October 2018

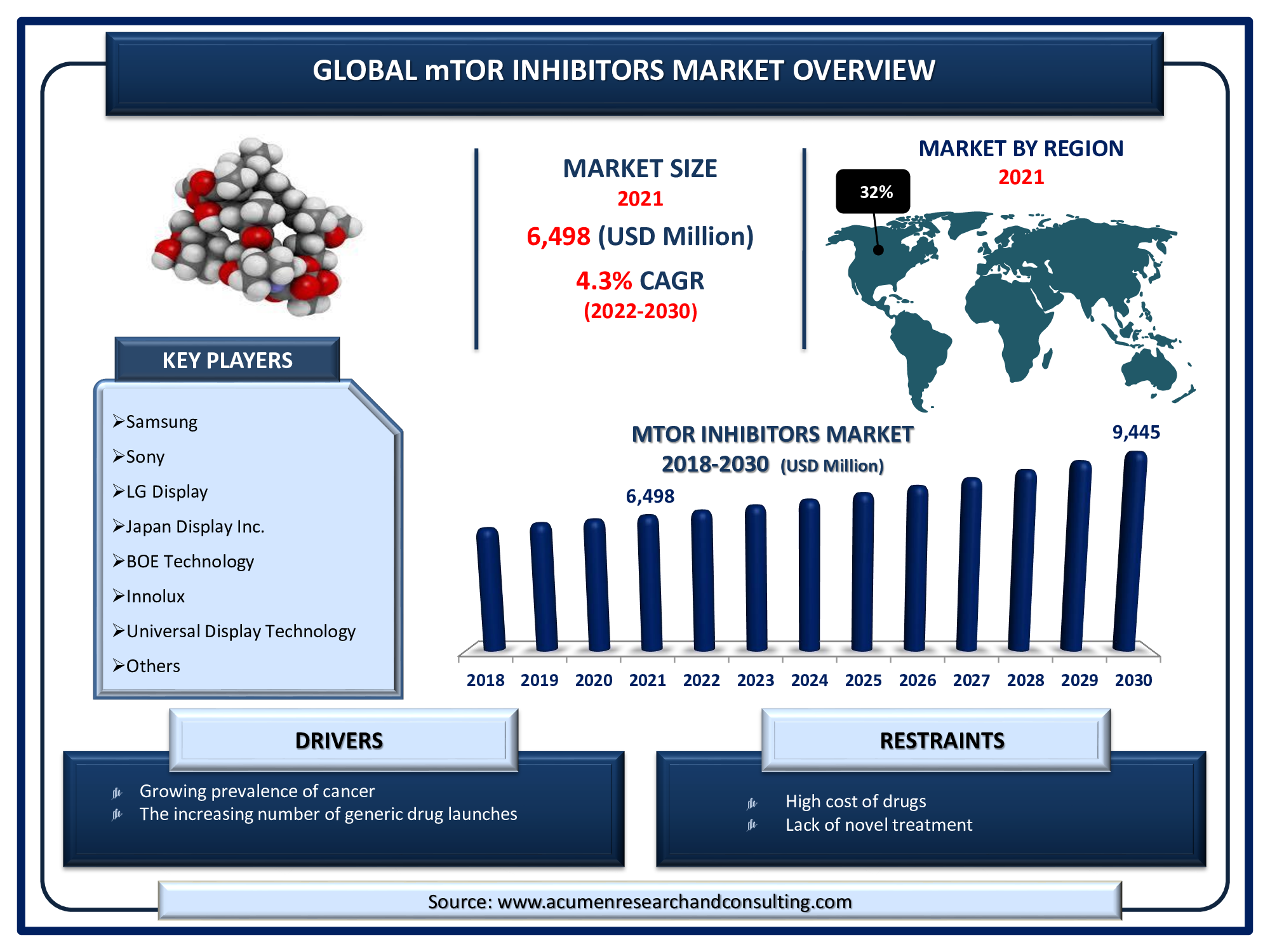

mTOR Inhibitors Market is estimated to reach USD 9,445 Mn by 2030, with a significant CAGR of 4.3%

The Global mTOR Inhibitors Market size accounted for USD 6,498 Mn in 2021 and is estimated to reach USD 9,445 Mn by 2030, with a significant CAGR of 4.3% from 2022 to 2030.

The mechanistic target of rapamycin (mTOR) is a conserved serine and threonine protein kinase. It is identified as the target of the immunosuppressive drug rapamycin. Since the discovery of mTOR, a great deal has been learned about the function of this kinase. It is now well established that mTOR plays a critical role in regulating cell growth and proliferation, making mTOR a therapeutic target for diseases caused by uncontrolled cell proliferation, such as cancer. Several mTOR inhibitors have been developed over the last decade, and many are currently in clinical trials for cancer treatment. mTOR controls cellular metabolism, growth, and expansion by forming and signaling via two protein complexes - mTORC1 and mTORC2. Rapalogs (rapamycin and its analogs) are the most well-established mTOR inhibitors, having shown tumor responses in clinical trials against a variety of tumor types. A surge in the number of generic drug launches is a leading mTOR inhibitors market trend that is pushing the demand forward.

