March 2024

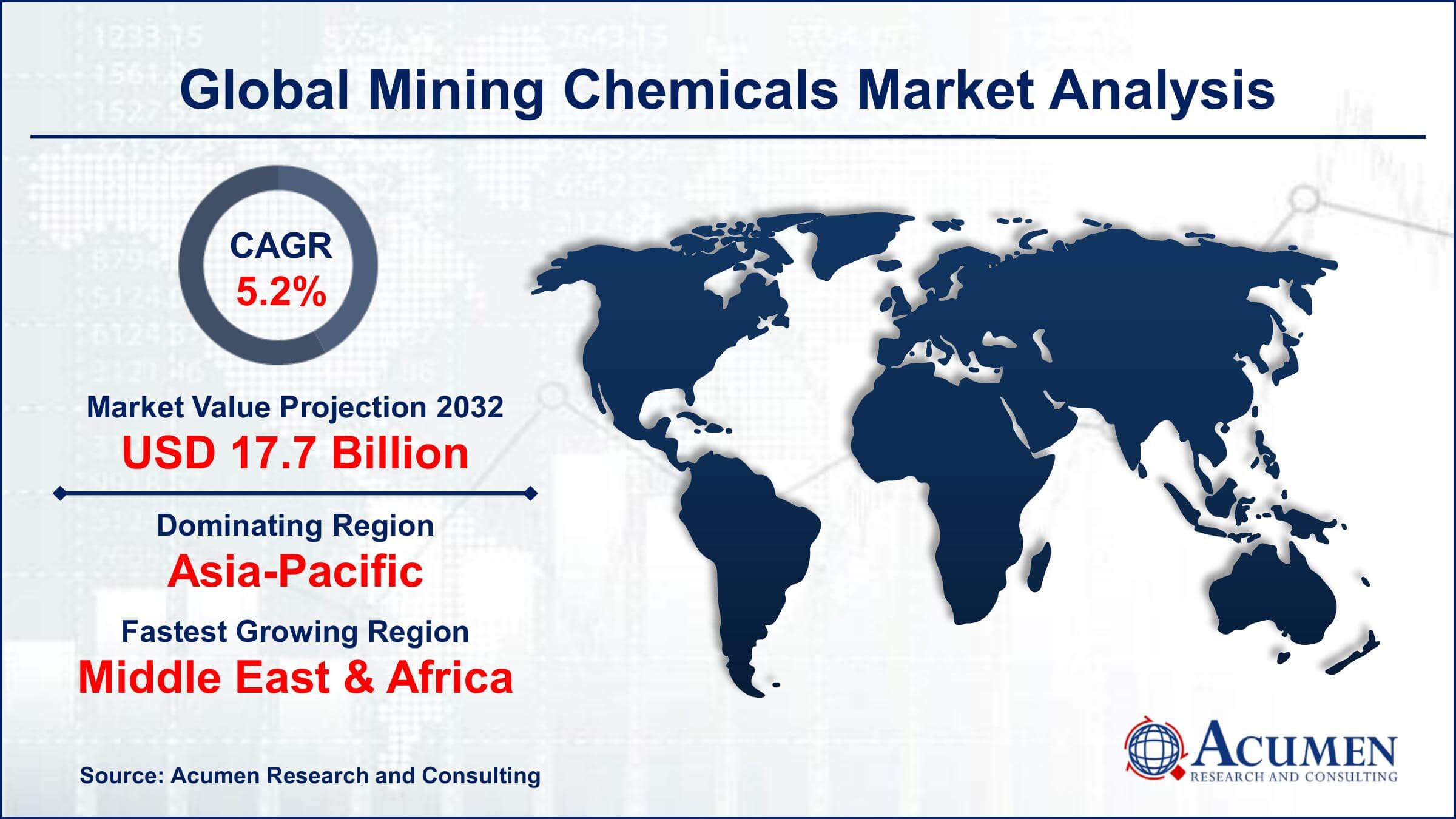

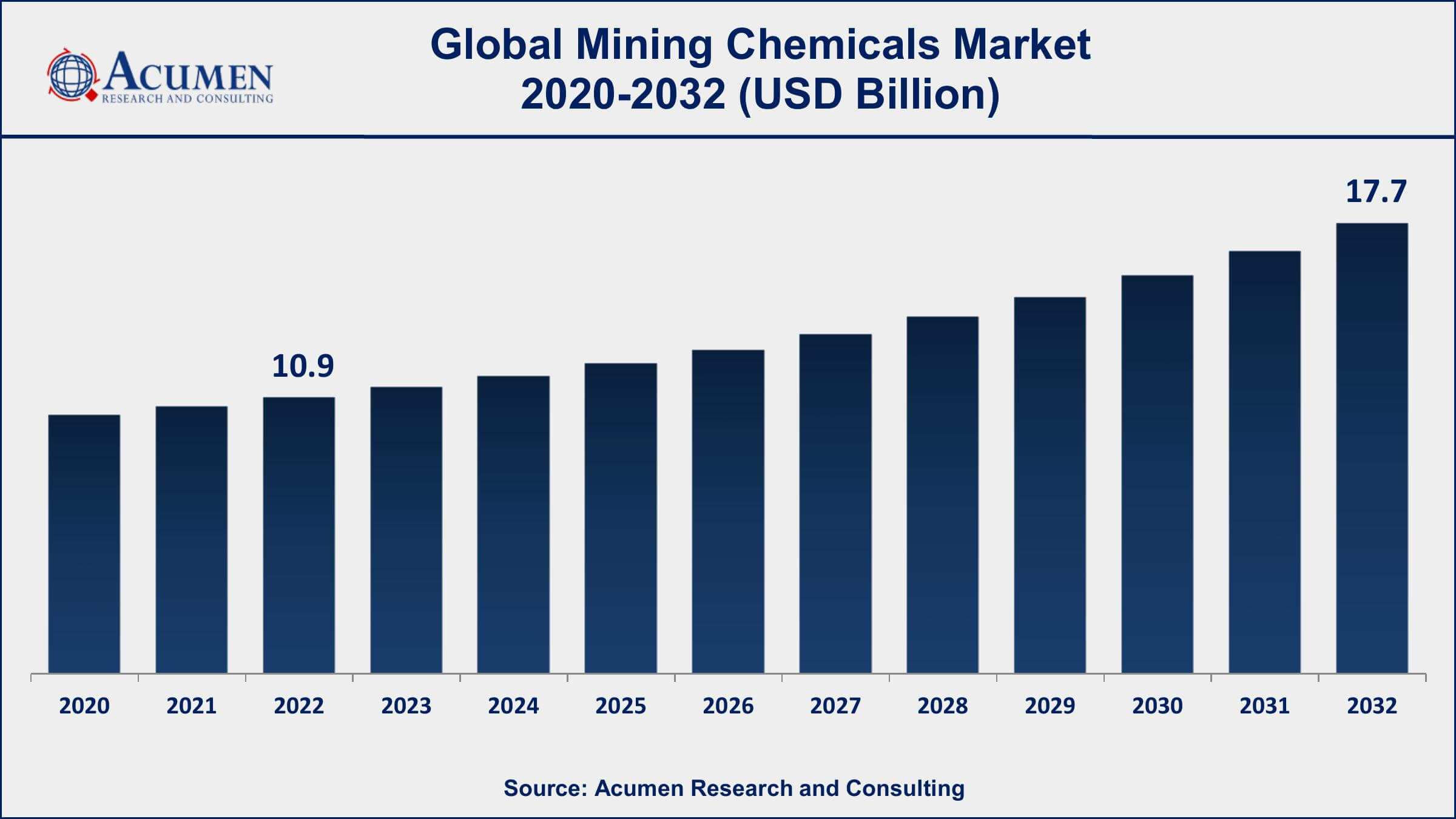

Mining Chemicals Market Size accounted for USD 10.9 Billion in 2022 and is projected to achieve a market size of USD 17.7 Billion by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

The Global Mining Chemicals Market Size accounted for USD 10.9 Billion in 2022 and is projected to achieve a market size of USD 17.7 Billion by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

Mining Chemicals Market Highlights

Mining chemicals are specialized chemicals used in various stages of the mining process to enhance the extraction of minerals from ore. These chemicals play a crucial role in improving the efficiency and productivity of mining operations by facilitating mineral separation, reducing energy consumption, controlling pH levels, and preventing equipment corrosion. Mining chemicals encompass a wide range of substances, including reagents, frothers, collectors, solvent extractants, grinding aids, and flocculants.

The market for mining chemicals has experienced significant growth over the past few years and is expected to continue expanding in the coming years. This growth is primarily driven by the rising demand for metals and minerals globally, coupled with the increasing complexity of ore deposits. As mining companies strive to extract minerals from lower-grade and more challenging deposits, the need for effective chemical solutions becomes paramount. Additionally, stringent environmental regulations and the growing focus on sustainable mining practices have spurred the development of eco-friendly mining chemicals, further driving the mining chemicals market growth.

