May 2020

No-Code Development Platform Market (By Component: Platform, Services; By Deployment Model: On-Premise, Cloud; By Organization Size: Large Enterprises, Small and Medium-sized Enterprises; By Industry Vertical: BFSI, Retail & E-commerce, Real Estate, Healthcare, Others) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

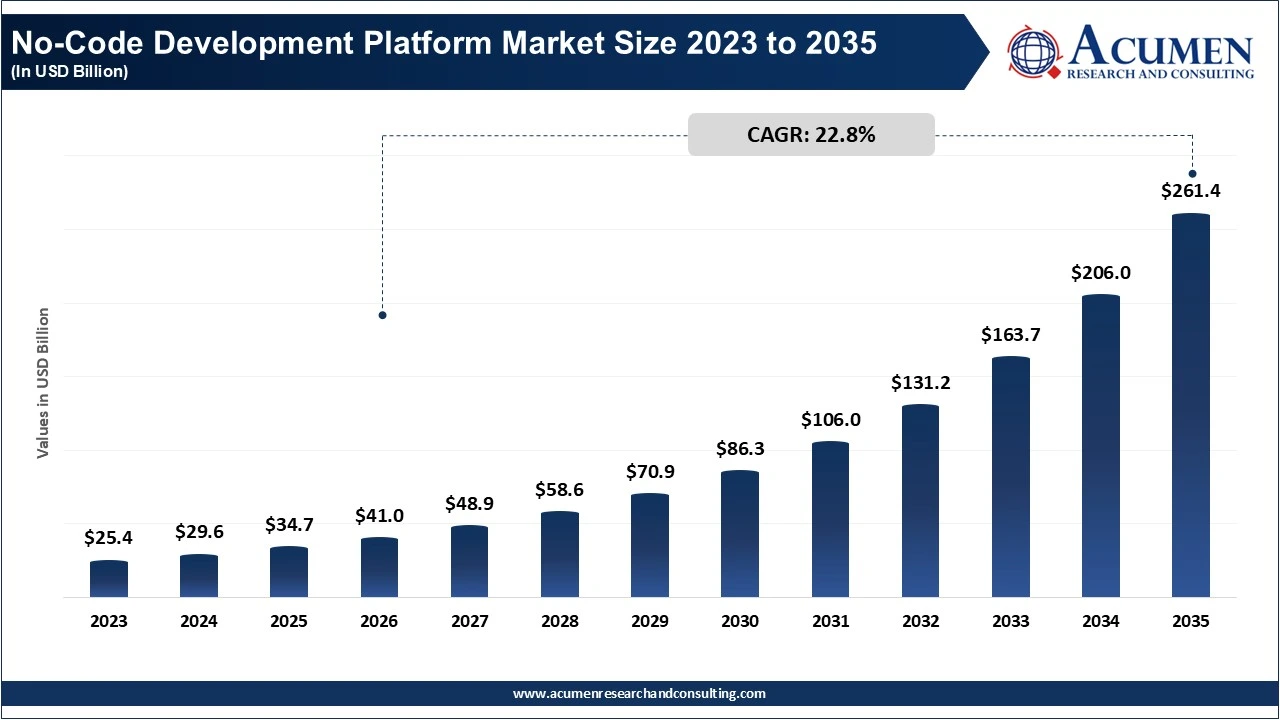

The global no-code development platform market size was accounted for USD 34.7 billion in 2025 and is estimated to surpass around USD 261.4 billion by 2035 growing at a CAGR of 22.8% from 2026 to 2035. The rapid growth in digital transformation is driving the growth or the no-code development platform market. Further, the proliferation of AI applications continues to support the market demand.

The no-code development platforms are witnessing the growing need for restructuring development processes and growth in rapid application development. These platforms facilitate rapid application development with the use of automation tools and pre-built templates, pre-configured modules, drag-and-drop tools, and visual interfaces. The escalating demand for cloud-based platforms is driving the market growth.

These platforms enable business users to generate insights, automate repetitive tasks, and build predictive models independently, lessening the pressure on IT teams and enhancing time-to-value. As enterprises greatly pursue digital transformation and look for agility and advancements, the ability of no-code platforms to support quicker experimentation and optimized operational integration becomes a key market driver.

| Area of Focus | Details |

| No-Code Development Platform Market Size 2025 | USD 34.7 Billion |

| No-Code Development Platform Market Forecast 2035 | USD 261.4 Billion |

| No-Code Development Platform Market CAGR During 2026 – 2035 | 22.8% |

| Segments Covered | By Component, By Deployment Model, By Organization Size, By Industry Vertical, and By Geography |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | SAP SE, Zoho Corporation, Hexaware Technologies Limited, Pegasystems Inc., ServiceNow Inc., Quickbase Inc., Glide, Webflow Inc., Caspio Inc., Appy Pie |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The worldwide market for no-code development platform is split based on component, deployment model, organization size, industry vertical, and geography.

