August 2023

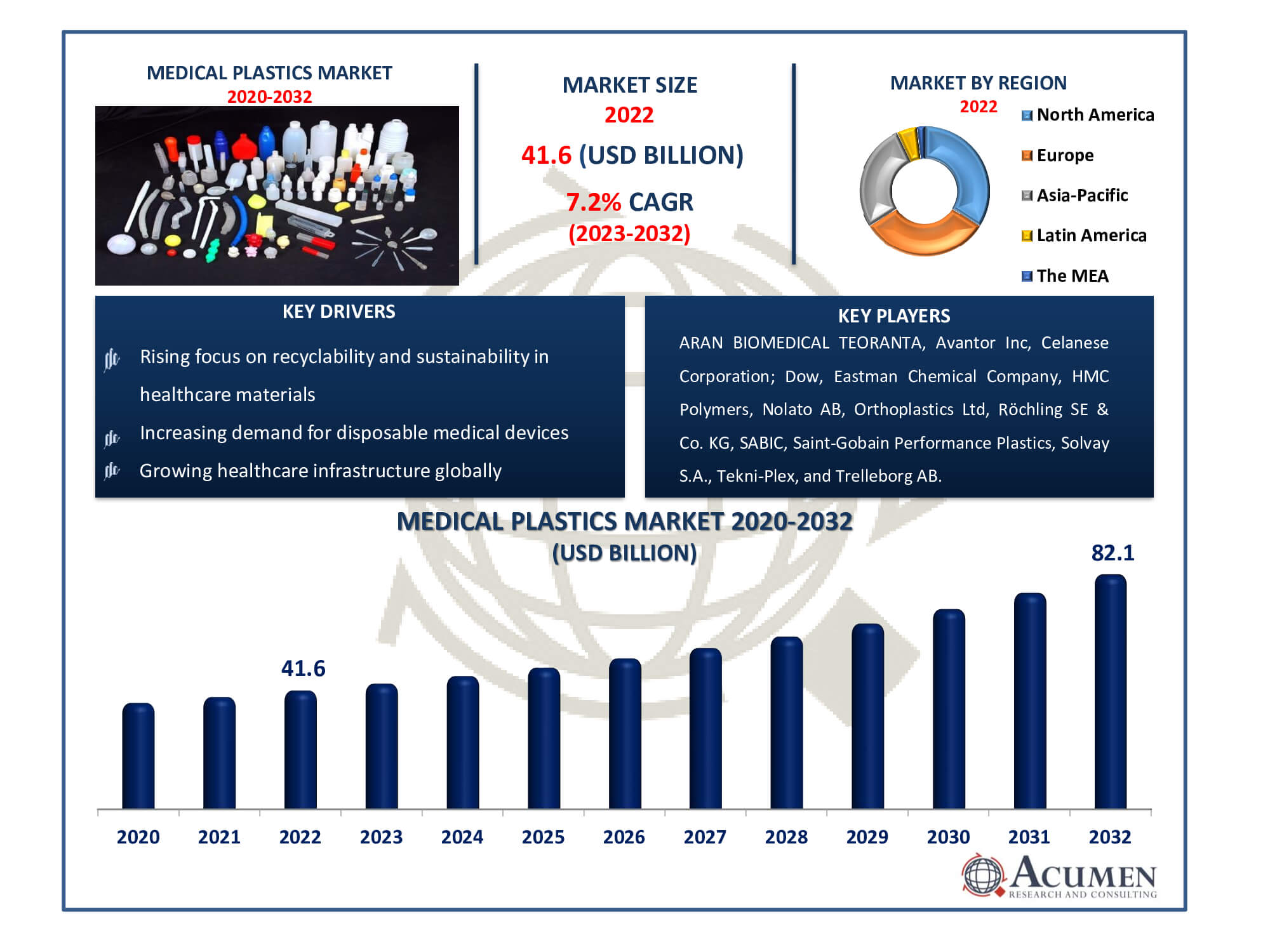

Medical Plastics Market Size accounted for USD 41.6 Billion in 2022 and is estimated to achieve a market size of USD 82.1 Billion by 2032 growing at a CAGR of 7.2% from 2023 to 2032.

