September 2023

The Global Microelectronics Market Size accounted for USD 542.5 Billion in 2024 and is estimated to achieve a market size of USD 979.2 Billion by 2033 growing at a CAGR of 6.8% from 2025 to 2033.

The Global Microelectronics Market Size accounted for USD 542.5 Billion in 2024 and is estimated to achieve a market size of USD 979.2 Billion by 2033 growing at a CAGR of 6.8% from 2025 to 2033.

According to Argonne National Laboratory, microelectronics is vital to modern technology, processing and storing information in devices such as computers and smartphones. Advances in this discipline are critical to the development of next-generation technologies like artificial intelligence, quantum computing, and advanced manufacturing. Investing in microelectronics R&D is critical for fostering innovation and remaining competitive in the global technology landscape.

|

Market |

Microelectronics Market |

|

Microelectronics Market Size 2024 |

USD 542.5 Billion |

|

Microelectronics Market Forecast 2033 |

USD 979.2 Billion |

|

Microelectronics Market CAGR During 2025 - 2033 |

6.8% |

|

Microelectronics Market Analysis Period |

2021 - 2033 |

|

Microelectronics Market Base Year |

2024 |

|

Microelectronics Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Component Type, By Technology, By Application, By End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Control4 Corporation, Johnson Controls Inc., Honeywell International Inc., ADT Corporation, Schneider Electric SE, Ingersoll Rand PLC, Crestron Electronics Inc., United Technologies Corporation, Cisco Systems Inc., and Acuity Brands Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increased demand for consumer devices such as smartphones, laptops, and smart wearables is propelling microelectronics sales. For example, in January 2022, the Indian government established a target of $300 billion in electronics output by 2025-26, with a significant emphasis on increasing smartphone exports. As a result, India is now the world's second-largest mobile phone manufacturer, with more than 200 manufacturing sites. Mobile phone exports surged by 91% in 2022-23 over the previous year, placing smartphones among India's top five exported items. Furthermore, smartphone shipments increased by 42% in 2023-24 to $15.6 billion, making them the country's fourth-largest export. This rising demand is fueling the growth of the microelectronics market.

Moreover, the International Journal of Reconfigurable and Embedded Systems (IJRES) discusses the creation of a low-cost, wireless IoT-based home automation system that allows for remote control of various components as well as automatic operation based on environmental variables. The proliferation of IoT and smart devices in both the industrial and home automation sectors is accelerating the industry's growth.

Despite the complicated global supply chain issues, particularly in raw materials, the use of gallium nitride (GaN) and silicon carbide (SiC) semiconductors for high-power applications opens up considerable prospects for the microelectronics sector. The Center for Strategic and International Studies (CSIS) defines GaN as a compound semiconductor with remarkable breakdown field strength, high electron mobility, and a broad bandgap. These features make GaN a prominent technology in high-performance, energy-efficient electronics.

The increasing GaN presents a strategic opportunity for the United States, which currently leads in GaN research. However, hurdles remain in scaling local manufacturing and ensuring a consistent supply of gallium, a crucial element primarily controlled by China. To maintain its technological edge and national security, the United States must invest in growing GaN epitaxy capacity, improving manufacturing processes, and diversifying its gallium supply chain.

The worldwide market for microelectronics is split based on component type, technology, application, end-user, and geography.

According to microelectronics industry analysis, semiconductors, specifically integrated circuits (ICs), transistors, and diodes, take the lead since they are at the heart of almost all electronic devices. ICs offer sophisticated functionality in tiny packages, whereas transistors and diodes are essential for signal processing and power control. Their broad application extends to areas like automotive, consumer electronics, telecommunications, and healthcare. Semiconductors remain at the forefront of technological innovation thanks to continuous downsizing and performance increases.

As per the technology segment, CMOS (complementary metal-oxide-semiconductor) technology plays a crucial role due to its high efficiency, low power consumption, and scalability. It is the foundation for most modern integrated circuits used in processors, memory, and sensors. Its compatibility with high-density integration makes it ideal for applications in consumer electronics, automotive systems, and IoT devices.

By application, automotive segment leads the microelectronics business, driven by rising demand for advanced driver assistance systems (ADAS), EV power management, and in-vehicle infotainment. As vehicles grow more software-defined and sensor-rich, microelectronics play an increasingly important role in enabling safety, communication, and automation. Meanwhile, the consumer electronics market is fast developing due to increased usage of smartphones, wearables, and smart home products.

According to the microelectronics market forecast, OEMs (original equipment manufacturers) are critical in the microelectronics industry because they design and manufacture end-user devices, fueling demand for customized, high-performance components. EMS suppliers play an important role in the efficient mass production of electronic assemblies, while research organizations and laboratories contribute by developing novel microelectronic technologies.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

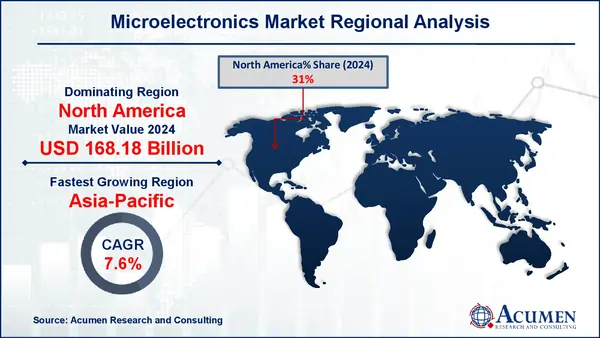

In terms of regional segments, North America dominates the microelectronics industry due to its extensive R&D ecosystem, the existence of large semiconductor companies, and significant demand from the defense and consumer electronics industries. In March 2024, the United States government announced a comprehensive microelectronics plan through the Networking and Information Technology Research and Development (NITRD) Program. The National Science and Technology Council's Subcommittee on Microelectronics Leadership developed this strategy to boost domestic semiconductor production, building on the CHIPS and Science Act. It plans to spend strategically in microelectronics R&D and infrastructure over the next five years. The region also derives an advantage from significant government support and early adoption of sophisticated technologies such as Gallium Nitride (GaN) and Silicon Carbide.

In contrast, the Asia-Pacific region is rapidly expanding, led by large-scale electronics manufacturing in China, India, South Korea, and Taiwan. In May 2023, United Semiconductor Japan Co., Ltd. and DENSO Corporation forged a cooperation to develop superior power semiconductors for electric vehicles, with the goal of reducing power losses by 20% over prior generations. Rising consumer demand, supportive government regulations, and expanding export opportunities are driving this expansion, reinforcing the region's position as a worldwide manufacturing hub.

Some of the top microelectronics companies offered in our report include Control4 Corporation, Johnson Controls Inc., Honeywell International Inc., ADT Corporation, Schneider Electric SE, Ingersoll Rand PLC, Crestron Electronics Inc., United Technologies Corporation, Cisco Systems Inc., and Acuity Brands Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2023

May 2025

May 2024

September 2022