The platforms segment dominated the no-code development platform market in 2025. No-code development platforms enable the creation of advanced models without the need for IT coding professionals. These platforms decrease the time that is required to build applications to minutes, enabling enterprises to integrate machine learning models into the organization’s processes efficiently. No-code development platforms lower the entry barriers for enterprises and individuals to begin experimenting with AI and ML. These solutions allow organizations to affordably and swiftly implement AI models, enabling their domain specialists to benefit from the cutting-edge technology.

| Component | Market Share (%) | Key Highlights |

| Platform | 89% | Dominant as it serves as the core technological foundation that allows users to build, deploy, and automate applications without in-depth programming expertise. |

| Services | 11% | The rapid shift toward specialized consulting, integration, and managed support offerings assist enterprises scale and optimize no-code implementations. |

According to the no-code development platform industry analysis, in 2025, the cloud-based deployment model dominated the market. This is primarily driven by the accelerating need for cost-effective, flexible, and highly scalable solutions. The rapid growth in digitalization is augmenting the segment's growth. Additionally, cloud-based development platforms aid with quicker time-to-market scenarios for innovative products, driven by rapid application implementation and setups. These platforms improve the overall security and alliance among developers, stakeholders, and teams to enhance productivity.

| Deployment Model | Market Share (%) | Key Highlights |

| On-premise | 24% | A key trend in the on-premise model is the growing adoption among highly regulated industries that seek stringent data control and enhanced security compliance for no-code deployments. |

| Cloud | 76% | Dominant as there is an escalating need for flexible, cost-effective, and highly scalable solutions. |

The large enterprises segment led the no-code development platform sector owing to the growing adoption of these platforms for complex project handling, management, and data analytics. Large enterprises necessitate solutions for complexities including cross-departmental workflow management and integrating legacy systems. These platforms provide flexibility in large enterprises and help to address changing business environments and scale up their applications. Larger organizations, banking, retail, and healthcare are adopting this platform for creating customized applications, automating internal operations, and enhancing overall experiences.

| Organization Size | Market Share (%) | Key Highlights |

| Large Enterprises | 88% | Dominant because of the growing adoption of these platforms for complex project handling, management, and data analytics. |

| Small and Medium-sized Enterprises | 12% | The growing shift toward no-code platforms for reducing the development costs and enabling quicker application creation without heavily relying on specialized IT teams is creating growth avenues for the segment. |