Global mTOR Inhibitors Market Dynamics

Market Growth Drivers:

Market Restraints:

Market Opportunities:

Report Coverage

| Market | mTOR Inhibitors Market |

| Market Size 2021 | USD 6,498 Mn |

| Market Forecast 2030 | USD 12,357 Mn |

| CAGR During 2022 - 2030 | 4.3% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Product Type, By Indication, By Route of Administration, By End-Users, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AbbVie Inc., Accord Healthcare, AstraZeneca, Bristol-Myers Squibb Company, Dr. Reddy’s Laboratories Ltd., Eli Lilly and Company, Hikma Pharmaceuticals PLC, Merck & Co Inc., Novartis AG, Pfizer Inc., Teva Pharmaceuticals Industries Ltd., and Zydus Pharmaceuticals, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The increasing prevalence of cancer disease is the primary factor expanding the global mTOR inhibitors market revenue. According to the American Cancer Society data, there were more than 1.9 million new cancer cases and 608,570 cancer deaths in the U.S. Similarly, it is estimated the number of cases in 2022 will be approximately the same and the number of deaths would rise to 609,360 in the U.S. Furthermore, according to estimates from the World Health Organization (WHO), cancer is the first or second leading cause of death before the age of 70 years in most part of the world. Many human tumors develop as a result of mTOR signalling dysregulation, which can make them more susceptible to mTOR inhibitors. Multiple elements of the mTOR pathway, such as PI3K amplification/mutation, AKT overexpression, eIF4E, and 4EBP1 and overexpression, have been linked to a variety of cancers. As a result, mTOR is an intriguing therapeutic target for treating multiple cancers, either alone or in conjunction with inhibitors of other pathways.

The increasing number of generic drug launches and rapid growth of product approvals from regulatory bodies are other significant factors that are driving the market demand during the forecasted years 2022 to 2030. In addition to that, the rising number of organ transplant surgeries is anticipated to surge the demand in the coming years. For example, in 2020, 39,034 transplants were executed from both living and dead donors which was a slight decrease in 2019 with 39,719 transplants. However, since June of 2020, living donor transplants have taken place at rates more comparable to pre-pandemic activity. Meanwhile, the high cost of drugs and interventional devices and the lack of novel treatment are some of the aspects that are limiting the market to grow.

Furthermore, the rising government spending on research & development activities and increasing technological advancements in renal pathological and physiological mechanisms would likely create numerous growth opportunities for the market during the forecasted period.

mTOR Inhibitor Market Segmentation

The global mTOR inhibitors market is segmented based on product type, indication, route of administration, end-users, distribution channel, and geography.

mTOR Inhibitors Market By Product Type

Among them, the rapamune segment is expected to grow with a substantial share in the coming years. Rapamune is a prescription medication used to treat the symptoms of renal transplant rejection prophylaxis and lymphangioleiomyomatosis. Rapamune can be used alone or in combination with other medications. Rapamune belongs to the immunosuppressant class of drugs.It is an immunosuppressive mTOR inhibitor indicated for the prevention of organ rejection in patients aged more than 13 years receiving renal transplants.

mTOR Inhibitors Market By Indication

Based on Iindication, the organ transplantation segment is showing stiff growth throughout the forecast timeframe. There are two mTOR inhibitors authorized for organ transplantation: sirolimus and everolimus, which are used in kidney, liver, and heart transplants. The development and approval of these transplantation medications has been contentious and complicated, but they also provide many noteworthy advantages for transplantation.

mTOR Inhibitors Market By Route of Administration

By route of administration, the oral segment held a considerable market share in 2021. Patients prefer oral administration because it is more convenient, but it is associated with poor adherence to treatment and poor and variable bioavailability. However, the intravenous route of administration is likely to result in greater treatment adherence, better control of plasma drug concentrations, and more regular monitoring of toxicity and therapeutic response. On the other hand, intravenous administration can be uncomfortable and inconvenient for patients.

