November 2018

Medical Equipment Calibration Services Market Size accounted for USD 1,271.3 Million in 2021 and is projected to achieve a market size of USD 3,314.5 Million by 2030 rising at a CAGR of 10.2% from 2022 to 2030.

The Global Medical Equipment Calibration Services Market Size accounted for USD 1,392.5 Million in 2021 and is projected to achieve a market size of USD 3,314.5 Million by 2030 rising at a CAGR of 10.2% from 2022 to 2030. Medical equipment calibration is done to reduce uncertainty in measurements, reduce errors, and bring precise measurements because a drift in measurement is absolutely unacceptable in the medical industry. Calibration is also required for medical equipment/industry used in hospitals for patient monitoring and treatment in order to have confidence in its functioning and operation.

Medical Equipment Calibration Services Market Report Statistics

Impact of COVID-19 on Medical Equipment Calibration Services Market Value

The COVID-19 pandemic has presented unique challenges to all businesses and industries. Maintenance and calibration of hospital equipment went for a toss in order to maintain regulatory compliance and ensure the health and safety of patients. Furthermore, the crisis has compelled the medtech industry to quickly recalibrate across the value chain in order to meet the critical needs of healthcare.

Global Medical Equipment Calibration Services Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Medical Equipment Calibration Services Market Report Coverage

| Market | Medical Equipment Calibration Services Market |

| Medical Equipment Calibration Services Market Size 2021 | USD 1,392.5 Million |

| Medical Equipment Calibration Services Market Forecast 2030 | USD 3,314.5 Million |

| Medical Equipment Calibration Services Market CAGR During 2022 - 2030 | 10.2% |

| Medical Equipment Calibration Services Market Analysis Period | 2018 - 2030 |

| Medical Equipment Calibration Services Market Base Year | 2021 |

| Medical Equipment Calibration Services Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Service, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Fluke Biomedical, Spectrum Technologies (Transcat Company), Industrial Calibration and Service Company, Inc., Custom Calibration, Inc., Calibration Laboratory, LLC., Morehouse Instrument Company, Inc., Strainsert, Inc., and Sierra Instruments, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Medical Equipment Calibration Services Market Growth Factors

Market Drivers

Stringent Regulations Imposed By the Authorized Bodies Bolster the Growth of Global Market

As with any medical device or machine, wear and tear over time has a direct impact on accuracy and performance. Periodic calibration is required to maintain the equipment's effectiveness and reduce the risk of causing harm to a patient. The Food and Drug Administration (FDA) has imposed stringent regulations on medical device companies regarding the establishment of standard operating procedures (SOP) that include instructions and acceptable limits for accuracy and precision. According to the NHSRC report, medical equipment testing and calibration can be done in accordance with a variety of national and international standards, including IEC606.1, EN60601.2.4, EN61010, VDE0751, MDADB9801, HE95, ANSI/AAMI, and others. This is possible for nearly all medical equipment, including defibrillators, pulse oximeters, infusion pumps, patient simulators, ventilators, fetal monitors, and patient monitors.

Rising Number of Calibration of Services Due To Calibration Service Subscriptions Offered By the Authorized Bodies Drive the Global Medical Equipment Calibration Services Market

According to a Food and Drug Administration (FDA) report, there is an accreditation scheme for conformity assessment (ASCA). The FDA grants ASCA Recognition to qualified accreditation bodies to accredit testing laboratories to perform premarket testing for medical device companies under the ASCA Pilot. The Pilot intends to increase consistency and predictability in the FDA's approach to assessing conformity with respect to FDA-recognized consensus standards and test methods eligible for inclusion in the ASCA pilot in medical device premarket by relying on international conformity assessment standards and a set of FDA-identified ASCA program specifications.