Global Mining Chemicals Market Trends

Market Drivers

Market Restraints

Market Opportunities

Mining Chemicals Market Report Coverage

| Market | Mining Chemicals Market |

| Mining Chemicals Market Size 2022 | USD 10.9 Billion |

| Mining Chemicals Market Forecast 2032 | USD 17.7 Billion |

| Mining Chemicals Market CAGR During 2023 - 2032 | 5.2% |

| Mining Chemicals Market Analysis Period | 2020 - 2032 |

| Mining Chemicals Market Base Year | 2022 |

| Mining Chemicals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Function, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AECI Mining Chemicals, BASF SE, Ashland, Dow, Cytec Solvay Group, Arkema, Clariant, Nowata, Kemira, Shell Chemicals, Quaker Chemical Corporation, Akzo Nobel N.V., and Sasol |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Mining chemicals are specialized chemical compounds that are used in various stages of the mining process to enhance the efficiency, productivity, and safety of mining operations. These chemicals are designed to address specific challenges and requirements associated with extracting minerals from ore deposits. Mining chemicals find application across different stages of mining, including exploration, ore extraction, mineral processing, and waste management. During exploration, mining chemicals are used to identify and analyze mineral deposits. These chemicals aid in geophysical surveys, sample analysis, and mineral identification, helping mining companies determine the economic viability of a potential mining site. In the extraction phase, chemicals such as explosives and blasting agents are utilized for controlled and efficient fragmentation of the rock, enabling easier extraction of minerals.

In mineral processing, mining chemicals play a vital role in separating valuable minerals from the ore. Frothers, collectors, and grinding aids are commonly used chemicals in flotation processes, which facilitate the separation of minerals from the gangue material. Solvent extractants are utilized to selectively extract specific metals from ore solutions. Furthermore, mining chemicals assist in waste management by minimizing the environmental impact of mining activities. Chemicals like flocculants and coagulants are employed in water treatment processes to separate solids from wastewater, reducing the release of harmful substances into the environment.

The mining chemicals market has been experiencing significant growth over the past few years and is expected to continue expanding in the coming years. Several factors are contributing to this growth. Firstly, the increasing demand for metals and minerals, driven by industrialization, infrastructure development, and the growing population, is boosting mining activities worldwide. This surge in mining operations is directly propelling the demand for mining chemicals as companies seek to optimize their mineral extraction processes and improve operational efficiency. Additionally, advancements in mining technologies and processes are creating new opportunities for the use of specialized mining chemicals. Technologies such as advanced flotation techniques, solvent extraction, and heap leaching require tailored chemical solutions to enhance mineral recovery and minimize environmental impact. As mining companies invest in these advanced technologies to extract minerals from more complex ore deposits, the demand for specialized mining chemicals is expected to rise.

Mining Chemicals Market Segmentation

The global Mining Chemicals Market segmentation is based on function, application, and geography.

Mining Chemicals Market By Function

In terms of functions, the flotation chemicals segment has seen significant growth in the recent years. Flotation chemicals are used in the flotation process, which is widely employed in mineral processing to separate valuable minerals from gangue materials. This separation is achieved by selectively attaching air bubbles to the target minerals, allowing them to rise to the surface for collection. One of the primary factors driving the growth of the flotation chemicals segment is the increasing demand for base metals, such as copper, lead, and zinc. These metals are vital in various industries, including construction, electronics, and automotive. As the demand for these metals continues to rise, mining companies are increasingly exploring lower-grade deposits, which require advanced flotation techniques and specialized chemicals for efficient extraction. Consequently, the demand for flotation chemicals is growing significantly to optimize the recovery of valuable minerals from complex ores. Moreover, ongoing technological advancements in flotation processes are contributing to the growth of the flotation chemicals segment.

Mining Chemicals Market By Application

According to the mining chemicals market forecast, the mineral processing segment is expected to witness significant growth in the coming years. Mineral processing involves various stages, including crushing, grinding, flotation, dewatering, and filtration, to extract and separate valuable minerals from the ore. Mining chemicals play a crucial role in optimizing these processes by enhancing mineral recovery, improving efficiency, and reducing operational costs. One of the key drivers for the growth of the mineral processing segment is the increasing demand for high-quality and value-added minerals. The growing industrialization and infrastructure development, particularly in emerging economies, have fueled the demand for minerals in various sectors such as construction, automotive, electronics, and energy. As a result, mining companies are investing in advanced mineral processing technologies and techniques to extract and process ores with higher efficiency and effectiveness. This, in turn, drives the demand for specialized mining chemicals that can optimize the mineral processing operations and improve the recovery rates of valuable minerals. Furthermore, the advent of advanced mineral processing technologies and equipment is propelling the growth of the mineral processing segment.

