August 2021

The Global Lignin Market is poised for significant growth, projected to expand from USD 1.09 Billion in 2023 to USD 1.65 Billion by 2032 at a CAGR of 4.8%.

The Global Lignin Market Size accounted for USD 1.09 Billion in 2023 and is estimated to achieve a market size of USD 1.65 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Lignin Market Highlights

Lignin is a complex organic polymer found in plant cell walls, particularly in wood and bark, which provides structural support and rigidity. It is the second most abundant natural polymer, following cellulose. Lignin has a variety of applications, including the manufacturing of biofuels, in which it is transformed into energy. It is also used to make bioplastics, adhesives, and coatings, which are a more sustainable alternative to petroleum-based products. In addition, lignin is used in the paper and pulp industries as a byproduct of wood processing. Its potential for pharmaceuticals, carbon fibers, and environmental remediation is also being investigated.

Global Lignin Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Lignin Market Report Coverage

| Market | Lignin Market |

| Lignin Market Size 2022 |

USD 1.09 Billion |

| Lignin Market Forecast 2032 | USD 1.65 Billion |

| Lignin Market CAGR During 2023 - 2032 | 4.8% |

| Lignin Market Analysis Period | 2020 - 2032 |

| Lignin Market Base Year |

2022 |

| Lignin Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Source, By Product, By Raw Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Metsa Group, Rayonier Advanced Material, Sweetwater Energy, Burgo Group S.p.A, UPM Biochemicals, Valmet Corporation, Nippon Paper Industries Co., Ltd, Domsjo Fabriker, Changzhou Shanfeng Chemical Industry Co Ltd, Stora Enso, Liquid Lignin Company, West Fraser, The Dallas Group of America, Inc., Domtar Corporation, and Borregaard LignoTech. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Lignin Market Insights

The global lignin business is growing rapidly, with a promising future outlook. The implementation industry's rise, as well as the increased rate of modernization and urbanization, is expected to boost the lignin sector in the next years. Market leaders are likely to seek emerging countries around the world since they provide opportunities for growth. Furthermore, the increasing number of partnerships and strategic collaborations are expected to drive market expansion in the future years. For instance, Nippon Paper Industries Co., Ltd. formed a strategic partnership with Sumitomo Corporation and Green Earth Institute Co., Ltd. in February 2023 to manufacture the first commercially viable cellulosic bioethanol from woody biomass in Japan, with the goal of developing it into biochemical products. The alliance aims to leverage Japan's abundant forest resources to ensure energy security and self-sufficiency while also contributing to the country's efforts to establish a decarbonized society. Furthermore, due to increased air pollution, demand for dust control equipment is expected to boost sector growth during the projection period. For instance, according to Down-To-Earth Organization, in 2023, India's annual average PM2.5 concentration increased to 54.4 μg/m3, slightly higher than the previous year.

Rising automobile manufacturing in the United States, as well as new product releases, are expected to boost demand for lightweight materials like carbon fibers, resulting in increased lignin usage in the future years. Because of the growing number of plantations, timber production from forest and agricultural plantations is expected to increase, providing pulp wood and common saw timber. This is expected to result in an oversupply of raw materials, further boosting industry development over the projection period.

Additionally, consistent production-related technical developments are expected to propel the sector forward. Sulfur-free lignin is gaining popularity due to its increased flexibility. Annual renewability, economic benefits, and acceptable accessibility are expected to promote the use of non-sulfated lignin in thermosetting and thermoplastic processes. Growing demand for natural feed additives in livestock nutrition, as well as growing use in a variety of end-use industries including paints and adhesives, construction, oil and pulp production, will drive market growth.

Increasing technological advancements and rapid urbanization have motivated companies to develop high-quality concrete mixtures to reduce rain and humidity damage and improve building sustainability, potentially increasing business growth. Increased livestock production and demand for high-quality animal protein increased the need for natural and safe feed additives. From an early stage, the product plays a vital role in improving animal diets and provides high fiber content to provide energy to fight diseases. Additionally, insecticides and pesticides reduce microbial attacks and regulate plant development. High-quality animal protein advances have enabled companies to offer superior animal feed additives, which are expected to promote corporate growth.