Medical Equipment Calibration Services Market Segmentation

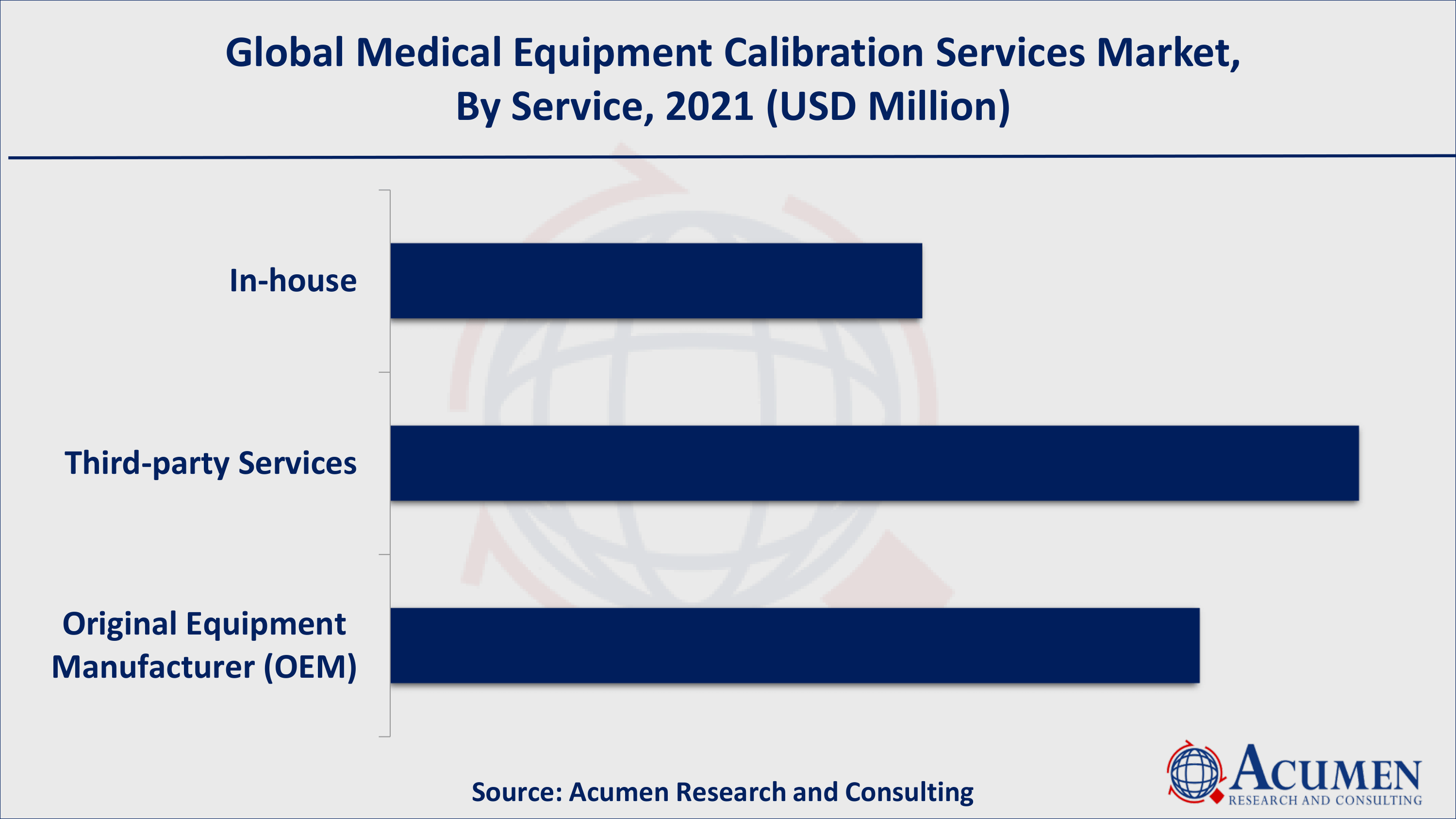

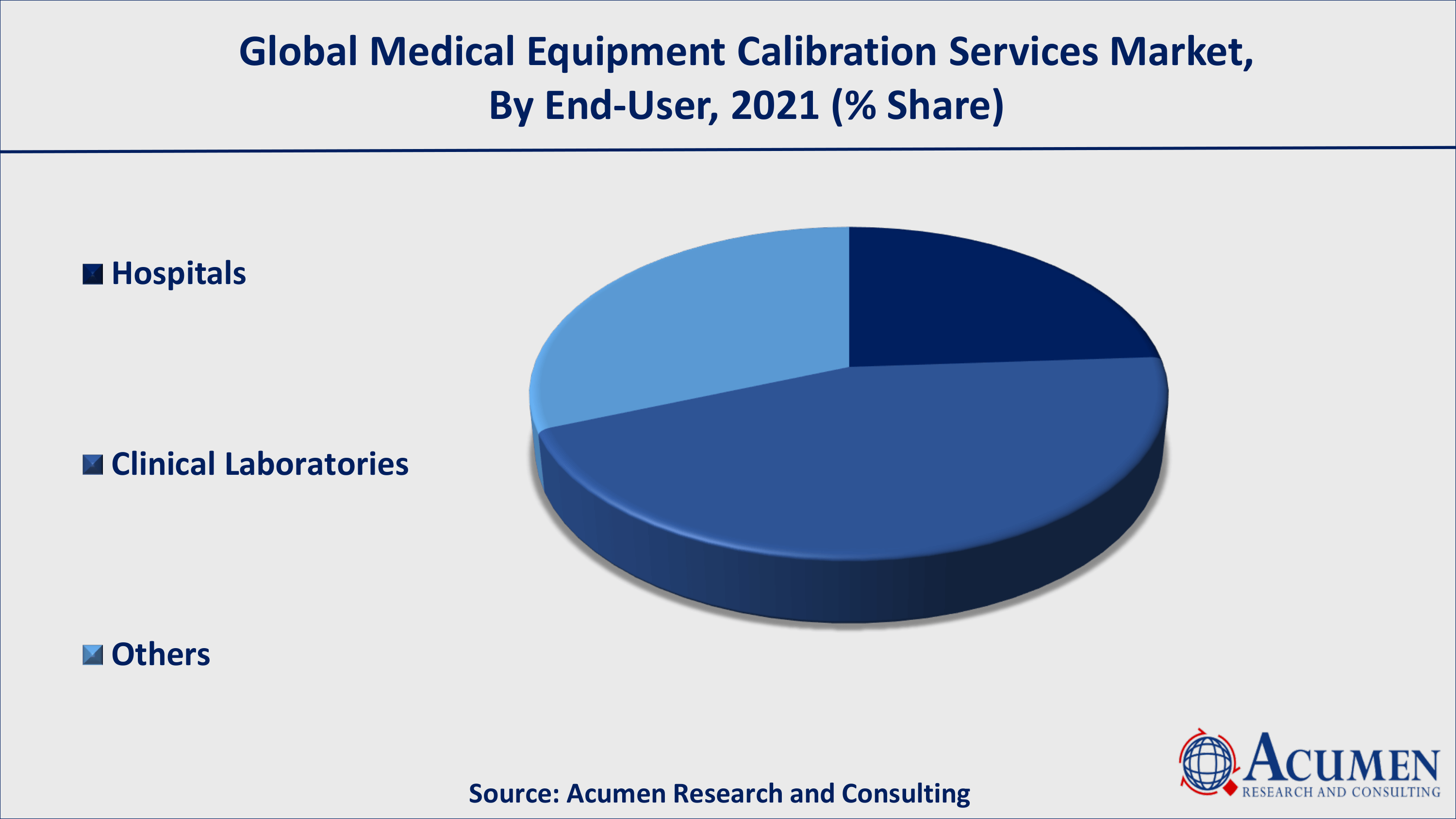

The global medical equipment calibration services market is segmented as service and end-user. Based on service, the market is segmented as in-house, third-party services, and original equipment manufacturer (OEM). By end-user, the market is segregated as hospitals, clinical laboratories, and among others.

Medical Equipment Calibration Services Market By Service

In terms of service, the third-party calibration service segment dominated the overall market in 2020, with a reasonable share that is expected to continue throughout the forecast period. According to the IJEAT report, the academic hospital has both in-house and independent service provider (third party) contracts because it has a reasonable annual cost of medical equipment (US$433) and very low downtime and turnaround time (1.2 and 1.5) days. As per our Medical Equipment Calibration Services industry analysis, such factors foster segmental growth ultimately contributing to the growth of the global Medical Equipment Calibration Services market.

Medical Equipment Calibration Services Market By End-User

According to end-user, the hospital segment has historically accounted for the highest revenue share and is expected to continue in this manner throughout the forecast period. When the downtime in the three hospitals is compared, the academic hospital has the lowest COSR (3.7%), the shortest downtime (1.2 days), and the shortest turnaround time (1.5 days). According to our Medical Equipment Calibration Services market forecast, such factors stimulate the segmental growth ultimately contributing growth of global Medical Equipment Calibration Services market.

Medical Equipment Calibration Services Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Medical Equipment Calibration Services Market Regional Analysis

North America Takes a Forefront Lead in the Medical Equipment Calibration Services Market

