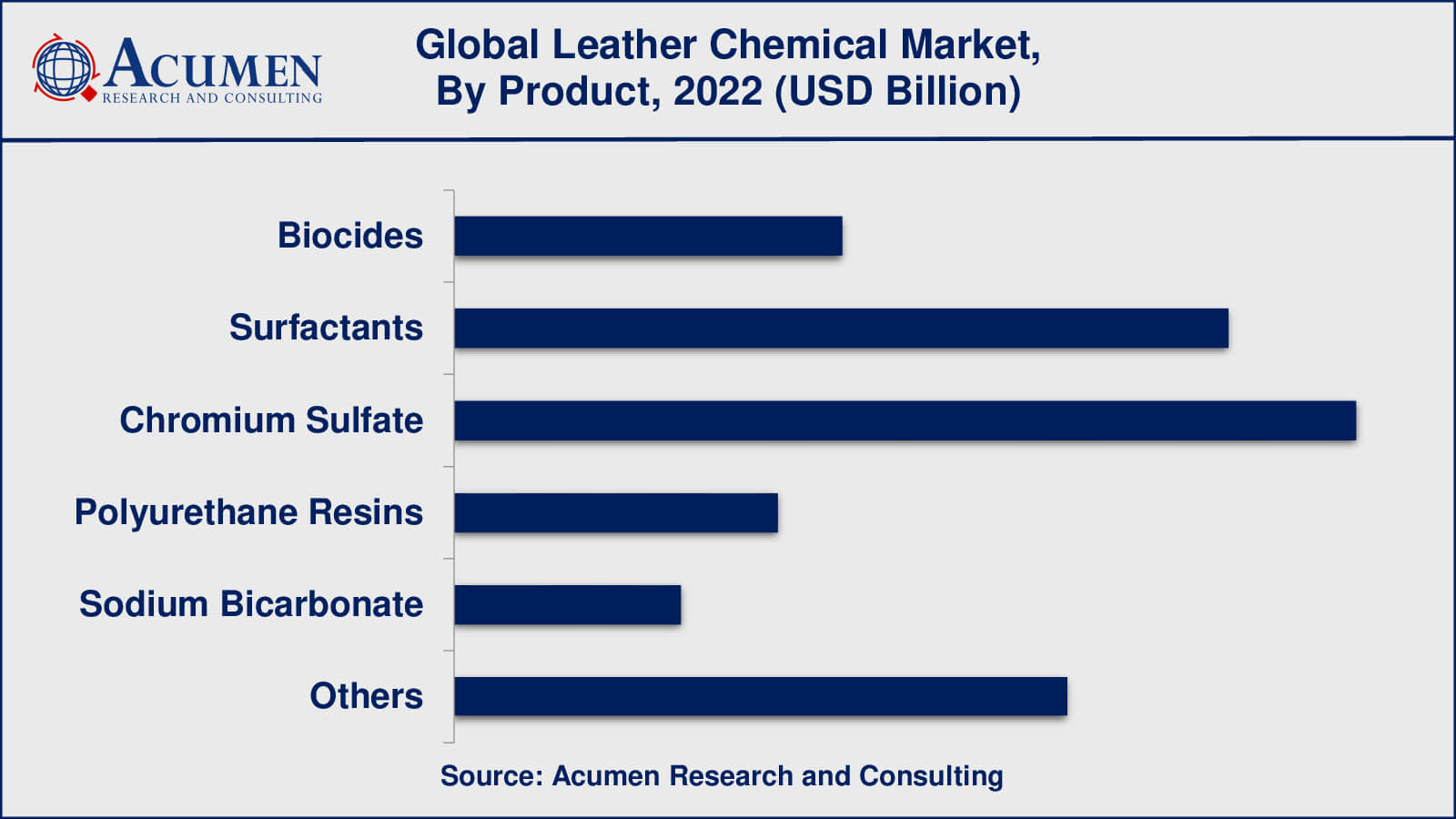

According to our research in the leather chemical industry, chromium sulphate is a key ingredient in the leather tanning process and is broadly used as a tanning agent to convert raw animal hides into leather. It gives leather properties like durability, water resistance, and heat stability, making it an important component in the leather manufacturing process.

