October 2022

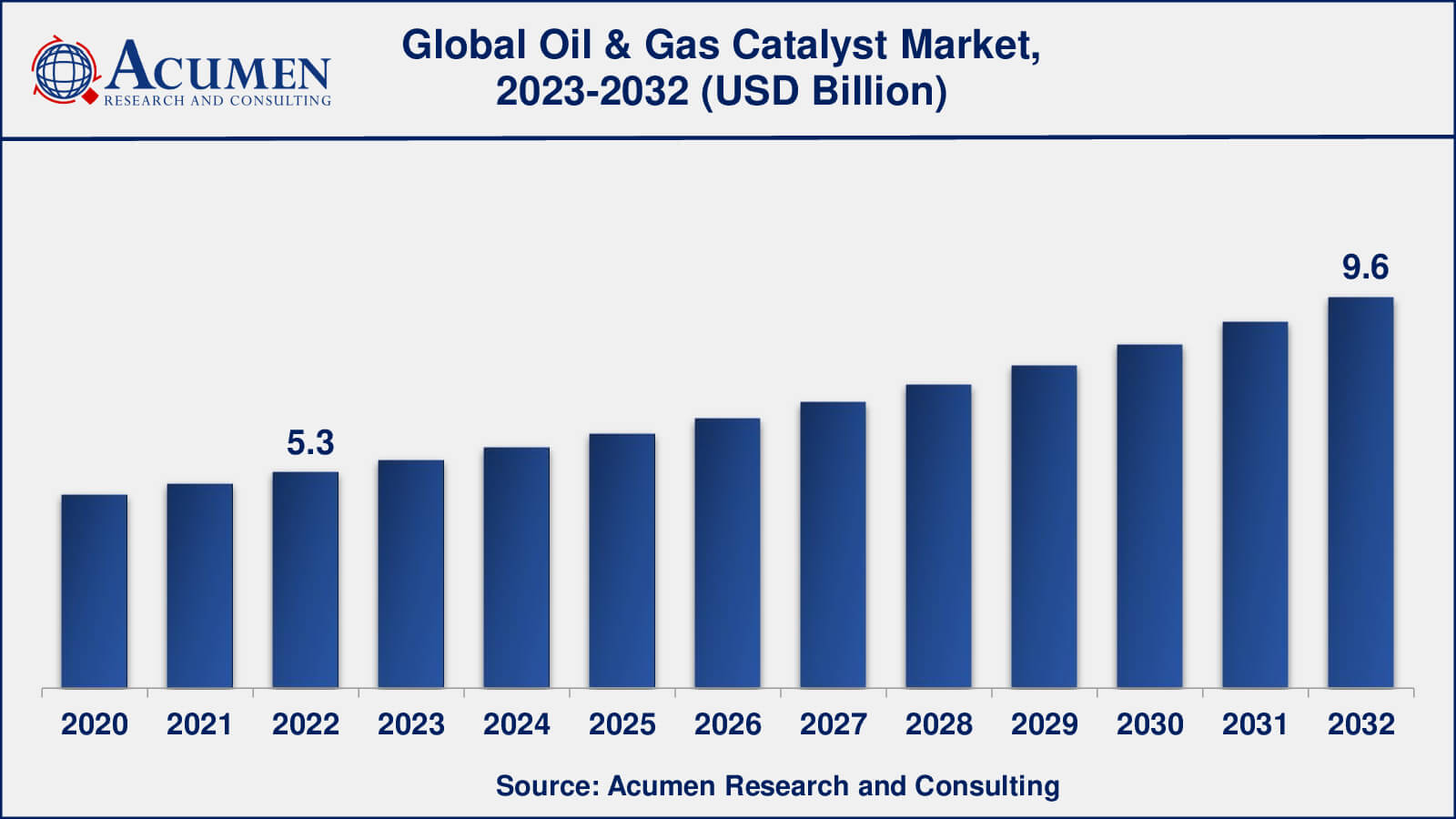

Oil & Gas Catalyst Market Size accounted for USD 5.3 Billion in 2022 and is estimated to achieve a market size of USD 9.6 Billion by 2032 growing at a CAGR of 6.2% from 2023 to 2032.

The Global Oil & Gas Catalyst Market Size accounted for USD 5.3 Billion in 2022 and is estimated to achieve a market size of USD 9.6 Billion by 2032 growing at a CAGR of 6.2% from 2023 to 2032.

