March 2023

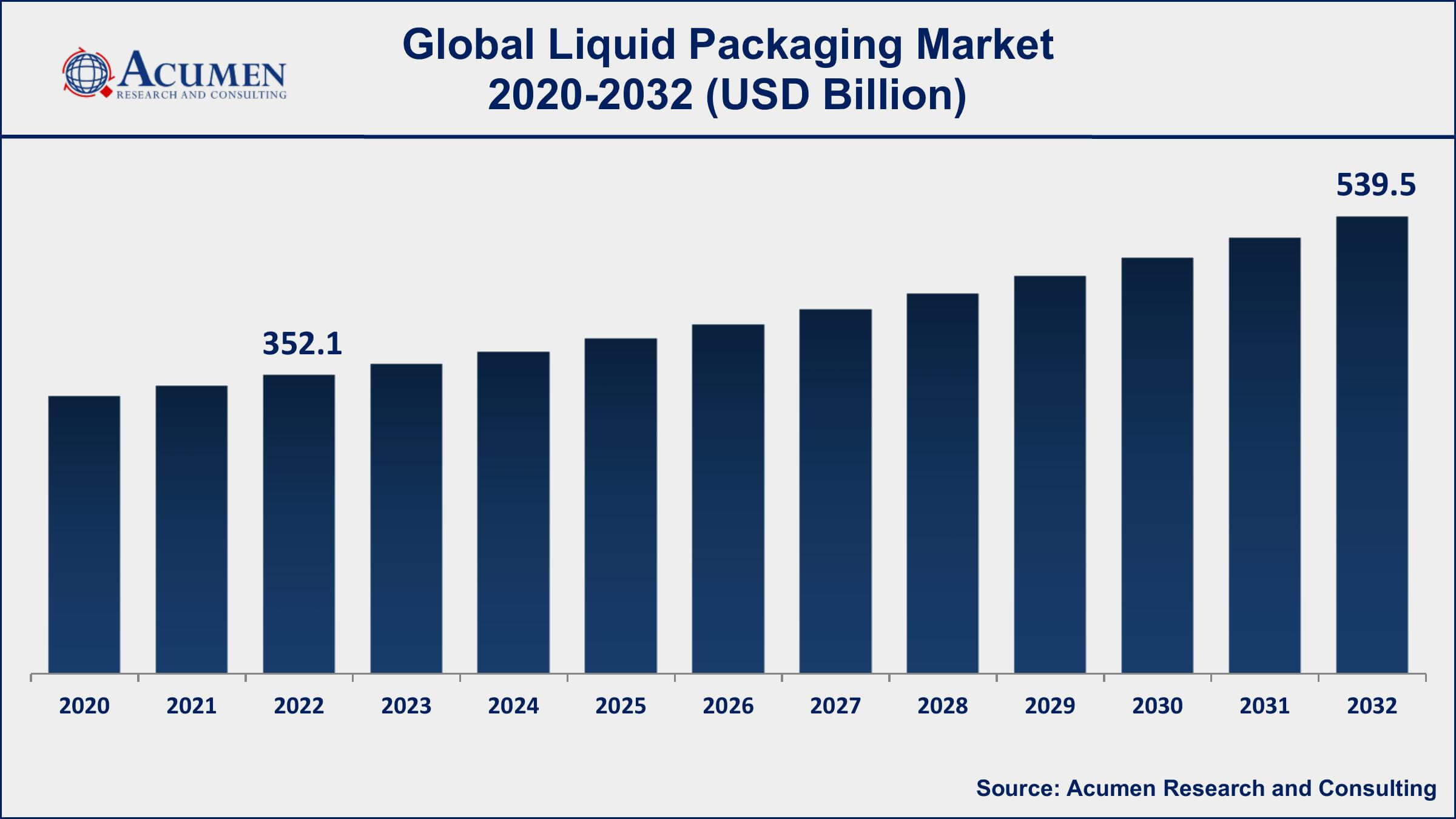

Liquid Packaging Market Size accounted for USD 352.1 Billion in 2022 and is projected to achieve a market size of USD 539.5 Billion by 2032 growing at a CAGR of 4.4% from 2023 to 2032.

The Global Liquid Packaging Market Size accounted for USD 352.1 Billion in 2022 and is projected to achieve a market size of USD 539.5 Billion by 2032 growing at a CAGR of 4.4% from 2023 to 2032.

Liquid Packaging Market Report Key Highlights

Liquid packaging refers to the process of packing and containing liquid products for storage, transportation, and distribution. The packaging of liquid products is essential to ensure that they remain safe, fresh, and of high quality throughout their shelf life. Liquid packaging comes in various forms, including bottles, jars, pouches, and cartons, among others. The packaging materials used for liquid packaging may vary depending on the product's nature, but some common materials include plastics, glass, and metal.

The global liquid packaging market has been growing steadily over the past few years due to the increasing demand for convenient and eco-friendly packaging solutions. The market is driven by factors such as the growing population, rising disposable incomes, and changing lifestyles that have led to an increase in the consumption of packaged goods. Additionally, technological advancements in the packaging industry have led to the development of lightweight, durable, and innovative liquid packaging solutions, which have further boosted market growth.