Surfactants of various types, including anionic, cationic, and non-ionic types, are used in various stages of leather processing, including soaking, degreasing, and dyeing. They aid in the emulsification of fats and oils, the removal of impurities, and the penetration and distribution of chemicals in leather, making them an essential component of the leather chemicals portfolio. Other products used in the leather industry for specific applications include biocides, polyurethane resins, sodium bicarbonate, and other specialty chemicals, but their market share varies depending on regional preferences, technological developments, and regulatory requirements.

Leather Chemical Processes

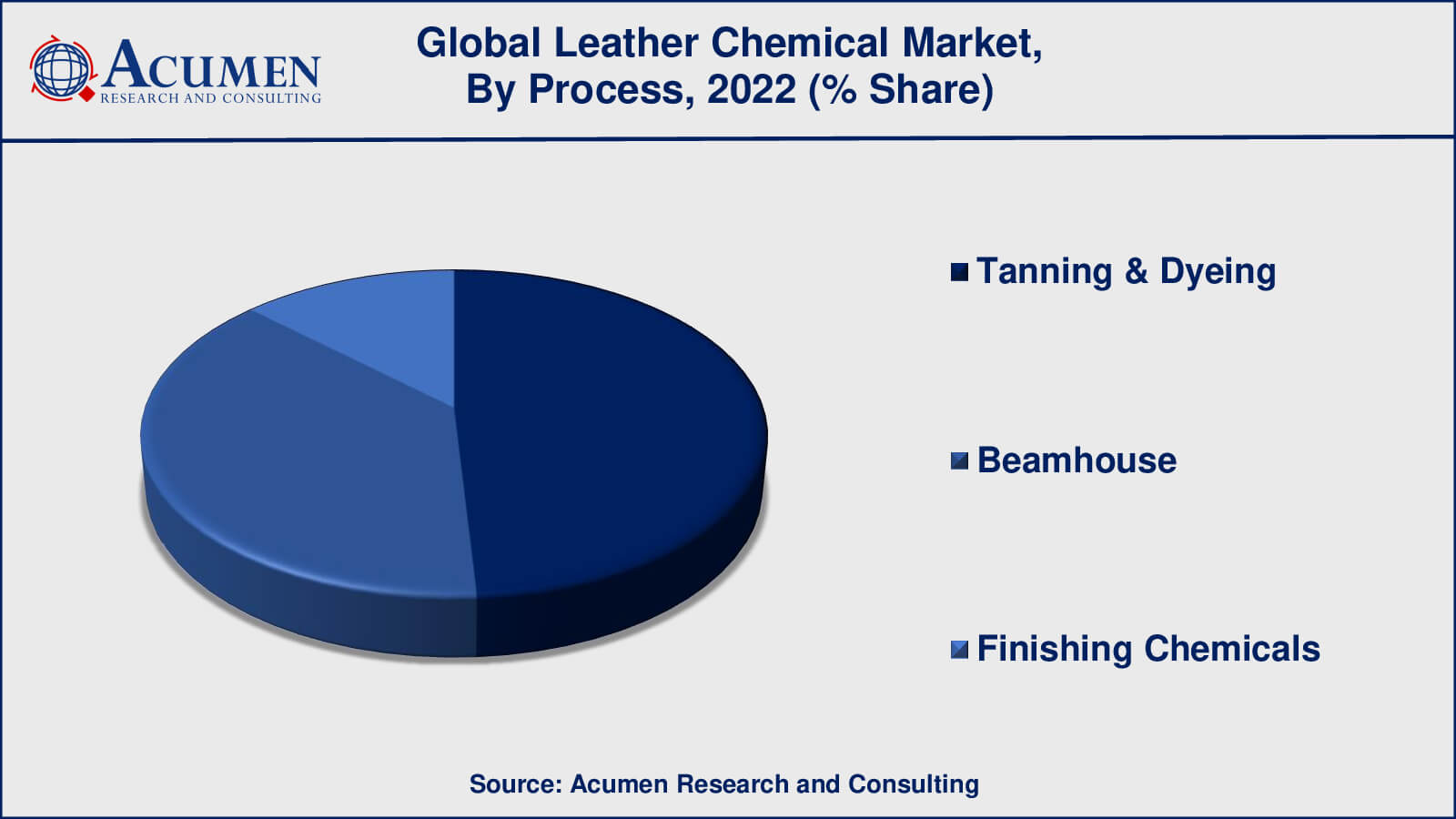

According to our leather chemical market forecast, the tanning and dyeing process, also known as the "wet-end" or "beamhouse" process, has historically dominated the leather chemicals market. This process involves treating raw animal hides with various chemicals to convert them into leather, including the use of tanning agents, dyestuffs, and other specialty chemicals. The tanning process imparts desirable properties to leather, such as increased durability, water resistance, and heat stability, making it suitable for various applications.

The beamhouse process is the initial stage of leather processing, where raw hides are cleaned, soaked, and treated with chemicals to remove hair, fats, and other impurities. Tanning agents are then used to convert the collagen fibers in the hides into a stable and flexible material, which is further dyed with dyestuffs to achieve the desired color. Finally, finishing chemicals are applied to enhance the appearance, feel, and performance characteristics of the leather.

Leather Chemical Applications

The leather chemicals market has historically been dominated by the footwear industry. Leather is a popular material for footwear manufacturing due to its desirable characteristics such as durability, comfort, and aesthetics. Leather chemicals are used in various stages of footwear production, such as tanning, dyeing, and finishing, to improve the quality, appearance, and performance of leather used in footwear.

