March 2023

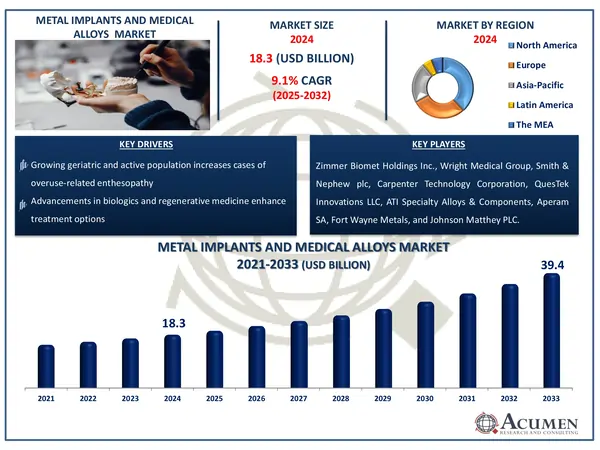

The Global Metal Implants and Medical Alloys Market Size accounted for USD 18.3 Billion in 2024 and is estimated to achieve a market size of USD 39.4 Billion by 2033 growing at a CAGR of 9.1% from 2025 to 2033.

The Global Metal Implants and Medical Alloys Market Size accounted for USD 18.3 Billion in 2024 and is estimated to achieve a market size of USD 39.4 Billion by 2033 growing at a CAGR of 9.1% from 2025 to 2033.

Metal implants are the biomaterials that are used to place inside or on the surface of the body. These are basically made up of stainless steel, Cobalt Chrome (CoCr) alloys, Titanium (Ti), and Ti alloys are widely used in orthopedic implants. The properties associated with these implants which make them an excellent choice for total joint replacement include high fracture toughness, hardness, corrosion resistance, high strength, and biocompatibility. The metal implants are either permanent or can be removed when they have no more use. For instance, hip and stent implants are placed permanently, whereas, chemotherapy ports or screws which are used to repair broken bones can be removed after the task completion. Moreover, the risks associated with these implants include infection or implant failure during or after the placement or removal.

Metal implants are the biomaterials that are used to place inside or on the surface of the body. These are basically made up of stainless steel, Cobalt Chrome (CoCr) alloys, Titanium (Ti), and Ti alloys are widely used in orthopedic implants. The properties associated with these implants which make them an excellent choice for total joint replacement include high fracture toughness, hardness, corrosion resistance, high strength, and biocompatibility. The metal implants are either permanent or can be removed when they have no more use. For instance, hip and stent implants are placed permanently, whereas, chemotherapy ports or screws which are used to repair broken bones can be removed after the task completion. Moreover, the risks associated with these implants include infection or implant failure during or after the placement or removal.

Global Metal Implants and Medical Alloys Market Dynamics

|

Market |

Threadlocker Market |

|

Threadlocker Market Size 2024 |

USD 18.3 Billion |

|

Threadlocker Market Forecast 2033 |

USD 39.4 Billion |

|

Threadlocker Market CAGR During 2025 - 2033 |

9.1% |

|

Threadlocker Market Analysis Period |

2021 - 2033 |

|

Threadlocker Market Base Year |

2024 |

|

Threadlocker Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Application, By Patient Demographics, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Zimmer Biomet Holdings Inc., Wright Medical Group, Smith & Nephew plc, Ametek Specialty Products, Carpenter Technology Corporation, Royal DSM, Stryker Corporation, QuesTek Innovations LLC, ATI Specialty Alloys & Components, Aperam SA, Fort Wayne Metals, and Johnson Matthey PLC. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The rising geriatric and obese populations globally, along with the increasing number of road accidents & trauma cases, are primarily driving the market growth. The increasing demand for minimally invasive surgical procedures across the globe, coupled with the development of minimally invasive devices, is supporting the market value. The growing prevalence of degenerative joint diseases is further accelerating the demand in the market. Moreover, the growing number of hospitals and surgical centers in emerging economies is likely to create potential opportunities over the forecast period from 2025 to 2033.

