October 2020

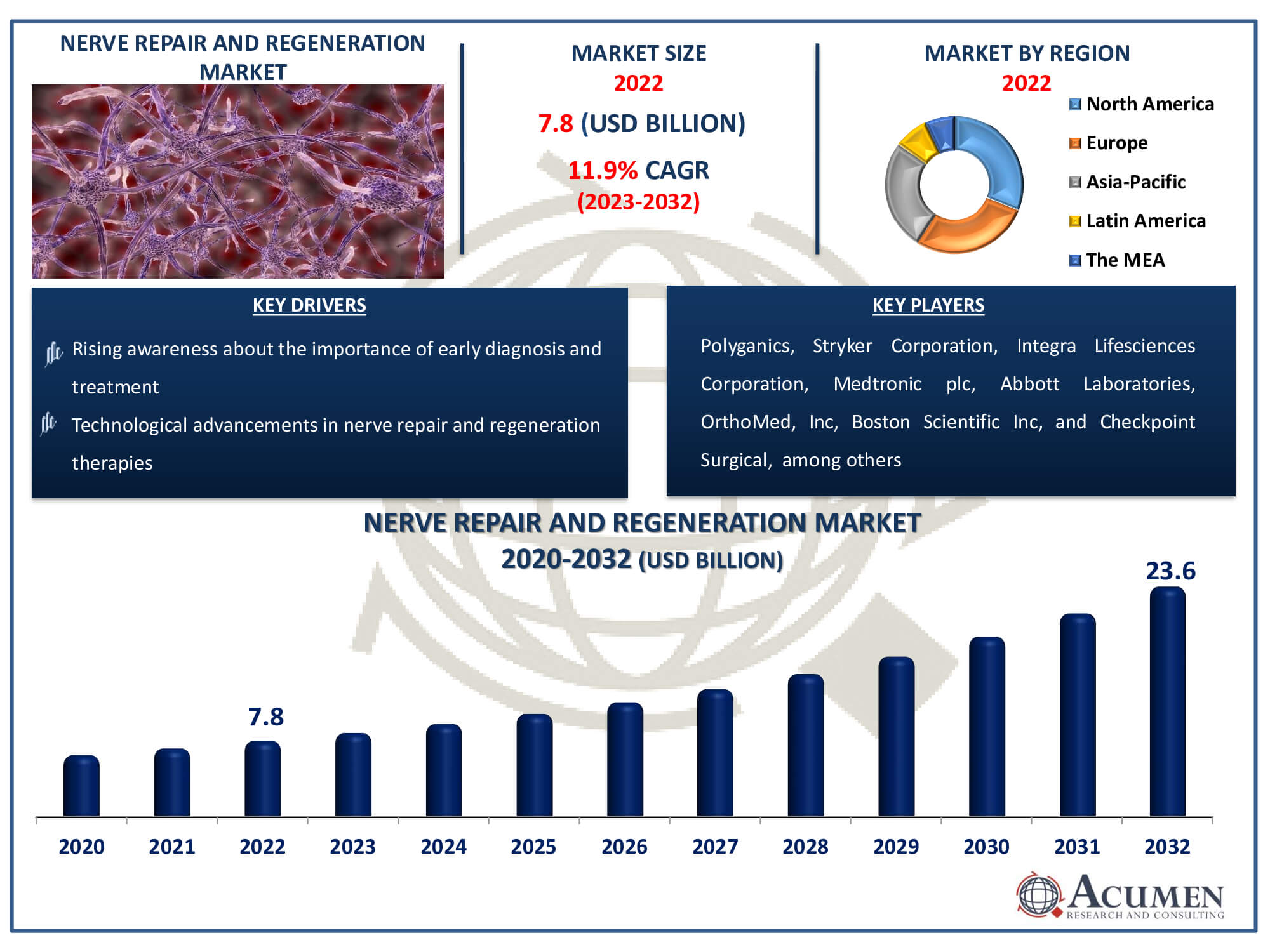

Nerve Repair and Regeneration Market Size accounted for USD 7.8 Billion in 2022 and is estimated to achieve a market size of USD 23.6 Billion by 2032 growing at a CAGR of 11.9% from 2023 to 2032.

The Nerve Repair and Regeneration Market Size accounted for USD 7.8 Billion in 2022 and is estimated to achieve a market size of USD 23.6 Billion by 2032 growing at a CAGR of 11.9% from 2023 to 2032.

Nerve Repair and Regeneration Market Highlights

The complicated and sensitive structures of the brain, spinal cord, and peripheral nerves are susceptible to various types of injury, ranging from neurodegenerative conditions to diseases like Alzheimer's, Parkinson's, multiple system atrophy, and amyotrophic lateral sclerosis. Peripheral nerves, which connect the brain and spinal cord to muscles and skin, are particularly fragile and prone to damage, potentially disrupting the brain's ability to communicate with muscles and organs. This includes biomaterials and neurostimulation devices for repairing and regenerating the nervous system.