In addition, upholstery is another important use for leather chemicals. Because of its luxurious feel, durability, and aesthetic appeal, leather is used in the production of upholstery for furniture, automotive interiors, and other seating applications. To meet the specific requirements of upholstery applications, such as softness, colour fastness, and wear and tear resistance, leather chemicals are used in the tanning, dyeing, and finishing processes.

Leather Chemical Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Leather Chemical Market Regional Analysis

The Asia-Pacific region has been a significant player in the leather chemicals market, driven by the presence of major leather manufacturing countries such as China, India, and Bangladesh. Rapid industrialization, increasing urbanization, and growing levels of disposable income in Asia-Pacific have led to increased demand for leather products, including footwear, upholstery, and leather goods. This has led to a strong demand for leather chemicals in the region. Additionally, favorable government policies, lower labour costs, and abundant availability of raw materials in Asia-Pacific have enticed investments in the leather industry, further catapulting the growth of the leather chemicals market in the region.

Europe is another prominent area in the leather chemicals market, with nations like Italy, Spain, and Germany being important participants in the leather manufacturing industry. Europe has a long-standing tradition of generating higher leather products, and there is a demand for leather chemicals for different applications, including automotive upholstery, luxury goods, and fashion garments. However, improving environmental regulations and growing consumer awareness regarding sustainability have contributed in stricter norms for the use of certain chemicals in leather processing in Europe.

Leather Chemical Market Players

Some of the top leather chemical companies offered in the professional report Lanxess AG, BASF SE, TFL, Schill & Seilacher GmbH & Co., Balmer Lawrie & Co. Ltd., Clariant Chemicals Ltd., Pidilite Industries Ltd., ATC Chemicals, Texapel, Indofil Industries Ltd., Tytan, Elementis plc, DyStar, Zschimmer & Schwarz & Co KG, Lawrence International, Loving Group Ltd., Tasa Group International, Chemtan Company, Inc. and Stahl International BV.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

April 2024

June 2024

December 2023