Oil & Gas Catalyst Market Highlights

Catalysts are chemicals used as additives to boost a chemical reaction. These catalysts do not undergo any transformations during the chemical reaction. They are differentiated based on their phase and the phase of reactants. Oil and gas catalysts are categorized on the basis of the processes for which they are used. Oil & gas catalysts find several applications in various end-use industries such as petrochemicals, refineries, foods, and chemicals among others. With the growth in demand for economical technologies, oil & gas catalysts play a crucial role in the refinery of petroleum and its applications. Furthermore, several major refinery procedures such as hydroprocessing, cracking, and reforming demand the presence of oil & gas catalysts.

Global Oil & Gas Catalyst Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Oil & Gas Catalyst Market Report Coverage

| Market | Oil & Gas Catalyst Market |

| Oil & Gas Catalyst Market Size 2022 | USD 5.3 Billion |

| Oil & Gas Catalyst Market Forecast 2032 | USD 9.6 Billion |

| Oil & Gas Catalyst Market CAGR During 2023 - 2032 | 6.2% |

| Oil & Gas Catalyst Market Analysis Period | 2020 - 2032 |

| Oil & Gas Catalyst Market Base Year | 2022 |

| Oil & Gas Catalyst Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arkema SA, Albemarle Corporation, Exxon Mobil Chemical Corporation, The Dow Chemical Company, Evonik Industries, Clariant AG, Honeywell International, and Chevron Phillips Chemical Company among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Oil & Gas Catalyst Market Insights

Growth in demand for energy fuels the growth of the global oil & gas catalysts market. The rapid demand for oil & gas catalysts at high temperatures in various fluid crackers to increase the octane score of gasoline is another key aspect fueling the growth of the market. In addition to this, an increase in research & development activities to enhance the quality of oil & gas catalysts also results in the rapid growth of the global oil & gas catalyst market. However, technological advancements in the synthesis of chemicals decrease the overall demand for catalysts, thus hampering market growth.

Oil & Gas Catalyst Market, By Segmentation

The worldwide market for oil & gas catalyst is split based on type, application, and geography.