Global Liquid Packaging Market Trends

Market Drivers

Market Restraints

Market Opportunities

Liquid Packaging Market Report Coverage

| Market | Liquid Packaging Market |

| Liquid Packaging Market Size 2022 | USD 352.1 Billion |

| Liquid Packaging Market Forecast 2032 | USD 539.5 Billion |

| Liquid Packaging Market CAGR During 2023 - 2032 | 4.4% |

| Liquid Packaging Market Analysis Period | 2020 - 2032 |

| Liquid Packaging Market Base Year | 2022 |

| Liquid Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By Packaging Type, By Technique, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Smurfit Kappa Group, Comar LLC, Klabin Paper, Liqui-Box Corporation, BillerudKorsnäs AB, International Paper Company, Nippon Paper Industries Co., Ltd., Evergreen Packaging Inc., The DOW Chemical Company, Tetra Laval International S.A., and Mondi PLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

One of the key factors driving the growth of the global liquid packaging market is the increasing inclination of consumers toward packaged drinks and food products. A fast-paced lifestyle as well as better convenience of packaged drinks as compared to other packaging methods such as glass bottles is another major factor fueling the liquid packaging market growth. Plastic packaging is one of the key alternatives and major competitors for carton packaging for drinks. Moreover, carton packaging scores much on recyclability and environmental grounds. In addition, consumers seek environmentally friendly modes of packaging which could be another major aspect anticipated to boost the market expansion. Also, in the long run, the feasible recyclability of liquid packages helps in reducing overall municipal wastage and brings down the total cost of production.

The global liquid packaging market is mainly regulated by changing economics, sustainability, and demographics. Asia-Pacific is considered home to the largest population in the world and is also considered the fastest-growing market for liquid packaging products. The rapid growth of population in countries such as India, China, Pakistan, Thailand, and Indonesia coupled with the increasing per capita disposable incomes has resulted in the rapid growth of the liquid food industry, which in turn is driving the growth of the liquid packaging market. While North America is witnessing stagnation in the global market, the growth in Europe is anticipated to be feasibly moderate. Latin America, Russia, Asia-Pacific, and Africa are considered to be the key regions driving the growth of the liquid packaging market value over the forecast period.

Liquid Packaging Market Segmentation

The global liquid packaging market segmentation is based on raw material, packaging type, technique, end-use, and geography.

Liquid Packaging Market By Raw Material

According to our liquid packaging industry analysis, the plastic segment held the largest market share in 2022. Plastic is widely used in liquid packaging due to its lightweight, durability, and cost-effectiveness. Some of the commonly used plastic materials in liquid packaging include polyethylene terephthalate (PET), polypropylene (PP), and high-density polyethylene (HDPE). One of the major drivers of the plastic segment in the market is its low cost compared to other materials like glass or metal. Additionally, plastic packaging is easy to produce, transport, and store, making it a convenient choice for manufacturers and consumers. Another driver of the plastic segment is the increasing demand for eco-friendly and sustainable packaging solutions, leading to the development of biodegradable and compostable plastic materials.

