March 2021

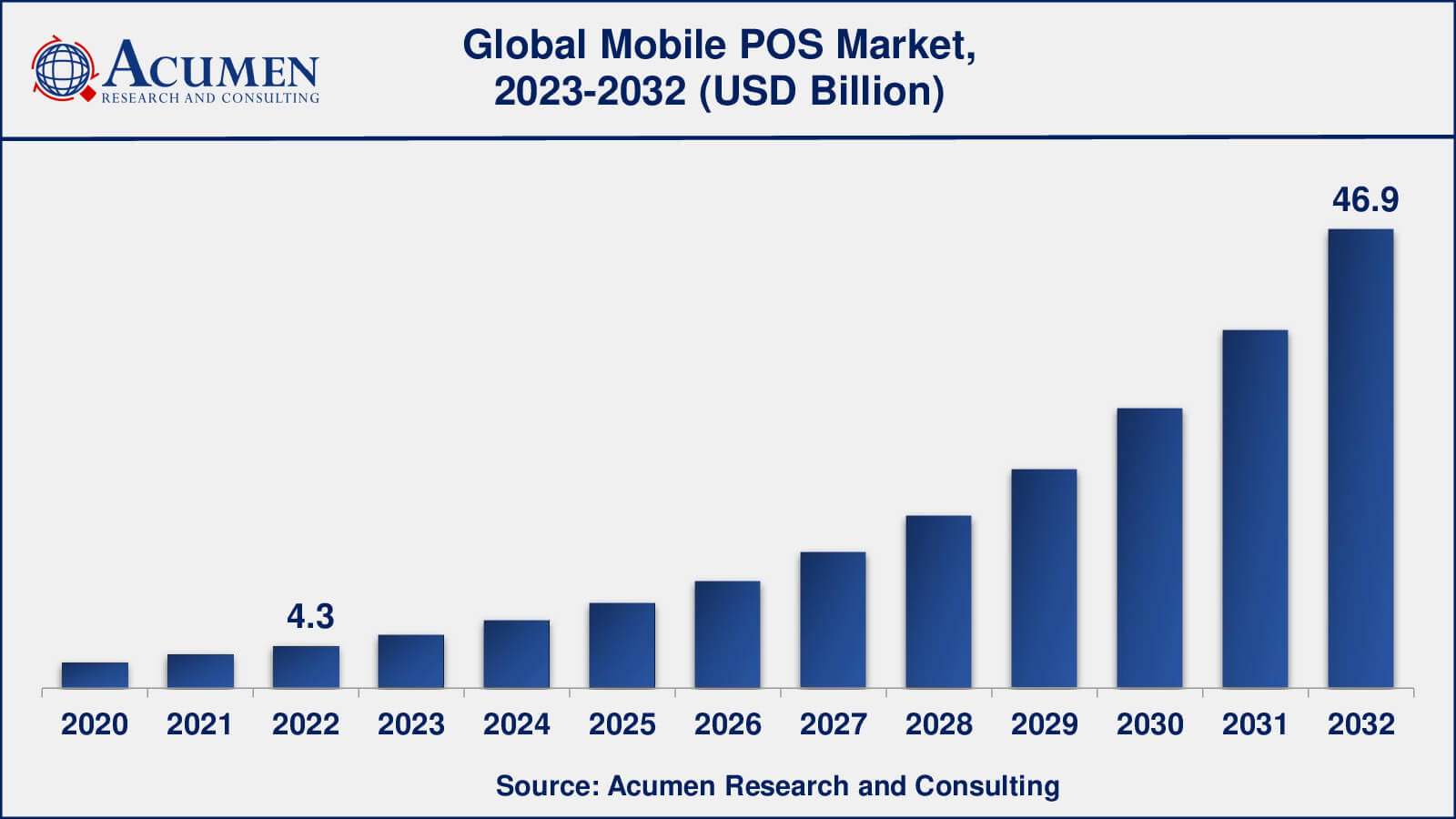

Mobile POS Market Size collected USD 4.3 Billion in 2022 and is set to achieve a market size of USD 46.9 Billion in 2032 growing at a CAGR of 27.0% from 2023 to 2032.

The Global Mobile POS Market Size collected USD 4.3 Billion in 2022 and is set to achieve a market size of USD 46.9 Billion in 2032 growing at a CAGR of 27.0% from 2023 to 2032.