Oil & Gas Catalyst Types

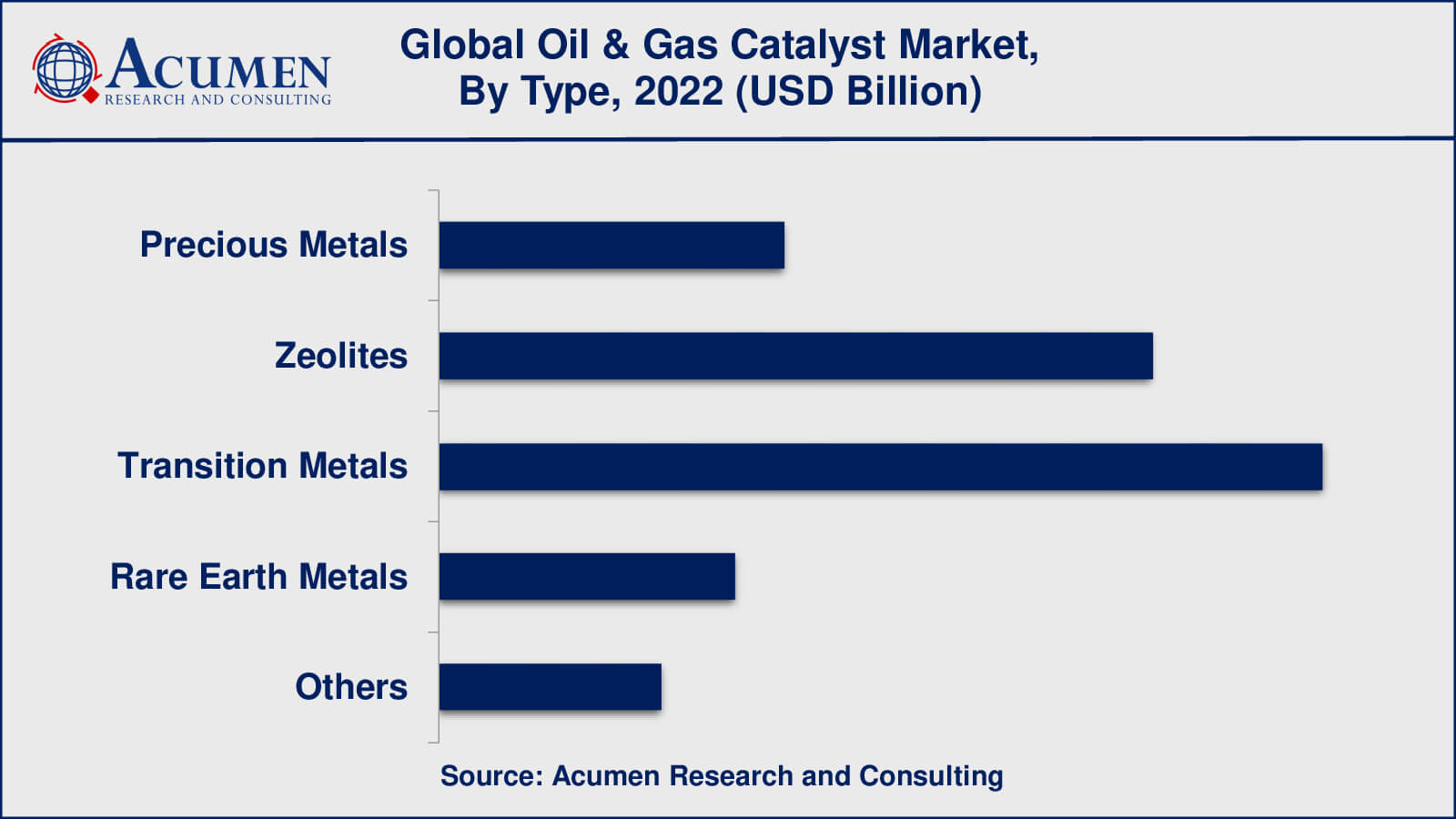

According to our oil & gas catalyst industry analysis, transition metals are likely to gain significat market share in 2022. Transition metals, such as nickel, cobalt, and iron, are known for their moderate to high catalytic activity and are widely used in various oil and gas catalyst applications. They are cost-effective and widely available, making them the most commonly used type of catalyst in the oil and gas industry.

Zeolites are crystalline aluminosilicate materials with a well-defined porous structure that provide high surface area and shape-selective properties, making them suitable for a variety of oil and gas catalyst applications. Zeolite catalysts, which are known for their high thermal stability and selectivity, are used in processes such as cracking, isomerization, and adsorption. Zeolite catalysts are less expensive than precious metal catalysts and may have a significant volume share in the oil and gas catalyst market.

Precious metals such as platinum, palladium, and gold are known for their high catalytic activity and are widely used in various oil and gas catalyst applications such as hydrocarbon conversion, hydrogenation, and oxidation processes. Because of their high selectivity, efficiency, and stability, precious metal catalysts are ideal for demanding and high-value processes. Precious metal catalysts, however, may not dominate the overall volume of catalysts used in the oil and gas industry due to their high cost and limited availability, but they may have a significant share in terms of value.

