October 2024

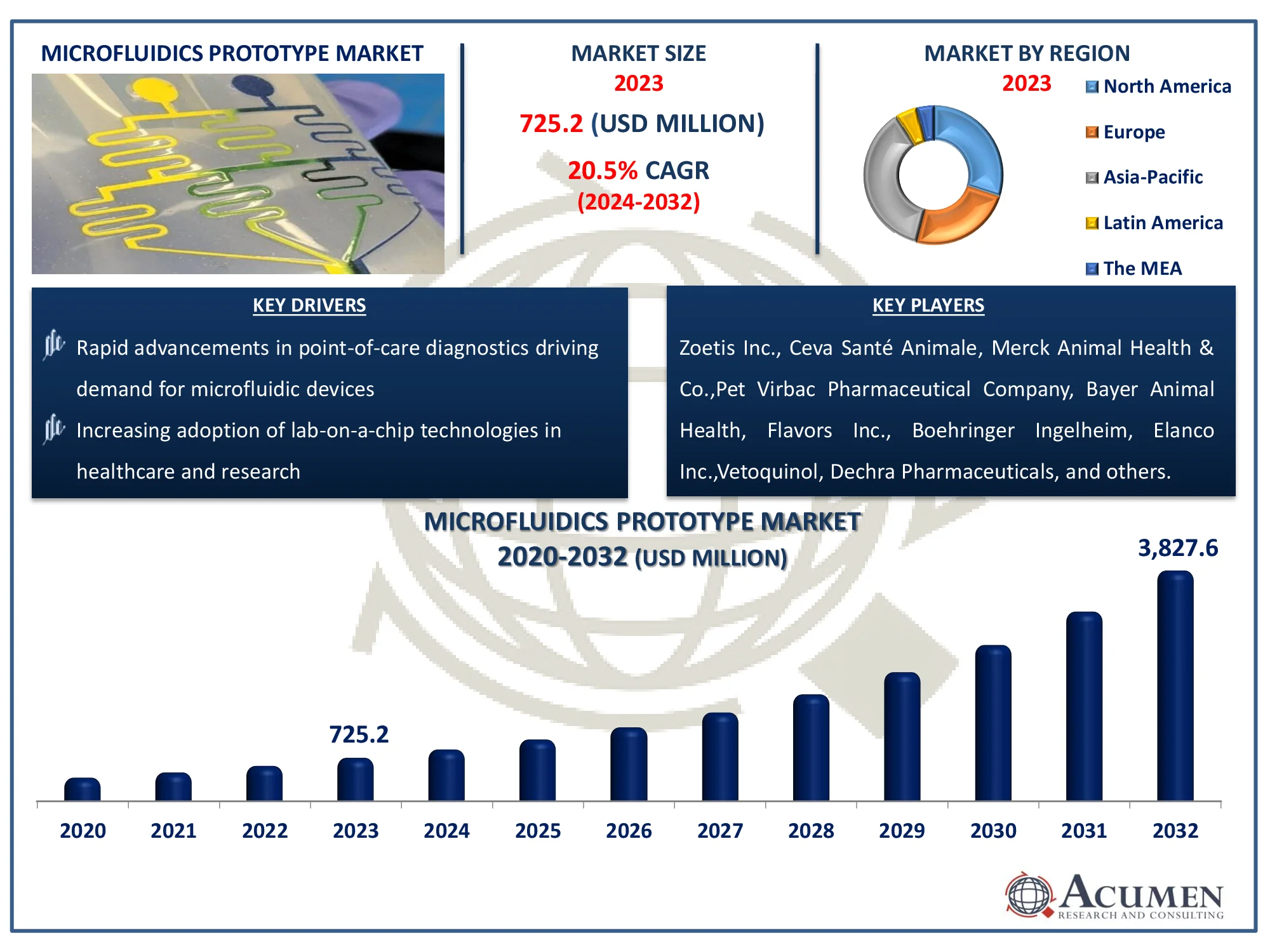

The Global Microfluidics Prototype Market Size accounted for USD 725.2 Million in 2023 and is estimated to achieve a market size of USD 3,827.6 Million by 2032 growing at a CAGR of 20.5% from 2024 to 2032.

The Global Microfluidics Prototype Market Size accounted for USD 725.2 Million in 2023 and is estimated to achieve a market size of USD 3,827.6 Million by 2032 growing at a CAGR of 20.5% from 2024 to 2032.