Mobile POS Market Report Statistics

A mobile POS or a mobile point of sale is a tablet, smartphone, or relatively dedicated wireless device that performs the roles and functions of an electronic point of sale terminal or a cash register. Owing to the increasing advancements in wireless network technology, the global mobile POS terminals market is set to witness strong growth in the next few years. Also, various benefits offered by mobile POS including portability, low upfront cost, positive return on investment, and easy usage are some reasons which have collectively boosted the adoption of mobile POS as an alternative to conventional retail applications. Also, the emergence of mobile wallet technology and the growing demand for NFC-based transactions are some other factors projected to fuel the growth of the global mobile POS market over the forecast period. Mobile POS technology allows the sales and service industries to perform financial transactions in an easier way, thus enhancing the overall customer experience

Global Mobile POS Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Mobile POS Market Report Coverage

| Market | Mobile POS Market |

| Mobile POS Market Size 2022 | USD 4.3 Billion |

| Mobile POS Market Forecast 2032 | USD 46.9 Billion |

| Mobile POS Market CAGR During 2023 - 2032 | 27.0% |

| Mobile POS Market Analysis Period | 2020 - 2032 |

| Mobile POS Market Base Year | 2022 |

| Mobile POS Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Enterprise Size, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | VeriFone, Inc., Ingenico Group, Oracle (MICROS Systems), First Data Corporation, Fiserv, Inc. Hewlett Packard Enterprise Development LP, iZettle AB., Panasonic Holdings Corporation, NEC Corporation, Toast, Inc., Zebra Technologies (Motorola Enterprise Solutions). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Mobile POS Market Growth Factors

The global mobile POS market has attained an upsurge over the past years due to the increasing use and adoption of mobile POS technology, especially in established retail chains across regional markets and a wide number of store formats. For instance, Home Depot, Apple, Urban Outfitters, Nordstrom, Gucci, etc. are some of the key retailers and early adopters of mobile POS technology. Also, the convergence of mobile and online payment methods, at a time of steady growth of the smartphone and mobile app market is another key factor behind the rapid and significant growth of the mobile POS market. With the advent of feasible wireless network communication technologies, an increased consumer preference for advanced mobile POS technology has been witnessed over the past few years. In addition, the low cost of mobile POS devices as well as speedier checkout transactions aids in meeting the targeted sale and enhances the overall labor efficiency. However, factors such as concerns related to data security coupled with government regulations and certifications are anticipated to hinder the growth of the global mobile POS market over the forecast period.

Mobile POS Market Segmentation

The worldwide mobile POS market is categorized based on component, enterprise size, end-use, and geography.