Oil & Gas Catalyst Applications

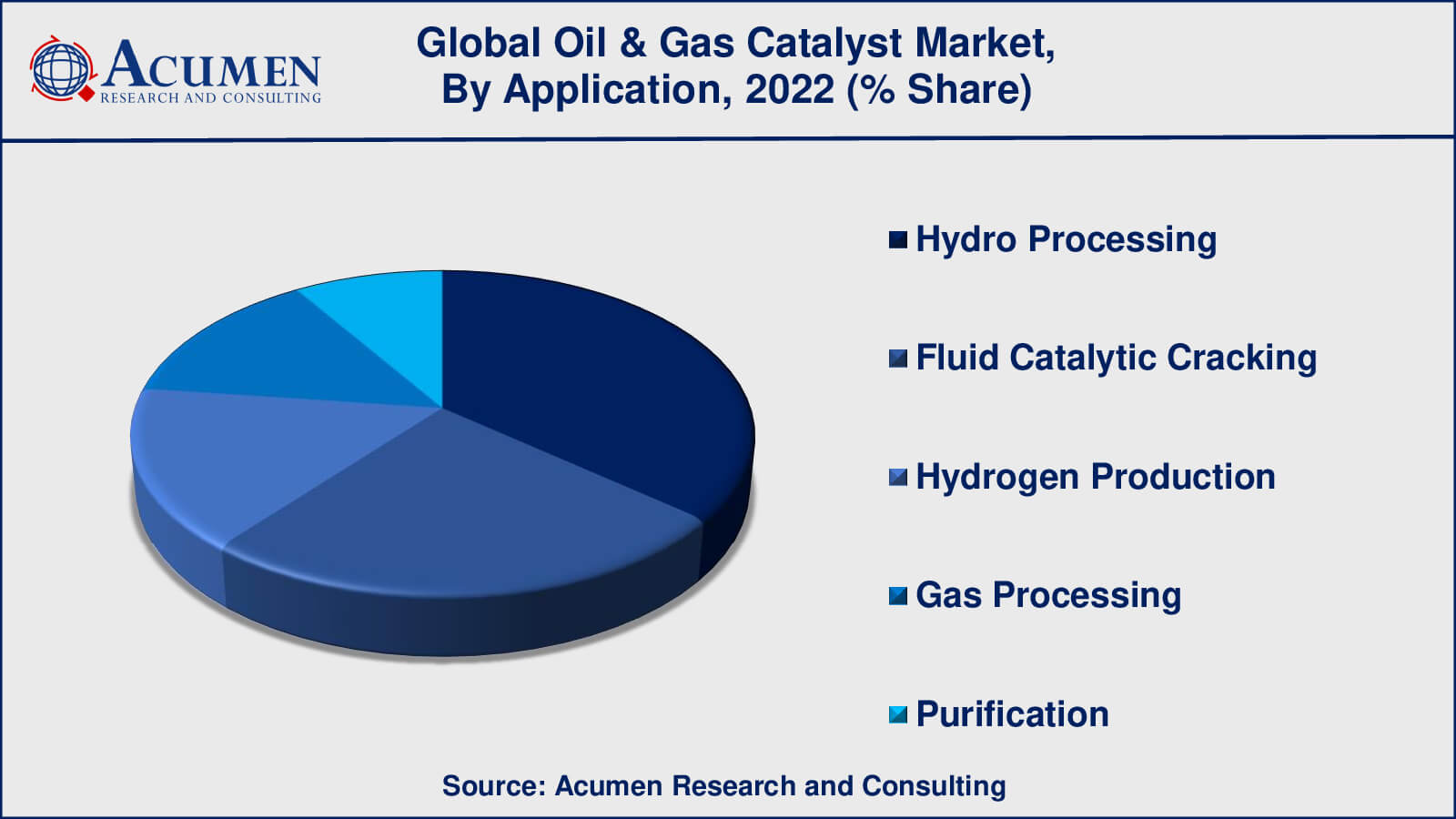

As per the oil & gas catalyst market forecast, hydro processing sub-segment is expected to occupy a noteworthy market share from 2023 to 2032. The primary application for oil and gas catalysts is hydro processing, which includes hydrocracking, hydrotreating, and hydrodesulfurization. Hydro processing catalysts are used to remove impurities such as sulphur, nitrogen, and metals from crude oil, as well as to convert heavy feedstocks into lighter and more valuable products such as petrol, diesel, and jet fuel. Hydro processing catalysts are widely used in refineries and monopolise the oil and gas catalyst market due to increased demand for cleaner fuels and stricter environmental regulations.

Fluid catalytic cracking (FCC) is a critical step in the production of petrol from crude oil, and FCC catalysts are widely used in refineries. FCC catalysts use a catalyst and a fluidized bed reactor to crack heavy hydrocarbons into lighter fractions, such as petrol. Because there is a high demand for petrol and other light fractions, FCC catalysts have a significant market share in the oil and gas catalyst market.

Oil & Gas Catalyst Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Oil & Gas Catalyst Market Regional Analysis

North America, which includes the United States and Canada, is an important market for oil and gas catalysts. The region is well-known for its developed oil and gas industry, which includes a large number of refineries and petrochemical plants. The need to upgrade heavy crude oil into lighter and cleaner products, meet stringent environmental regulations, and maximize operational efficiency is driving demand for oil and gas catalysts in North America. The United States is one of the region's largest consumers of oil and gas catalysts, with a particular emphasis on hydro processing catalysts and fluid catalytic cracking catalysts.

Asia-Pacific is a rapidly expanding market for oil and gas catalysts, owing to rising energy demand in emerging economies such as China, India, and Southeast Asian countries. The region's refining and petrochemical industries are expanding, as is the demand for cleaner fuels, industrial chemicals, and plastics. The need to upgrade heavy feedstocks, adhere to environmental regulations, and improve process efficiency is driving demand for oil and gas catalysts in Asia-Pacific. China and India are the region's largest consumers of oil and gas catalysts, with high demand for hydro processing and hydrogen production catalysts.

Oil & Gas Catalyst Market Players

Some of the top oil & gas catalyst companies offered in the professional report include Arkema SA, Albemarle Corporation, Exxon Mobil Chemical Corporation, The Dow Chemical Company, Evonik Industries, Clariant AG, Honeywell International and Chevron Phillips Chemical Company.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2022

January 2025

August 2018

August 2022