Microfluidics Prototype Market Highlights

A microfluidics prototype is a reduced-size version of a microfluidic device used for testing and experimentation. It entails controlling small amounts of fluid within tubes or chambers ranging in size from micrometers to millimeters. These prototypes are widely utilized in the development of lab-on-a-chip systems for diagnostics, drug delivery, and research. Microfluidics prototypes promote quick iteration, allowing researchers to optimize concepts prior to full-scale production. Technological breakthroughs aid personalized medicine, environmental monitoring, and biotechnology alike.

Global Microfluidics Prototype Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Microfluidics Prototype Market Report Coverage

|

Market |

Microfluidics Prototype Market |

|

Microfluidics Prototype Market Size 2023 |

USD 725.2 Million |

|

Microfluidics Prototype Market Forecast 2032 |

USD 3,827.6 Million |

|

Microfluidics Prototype Market CAGR During 2024 - 2032 |

20.5% |

|

Microfluidics Prototype Market Analysis Period |

2020 - 2032 |

|

Microfluidics Prototype Market Base Year |

2023 |

|

Microfluidics Prototype Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Component, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Dolomite Microfluidics, Potomac, uFluidix, ALine, Inc., Alvéole, Sony Group Corporation (Micronics, Inc.), TE Connectivity (MicroLIQUID), thinXXS Microtechnology, and Micronit Micro Technologies B.V. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Microfluidics Prototype Market Insights

Trend-setting innovations, increasing demand for sample analysis, and advancements in 3D printing technology are key drivers expected to propel the microfluidics prototype market during the forecast period. For instance, the World Economic Forum highlights a breakthrough in “3D printing for robotics” i.e. researchers achieve successful 3D printing of a hand complete with bones, ligaments, and tendons. These advancements indicate significant progress in 3D printing, enhancing its capabilities and applications across various fields.

The market is anticipated to experience significant growth in the coming years due to major players aiming to accelerate technological advancements in emerging industries. For instance, June 2024, uFluidix, developed an AI-WMCS, a wearable microfluidic colorimetric sensor system assisted by artificial intelligence, which represents significant progress in health monitoring without invasive methods. The AI-WMCS provides a smooth way to gather and examine tear samples by combining a bendable microfluidic epidermal patch with a CSDAS linked to a smartphone.

RSC Publishing highlights recent research in microfluidic-based wearable sweat sensors, emphasizing real-time monitoring of lactate, chloride, and glucose concentrations, as well as sweat rate, pH, and total sweat loss. These sensors are essential for preventive care, timely diagnosis, and point-of-care health and fitness monitoring. The growing demand for microfluidic-based wearable health monitoring devices is significantly driving the microfluidics prototype industry to new heights.

Microfluidics Prototype Market Segmentation

The worldwide market for microfluidics prototype is split based on component, application, and geography.

Microfluidics Prototype Market By Component

According to the microfluidics prototype industry analysis, the microfluidic chips category is expected to have significant growth in the future years. These chips are critical components of lab-on-a-chip systems, providing compact and efficient solutions for a variety of applications such as diagnostics, drug testing, and environmental monitoring. Their capacity to manage small fluid volumes with accuracy is critical to advances in healthcare and research. As demand for more efficient, portable, and cost-effective solutions increases, the microfluidic chips market is likely to create significant industry growth.

Microfluidics Prototype Market By Application

According to the microfluidics prototype market forecast, point-of-care blood/urine analysis cartridges are in high demand in rapid diagnostics and tailored treatment, as they provide quick and efficient findings. These gadgets play an important role in enhancing healthcare delivery since they allow for real-time monitoring of patients' situations. Cell separation is utilized to isolate specific cell types in diagnostics and research, while in-vitro platforms for stem cell research allow for exact control over cellular conditions. Drug efficacy monitoring apps are critical for assessing pharmaceutical therapies.