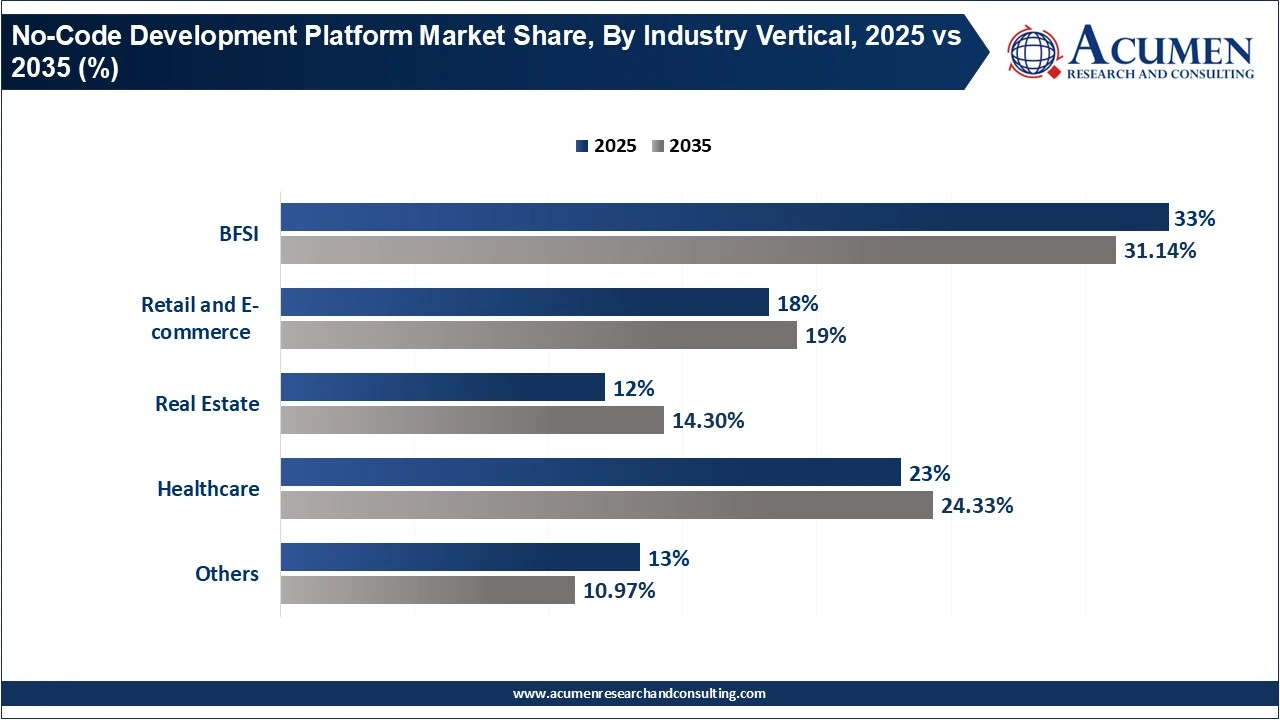

The BFSI segment held the largest market share in 2025. This is driven by the growth in adoption of no-code development platforms for faster development and deployment processes, automating processes, and improving the consumer experiences. The rapid digitalization in this industry is encouraging a surge in the deployment of these platforms to optimize processes and further boost digital transformation. The industry is looking for solutions to save resources in IT infrastructure, making such platforms a great fit. The increasing need to improve consumer experience further fuels the segmental growth.

| Industry Vertical | Market Share (%) | Key Highlights |

| BFSI | 33% | Dominant as no-code platforms are increasingly being adopted in the sector, enabling rapid building of secure and compliant customer-facing applications, while automating workflows in the back office. |

| Retail & E-commerce | 18% | The retailers are increasingly using no-code tools to customize digital storefronts, optimize inventory processes, and launch quick marketing apps. |

| Real Estate | 12% | No-code platforms are increasingly being used within real estate firms to create efficiencies in property management, workflow automation, and customer engagement portals. |

| Healthcare | 23% | Healthcare providers are adopting no-code solutions to digitize patient influx, streamline clinical operations, and support rapid creation of compliance-ready apps. |

| Others | 13% | No-code platforms serve a wide variety of industries to accelerate digital transformation, avoid IT backlogs, and empower the building of custom solutions by citizen developers. |

North America dominated the no-code development platform market by garnering a major market share in 2025. This is attributed to the robust presence of key tech players, high adoption of novel technologies, advanced IT infrastructure, and efficient initiatives in digital transformation. North America has a well-established IT infrastructure, driving significant adoption of these platforms. Moreover, the existence of a vast number of tech giants and startups proliferates the market competitiveness in the region.

| Region | Market Share (%) | Key Highlights |

| North America | 36% | Dominant because of the robust presence of key tech players, high adoption of novel technologies, advanced IT infrastructure, and efficient initiatives in digital transformation. |

| Europe | 29% | The growth of regulated, enterprise-grade no-code adoption continues to be on a strong upward trend in the Europe market due to strict data protection laws (GDPR) and rapid digital transformation across public and private sectors. |

| Asia-Pacific | 24% | The region’s steady growth is driven by rising adoption of mobile applications, rapid digitization, and expansion of the IT sector. |

| MEA | 6% | MEA is observing heightened demand for no-code platforms as governments and enterprises increase the pace of digitalization agendas and seek cost-efficient solutions. |

| Latin America | 4% | In Latin America, a growing trend is seen whereby SMEs are increasingly utilizing no-code tools for enterprise business operations modernization, decreasing development costs, and swiftly deploying localized digital applications. |

Asia-Pacific is projected to grow at a notable pace during the forecast period. The region’s steady growth is driven by rising adoption of mobile applications, rapid digitization, and expansion of the IT sector. The growth of large enterprises in the region is augmenting the adoption of no-code development platforms for the deployment and development of advanced applications. Countries such as India, Japan, China, Australia, and South Korea are boosting the regional market growth due to their increasing focus on digital literacy, technological innovation, and expansion of IT infrastructure.

By Component

By Deployment Model

By Organization Size

By Industry Vertical

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2020

March 2023

January 2021

March 2025