It is naturally found in a variety of crops; however the chemical is thought to be a barrier to nutrient digestion, potentially limiting market growth. It disrupts digestive function and acts as an enzyme limitation. This has a significant impact on the animal's digestive cycle. Plants with high levels of these chemicals, such as roots, provide fewer digestibilities than plants with low levels. However, adequate material accessibility, economical feasibility, and organic features will encourage consumer supply. Growing demand for natural feed additives in pet health, as well as expanded application in a variety of end-use industries such as paints and adhesives, construction, oil and pulp production, will drive corporate growth.

Lignin Market Segmentation

The worldwide market for lignin is split based on source, product, raw material, application, and geography.

Lignin Sources

According to the lignin industry analysis, sulfite pulping is predicted to see significant expansion in the industry due to its capacity to produce high-purity lignosulfonates with a variety of uses. Lignosulfonates produced by sulfite pulping are widely utilized as dispersants, binders, and emulsifiers in industries such as construction, agriculture, and chemicals. The procedure also allows for the extraction of specific lignin types for advanced applications such as carbon fibers and bio-based polymers. The growing demand for environmentally acceptable and sustainable additives encourages the use of lignin from sulfite pulping operations.

Lignin Products

According to the lignin industry analysis, ligno-sulphonates was the largest category in 2023 and is predicted to continue dominating in the next years. Increased concrete output in the United States, China, and India is expected to drive demand for ligno-sulphonates as the building sector improves, encouraging segment development. The growing awareness of crude oil dependency has driven makers of BTX, phenolic resins, and carbon fibers to employ bio-based raw materials. This is expected to increase lignin production in the future years.

Demand for sulfur-free lignin is expected to rise as demand for dispersants rises in North America's automotive and concrete industries. Demand is expected to rise as the building and oil and gas sectors expand in this region. Increasing item implementation as a dust suppressor is expected to bring up new market growth opportunities. Extensive R&D to replace nonrenewable power sources in rising nations, like China and India, is expected to open up new business opportunities in the predictive age.

Lignin Raw Materials

According to the lignin market forecast, hardwood, as a raw material, is predicted to increase rapidly in market because to its high lignin content and higher extractability over other sources. Hardwood lignin is frequently employed in the production of high-performance dispersants, adhesives, and bio-based compounds that are in line with current sustainability trends. The availability of hardwood and its efficient processing in the pulp and paper sectors contribute to its growing popularity. Furthermore, its adaptability in applications such as carbon materials and biofuels drives up demand in the lignin industry.

Lignin Applications

According to the lignin market forecast, dispersants leads market because of their efficiency in enhancing particle dispersion in a variety of industrial processes. Lignin-based dispersants are commonly used in concrete admixtures to improve workability and reduce water consumption, making them essential in the construction sector. They are also used in agrochemicals, paints, and coatings to help stabilize compositions and avoid sedimentation. Their eco-friendliness and cost-effectiveness increase demand, cementing their leading position in the lignin market.