North America has dominated the equipment calibration service market in the past and is expected to do so again during the forecast period. As medical equipment maintenance is required in North American provinces due to stringent regulations, it is one of the major factors contributing to regional growth. For example, the regulations of the US Centre for Medicare and Medicaid Services (CMS), USFDA, and OEMs, as well as the accreditation requirements of the Healthcare Facilities Accreditation Program HFAP, Det Norske Veritas (DNV), and The Joint Commission (TJC) require hospitals in the region to adhere to equipment maintenance. Furthermore, rising awareness for preventive medical equipment maintenance stimulates the Medical Equipment Calibration Services market in the North America regional market, which is ultimately responsible for the market's overall growth.

Asia Pacific, on the other hand, is expected to have the fastest growing CAGR in the coming years. For example, according to a report released by the Australian Trade and Investment Commission, Australia's health and medical industry has grown dramatically in size and reputation over the last decade, thanks to strong R&D support, a robust healthcare system, professional skills, and other factors. The therapeutic goods administration regulates the medical device industry (TGA). Furthermore, Australia's medical device industry is listed as having distinct competitive advantages due to its shorter time to market when compared to other drug discovery; it has established a significant position within the APAC regional market.

Apart from that, China and India have already established a significant position and are growing at twice the rate of the overall market, owing to favorable healthcare reforms, local government incentives, and rising demand for healthcare. Furthermore, both countries are transforming into rapid innovation hubs by localizing innovation and manufacturing, implementing country-specific distribution models and sales channels, investing in local technology infrastructure, and collaborating with domestic value chain stakeholders. Such factors have a positive impact on the growth of the APAC regional market, ultimately contributing to the overall growth.

Medical Equipment Calibration Services Market Players

Some of the global medical equipment calibration services companies include Fluke Biomedical, Spectrum Technologies (Transcat Company), Industrial Calibration and Service Company, Inc., Custom Calibration, Inc., Calibration Laboratory, LLC., Morehouse Instrument Company, Inc., Strainsert, Inc., and Sierra Instruments, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2018

March 2021

May 2018

February 2020