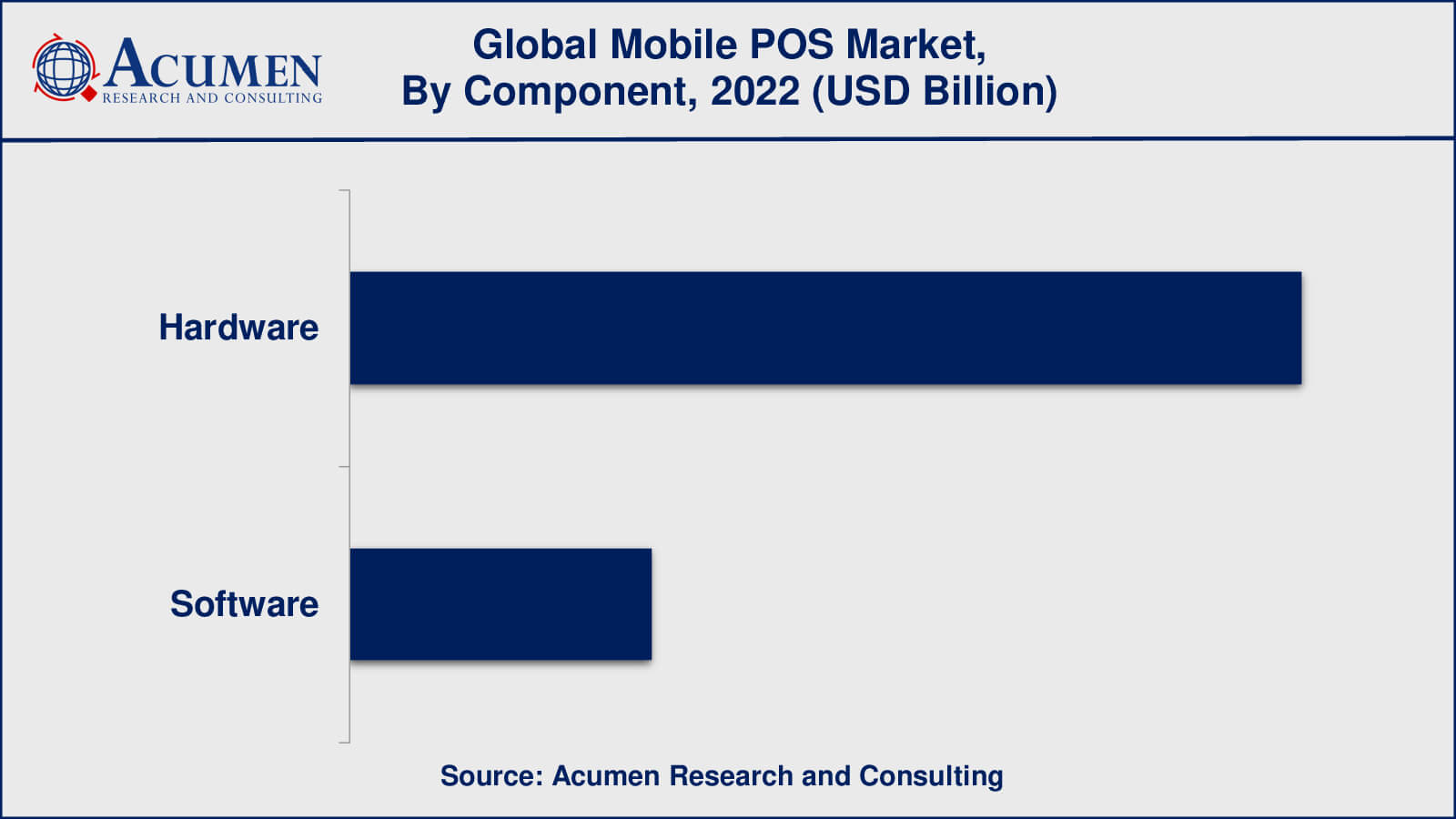

Mobile POS Market By Component

According to the mobile POS market forecast, the hardware component of the mobile POS market will continue to grow significantly as demand for mobile payment solutions rises. As mobile payment solutions become more common, businesses will need to invest in new hardware or upgrade their existing systems to support these payment methods, causing the mobile POS hardware market to expand.

In terms of revenue, however, the software component of the mobile POS market is expected to grow faster than the hardware component in the coming years. This is due to the growing popularity of cloud-based software solutions, which provide more advanced functionality and flexibility than traditional on-premise software. Cloud-based software solutions are also easier to update and maintain, which saves businesses money on costly upgrades or replacement hardware. Furthermore, cloud-based solutions are typically provided as a subscription-based service, providing software providers with a predictable and recurring revenue stream.

Mobile POS Market By Enterprise Size

Mobile POS solutions are increasingly being adopted by SMEs because they provide a more affordable and flexible payment solution than traditional POS systems. Mobile POS solutions enable SMEs to accept payments anywhere, at any time, and to provide their customers with a variety of payment options, such as contactless payments and digital wallets. Furthermore, mobile POS solutions are typically provided as a subscription-based service, allowing SMEs to pay for only the features they require while avoiding upfront hardware costs. This makes mobile POS solutions more affordable for SMEs on a tight budget.

Large enterprises, on the other hand, might have previously invested in traditional POS systems and may be more hesitant to adopt mobile POS solutions. Larger businesses, on the other hand, remain important players in the mobile POS market because they may require more additional features and integration with other systems.

