October 2022

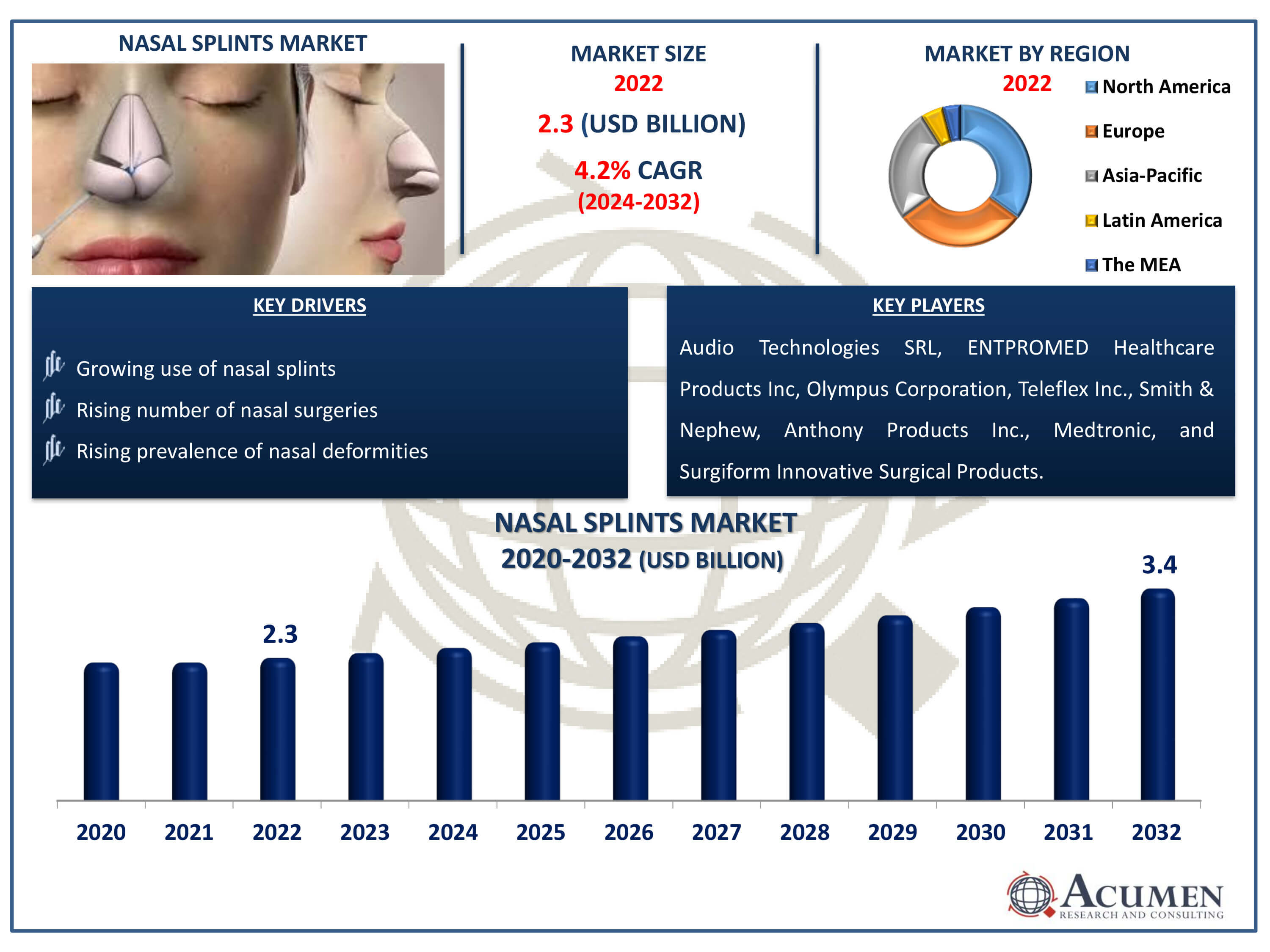

Nasal Splints Market Size accounted for USD 2.3 Billion in 2022 and is estimated to achieve a market size of USD 3.4 Billion by 2032 growing at a CAGR of 4.2% from 2024 to 2032.