Lignin Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

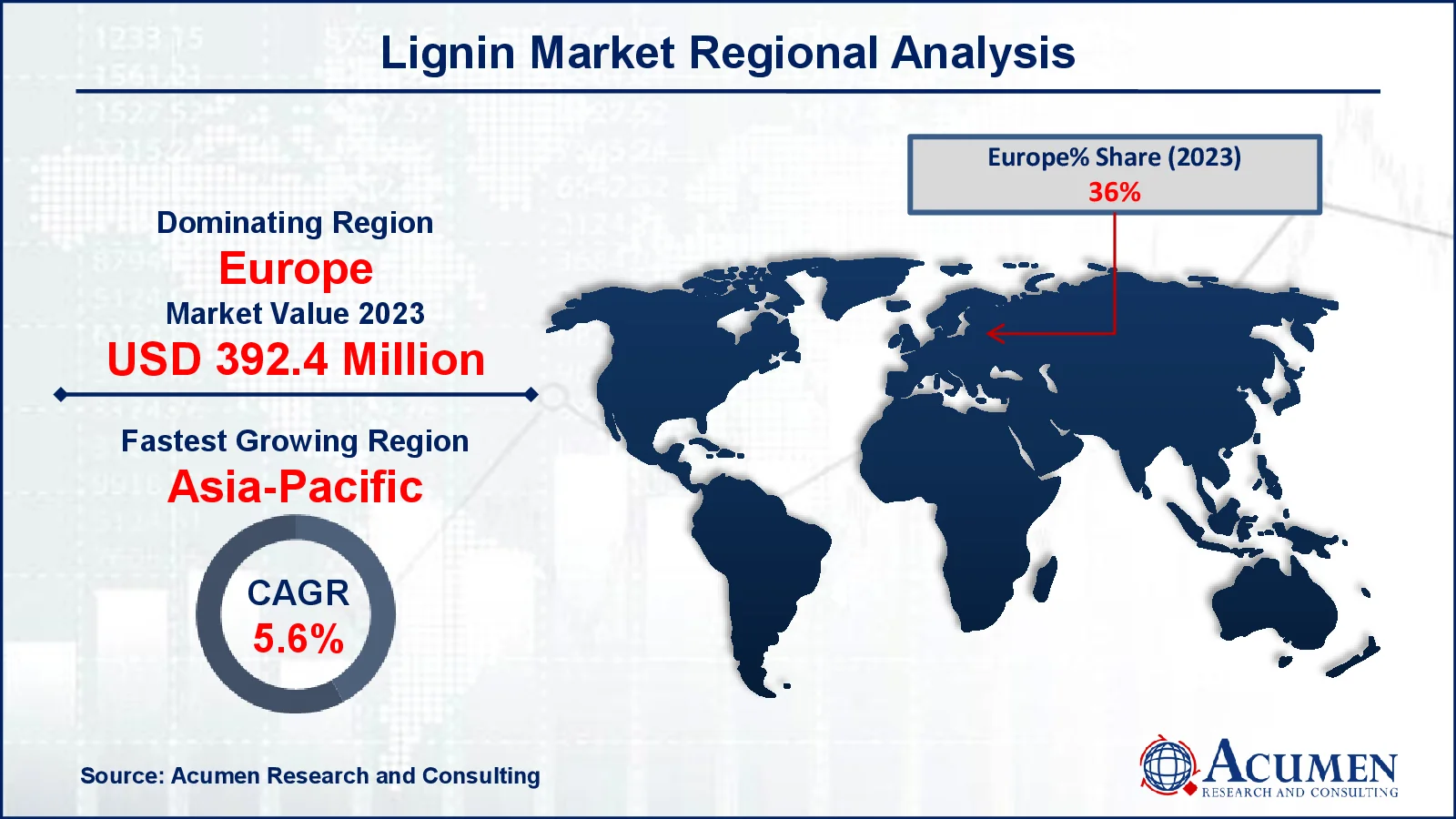

Lignin Market Regional Analysis

For several reasons, in 2023, Europe had the largest national economy. The region is likely to maintain its dominant role in the next years due to strict GHG emission restrictions combined with a strong bio-polymer industrial base in Germany, France, the Netherlands, and Belgium.

The growing demand for lightweight automotive products and bio-based materials in Europe is expected to have a positive market impact. Furthermore, greater use in aromatic applications and extensive R&D are expected to aid regional growth. The presence of a large-scale chemical manufacturing sector in Asia Pacific is expected to play a significant role in fostering growth during the projection period. Macromolecules were the most popular consumer implementation category because to increased consumption of activated carbon, binders, composites, preservatives, and polyols.

The growing trend among US chemical businesses to use bio-based raw materials in product manufacturing is expected to stimulate bio-refinery deployment, raising customer demand as a catalyst. Furthermore, growth in the building renovation industry is expected to propel the market forward.

Lignin Market Players

Some of the top lignin companies offered in our report include Metsa Group, Rayonier Advanced Material, Sweetwater Energy, Burgo Group S.p.A, UPM Biochemicals, Valmet Corporation, Nippon Paper Industries Co., Ltd, Domsjo Fabriker, Changzhou Shanfeng Chemical Industry Co Ltd, Stora Enso, Liquid Lignin Company, West Fraser, The Dallas Group of America, Inc., Domtar Corporation, and Borregaard LignoTech.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2021

September 2023

August 2022

July 2023