The Medical Plastics Market Size accounted for USD 41.6 Billion in 2022 and is estimated to achieve a market size of USD 82.1 Billion by 2032 growing at a CAGR of 7.2% from 2023 to 2032.

Medical Plastics Market Highlights

Medical plastics are a specialized class of materials designed specifically for use in healthcare equipment, devices, and packaging due to their unique properties, including transparency, sterility, durability, flexibility, and biocompatibility. These polymers, recognized for their flexibility during manufacturing, offer a lightweight, organic, and cost-effective alternative to traditional materials like titanium or stainless steel in medical equipment. They significantly improve the performance of healthcare tubes, especially disposable ones, and effectively replace metal components in various medical devices. Medical plastics find extensive application in catheters, sprayers, dental tools, diagnostics, medicinal supplies, implants, medical bags, and surgical instruments.

Global Medical Plastics Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Medical Plastics Market Report Coverage

| Market | Medical Plastics Market |

| Medical Plastics Market Size 2022 | USD 41.6 Billion |

| Medical Plastics Market Forecast 2032 | USD 82.1 Billion |

| Medical Plastics Market CAGR During 2023 - 2032 | 7.2% |

| Medical Plastics Market Analysis Period | 2020 - 2032 |

| Medical Plastics Market Base Year |

2022 |

| Medical Plastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Process Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ARAN BIOMEDICAL TEORANTA, Avantor Inc, Celanese Corporation, Dow, Eastman Chemical Company, HMC Polymers, Nolato AB, Orthoplastics Ltd, Röchling SE & Co. KG, SABIC, Saint-Gobain Performance Plastics, Solvay S.A., Tekni-Plex, and Trelleborg AB. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Plastics Market Insights

The global demand for medical plastic products, such as disposable medical devices like bedpans, inhalation masks, and IV tubes, is expected to rise. Medical plastics offer advantages in producing tools, surgical wraps, irrigation bottles, and examination gloves, making ongoing sterilization easier. The manufacturing of medical instruments benefits significantly from medical-grade plastics due to their recyclability. These plastics, used in orthopedic appliances, artificial corneas, hearing aids, and catheters, are lightweight and highly recyclable. Concerns about health regulations regarding plastic use have prompted governing bodies worldwide to focus on regulation. However, medical plastics' high recyclability minimizes environmental impact. This factor significantly drives the global medical plastics market.

The emergence of 3D printing in creating patient-specific prosthetic limbs and orthotic braces, especially in developing countries, is projected to further boost the medical plastic market. Manufacturers worldwide aim to reduce production costs for prosthetics. Leveraging 3D printing technology allows for the customization of medical implants for body parts like knees, hips, ankles, spinal cords, and the skull. Additionally, this technology can produce sterile instruments such as forceps, hemostats, scalpel handles, and clamps.

The rising demand for medical devices, coupled with the increasing number of insured individuals in the US, is anticipated to positively impact the sector's growth in the coming years. Additionally, the market is characterized by numerous companies engaged in manufacturing advanced-grade plastics tailored for the healthcare industry. The industry demonstrates comprehensive integration across different stages of the value chain. HELM AG, for instance, integrates all four stages from raw material production to plastics manufacturing and the creation of final products used by hospitals, healthcare institutions, and private clinics. Regulation of such polymers is overseen by various agencies worldwide. The European Council Directive 93/42/EEC provides guidance on medical device consumption, and restructuring of European regulations for these devices significantly influences industry growth in the region.