The Nasal Splints Market Size accounted for USD 2.3 Billion in 2022 and is estimated to achieve a market size of USD 3.4 Billion by 2032 growing at a CAGR of 4.2% from 2024 to 2032.

Nasal Splints Market Highlights

Nasal splints are medical devices designed to support and stabilize the nasal septum and/or nasal passages. They are typically used following nasal surgery, such as septoplasty or rhinoplasty, to maintain proper alignment and prevent post-operative complications like septal deviation or collapse. These splints are usually made of silicone or plastic and are inserted into the nostrils during the healing process. Nasal splints can also be utilized to address nasal obstruction due to conditions like deviated septum or nasal valve collapse, providing temporary relief and improving airflow.

Global Nasal Splints Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Nasal Splints Market Report Coverage

| Market | Nasal Splints Market |

| Nasal Splints Market Size 2022 | USD 2.3 Billion |

| Nasal Splints Market Forecast 2032 |

USD 3.4 Billion |

| Nasal Splints Market CAGR During 2024 - 2032 | 4.2% |

| Nasal Splints Market Analysis Period | 2020 - 2032 |

| Nasal Splints Market Base Year |

2022 |

| Nasal Splints Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Material, By Application, By Route Of Administration, By End-Users, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Audio Technologies SRL, ENTPROMED Healthcare Products Inc, Olympus Corporation, Teleflex Inc., Smith & Nephew, Medtronic, Surgiform Innovative Surgical Products, E. Benson Hood Laboratories, Inc., Boston Medical Products Inc, and Anthony Products Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Nasal Splints Market Insights

The rising prevalence of nasal deformities is a key driver of growth in the nasal splints market. The increasing incidence of nasal deformities, such as deviated septum, nasal fractures, and congenital nasal abnormalities, significantly contributes to the expanding demand for nasal splints. These medical devices are specifically designed to support and stabilize nasal structures during the post-surgery or trauma healing process. They play a crucial role in maintaining the shape and function of the nose, thereby preventing complications such as septal hematoma and nasal airway obstruction. As awareness about nasal health and available treatment options increases, coupled with advancements in nasal splint technology, the global demand for these devices is expected to continue growing.

However, the high cost associated with nasal surgeries poses a significant barrier to the growth of the nasal splint market. Patients may opt out of surgery or seek alternative, less expensive treatment options due to financial constraints. Additionally, expenses related to pre-operative consultations, post-operative care, and potential complications further contribute to the overall cost burden. To overcome this challenge, the development of more affordable nasal splint options or innovative financing models could help make nasal surgeries and related products more accessible to patients. Moreover, obstacles related to nasal splints, such as discomfort or poor fit, also hinder market growth.

Technological advancements present a significant opportunity for the nasal splints market. Innovations such as 3D printing enable the customization of splints for individual patients, enhancing comfort and effectiveness. Additionally, advancements in material science contribute to the development of lightweight yet durable splints, improving patient compliance and outcomes. Furthermore, integration with digital health technologies allows for remote monitoring and adjustment, enhancing the overall patient experience. These advancements not only drive market growth but also pave the way for more efficient nasal splint solutions.

Furthermore, growing awareness about reconstructive surgeries and the expansion of the healthcare industry are expected to create opportunities for the nasal splint market in the coming years.

Nasal Splints Market Segmentation

The worldwide market for nasal splints is split based on type, application, materials, route of administration, end-users, and geography.

Nasal Splint Types

According to nasal splints industry analysis, malleable type dominates the nasal splints market due to several factors, such as better comfort, easier fitting, or more effective treatment outcomes compared to rigid nasal splints. Malleable nasal splints offer the advantage potentially providing better support and stabilization during the healing process. Additionally, they may be more comfortable for patients to wear, leading to improved compliance with post-operative care instructions. Medical professionals may also prefer malleable nasal splints for their ease of use during procedures and their ability to be adjusted or customized to meet specific patient needs. Furthermore, ongoing development in malleable type further contributes to its dominance in the market. For instance, Innovia medical presents NETWORK ENT external malleable nasal splints, designed for use without heat.