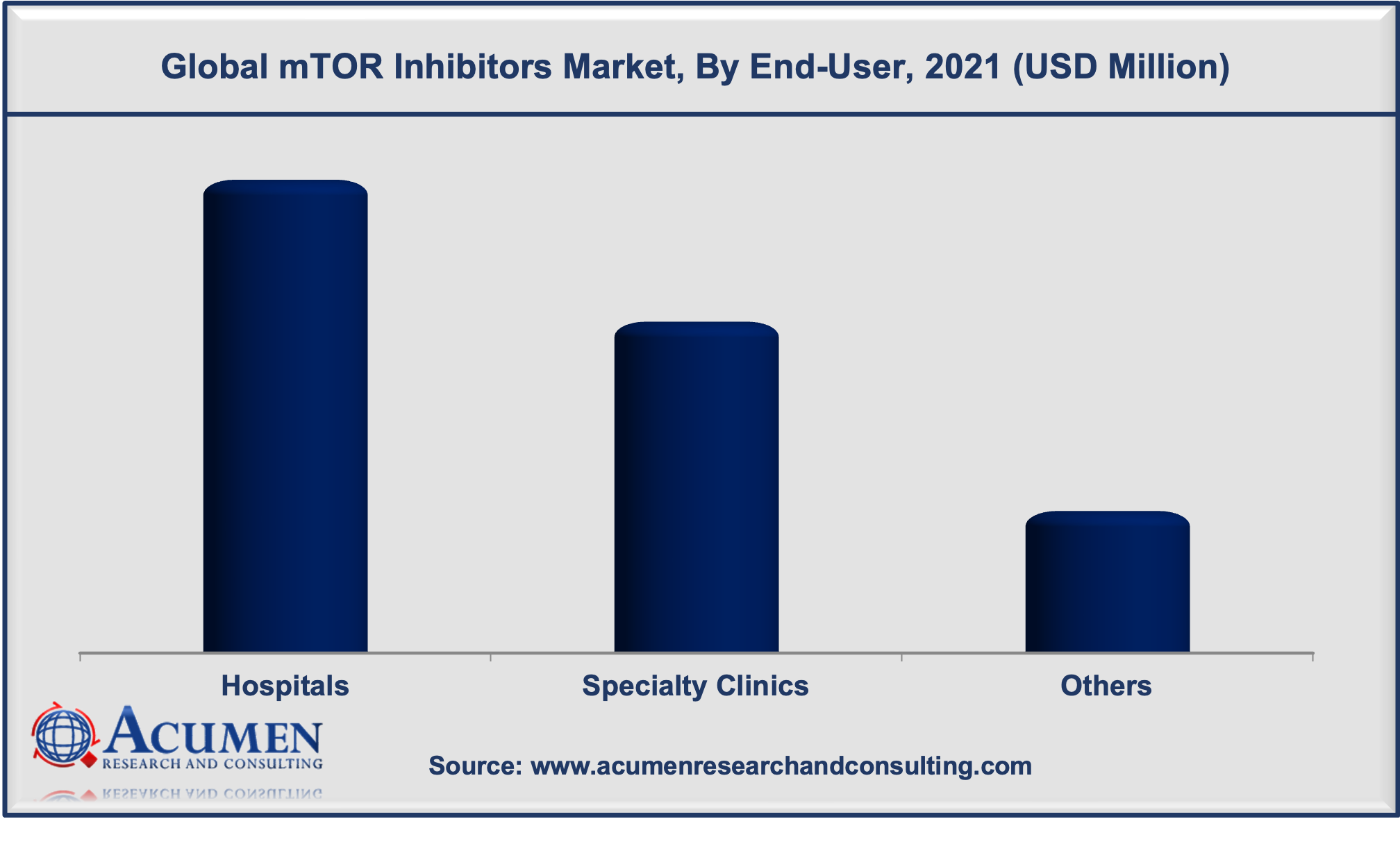

mTOR Inhibitors Market By End-Users

Based on our analysis, the hospital segment is likely to attain a noteworthy market share in 2021. Numerous advantages of hospitals such as the presence of experienced medical professionals, the presence of emergency units, availability of advanced medical devices, and better diagnosis and treatment are supporting the market growth. Additionally, the surging cases of cancer, and the growing number of organ transplants that are mostly operated on are boosting the hospital segment revenue.

mTOR Inhibitors Market By Distribution Channel

Out of these, the hospital pharmacies gathered the utmost shares from the mTOR inhibitors market. Increased interaction with prescribers and other health professionals, greater input in prescribing decisions about drugs and administration, and better access to medical records of patients are some of the leading aspects that are supporting the hospital pharmacies segment. Meanwhile, the online pharmacy segment is projected to witness the fastest growth rate during the forecast period.

mTOR Inhibitors Market Regional Overview

North America

Europe

Latin America

Asia-Pacific

The Middle East & Africa (MEA)

Presence of Leading Companies in North America Region Fuels the Regional Market Growth

The regional segmentation is given as North America, Latin America, Asia-Pacific, Europe, and the MEA. Among all the regions, North America region commanded the majority of the market share all through the forecasted years. Some of the factors such as rapid growth in healthcare expenditure, presence of key players and advanced healthcare facilities, and increasing number of elderly populations will spur the North America mTOR inhibitors market growth. On the other hand, the Asia-Pacific region is likely to attain the fastest CAGR from 2022 to 2030. This could be attributed to the surging number of cancer patients, rising government initiatives toward drug development, and growing awareness for novel treatments.

Market Players

Some of the top vendors offered in the professional report include AbbVie Inc., Accord Healthcare, AstraZeneca, Bristol-Myers Squibb Company, Dr. Reddy’s Laboratories Ltd., Eli Lilly and Company, Hikma Pharmaceuticals PLC, Merck & Co Inc., Novartis AG, Pfizer Inc., Teva Pharmaceuticals Industries Ltd., and Zydus Pharmaceuticals, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2018

February 2024

April 2023

June 2022