Furthermore, advances in biomaterial technology, as well as the increased use of titanium and cobalt-based alloys for greater biocompatibility and durability, are having a favorable impact on the industry. The advancement of 3D printing technology in metal implants is transforming the market by allowing for patient-specific implants with greater precision. Increasing research & development activities aimed at developing corrosion-resistant and lightweight medical alloys are fostering market expansion. Furthermore, favorable government initiatives and reimbursement policies supporting orthopedic and dental implants are expected to contribute to industry growth. On the other hand, the high cost of metal implants and the lack of skilled surgeons are expected to hamper the growth during the forecast timeframe.

Metal Implants and Medical Alloys Market Segmentation

Metal Implants and Medical Alloys Market SegmentationThe worldwide market for metal implants and medical alloys is split based on type, application, and geography.

According to metal implants and medical alloys industry analysis, by application, titanium (Ti) segment is accounted for the fastest growth over the forecast period due to its non-allergic, non-magnetic, and non-radio-opaque nature. The nature of the material makes it a preferable choice for bone implants without any additional coating. The titanium implants have various properties including greater strain-bearing capacity, high biocompatibility, rigidity, strength, and high corrosion resistance, which are supporting their growth in the market.

Based on application, orthopedic implants segment is anticipated to register maximum growth over the forecast timeframe owing to the rising prevalence of orthopedic disorders across the globe. The wide scope of orthopedic implants encompasses joint reconstruction devices, spinal implants, and trauma fixation devices are contributing to the segment growth.

Furthermore, the expanding senior population, which is predisposed to musculoskeletal illnesses such as osteoporosis and arthritis, is driving increased demand for orthopedic implants. The increasing use of advanced materials, such as titanium and cobalt-chromium alloys, for better durability and biocompatibility is driving market expansion. Furthermore, advances in robotic-assisted orthopedic surgery and 3D-printed patient-specific implants are enhancing treatment outcomes, making orthopedic implants more efficient and widely used. The rising prevalence of sports-related injuries, together with the better availability of advantageous reimbursement policies for orthopedic surgeries, are likely to boost the market outlook for this category in the future years.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Metal Implants and Medical Alloys Market Regional Analysis

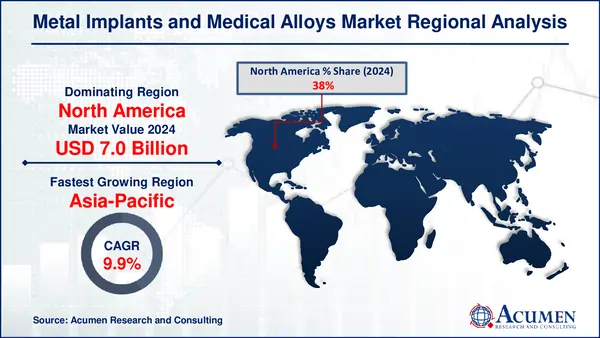

Metal Implants and Medical Alloys Market Regional AnalysisNorth America dominates the metal implants and medical alloys market, owing to improved healthcare infrastructure, high implant acceptance rates, and an aging population. The United States accounts for the biggest share, driven by increased orthopedic and dental implant treatments and well-established payment regulations. The presence of major market participants like Zimmer Biomet, Stryker, and Johnson & Johnson bolsters regional growth. Furthermore, advances in material science, such as titanium and cobalt-based alloys, are increasing demand for long-lasting and biocompatible implants. In 2023, North America generated more than 38% of worldwide market revenue.

Asia-Pacific is the fastest-growing market, owing to an aging population, rising healthcare costs, and greater awareness of implant-based treatments. China, Japan, and India are major contributors, with China leading due to rising urbanization and government attempts to promote domestic medical device manufacture. The region also benefits from cheaper production costs, which entice worldwide implant manufacturers to set up manufacturing operations. Furthermore, medical tourism is expanding in countries such as India and Thailand, which is increasing the use of low-cost implants. Asia-Pacific is expected to increase at an exponential CAGR from 2024 to 2030, outperforming other areas due to improved regulatory frameworks and an increasing frequency of chronic illnesses requiring implants.

Some of the top Metal Implants and Medical Alloys companies offered in our report include Zimmer Biomet Holdings Inc., Wright Medical Group, Smith & Nephew plc, Ametek Specialty Products, Carpenter Technology Corporation, Royal DSM, Stryker Corporation, QuesTek Innovations LLC, ATI Specialty Alloys & Components, Aperam SA, Fort Wayne Metals, and Johnson Matthey PLC.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

March 2025

May 2024

June 2024