Global Nerve Repair and Regeneration Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Nerve Repair and Regeneration Market Report Coverage

| Market | Nerve Repair And Regeneration Market |

| Nerve Repair And Regeneration Market Size 2022 | USD 7.8 Billion |

| Nerve Repair And Regeneration Market Forecast 2032 | USD 23.6 Billion |

| Nerve Repair And Regeneration Market CAGR During 2023 - 2032 | 11.9% |

| Nerve Repair And Regeneration Market Analysis Period | 2020 - 2032 |

| Nerve Repair And Regeneration Market Base Year |

2022 |

| Nerve Repair And Regeneration Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Surgery, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Polyganics, Stryker Corporation, Integra Lifesciences Corporation, Medtronic plc, Abbott Laboratories, OrthoMed, Inc, Boston Scientific Inc, Checkpoint Surgical, Synovis Micro Companies Alliance, Baxter International, Inc., and AxoGen, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Nerve Repair And Regeneration Market Insights

The main drivers of the market include the rising prevalence of neurological disorders and the robust pipeline of major companies. Improved therapy effectiveness for neurological disorders, facilitated by various technological advancements, is also expected to contribute to market growth. Baxter completed the marketing authorization process for 'HEMOPATCH,' a ready-to-use surgical patch, in the European market in March 2016. This patch is approved as a hemostatic system to prevent blood loss or other body fluid leakage and to halt dura mater shrinkage during traumatic injuries to the brain, central nervous system (CNS), or other body components.

Additionally, a range of therapies is available for treating various central nervous system (CNS) illnesses such as Parkinson's disease and Alzheimer's, as well as a broader spectrum of applications. According to the World Health Organization (WHO), in 2018, 326 million individuals experienced migraine pain, while 24 million suffered from Alzheimer's disease. Increased awareness, environmental factors, lifestyle choices, genetics, nutrition, and physical injuries can contribute to these conditions. A report published in 2015 highlighted findings from an annual meeting of the American Society for Hand Surgery (ASSH), indicating that therapy for patients with severe nerve damage may result in the restoration of motor and sensory nerve functions through processed nerve allografts. The study demonstrated sensory nerve function regeneration in 75% and motor function restoration in 85% of patients who received PNA allograft (Avance Nerve Graft, AxoGen).

Nerve Repair and Regeneration Market Segmentation

The worldwide market for nerve repair and regeneration is split based on product, surgery, and geography.

Nerve Repair and Regeneration Products

According to nerve repair and regeneration industry analysis, neurostimulation and neuromodulation devices segment is the largest in 2022. Within the neurostimulation and neuromodulation devices SCS subsegment is expected to the largest product segment, commanding a market share of more than 40% in 2022. Its dominance was driven by the wide availability of commercially viable backbone products and a diverse range of applications.

The market is poised for increased investment from major companies aiming to develop more efficient equipment in the nerve repair and regeneration industry forecast period. For instance, in May 2016, the FDA approved the precision assembly system MRI spinal cord stimulator system by boston scientific. The company claimed that its system provides 70% more relief from back pain.

Due to advancements in technology, a broad range of applications, public funding for innovation, and biocompatibility, the biomaterials segment is expected to witness the highest compound annual growth rate (CAGR) between 2023 and 2032. Superior products, particularly biodegradable polymers, are anticipated to enhance spinal stabilization, treat fractures, and reduce hospitalization.

Nerve Repair and Regeneration Surgeries

The industry is categorized into direct nerve repair/neurorrhaphy, nerve grafting, stem cell treatment, and neurostimulation & neuromodulation surgery. In 2022, neurostimulation and neuromodulation surgery accounted for the largest proportion of the market. Over the nerve repair and regeneration market forecast period, stem cell therapy is expected to exhibit the highest compound annual growth rate (CAGR). Various public initiatives and approvals are projected to drive the clinical biomaterials market. In the U.S., approximately 570 stem cell therapy clinics are currently available, with the number expected to rise, thereby fostering development in this segment.

Anticipated product marketing in the coming years is also poised to bolster market growth, driven by investments from businesses and research institutes. For instance, in June 2016, Axonics Modulation Technologies received CE mark approval from the European Union for its sacral nerve modulation system. The company plans to commercialize it following a follow-up post-market clinical trial.

Neurostimulation/neuromodulation surgery dominated the industry in 2018, attributed to the accessibility of various products and technological advancements aimed at reducing chronic pain. For example, in April 2016, St. Jude introduced the DRG-Dorsal Root Ganglion implant in the U.S., featuring the axium neurostimulator system. This system effectively reduces chronic pain for sufferers of complex regional pain syndrome I and II, which traditional SCS cannot accomplish.