Microfluidics Prototype Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

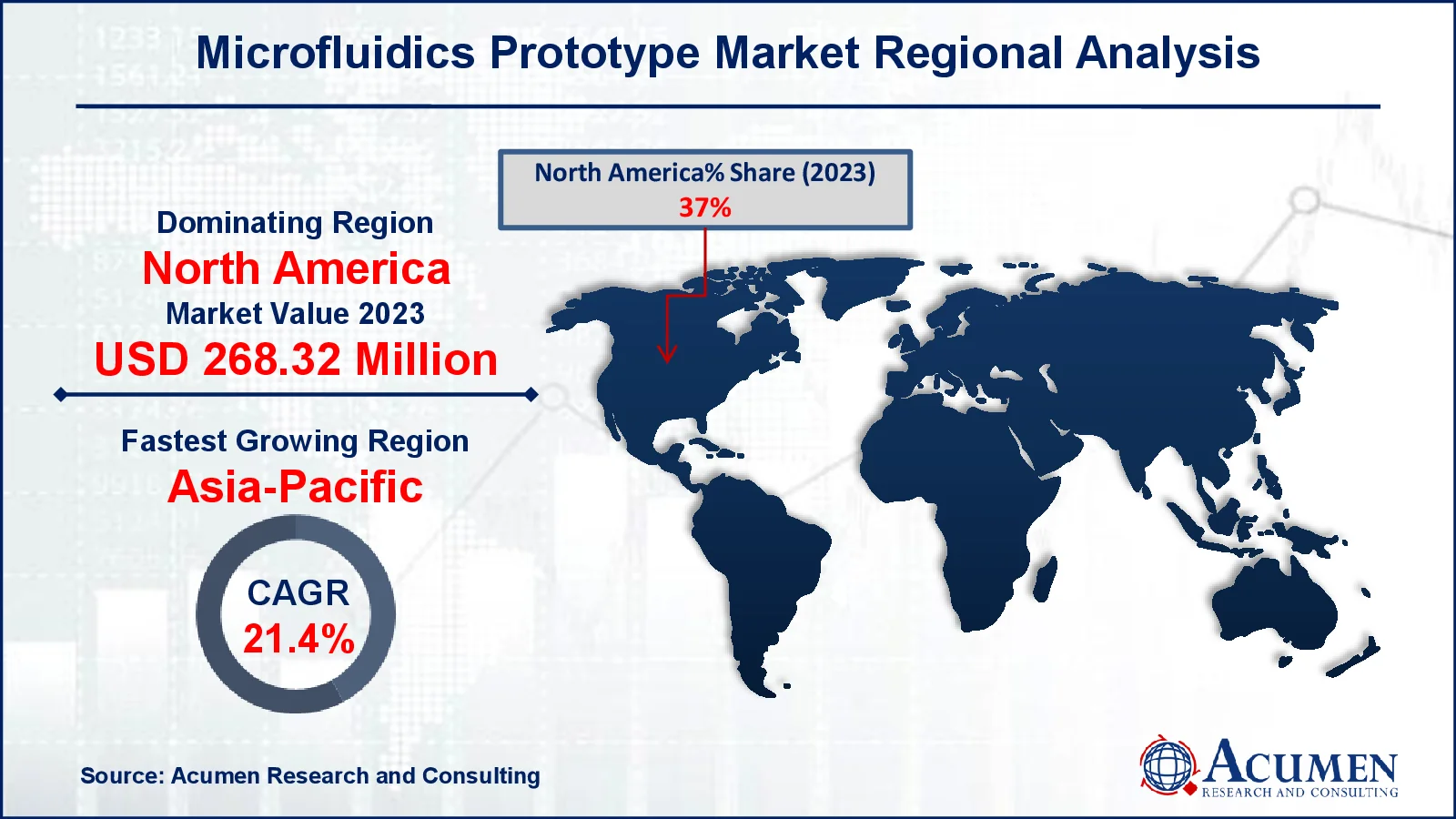

Microfluidics Prototype Market Regional Analysis

For several reasons, North America dominated the microfluidics prototype market, with the United States having the greatest share. This dominance can be linked to large research investment, the implementation of sophisticated sample volume screening procedures, and the availability of enormous financial backing. For instance, according to the National Center for Science and Engineering Statistics, the United States National Science Foundation provides hundreds of funding opportunities, such as grants, cooperation agreements, and fellowships, to promote research and education in science and engineering. Furthermore, the United States has more than 170 prototyping vendors, compared to about 90 in Europe.

The Asia-Pacific (APAC) market is the fastest-growing, driven by a growing economy, government initiatives for growing research infrastructure, and access to affordable labor. For example, in 2023, the Indian government announced a number of R&D initiatives, including the Anusandhan National Research Foundation (ANRF) and the development of new Centres of Excellence. Global firms are exploring untapped areas in APAC.

The European microfluidics prototyping market is expected to grow quickly, with the United Kingdom playing an important role as technology progresses.

Microfluidics Prototype Market Players

Some of the top microfluidics prototype companies offered in our report include Dolomite Microfluidics, Potomac, uFluidix, ALine, Inc., Alvéole, Sony Group Corporation (Micronics, Inc.), TE Connectivity (MicroLIQUID), thinXXS Microtechnology, and Micronit Micro Technologies B.V.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2024

June 2021

February 2021

January 2018