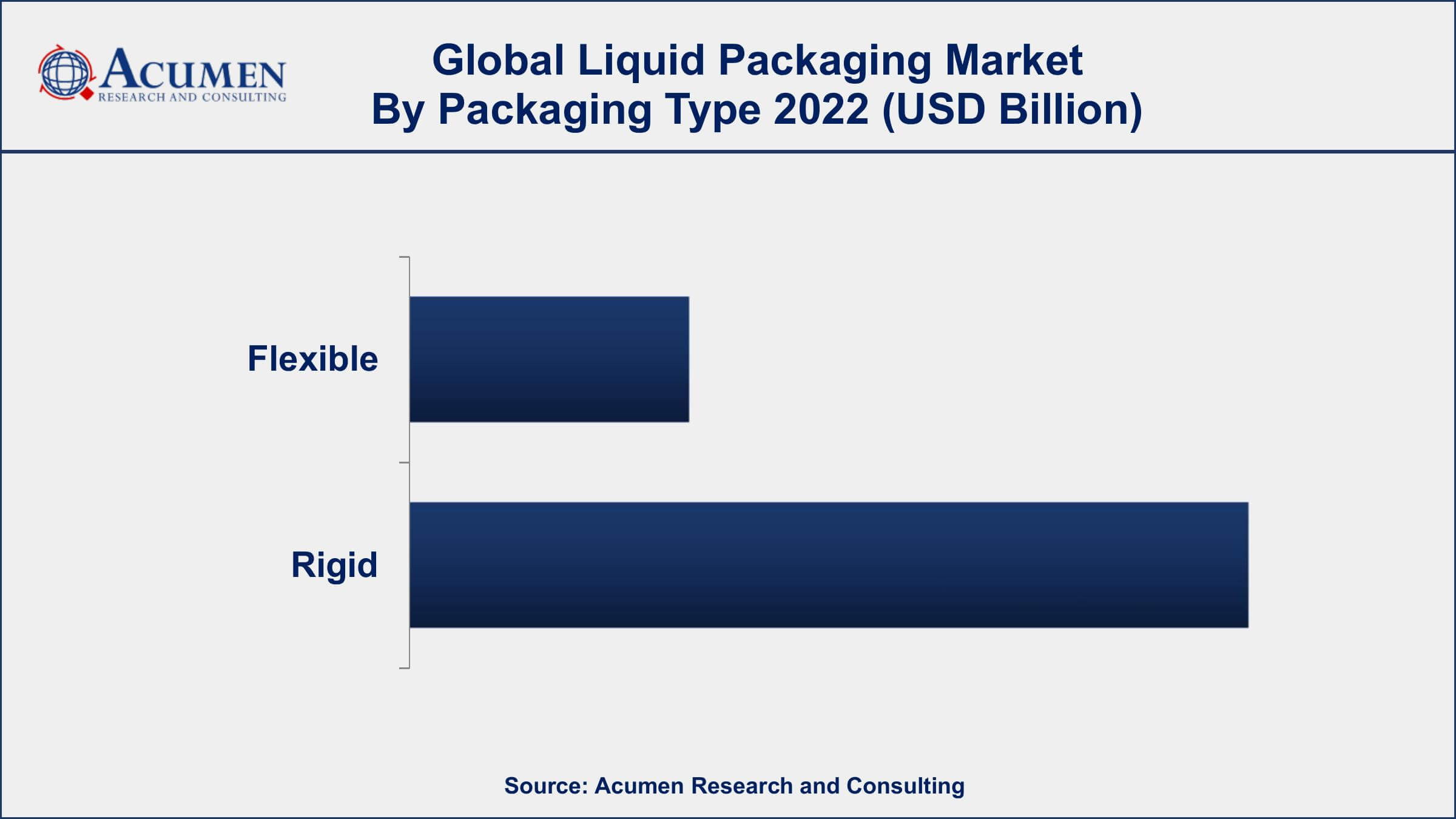

Liquid Packaging Market By Packaging Type

In terms of technologies, the rigid segment is a crucial raw material of the liquid packaging market growth. Rigid packaging refers to containers that maintain their shape, even when they are empty. Rigid packaging materials are typically used for packaging liquid products that require higher levels of protection during transport and storage, such as carbonated drinks, dairy products, and pharmaceuticals. The major materials used for rigid liquid packaging include plastic, metal, and glass. Plastic is the most widely used material in the rigid segment, followed by metal and glass. The plastic materials used for rigid liquid packaging include PET, PP, HDPE, and polycarbonate (PC). The demand for the rigid segment in the liquid packaging market is driven by several factors, including the high demand for convenience, portability, and durability.

Liquid Packaging Market By Technique

According to the liquid packaging market forecast, the aseptic packaging segment is expected to witness a considerable growth rate in the coming years. Aseptic packaging is a technique used for preserving liquids and other products by sterilizing them and packaging them in sterile containers, thereby ensuring the preservation of the product's quality and freshness without the need for refrigeration. The major materials used for aseptic packaging include plastic, metal, and paper-based materials such as cartons. The most commonly used aseptic packaging materials are Tetra Pak cartons, which are made from multiple layers of paperboard, aluminum, and plastic. Other materials used for aseptic packaging include PET, PP, and HDPE.

Liquid Packaging Market By End-use

In terms of the end-user, the food & beverage segment dominates the liquid packaging market in 2022. The food and beverage industry is the largest end-user of liquid packaging materials, and it includes a wide range of products, including juices, dairy products, soft drinks, alcoholic beverages, and water. The demand for liquid packaging in the food and beverage segment is driven by several factors, including the increasing demand for convenience, portability, and longer shelf life. Additionally, the demand for packaged food and beverages is increasing due to the busy and fast-paced lifestyle of consumers, and the growing preference for healthy and natural products. The major materials used for liquid packaging in the food and beverage segment include plastic, metal, and paper-based materials such as cartons.

Liquid Packaging Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Liquid Packaging Market Regional Analysis

The Asia-Pacific region dominates the liquid packaging market, accounting for a significant share of the global market. The region's dominance can be attributed to several factors, including the growing demand for packaged food and beverages, increasing urbanization, and the rising population in the region. One of the key factors driving the demand for liquid packaging in the Asia-Pacific region is the increasing demand for convenience and portability. The region has a large and growing middle class with busy and fast-paced lifestyles, which has led to an increase in demand for packaged food and beverages. Additionally, the region's large and growing population, particularly in countries like China and India, has also contributed to the growing demand for liquid packaging.

Liquid Packaging Market Player

Some of the top liquid packaging market companies offered in the professional report includes Smurfit Kappa Group, Comar LLC, Klabin Paper, Liqui-Box Corporation, BillerudKorsnäs AB, International Paper Company, Nippon Paper Industries Co., Ltd., Evergreen Packaging Inc., The DOW Chemical Company, Tetra Laval International S.A., and Mondi PLC.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

April 2020

March 2020

April 2025