Technological advancements in the healthcare sector drive continuous progress in the manufacture of advanced plastics. Companies prioritize new product development as a leading strategy for market expansion and invest significantly in research and development to create innovative products. Intense industry competition is likely to enhance consumer purchasing power, primarily influenced by factors such as product quality and cost competitiveness. This increase in buyer power is expected to drive production volumes due to the easy availability of medical plastics. In the US, governing agencies have shown a growing inclination towards plastic recycling. Federal investments in healthcare research and development initiatives are also expected to stimulate industry growth, fostering advancements in the medical field.

Medical Plastics Market Segmentation

The worldwide market for medical plastics is split based on type, process technology, application, and geography.

Medical Plastic Types

The medical plastics industry is dominated by the polyvinyl chloride (PVC) sector. Its affordability and adaptability are credited with its broad use, providing a durable yet flexible solution that is essential for a range of medical uses. Because PVC can be moulded into a wide range of shapes, it is widely used in the production of medical tubing, blood bags, intravenous components, and flexible containers. Its suitability for sterilisation procedures further increases its allure for essential medical equipment. The PVC segment holds a dominant market position in the medical plastics industry due to its capacity to offer dependable, reasonably priced, and versatile solutions for an extensive range of medical supplies and devices.

Medical Plastic Process Technologies

According to medical plastics market analysis, the most widely used process technology in the medical plastics industry is injection moulding. Its dominance stems from its great reproducibility and efficient production of precise and complex medical components. This process provides excellent control over dimensions, making it possible to create complex designs that are essential for syringes, surgical tools, medical equipment, and other complex parts. The technique is a desirable option because of its speed, scalability, and versatility in handling different materials. Because injection moulding can produce consistently high-quality products, it is the preferred process method for producing medical plastics in the healthcare industry, which has strict quality standards.

Medical Plastic Applications

The medical components division controls the majority of the medical plastics market due to its widespread usage in a wide range of medical equipment. Surgical instruments, diagnostic instruments, tubing, connectors, housings, and other essential parts are all included in this broad category of components. They are important because they are multipurpose and indispensable in the healthcare industry, which guarantees their widespread use in the production of accurate, robust, and frequently intricate components that are essential to the dependability and performance of medical equipment. The reason behind their prominence as the biggest category in the medical plastics market is the need for reliable, superior medical components.