Nasal Splint Applications

According to the nasal splints industry forecast, plastic surgery in the nasal splint market is expected to rise in the forecast year due to various factors such as increasing demand for cosmetic procedures, advancements in surgical techniques, and growing awareness about aesthetic enhancements. Plastic surgery involves procedures like rhinoplasty, which reshapes or reconstructs the nose for cosmetic or functional purposes. Additionally, ENT stands for Ear, Nose, and Throat. It is a medical specialty focusing on the diagnosis and treatment of disorders and conditions related to the ear, nose, throat, head, and neck regions. Medical professionals specializing in ENT are known as otolaryngologists or ENT doctors. They are trained to address a wide range of issues, including hearing loss, sinusitis, tonsillitis, voice disorders, and nasal obstruction. Overall, the ENT field is also anticipated to drive the demand for the nasal splint market.

Nasal Splint Materials

According to the nasal splints market industry, silicon splint material is the dominant choice in the nasal splints market due to its versatility and effectiveness. Silicon splints offer a combination of flexibility and rigidity, allowing them to provide optimal support while conforming to the shape of the nose. Additionally, they are hypoallergenic and comfortable for patients, reducing the risk of complications and ensuring better compliance with post-operative care. Their non-stick surface also facilitates easier removal, minimizing discomfort during the healing process. Overall, these qualities make silicon splints the preferred option for nasal splinting.

Nasal Splint Route of Administrations

According to the nasal splints market industry, intranasal route dominates the nasal splint market, due to its numerous advantages. This method involves placing the splint directly into the nasal passages, providing targeted support and stabilization for various nasal conditions such as septal deviations, fractures, or post-surgical recovery. Intranasal splints offer improved comfort for patients compared to external splints, as they are less intrusive and don't obstruct external appearance. Furthermore, they facilitate better breathing by maintaining nasal patency while minimizing discomfort during removal. These factors have propelled the intranasal route to prominence in the nasal splint market.

Nasal Splint End-Users

According to the nasal splints market forecast, the demand for hospital and clinic services is expected to rise steadily in the coming years due to several factors. For instance, in 2022, hospitals in the U.S. conducted 578,599 reconstructive procedures, accounting for 57% of all reconstruction procedures performed nationwide, as indicated by the 2022 ASPS Procedural Statistics Release. Population growth, aging demographics, and increased access to healthcare services are primary drivers behind this trend. Additionally, advancements in medical technology and treatments lead to higher demand for specialized care. Moreover, the global focus on preventive healthcare and wellness initiatives encourages more individuals to seek medical attention. As a result, hospitals and clinics are likely to experience increased patient volumes and require more healthcare professionals to meet growing demands.