Nerve Repair and Regeneration Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

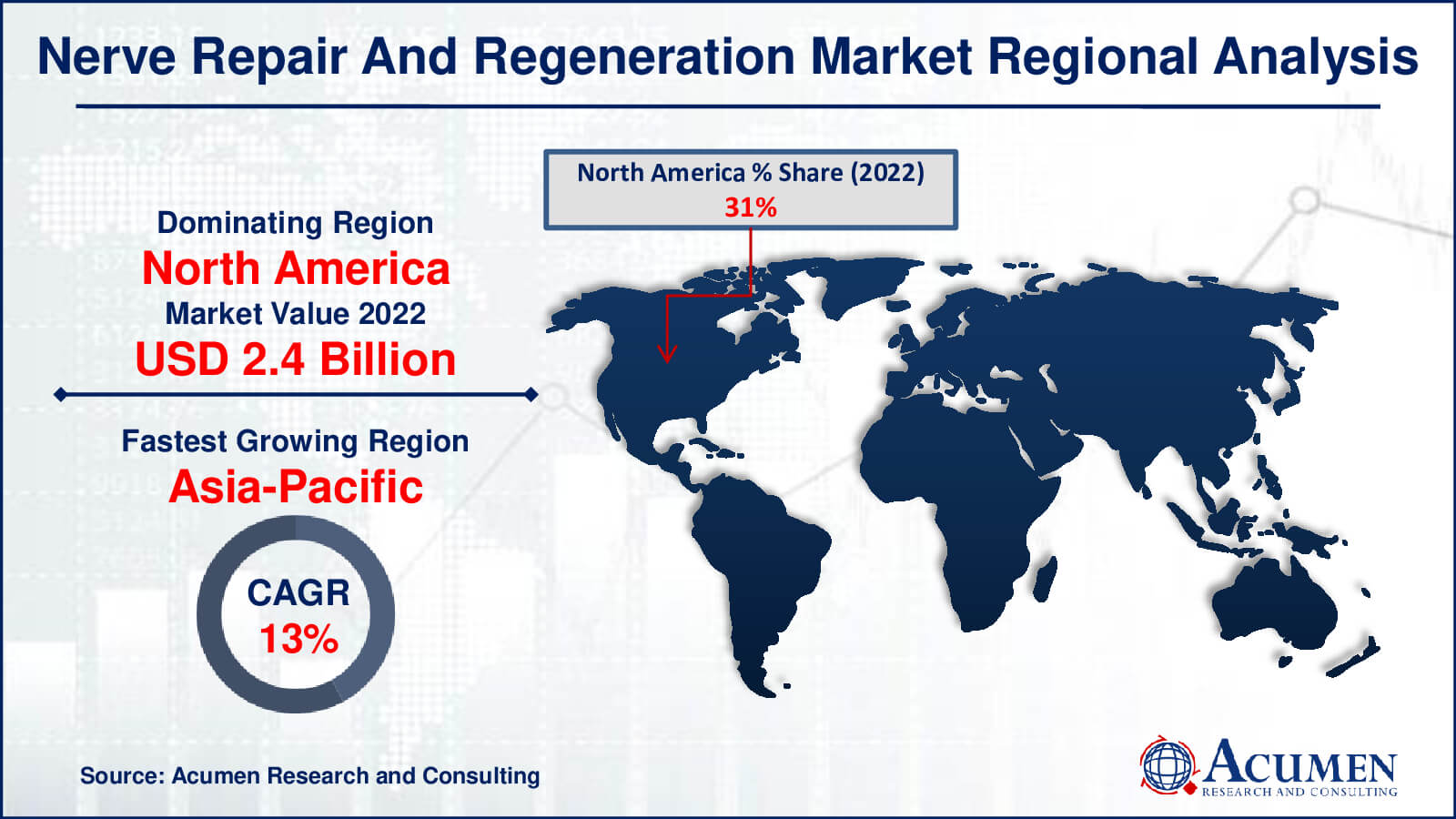

Nerve Repair and Regeneration Market Regional Analysis

In terms of nerve repair and regeneration market analysis, North America emerged as the market leader in the region in 2022, driven by the expansion of neural diseases and healthcare support initiatives. The region's dominance is further bolstered by the presence of key market players and the availability of sophisticated technological devices. For instance, in February 2016, Medtronic plc introduced Reclaim DBS therapy to treat Obsessive-Compulsive Disorder (OCD). Additionally, in May 2016, Boston Scientific received FDA approval for its Precision Montage MRI-safe Spinal Cord Stimulation (SCS) system, used for chronic pain management.

The Asia-Pacific region, with its rapidly growing population, increasing patient awareness, supportive public projects, minimal medical requirements, and emergence of innovative techniques, is experiencing the fastest growth. Key countries contributing to the region's development include China, India, Japan, Australia, and Singapore. In December 2015, the Australian Therapeutic Goods Administration (TGA) approved a clinical trial of a treatment method based on human parthenogenetic stem cells (ISC-hpNSC) for patients suffering from Parkinson's disease. This approval is expected to drive the region's stem cell therapy market.

Nerve Repair and Regeneration Market Players

Some of the top nerve repair and regeneration companies offered in our report includes Polyganics, Stryker Corporation, Integra Lifesciences Corporation, Medtronic plc, Abbott Laboratories, OrthoMed, Inc, Boston Scientific Inc, Checkpoint Surgical, Axogenic, Synovis Micro Companies Alliance, Baxter International, Inc., and AxoGen, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2020

November 2022

September 2024

August 2023