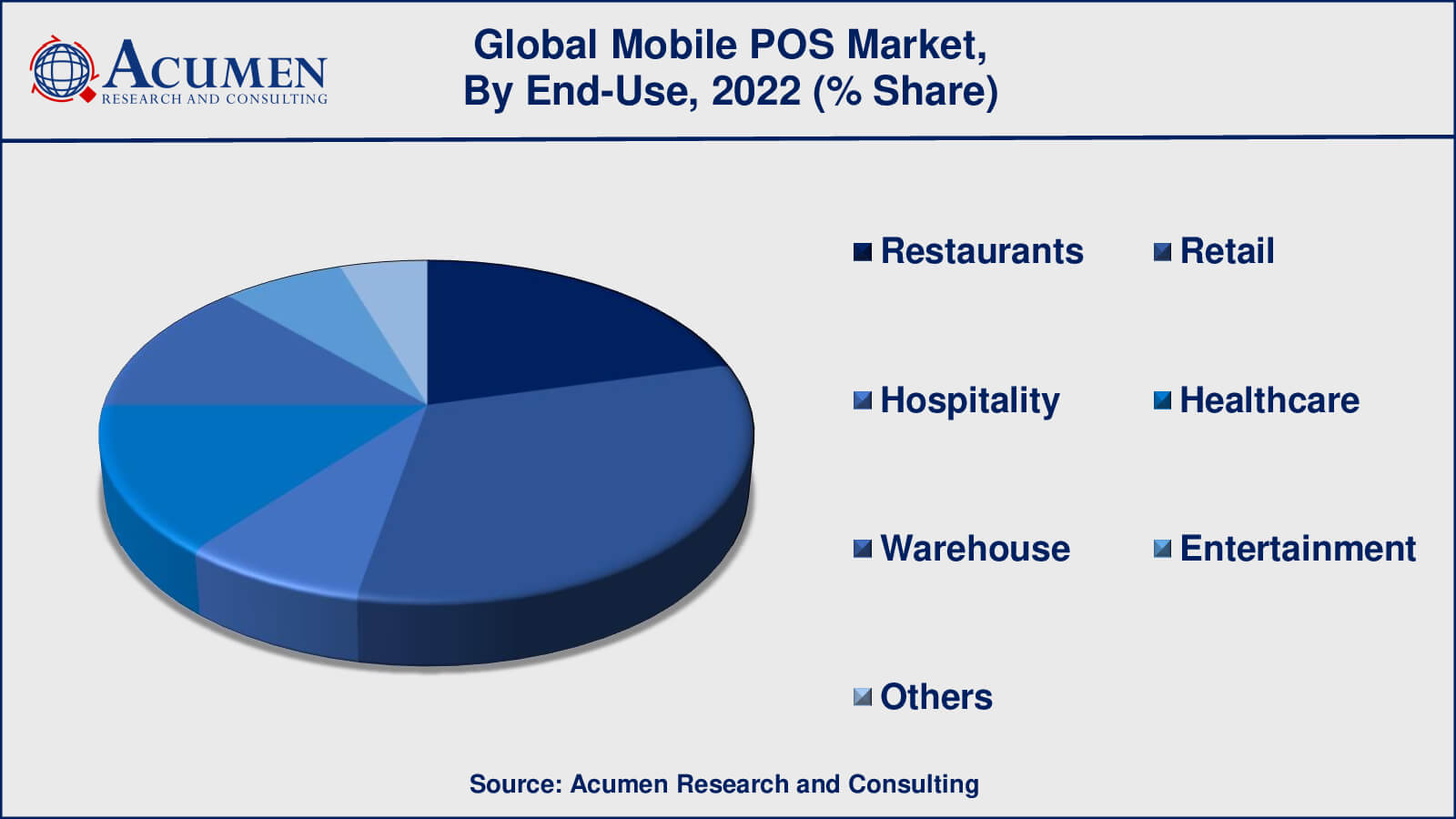

Mobile POS Market By End-Use

Retail is a significant end-use segment for mobile POS solutions because these solutions enable businesses to accept payments anywhere and provide customers with a more flexible payment solution. Advanced features such as inventory management, customer relationship management, and reporting can be found in mobile POS solutions.

Restaurants have also embraced mobile POS solutions, which allow for more efficient ordering and payment processing. Mobile POS solutions may also include tableside ordering, bill splitting, and integration with kitchen display systems.

The hospitality industry, which includes resorts, hotels, and event venues, has also adopted mobile POS solutions in order to provide guests with more convenient payment options. Mobile POS solutions can include mobile room service ordering, mobile check-in, and contactless payment options.

Mobile POS Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Mobile POS Market Regional Analysis

North America is anticipated to maintain its dominance in the global mobile POS market over the forecast period owing to the rapidly increasing adoption of advanced technology in the form of mobile POS devices, swiping machines, and smartphones among others. However, the Asia-Pacific region is projected to account for the highest and fastest growth potential in the global mobile POS market owing to the increasing per capita disposable income and increasing technological advancements in developing countries such as Japan, China, Korea, Indonesia, and others. Moreover, other emerging markets such as Latin America and Middle East & Africa are projected to tender bright opportunities for the growth of the global mobile POS market over the forecast period.

Mobile POS Market Players

Some of the global mobile POS companies profiled in the report include VeriFone, Inc., Ingenico Group, Oracle (MICROS Systems), First Data Corporation, Fiserv, Inc. Hewlett Packard Enterprise Development LP, iZettle AB., Panasonic Holdings Corporation, NEC Corporation, Toast, Inc., Zebra Technologies (Motorola Enterprise Solutions).

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2021

March 2023

April 2025

December 2023