Nasal Splints Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

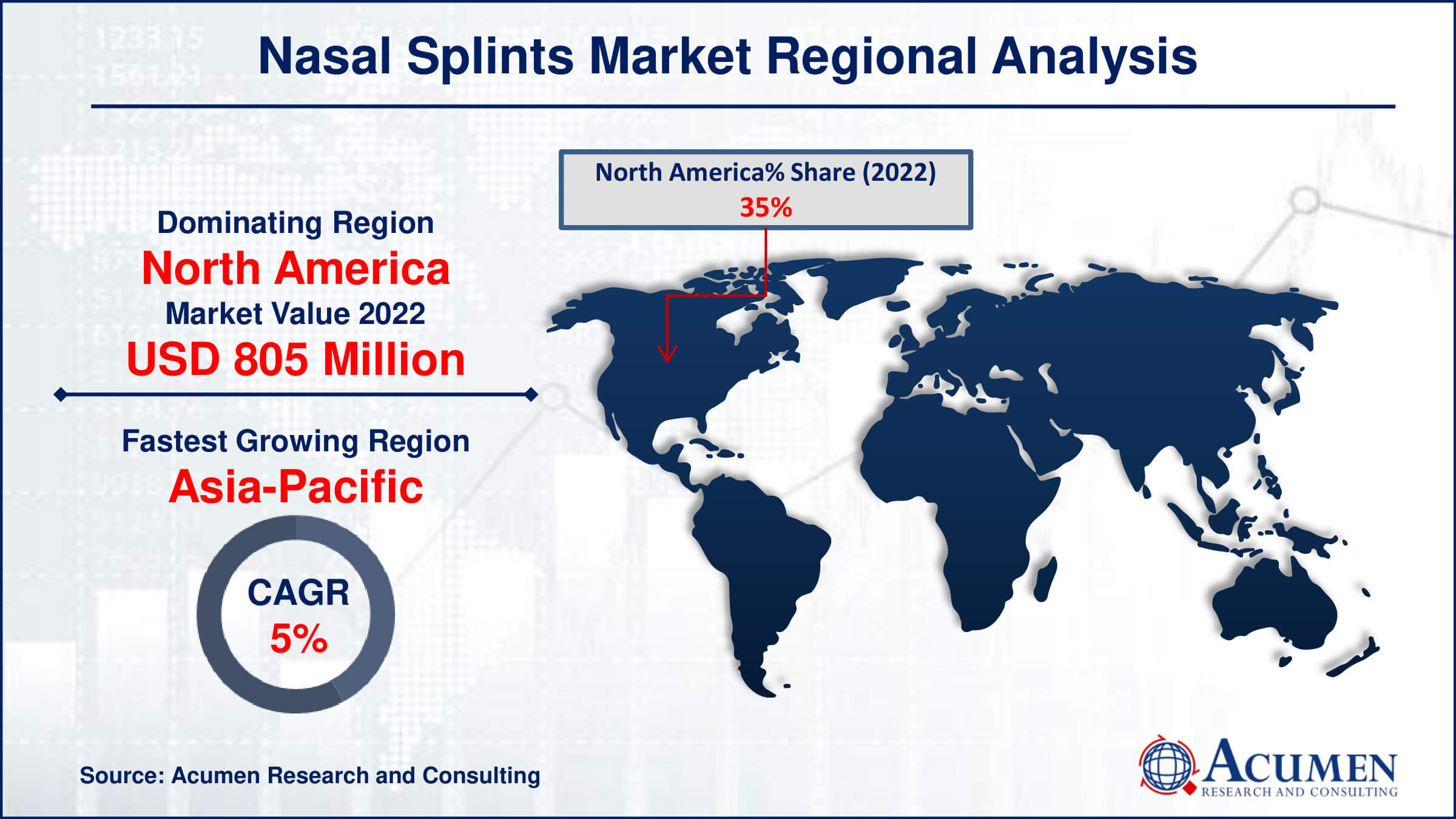

Nasal Splints Market Regional Analysis

In terms of nasal splints industry analysis, North America dominates the nasal splints market, boasting significant market share due to factors such as high healthcare expenditure, advanced healthcare infrastructure, and increasing prevalence of nasal conditions. The region benefits from extensive research and development activities, leading to the introduction of innovative nasal splint products. For instance, rinastent bioresorbable nasal splint launched by the Stryker, on January 2022 for nasal surgeries. Additionally, in May 2021, Summit Medical, a subsidiary of Innovia Medical specializing in ENT medical devices and instrument protection products, introduced the Accudent Nasal Splint in the United States. The growing prevalence of nasal conditions and the increasing demand for minimally invasive procedures further contribute to the market's expansion in North America. Moreover, strong regulatory frameworks ensure the safety and efficacy of nasal splint devices, bolstering consumer confidence and market growth in the region.

Asia-Pacific region is emerging as the fastest-growing market for nasal splints. This growth can be attributed to rising awareness about nasal disorders, improving healthcare infrastructure, and increasing disposable income in countries like China, India, and Japan. As these nations focus more on healthcare development and accessibility, the demand for nasal splints is expected to surge, driving market growth in the region.

Nasal Splints Market Players

Some of the top nasal splints companies offered in our report include Audio Technologies SRL, ENTPROMED Healthcare Products Inc, Olympus Corporation, Teleflex Inc., Smith & Nephew, Medtronic, Surgiform Innovative Surgical Products, E. Benson Hood Laboratories, Inc., Boston Medical Products Inc, and Anthony Products Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2022

September 2024

October 2024

March 2025