Mining Chemicals Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Mining Chemicals Market Regional Analysis

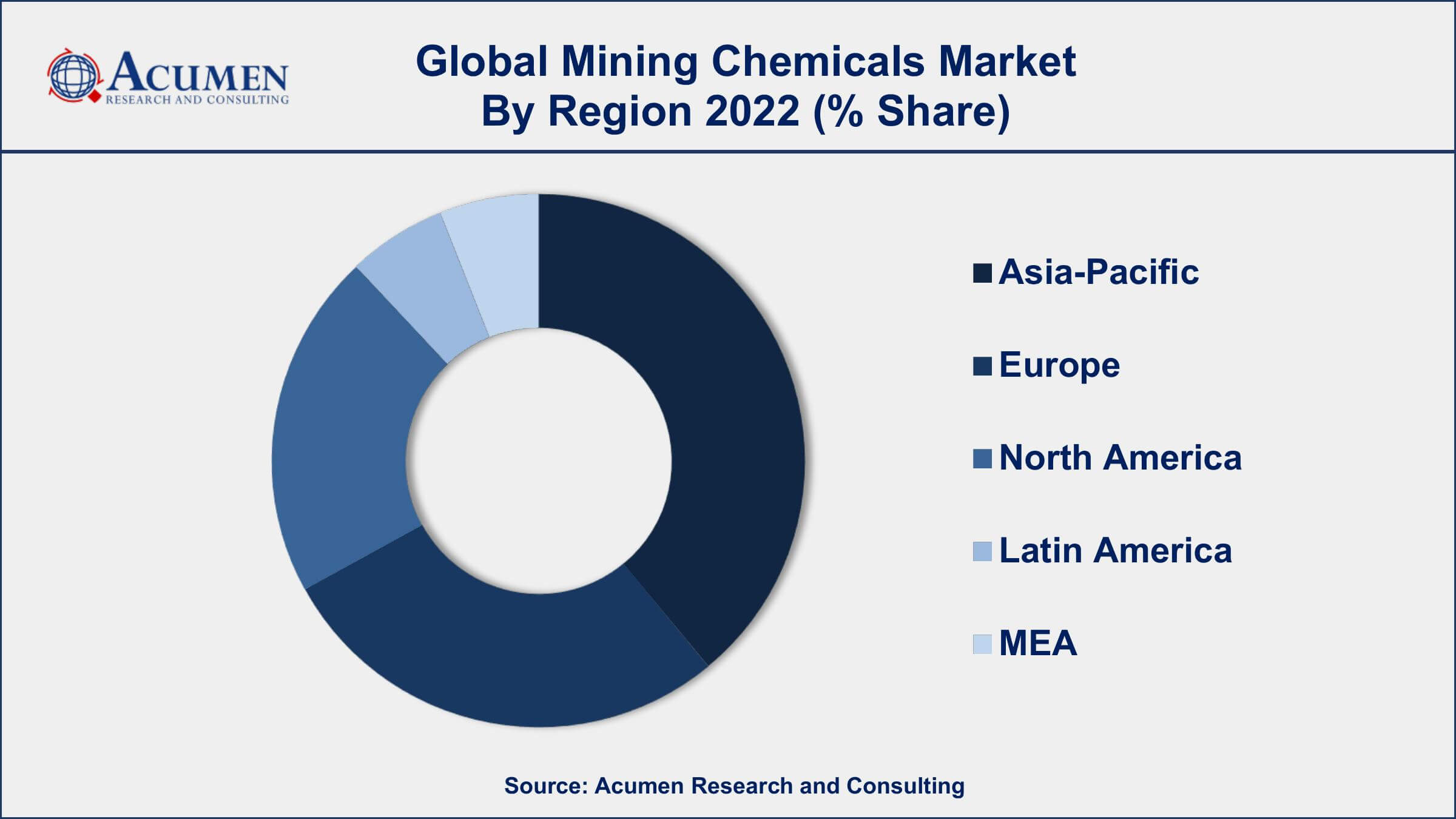

Geographically, the Asia-Pacific is a dominant region in the mining chemicals market in 2022. Asia-Pacific is home to rapidly growing economies, such as China and India, which have high demands for metals and minerals to fuel their industrialization and infrastructure development. These countries have extensive mining operations to meet their growing needs, leading to a substantial demand for mining chemicals. Additionally, other countries in the region, including Australia, Indonesia, and Kazakhstan, are major producers of various minerals, further contributing to the dominance of Asia-Pacific in the market. Moreover, Asia-Pacific benefits from a favorable regulatory environment and government initiatives that support mining activities. Governments in the region have implemented policies to encourage domestic mineral production, providing incentives for mining companies and creating a conducive business environment. These supportive regulations and policies have attracted significant investments in the mining sector, driving the demand for mining chemicals. Furthermore, the presence of major mining chemical manufacturers and suppliers in the Asia-Pacific region strengthens its dominance in the market.

Mining Chemicals Market Player

Some of the top mining chemicals market companies offered in the professional report include AECI Mining Chemicals, BASF SE, Ashland, Dow, Cytec Solvay Group, Arkema, Clariant, Nowata, Kemira, Shell Chemicals, Quaker Chemical Corporation, Akzo Nobel N.V., and Sasol

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2024

February 2020

January 2018

January 2025