Medical Plastics Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

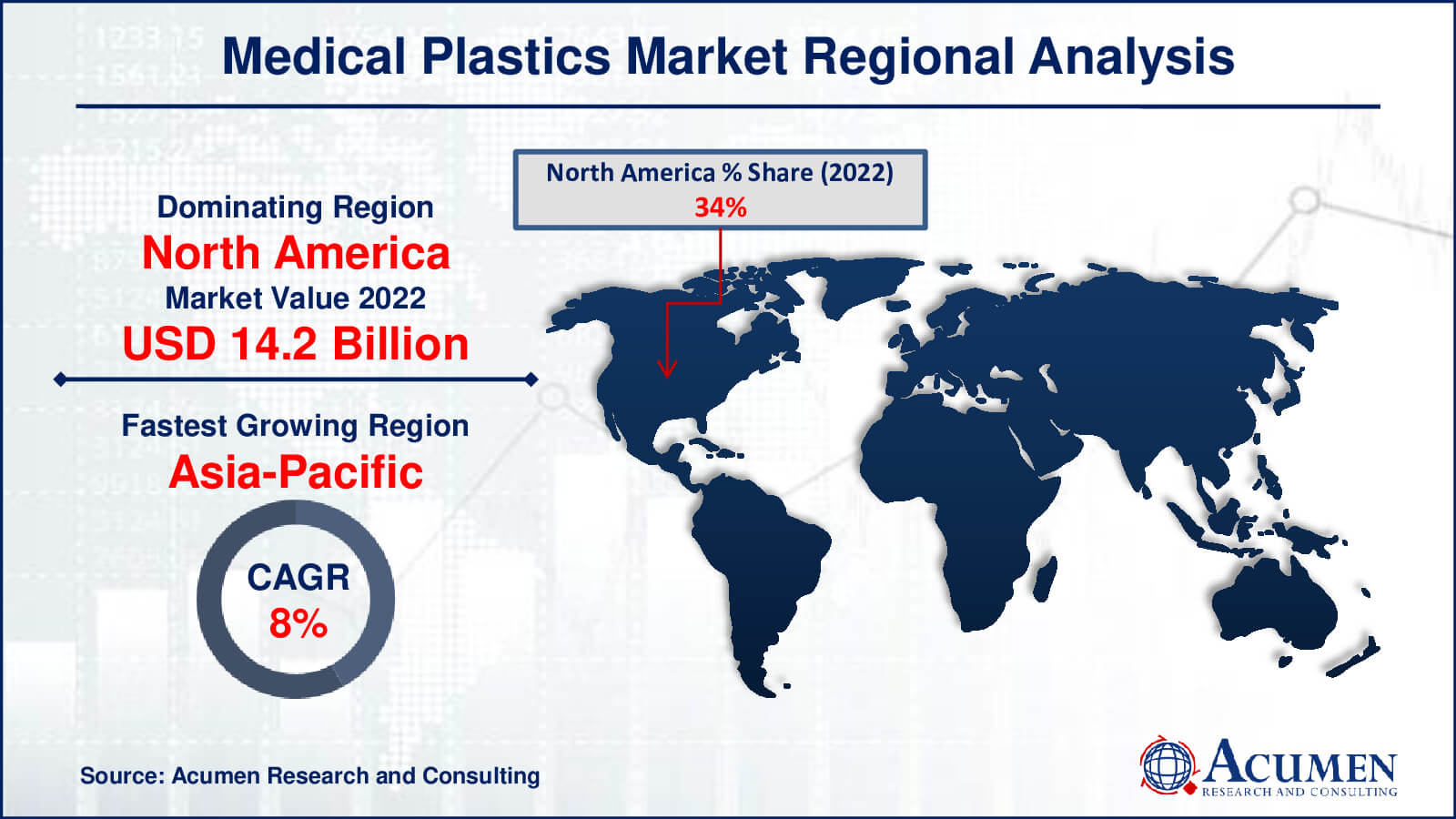

Medical Plastics Market Regional Analysis

In terms of medical plastics industry analysis, North America dominated the global market in 2022 in both revenue and volume, primarily driven by significant consumption in the United States. The country's aging population and long-standing prevalence of chronic diseases, coupled with the 2010 Patient Protection and Affordable Care Act, have expanded access to health services for previously uninsured segments of the population. Consequently, there is a growing need for cost-effective healthcare equipment to meet the escalating demand. With these factors in play, the demand for healthcare plastics in the US is anticipated to rise.

Following North America, Europe ranked second in consumption of medical plastics in 2022. Key markets for medical plastics in Europe include Germany, France, and Italy. Asia-Pacific is the fastest growing region. In the Asia Pacific region, growth in the medical supply market, government initiatives, and low labor costs are driving factors for the medical plastics market. Disposable medicines have seen a significant increase in use in recent years in the Asia Pacific region, with China emerging as a dominant player in the market for medical plastics.

In the Middle East, Africa, and Latin America, there has been moderate growth in demand for medical plastics in recent years. Analysts predict this trend to persist in the medical plastics industry forecast year.

Medical Plastics Market Players

Some of the top medical plastics companies offered in our report includes ARAN BIOMEDICAL TEORANTA, Avantor Inc, Celanese Corporation, Dow, Eastman Chemical Company, HMC Polymers, Nolato AB, Orthoplastics Ltd, Röchling SE & Co. KG, SABIC, Saint-Gobain Performance Plastics, Solvay S.A., Tekni-Plex, and Trelleborg AB.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2023

July 2020

July 2020

December 2020